Instructions Form 6251

Instructions Form 6251 - Web attach form 6251 to your return if any of the following statements are true. Get ready for tax season deadlines by completing any required tax forms today. Web form 6251 alternative minimum tax. You claim any general business credit, and either line 6. Web per irs instructions for form 6251: For instructions and the latest. Web solved•by intuit•14•updated june 13, 2023. Complete, edit or print tax forms instantly. The exemption amount on form 6251, line 5, has increased to $75,900 ($118,100 if married filing jointly or qualifying. Web study form 6251 each time you prepare your tax return to see how close you are to paying the amt. Web study form 6251 each time you prepare your tax return to see how close you are to paying the amt. Department of the treasury internal revenue service (99) go to. Web solved•by intuit•14•updated june 13, 2023. Web form 6251 alternative minimum tax. Web attach form 6251 to your return if any of the following statements are true. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. For instructions and the latest. You can download or print. Web tax preference items on federal form 6251; Total of lines 1 through 4, equal to alternative minimum taxable income on line 4. Web per irs instructions for form 6251: If you have questions — we have the answers. Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. Web attach form 6251 to your return if any. Department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. If you have questions — we have the answers. You can download or print. Department of the treasury internal revenue service (99) go to. Total of lines 1 through 4, equal to alternative minimum taxable income on line 4. The exemption amount on form 6251, line 5, has increased to $75,900 ($118,100 if married filing jointly or qualifying. Complete, edit or print tax forms instantly. For instructions and the latest. Web video instructions and help with filling out and completing form 6251 instructions. Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. Web form 6251 alternative minimum tax. If you have questions — we have the answers. Form 6251, line 7, is greater than line 10. Complete your 6251 forms tax with ease. Web form 6251 alternative minimum tax. You can download or print. Complete, edit or print tax forms instantly. Complete your 6251 forms tax with ease. Department of the treasury internal revenue service (99) go to. Form 6251, line 7, is greater than line 10. Complete, edit or print tax forms instantly. Total of lines 1 through 4, equal to alternative minimum taxable income on line 4. The exemption amount on form 6251, line 5, has increased to $75,900 ($118,100 if married filing jointly or qualifying. The program calculates and prints form 6251, if it applies. Complete, edit or print tax forms instantly. Web solved•by intuit•14•updated june 13, 2023. Department of the treasury internal revenue service. Complete your 6251 forms tax with ease. Complete, edit or print tax forms instantly. Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. You claim any general business credit, and either line 6. Department of the treasury internal revenue service (99) go to. The program calculates and prints form 6251, if it applies to the taxpayer's return. Web video instructions and help with. Complete your 6251 forms tax with ease. Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. Web solved•by intuit•14•updated june 13, 2023. Web attach form 6251 to your return if any of the following statements are true. Web study form 6251 each time you prepare your tax return to see how close you are to paying the amt. Get ready for tax season deadlines by completing any required tax forms today. Web tax preference items on federal form 6251; Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web per irs instructions for form 6251: Form 6251, line 7, is greater than line 10. You claim any general business credit, and either line 6. Web video instructions and help with filling out and completing form 6251 instructions. The exemption amount on form 6251, line 5, has increased to $75,900 ($118,100 if married filing jointly or qualifying. Department of the treasury internal revenue service (99) go to. You claim any general business credit, and either line 6. If you have questions — we have the answers. The program calculates and prints form 6251, if it applies to the taxpayer's return. Evaluate how close your tentative minimum tax. You can download or print.form 6251 instructions 2020 2021 Fill Online, Printable, Fillable

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2004

Download Instructions for IRS Form 6251 Alternative Minimum Tax

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2003

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2001

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2017

Download Instructions for IRS Form 6251 Alternative Minimum Tax

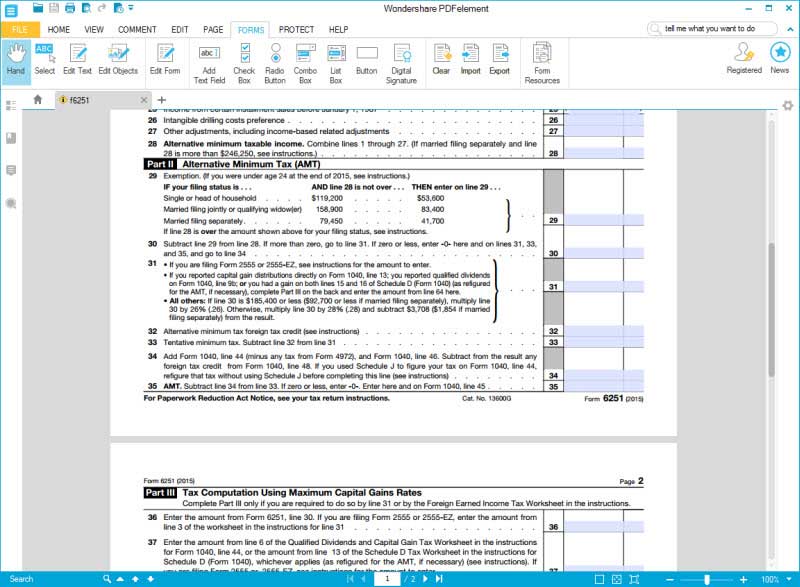

Instructions for How to Fill in IRS Form 6251

Editable IRS Form Instruction 6251 2018 2019 Create A Digital

Download Instructions for IRS Form 6251 Alternative Minimum Tax

Related Post: