Instructions Form 6252

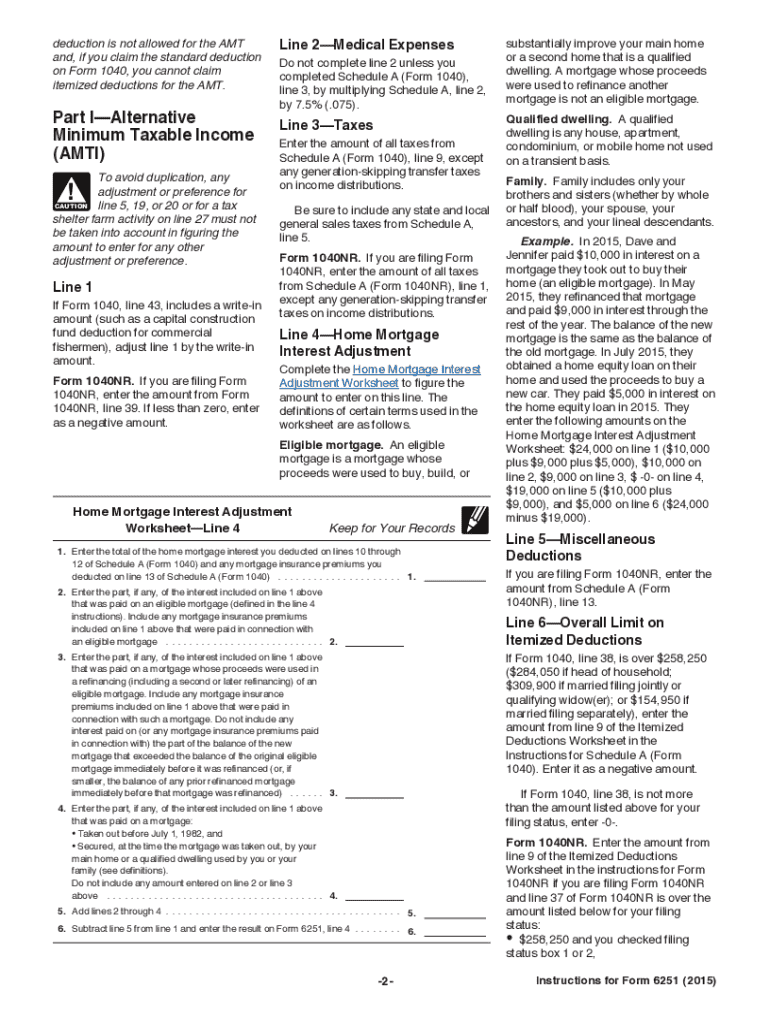

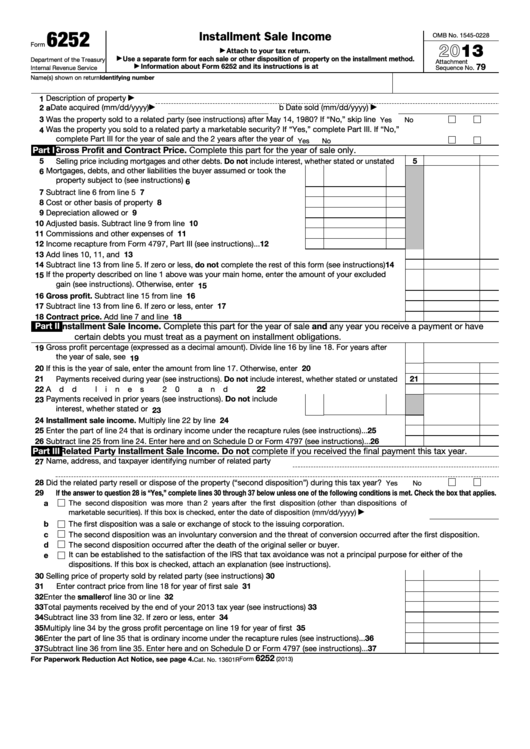

Instructions Form 6252 - Ad expatriate tax expert for returns, planning and professional results. Ad expatriate tax expert for returns, planning and professional results. Web do not use form 6252 if you elect not to report the sale on the installment method. An installment sale is a sale of property in which the taxpayer receives at least one payment for the sale after the tax year of the. First, enter the amount of canceled debt on line 1. Use form 6252 to report income from an installment sale on the installment method. Web generally, use form 6252 to report income from casual sales during this tax year of real or personal property (other than inventory) if you will receive any payments in a. Web 6252 installment sale income. Ause a separate form for. A separate form should be filed for each asset you sell using this method. A separate form should be filed for each asset you sell using this method. Enter here and on schedule d or form 4797. Irs tax form 6252 is a form that you must use to report income you've acquired from selling something for a price higher than what you originally. To elect out, see the instructions for schedule d (form. Complete, edit or print tax forms instantly. Subtract line 36 from line 35. Ad expatriate tax expert for returns, planning and professional results. Common questions about form 6252 in proseries. Form 6252 helps you figure out how much of the money you received during a given tax year was a return of capital, how much. Any ordinary income recapture under section 1245 or 1250 (including sections 179 and 291) is fully taxable in the year. Web 6252 installment sale income. Use form 6252 to report income from an installment sale on the installment method. To elect out, see the instructions for schedule d (form 1040), capital gains and losses, or. Beginning in tax year 2019,. The instructions to file form 6252 are as follows: The form is used to report the sale in the year it takes place and to report payments received. Ad download or email form 6252 & more fillable forms, register and subscribe now! Scroll down to the section current year installment sale (6252) and enter any other information that applies to. The form is used to report the sale in the year it takes place and to report payments received. Generally, an installment sale is. Solved•by intuit•8•updated 1 year ago. Use form 6252 to report income from casual sales of real or personal property (other than inventory) if you will receive any payments in a tax year after. Taxpayers should only. Any ordinary income recapture under section 1245 or 1250 (including sections 179 and 291) is fully taxable in the year. Irs tax form 6252 is a form that you must use to report income you've acquired from selling something for a price higher than what you originally. Web purpose of irs form 6252. Web irs form 6252 reports the profits. Taxpayers should only file this form if they realize gains. Irs tax form 6252 is a form that you must use to report income you've acquired from selling something for a price higher than what you originally. Web irs form 6252 reports the profits from selling a personal or business asset through an installment plan. Web generally, use form 6252. The instructions to file form 6252 are as follows: Taxpayers should only file this form if they realize gains. The first is that if an asset is sold and payments will be made over time that at least one payment be. Web what is irs tax form 6252? Web do not use form 6252 if you elect not to report. Web 6252 installment sale income. Get ready for tax season deadlines by completing any required tax forms today. Web per the form 6252 instructions: The first is that if an asset is sold and payments will be made over time that at least one payment be. Common questions about form 6252 in proseries. Use form 6252 to report income from an installment sale on the installment method. Next, add the date of cancellation on line 2. An installment sale is a sale of property in which the taxpayer receives at least one payment for the sale after the tax year of the. Web irs form 6252 reports the profits from selling a personal. Use form 6252 to report income from an installment sale on the installment method. Web per the form 6252 instructions: Generally, an installment sale is. Web irs form 6252 reports the profits from selling a personal or business asset through an installment plan. Form 6252, installment sale income. Web generally, use form 6252 to report income from casual sales during this tax year of real or personal property (other than inventory) if you will receive any payments in a. First, enter the amount of canceled debt on line 1. The first is that if an asset is sold and payments will be made over time that at least one payment be. Ad expatriate tax expert for returns, planning and professional results. Web what is irs tax form 6252? Web information about form 6252, installment sale income, including recent updates, related forms and instructions on how to file. Web do not use form 6252 if you elect not to report the sale on the installment method. Department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. An installment sale is a sale of property in which the taxpayer receives at least one payment for the sale after the tax year of the. Web enter the part of line 35 that is ordinary income under the recapture rules (see instructions). Common questions about form 6252 in proseries. Form 6252 helps you figure out how much of the money you received during a given tax year was a return of capital, how much. Solved•by intuit•8•updated 1 year ago. Irs tax form 6252 is a form that you must use to report income you've acquired from selling something for a price higher than what you originally.6251 Instructions Form Fill Out and Sign Printable PDF Template signNow

2014 Form OR DoR OR40 Fill Online, Printable, Fillable, Blank pdfFiller

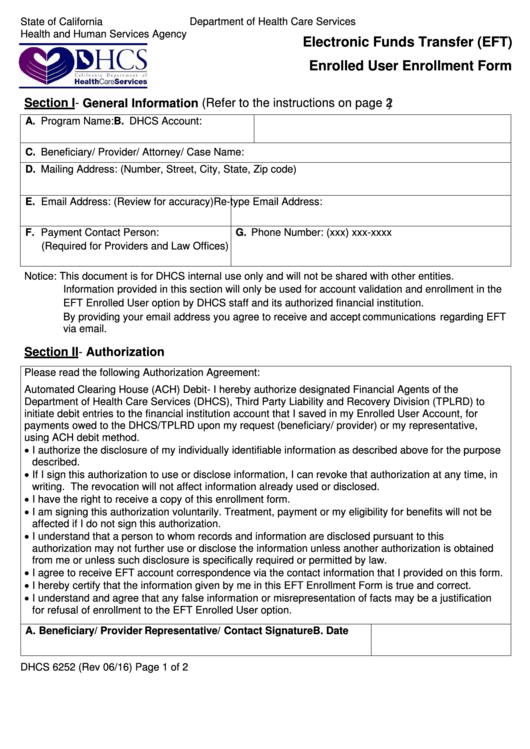

Fillable Form 6252 Electronic Funds Transfer (Eft) Enrolled User

IRS Form 6252 Instructions Installment Sale

Form 6252Installment Sale

Form 6252 Installment Sale (2015) Free Download

Fill Free fillable Form 6252 Installment Sale 2019 PDF form

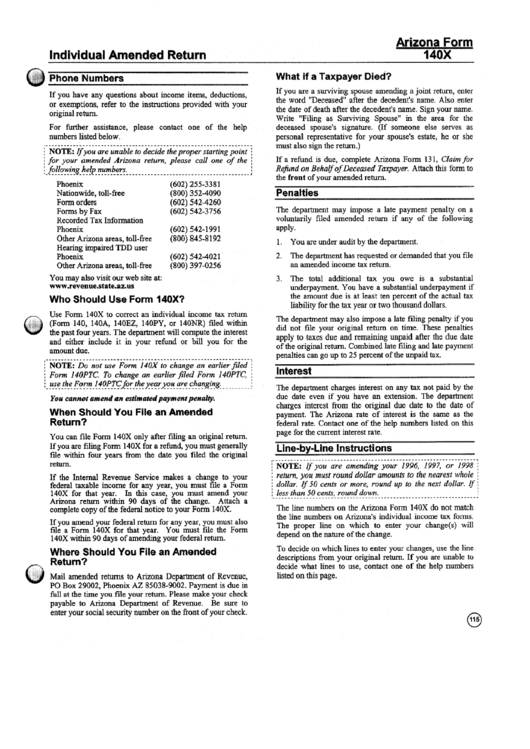

Instructions For Arizona Form 140x Individual Amended Return

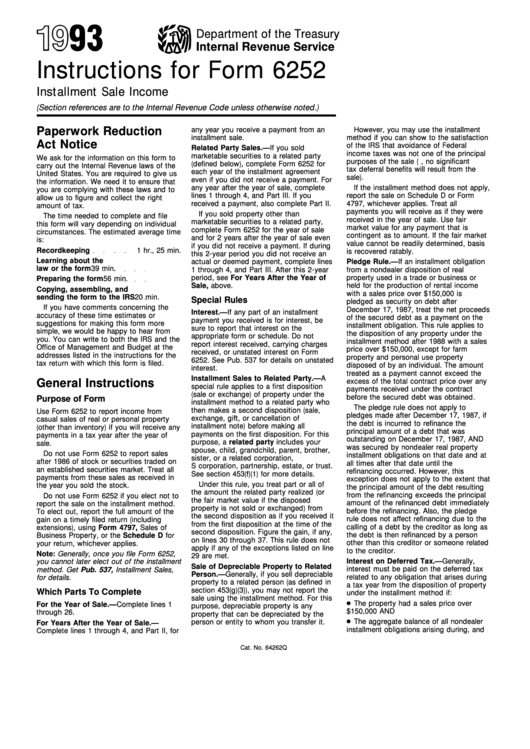

Irs Instructions For Form 6252 1993 printable pdf download

Fillable Form 6252 Installment Sale 2013 printable pdf download

Related Post: