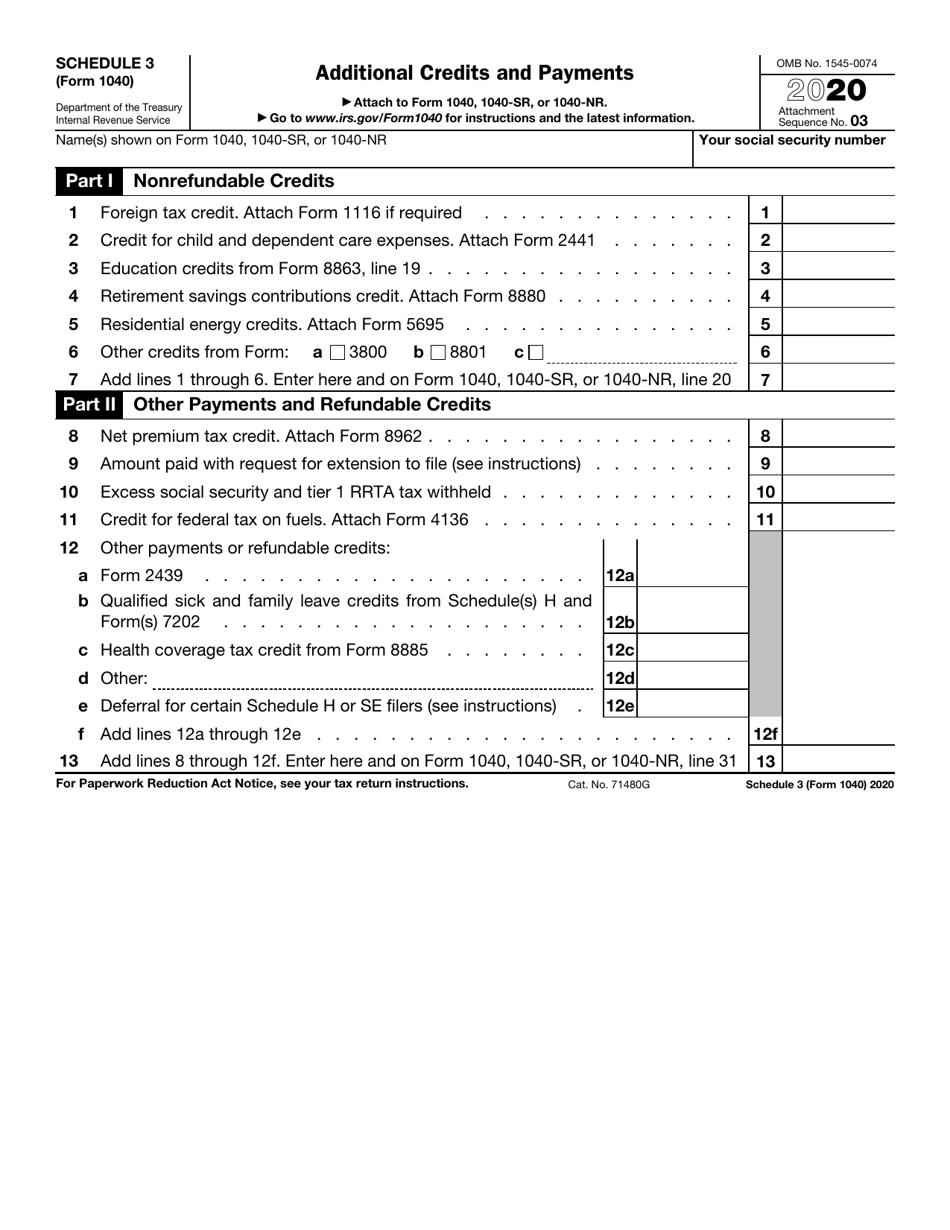

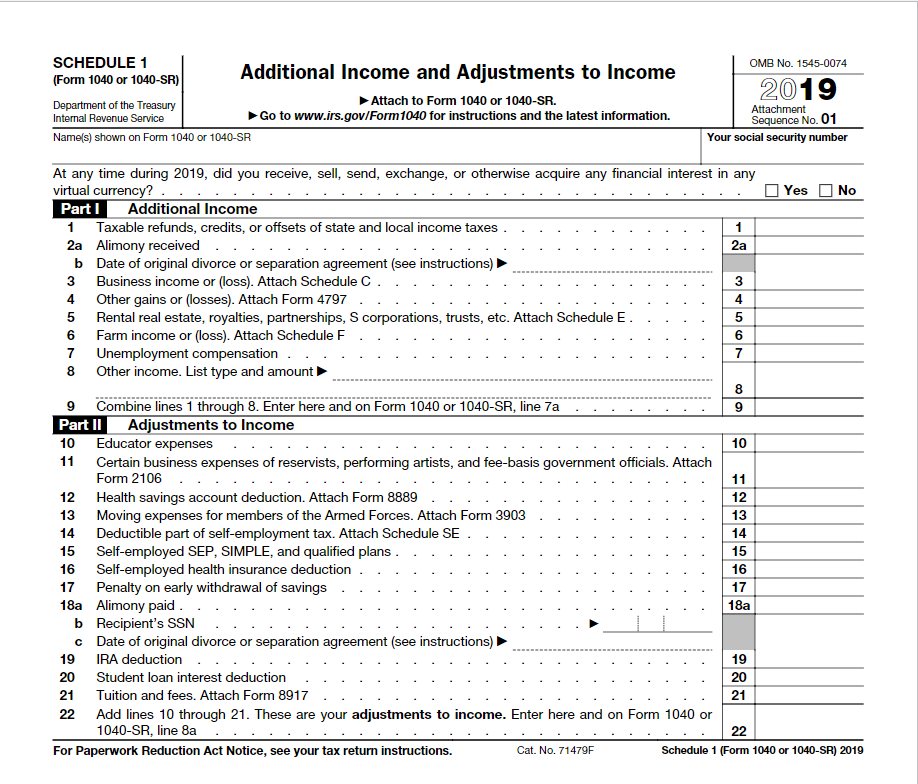

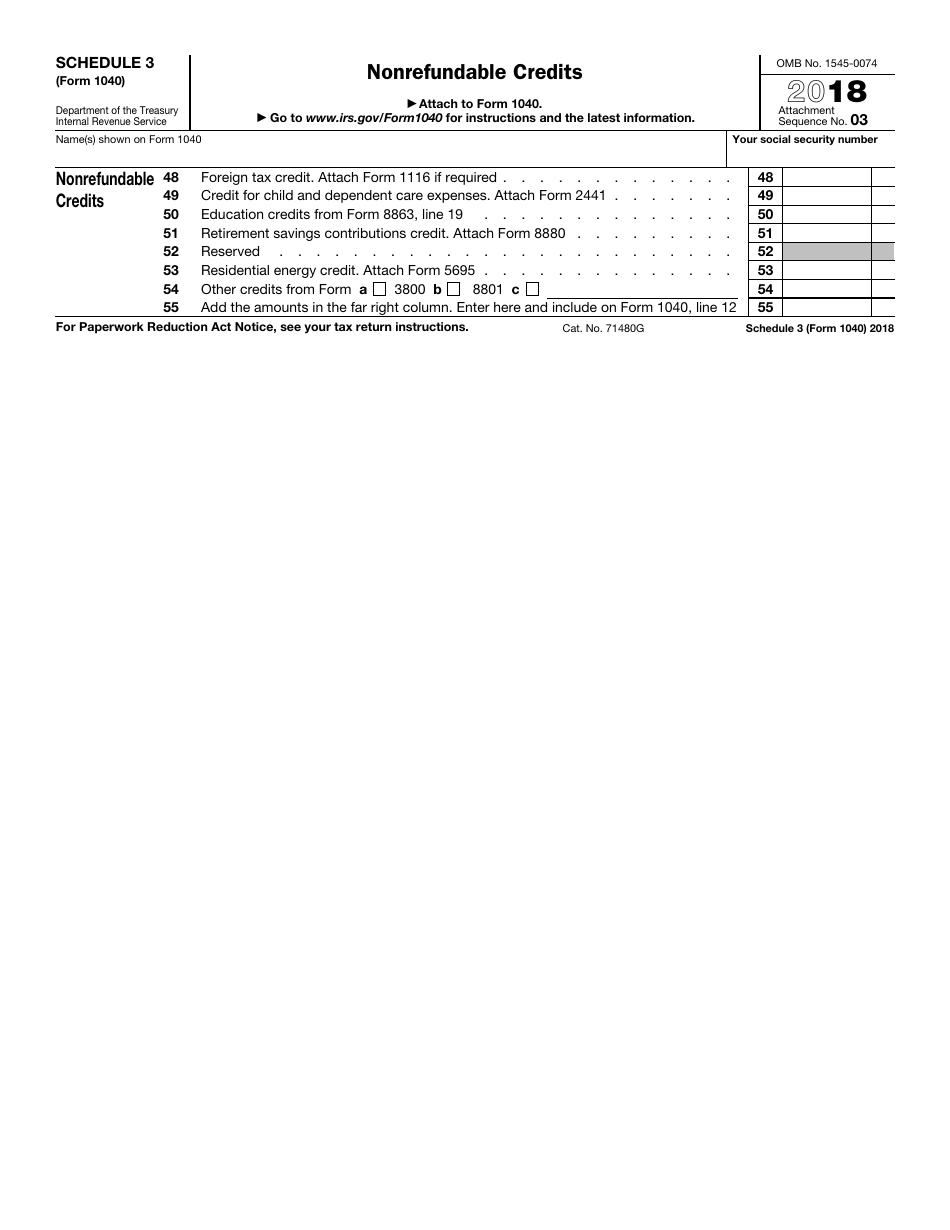

Irs Form 1040 Schedule 3

Irs Form 1040 Schedule 3 - 1040 schedule 3 line 12e. Web schedule 3 (form 1040), additional credits and payments. Web no, form 1040 and form 1099 are two different federal tax forms. This includes nonrefundable and refundable credits (additional credits and payments and other payments/refundable credits). Web treasury/irs schedule 3 (form 1040) 2023. 13, 2023 — the internal revenue service today announced tax relief for individuals and businesses affected by idalia in 28 of the state’s 159 counties in georgia. Go to www.irs.gov/form1040 for instructions and the latest information. These taxpayers now have until feb. This form is also two pages and has two parts. Web some of the credits will be entered on the appropriate lines of the return while some payments and credits may be entered on schedule 3, additional credits and payments. Earned income credit will be covered in the next lesson. Discover helpful information and resources on taxes from aarp. 15, 2024, to file various federal individual and business tax returns and make tax payments. Form 1040 is a form that you fill out and send to the irs reporting your income, deductions, credits, and tax due. Ad use the tax. For instructions and the latest information. These taxpayers now have until feb. Go to www.irs.gov/form1040 for instructions and the latest information. This form can be complex, so you must take your time to complete it to ensure accuracy and minimize. Go to www.irs.gov/form1040 for instructions and the latest information. For instructions and the latest information. Float this topic for current user. Web some of the credits will be entered on the appropriate lines of the return while some payments and credits may be entered on schedule 3, additional credits and payments. On line 31, enter the amount of any section 179 expense deduction from form 4562 that is attributable. Irs issues guidance on state tax payments to help taxpayers. On line 31, enter the amount of any section 179 expense deduction from form 4562 that is attributable to schedule e income or loss. Schedule 3 for form 1040 of the 2020 tax year. Go to www.irs.gov/form1040 for instructions and the latest information. Web proseries tax discussions: Float this topic for current user. 3.2k views 1 year ago irs forms & schedules. Web treasury/irs schedule 3 (form 1040) 2023. Ad use the tax calculator to estimate your tax refund or the amount you may owe the irs. Web irs schedule 1 lists additional income sources such as taxable state refunds, business income, alimony received, and unemployment compensation. 15, 2024, to file various federal individual and business tax returns and make tax payments. Web schedule 3 is titled additional credits and payments. Department of the treasury internal revenue service. Ad use the tax calculator to estimate your tax refund or the amount you may owe the irs. Go to www.irs.gov/form1040 for instructions and the latest information. Float this topic for current user. Irs issues guidance on state tax payments to help taxpayers. Ad use the tax calculator to estimate your tax refund or the amount you may owe the irs. Web treasury/irs schedule 3 (form 1040) 2023. A nonrefundable credit can offset your tax liability, but you can't receive a refund (i.e., direct deposit or check). Ad use the tax calculator to estimate your tax refund or the amount you may owe the irs. Go to www.irs.gov/form1040 for instructions and the latest information. Earned income credit will be covered in the next lesson. These taxpayers now have until feb. Irs issues guidance on state tax payments to help taxpayers. Department of the treasury internal revenue service (99). Ad use the tax calculator to estimate your tax refund or the amount you may owe the irs. Go to www.irs.gov/form1040 for instructions and the latest information. Discover helpful information and resources on taxes from aarp. Float this topic for current user. Discover helpful information and resources on taxes from aarp. Form 1040 is a form that you fill out and send to the irs reporting your income, deductions, credits, and tax due. Go to www.irs.gov/schedulea for instructions and the latest information. This form can be complex, so you must take your time to complete it to ensure accuracy and minimize. Irs. On line 31, enter the amount of any section 179 expense deduction from form 4562 that is attributable to schedule e income or loss. Form 1040 is a form that you fill out and send to the irs reporting your income, deductions, credits, and tax due. I am trying to avoid deferral of se tax on schedule line 12e of form 1040. Part i is titled nonrefundable credits. Irs issues guidance on state tax payments to help taxpayers. 71480g 12f 13 schedule 3 (form 1040) 2020 f. These taxpayers now have until feb. Department of the treasury internal revenue service. Web some of the credits will be entered on the appropriate lines of the return while some payments and credits may be entered on schedule 3, additional credits and payments. 15, 2024, to file various federal individual and business tax returns and make tax payments. Ad use the tax calculator to estimate your tax refund or the amount you may owe the irs. Float this topic for current user. Discover helpful information and resources on taxes from aarp. You’ll use that information when you fill out form 1040. 1040 schedule 3 line 12e. Earned income credit will be covered in the next lesson. Go to www.irs.gov/schedulea for instructions and the latest information. Premium tax credit, additional child tax credit and the refundable education credit have already been covered. This form is also two pages and has two parts. Web treasury/irs schedule 3 (form 1040) 2023.IRS Form 1040 Schedule 3 Download Fillable PDF or Fill Online

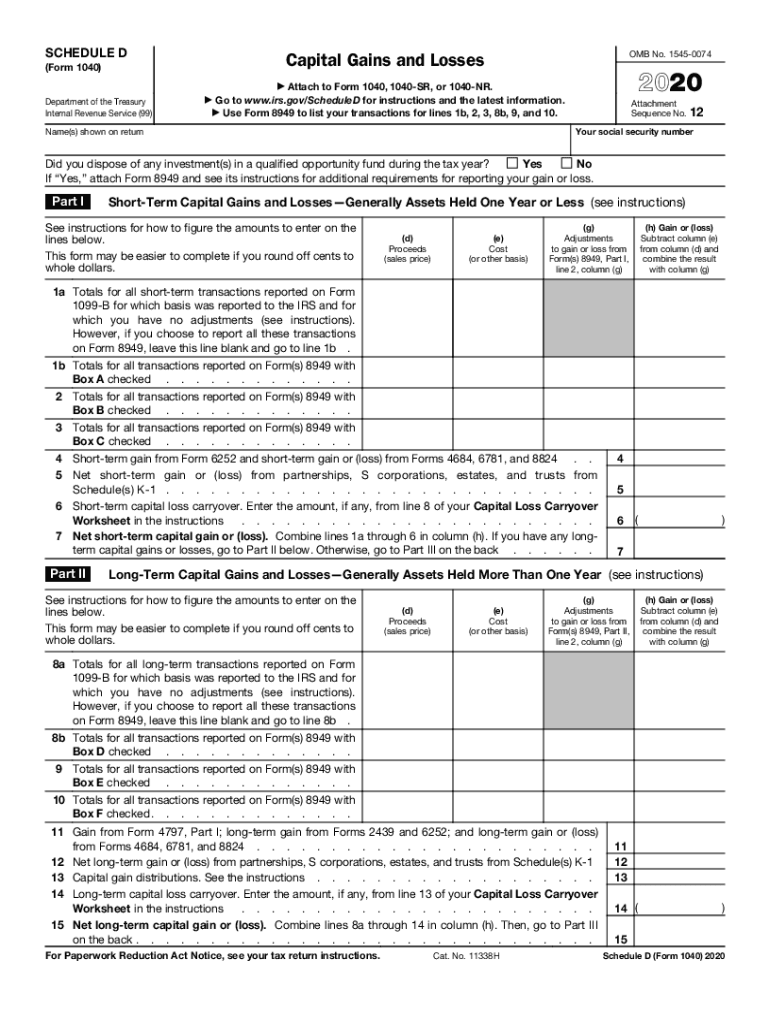

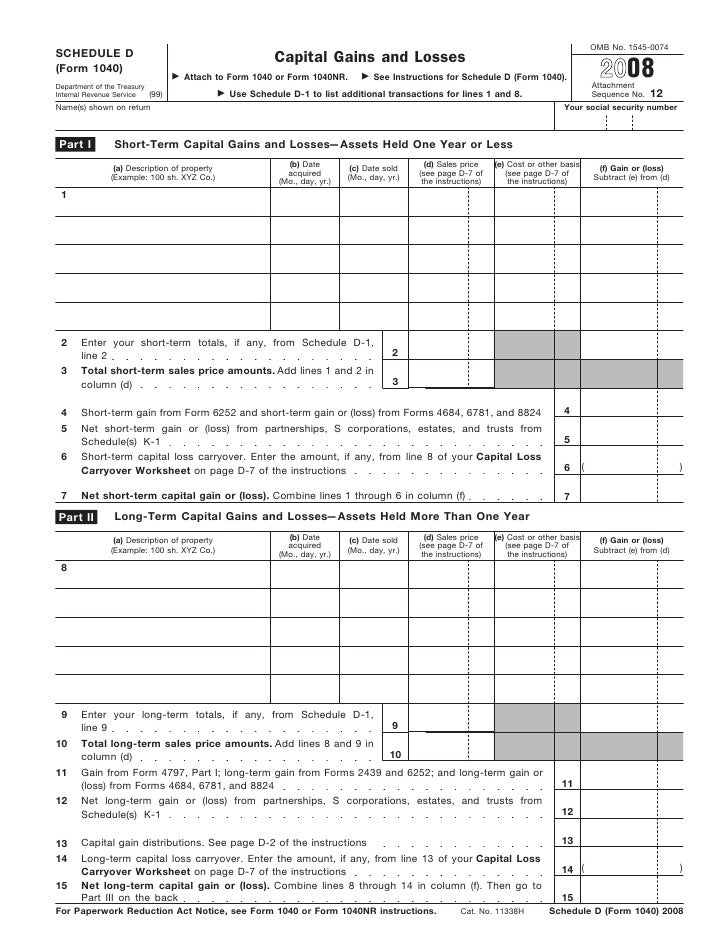

2020 Form IRS 1040 Schedule D Fill Online, Printable, Fillable, Blank

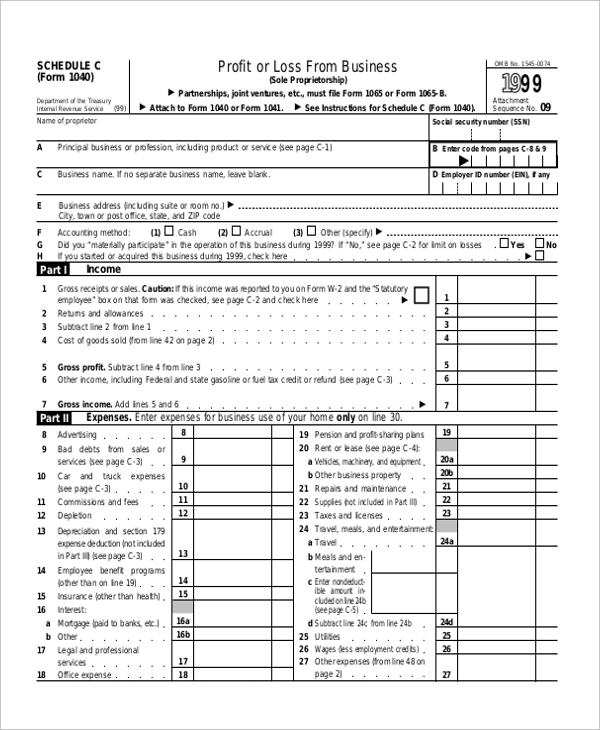

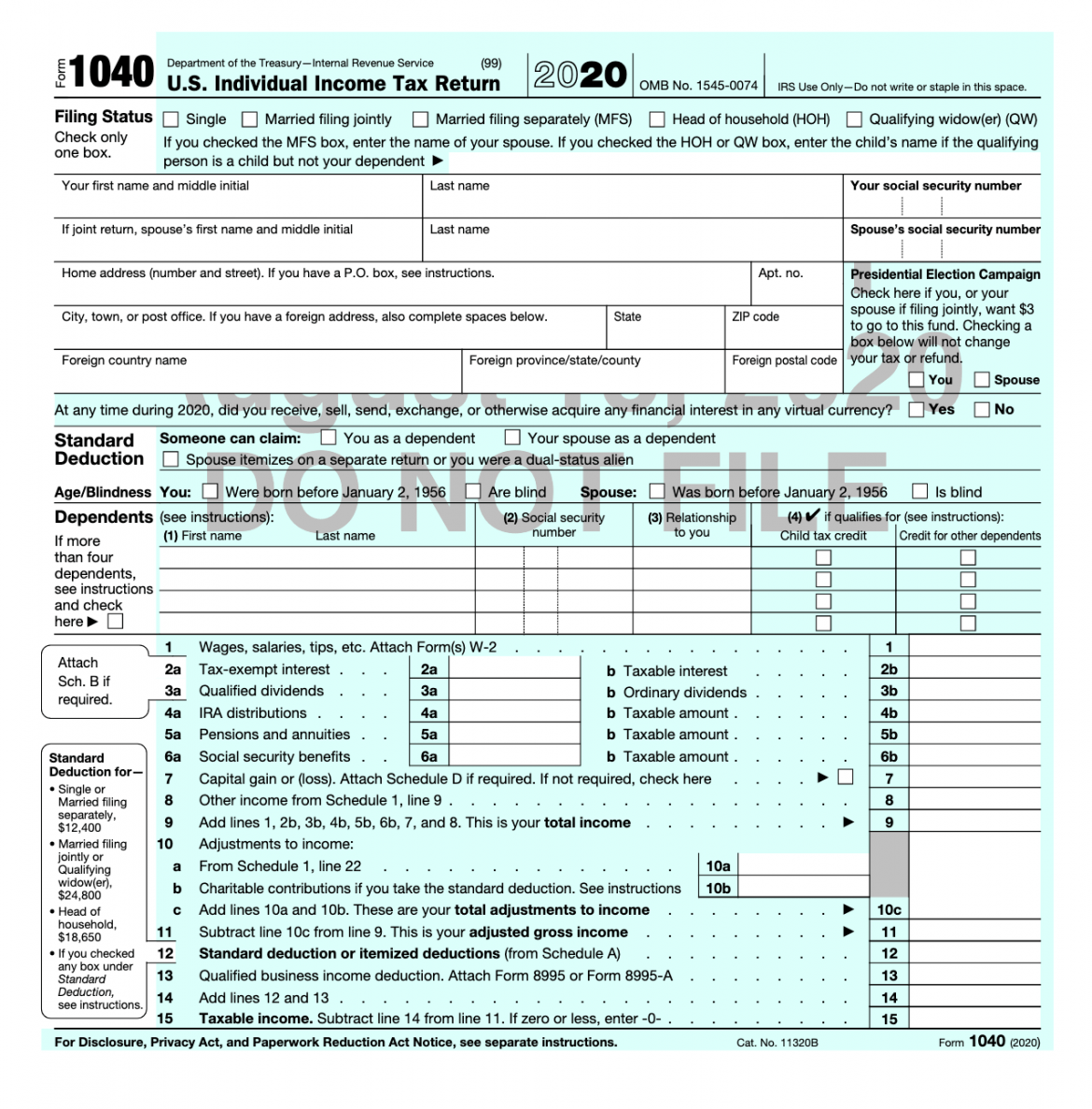

Irs 1040 Form 2020 Pdf 1040ez Form Fill Out And Sign Printable Pdf

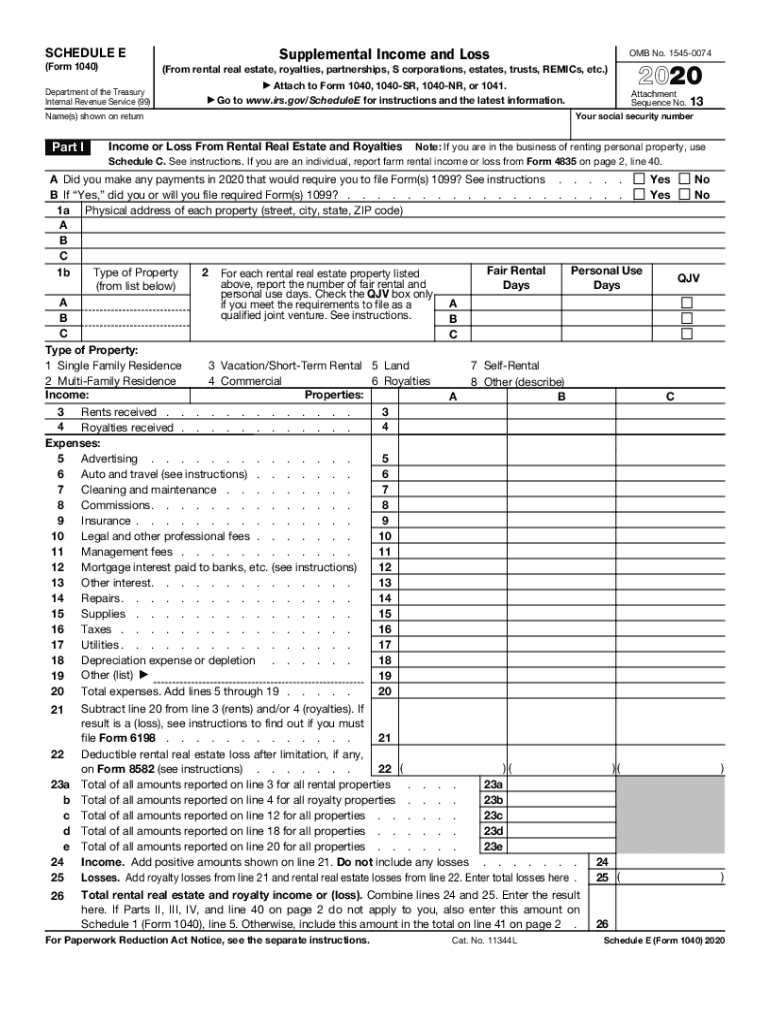

2020 Form IRS 1040 Schedule E Fill Online, Printable, Fillable, Blank

1040 Schedule 3 (Drake18 and Drake19) (Schedule3)

Irs 1040 Form Schedule 1 IRS Form 1040 Schedule 3 Download Fillable

Form 1040, Schedule DCapital Gains and Losses Worksheet Template Tips

What’s New On Form 1040 For 2020 Taxgirl

Tax Form 1040 Schedule E Who is this Form for & How to Fill It

IRS Form 1040 Schedule 3 2018 Fill Out, Sign Online and Download

Related Post: