Instructions To Form 1116

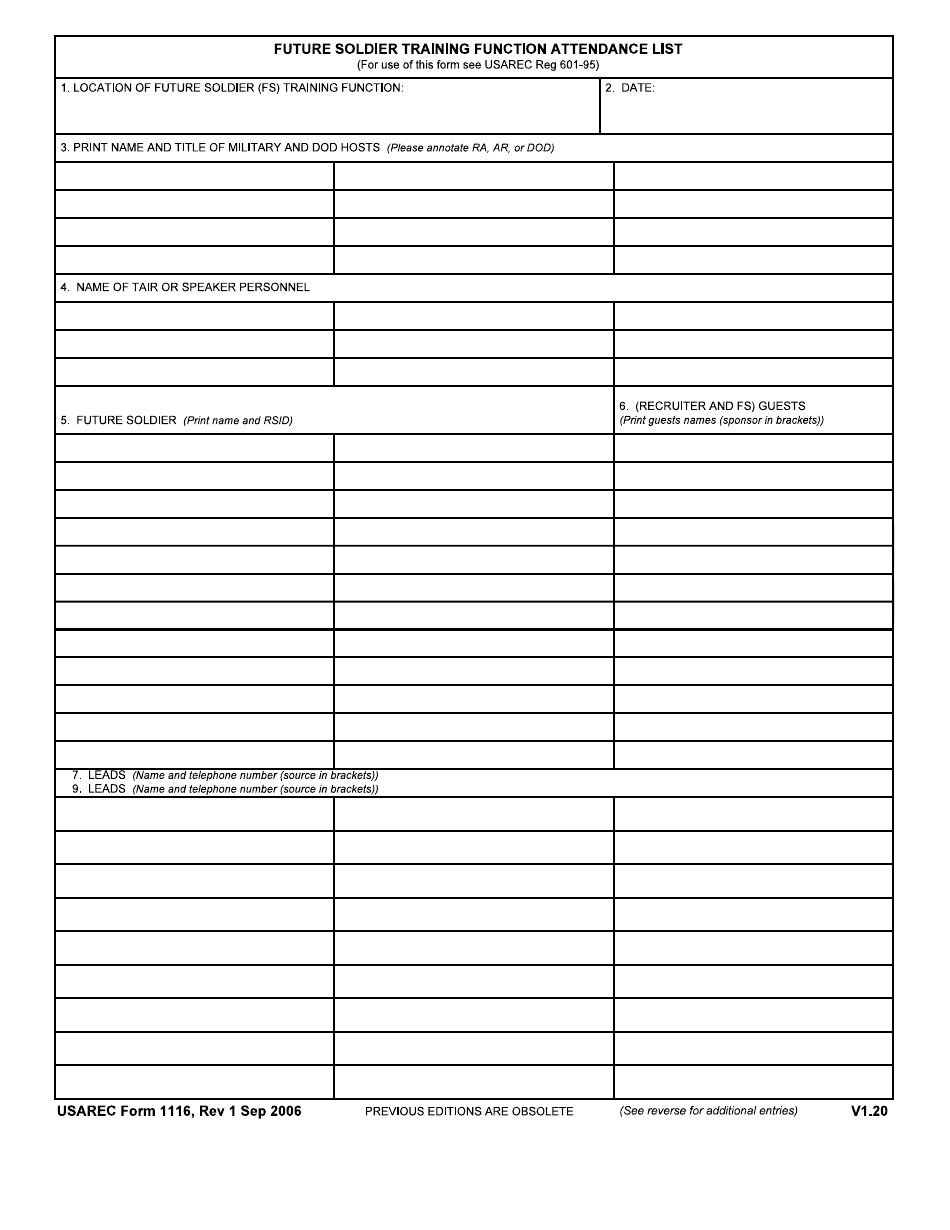

Instructions To Form 1116 - Web to help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately compute the credit using form 1116,. As shown on page 1 of your tax return. Web general instructions.1 election to claim the foreign tax credit without filing form 1116.1 purpose of form.1 credit or deduction.2 foreign taxes. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web instructions for form 1116 foreign tax credit (individual, estate, or trust) publication 514 foreign tax credit for individuals note that any link in the information above is updated. Web the irs form 1116 is a form used to calculate the amount of foreign tax credit you can claim on your us income tax return. Foreign income less amounts recaptured. You can elect to claim the credit for qualified foreign taxes without filing form 1116 if you meet all of the following. This should match the country you selected on the 1116 screen in step 4. Web this rule applies whether or not you can make the election to claim the foreign tax credit without filing form 1116 (as explained earlier). See the instructions for line 12, later. Web select the form 1116 name or number. Web form 1116 instructions. To make the election, just enter on the foreign tax credit line of your tax return (for example, schedule 3 (form 1040), part i,. Form 1116 can be complex, and it’s crucial to follow the instructions provided by the irs carefully. Taxable income or loss from. You provide detailed information using each of the form's four. Enter “1099 taxes” in part ii, column (j),. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Both the credit and the deduction are entered in the same place. Foreign income less amounts recaptured. Table of contents how do i complete irs form 1116? Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. As shown on page 1 of your tax return. To make the election, just enter on the foreign. Web this rule applies whether or not you can make the election to claim the foreign tax credit without filing form 1116 (as explained earlier). Enter the partners foreign gross income. As shown on page 1 of your tax return. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign. Web general instructions.1 election to claim the foreign tax credit without filing form 1116.1 purpose of form.1 credit or deduction.2 foreign taxes. As shown on page 1 of your tax return. Web to help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately compute the credit using form. As shown on page 1 of your tax return. Foreign income less amounts recaptured. There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. To make the election, just enter on the foreign tax credit line of your tax return (for example, schedule 3 (form 1040), part i,. Form 1116. Web the irs form 1116 is a form used to calculate the amount of foreign tax credit you can claim on your us income tax return. You can elect to claim the credit for qualified foreign taxes without filing form 1116 if you meet all of the following. See the instructions for line 12, later. Web for instructions and the. Form 1116 can be complex, and it’s crucial to follow the instructions provided by the irs carefully. This should match the country you selected on the 1116 screen in step 4. Web instructions for form 1116 foreign tax credit (individual, estate, or trust) publication 514 foreign tax credit for individuals note that any link in the information above is updated.. Web this rule applies whether or not you can make the election to claim the foreign tax credit without filing form 1116 (as explained earlier). There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. Web let’s start with step by step instructions on completing form 1116. Web the irs. Web the irs form 1116 is a form used to calculate the amount of foreign tax credit you can claim on your us income tax return. Web to help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately compute the credit using form 1116,. Web to see when. Use form 2555 to claim the. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Taxpayers are therefore reporting running balances of. See the instructions for line 12, later. Table of contents how do i complete irs form 1116? Web the irs form 1116 is a form used to calculate the amount of foreign tax credit you can claim on your us income tax return. As shown on page 1 of your tax return. Web general instructions.1 election to claim the foreign tax credit without filing form 1116.1 purpose of form.1 credit or deduction.2 foreign taxes. To make the election, just enter on the foreign tax credit line of your tax return (for example, schedule 3 (form 1040), part i,. Form 1116 can be complex, and it’s crucial to follow the instructions provided by the irs carefully. Web per irs instructions for form 1116 foreign tax credit (individual, estate, or trust), page 1: Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Both the credit and the deduction are entered in the same place. Foreign income less amounts recaptured. Web 8 rows use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current. You provide detailed information using each of the form's four. Web form 1116 instructions. Web claiming without filing form 1116. There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. Web to be eligible for this election, qualified foreign taxes must be $300 ($600 if mfj) or less, all foreign source income is passive category (such as interest and dividends) and taxpayer.USAREC Form 1116 Download Fillable PDF or Fill Online Future Soldier

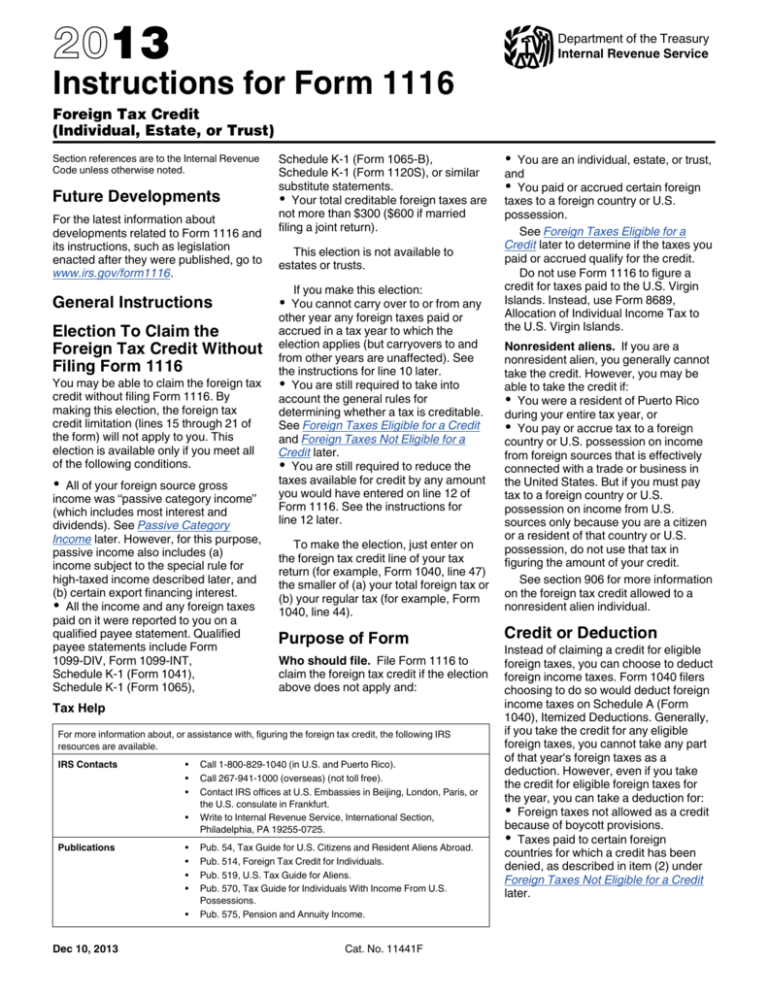

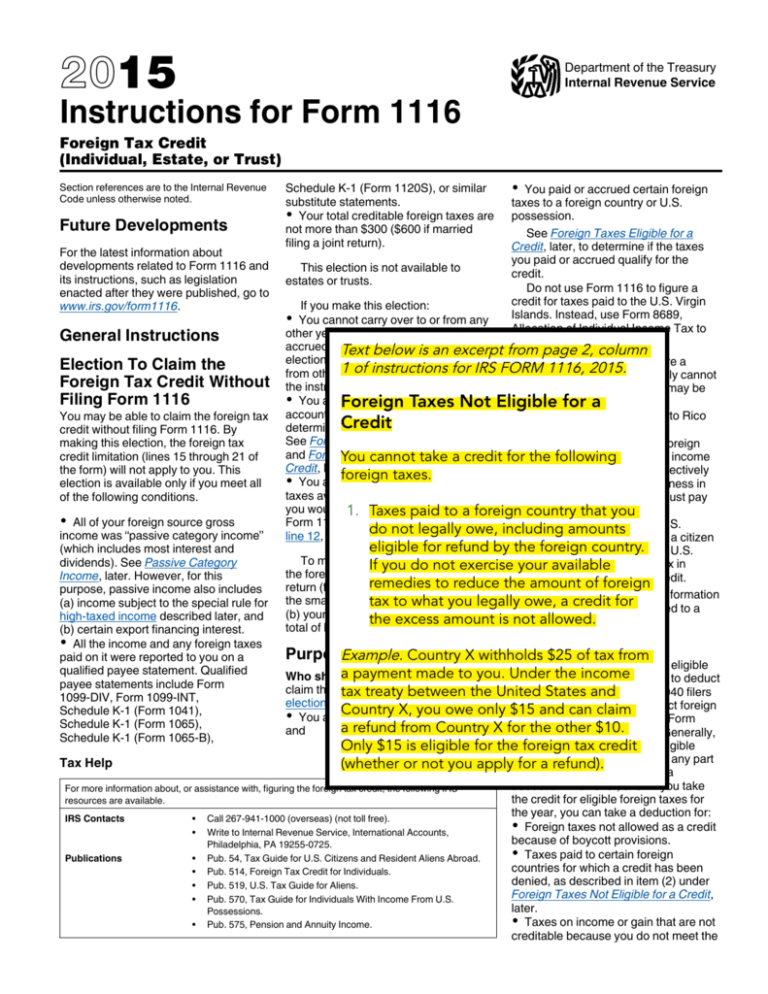

Instructions for Form 1116

Foreign Tax Credit & IRS Form 1116 Explained Greenback Expat Taxes

Foreign Tax Credit Form 1116 and how to file it (example for US expats)

Foreign Tax Credit & IRS Form 1116 Explained Greenback Expat Taxes

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Foreign Tax Credit Form 1116 and how to file it (example for US expats)

Instructions for Form 1116

Instructions for Form 1116

USCs and LPRs Living Outside the U.S. Key Tax and BSA Forms « Tax

Related Post: