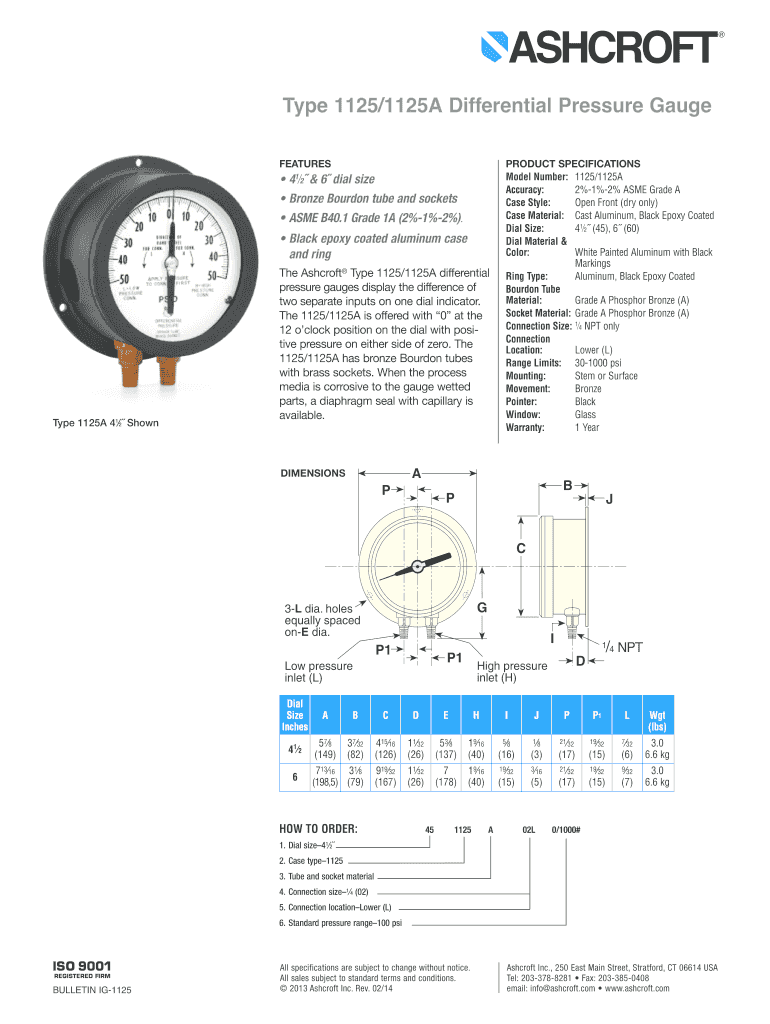

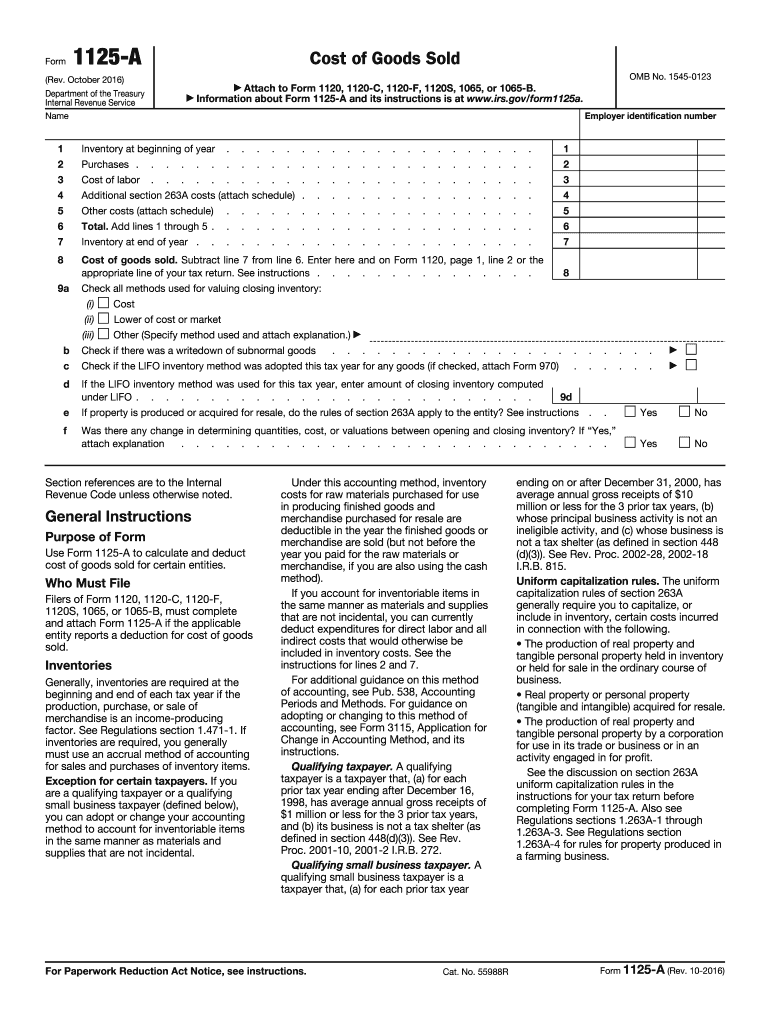

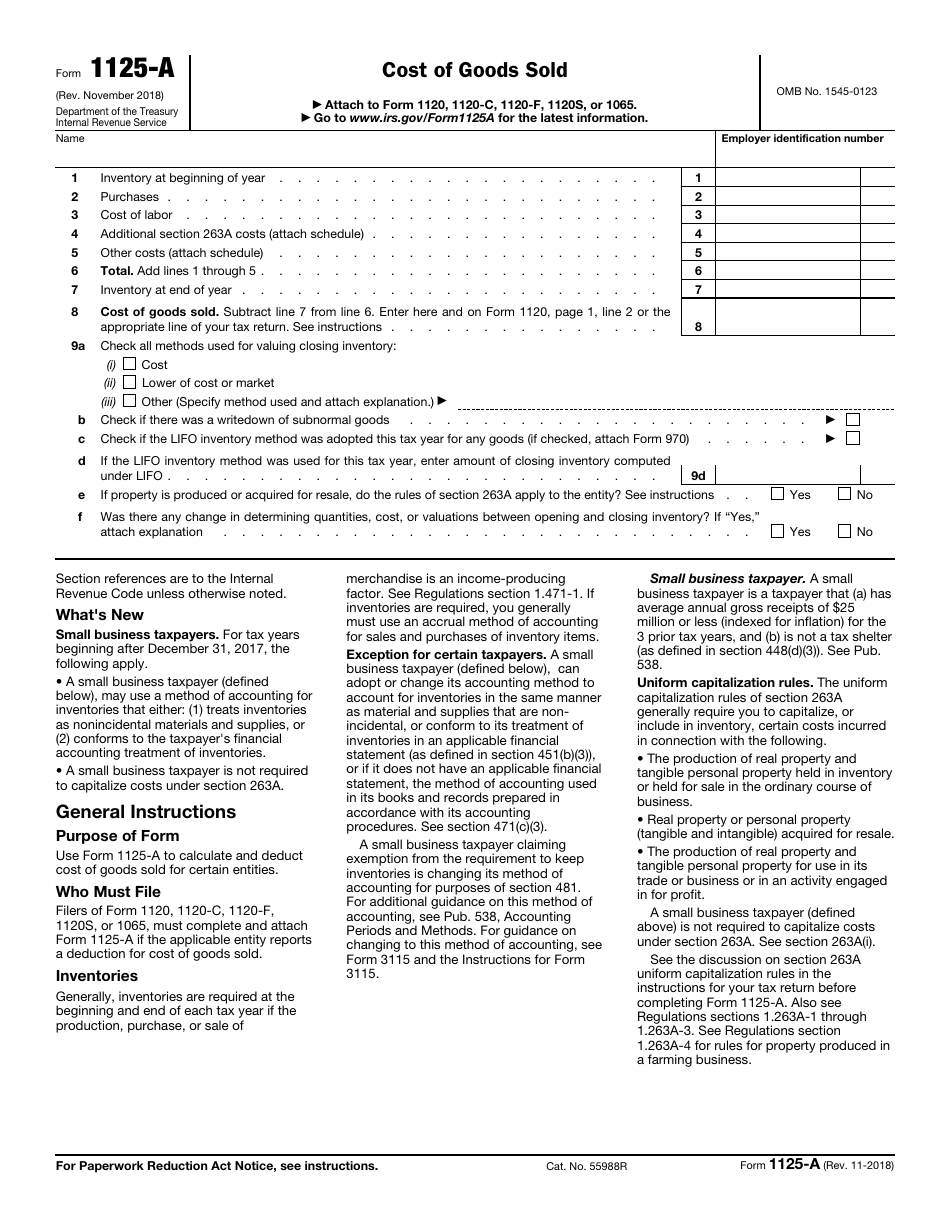

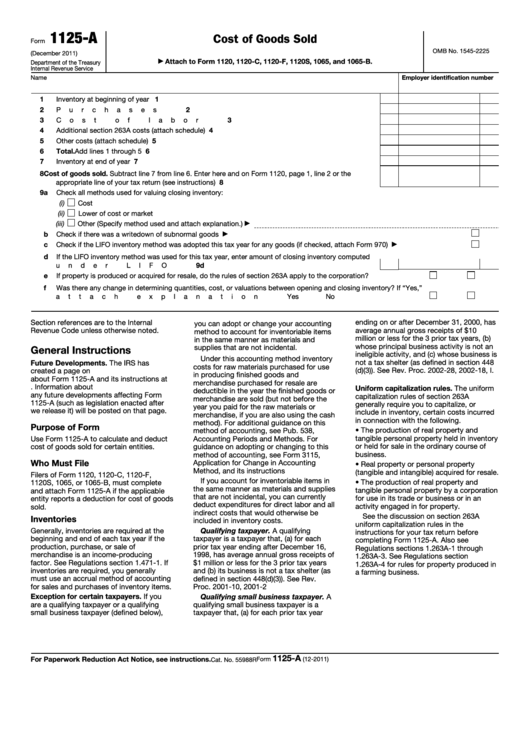

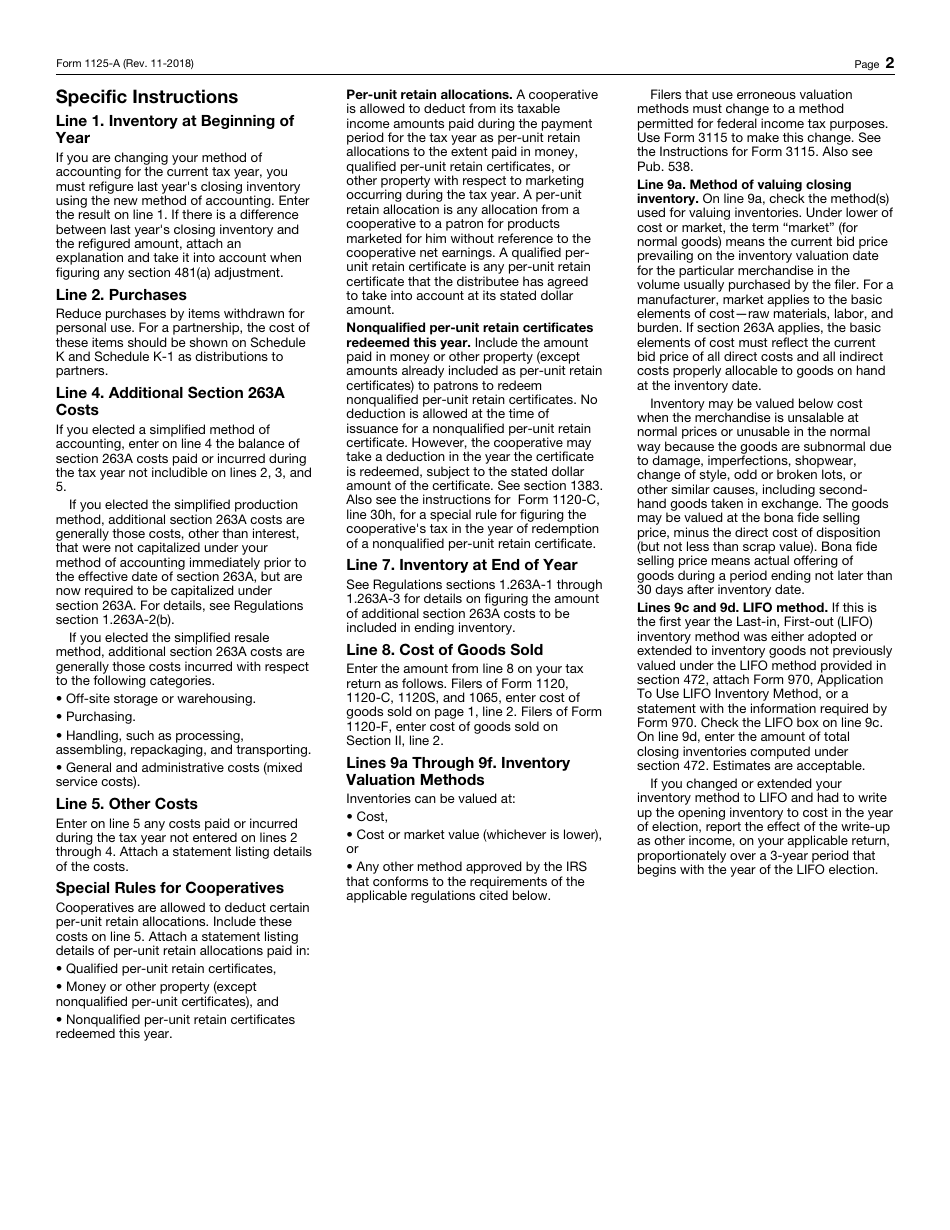

Irs Form 1125A

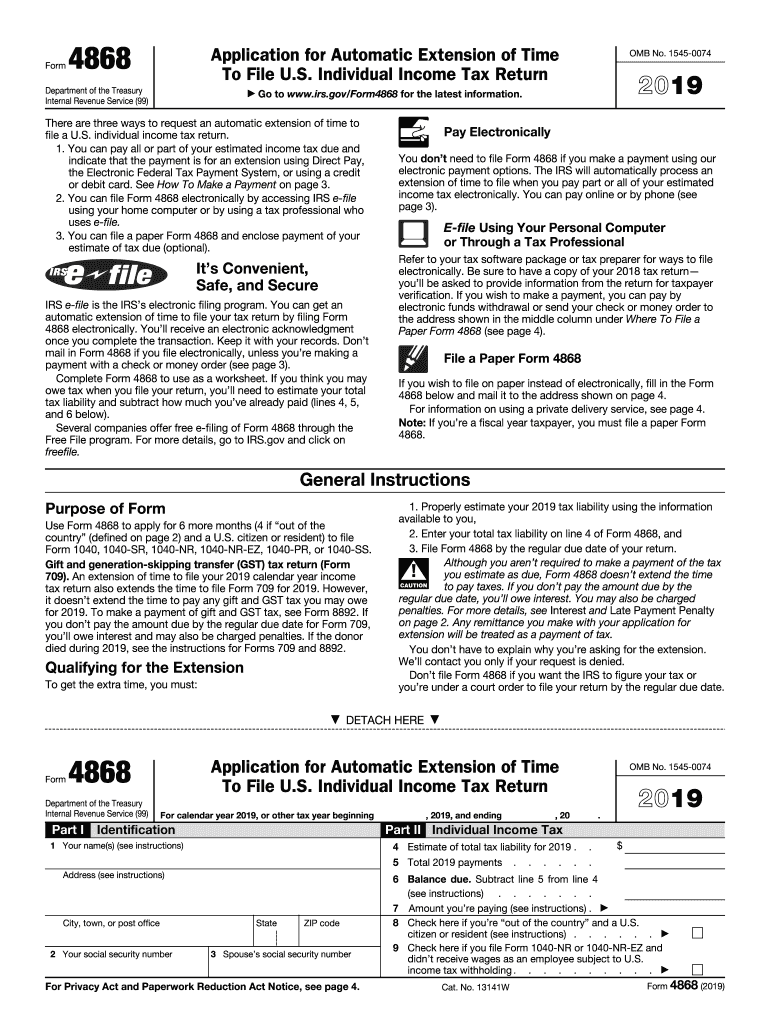

Irs Form 1125A - Enter the ale member’s complete address (including. Web for businesses that sell inventory to customers, the cost of goods sold (cogs) deduction is likely going to be the largest expense for the expense. According to irs publication 538,. To access the form, you will need to open a business return on the desktop and then go to add form/display and type 1125a. This tax form is to be used in. Complete, edit or print tax forms instantly. Easily fill out pdf blank, edit, and sign them. The cost of goods sold. Ad we help get taxpayers relief from owed irs back taxes. Web forms, instructions and publications search. Please use the link below to. Web forms, instructions and publications search. Save or instantly send your ready documents. Estimate how much you could potentially save in just a matter of minutes. This information is used in conjunction. Web how to access the form: Certain entities with total receipts. Access irs forms, instructions and publications in electronic and print media. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. The cost of goods sold. Finished goods or merchandise are sold reduce. Please use the link below to. Certain entities with total receipts. Enter the ale member’s complete address (including. Web how to access the form: Cost of goods sold appropriate line (irs) form is 1 page long and contains: Enter the ale member’s complete address (including. Complete, edit or print tax forms instantly. Please use the link below to. This information is used in conjunction. Web how to access the form: Easily fill out pdf blank, edit, and sign them. Ad we help get taxpayers relief from owed irs back taxes. According to irs publication 538,. Cost of goods sold appropriate line (irs) form is 1 page long and contains: Finished goods or merchandise are sold reduce. Access irs forms, instructions and publications in electronic and print media. Complete, edit or print tax forms instantly. Save or instantly send your ready documents. You can download or print current or past. Enter the ale member’s complete address (including. Save or instantly send your ready documents. This information is used in conjunction. This tax form is to be used in. Easily fill out pdf blank, edit, and sign them. The cost of goods sold. This tax form is to be used in. Web forms, instructions and publications search. Access irs forms, instructions and publications in electronic and print media. Enter the ale member’s complete address (including. This information is used in conjunction. To access the form, you will need to open a business return on the desktop and then go to add form/display and type 1125a. Certain entities with total receipts. Estimate how much you could potentially save in just a matter of minutes. Access irs forms, instructions and publications in electronic and print media. Easily fill out pdf blank, edit, and sign them. The cost of goods sold. According to irs publication 538,. Cost of goods sold appropriate line (irs) form is 1 page long and contains: Complete, edit or print tax forms instantly. Web forms, instructions and publications search. Access irs forms, instructions and publications in electronic and print media. Finished goods or merchandise are sold reduce. This tax form is to be used in. Estimate how much you could potentially save in just a matter of minutes. The cost of goods sold. You can download or print current or past. This information is used in conjunction. Certain entities with total receipts. Enter the ale member’s complete address (including. Ad we help get taxpayers relief from owed irs back taxes. Please use the link below to. Web how to access the form: Cost of goods sold appropriate line (irs) form is 1 page long and contains: Save or instantly send your ready documents. Web for businesses that sell inventory to customers, the cost of goods sold (cogs) deduction is likely going to be the largest expense for the expense. Easily fill out pdf blank, edit, and sign them. To access the form, you will need to open a business return on the desktop and then go to add form/display and type 1125a. According to irs publication 538,.Form 4868 Fill out & sign online DocHub

IRS Form 1125A Cost of Goods Sold YouTube

Form 1125 a December Internal Revenue Service Fill Out and Sign

2016 Form IRS 1125AFill Online, Printable, Fillable, Blank pdfFiller

IRS Form 1125A Fill Out, Sign Online and Download Fillable PDF

Fillable Form 1125A Cost Of Goods Sold printable pdf download

IRS Form 1125A Fill Out, Sign Online and Download Fillable PDF

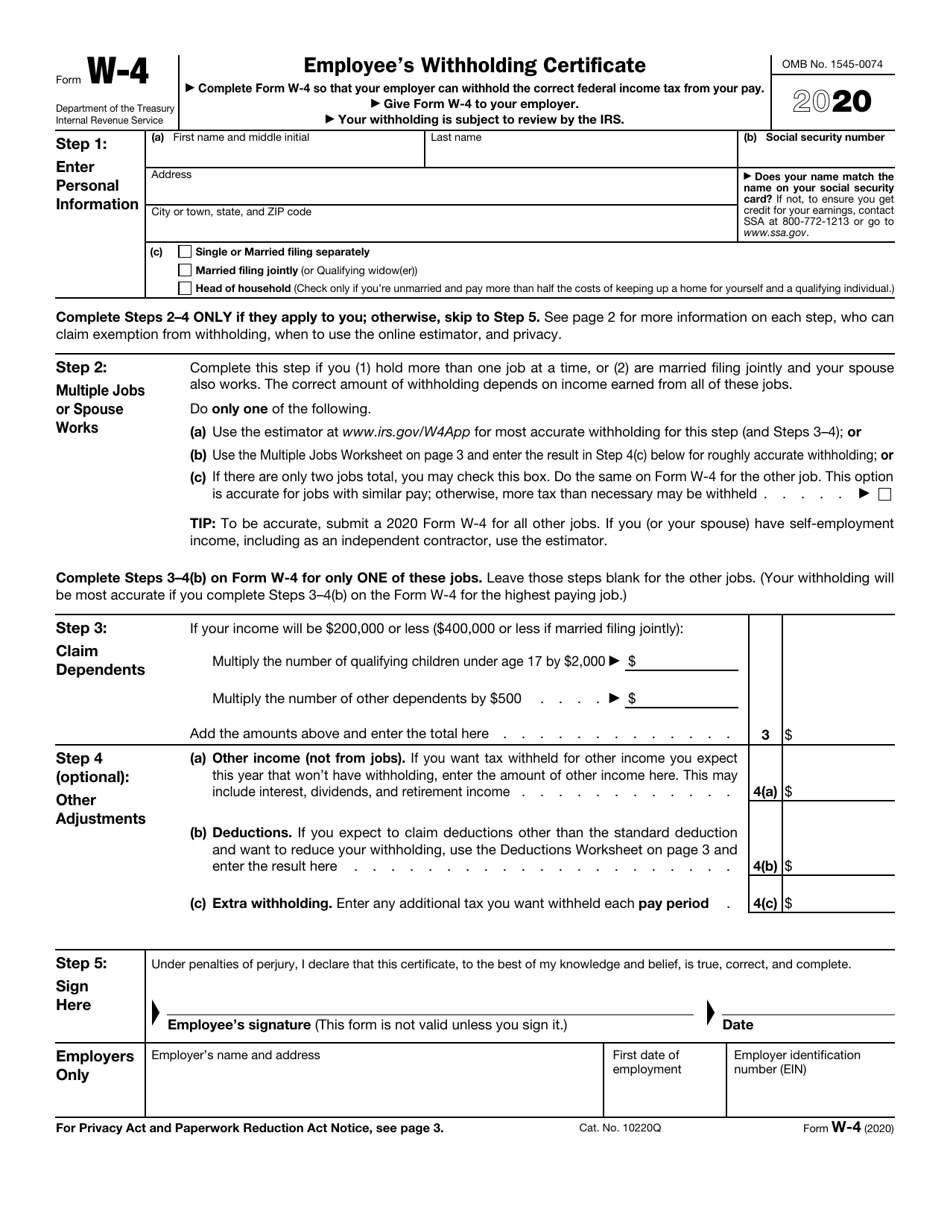

IRS Form W 4V Printable

Form 1125 Fill Out and Sign Printable PDF Template signNow

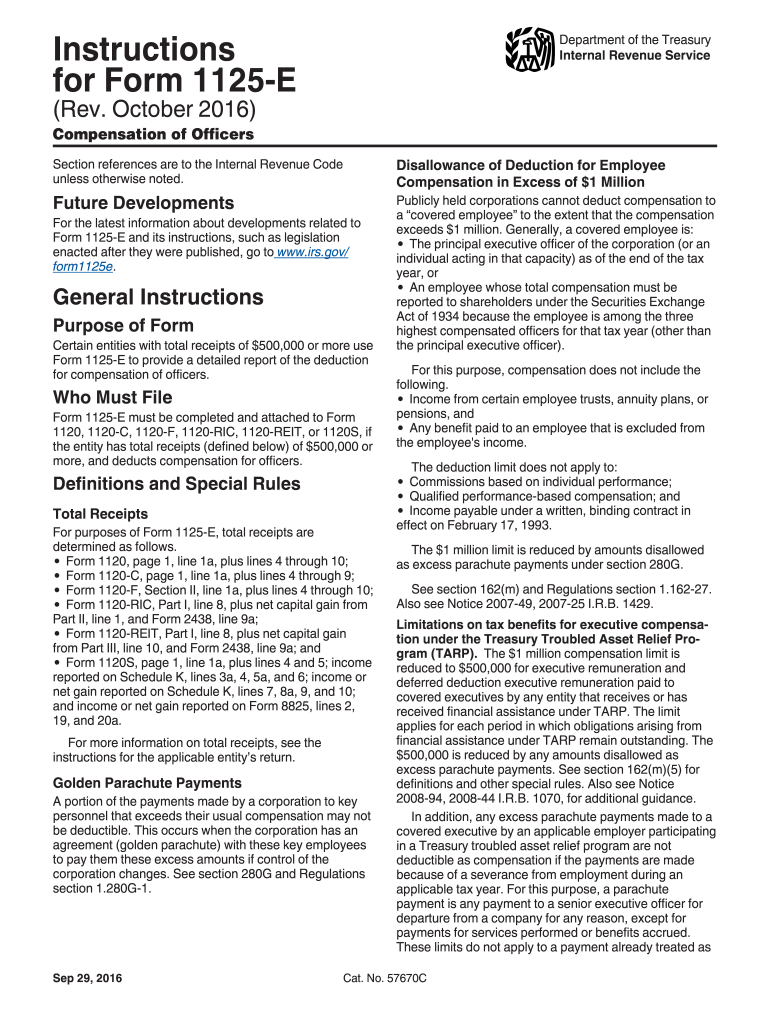

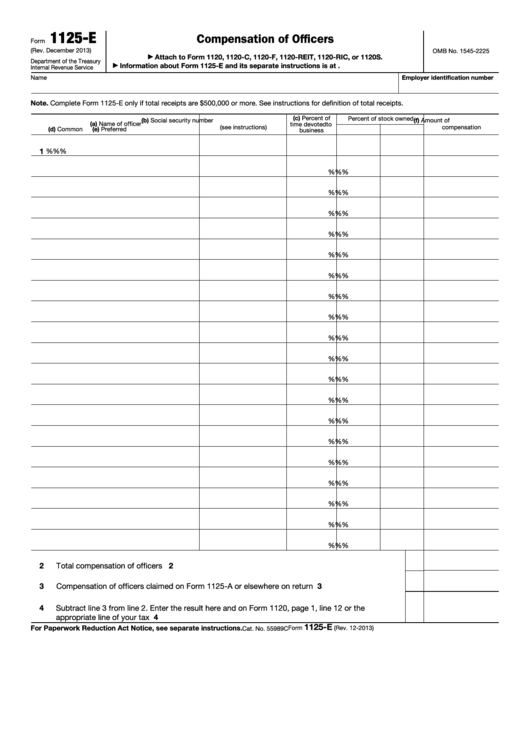

Fillable Form 1125E Compensation Of Officers printable pdf download

Related Post: