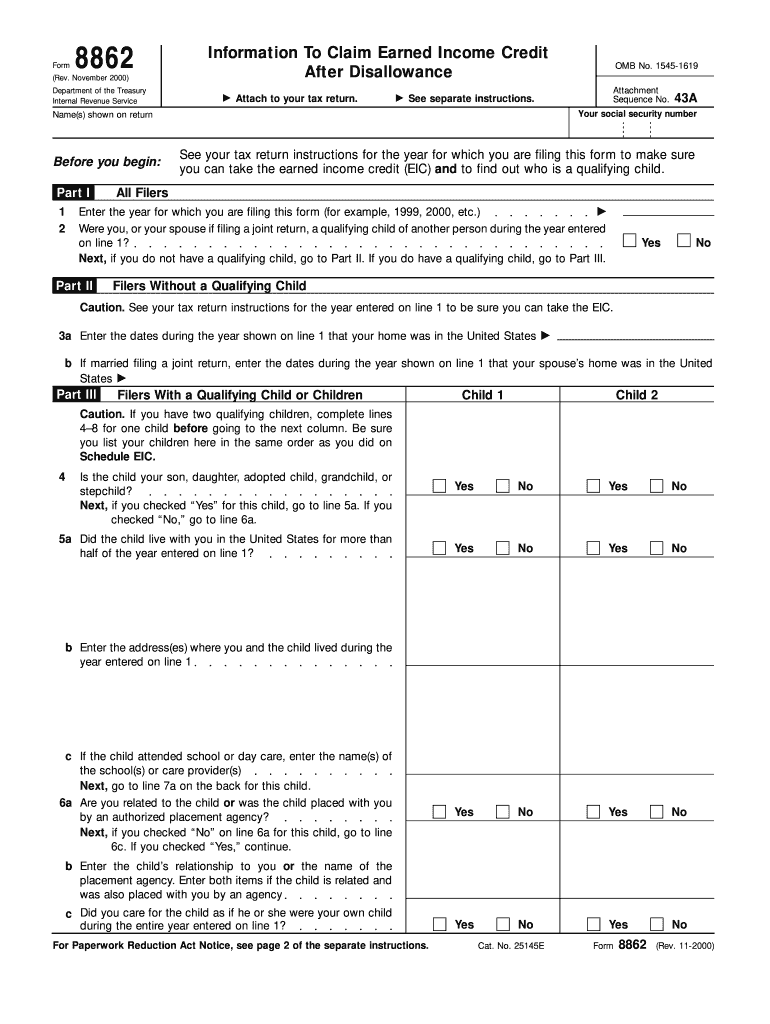

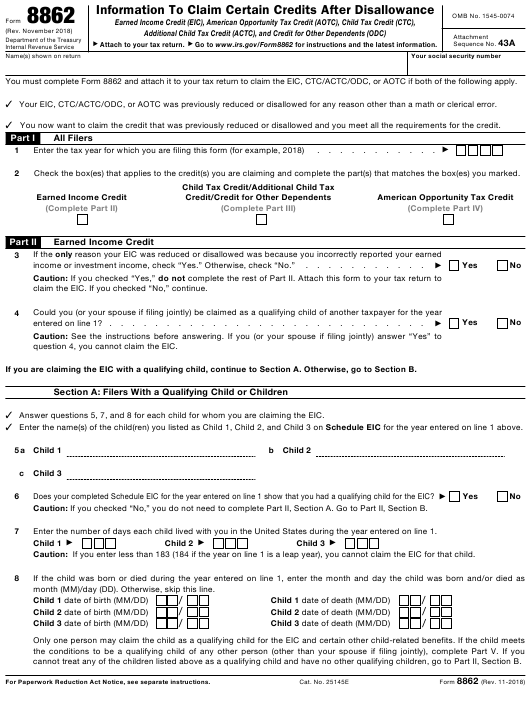

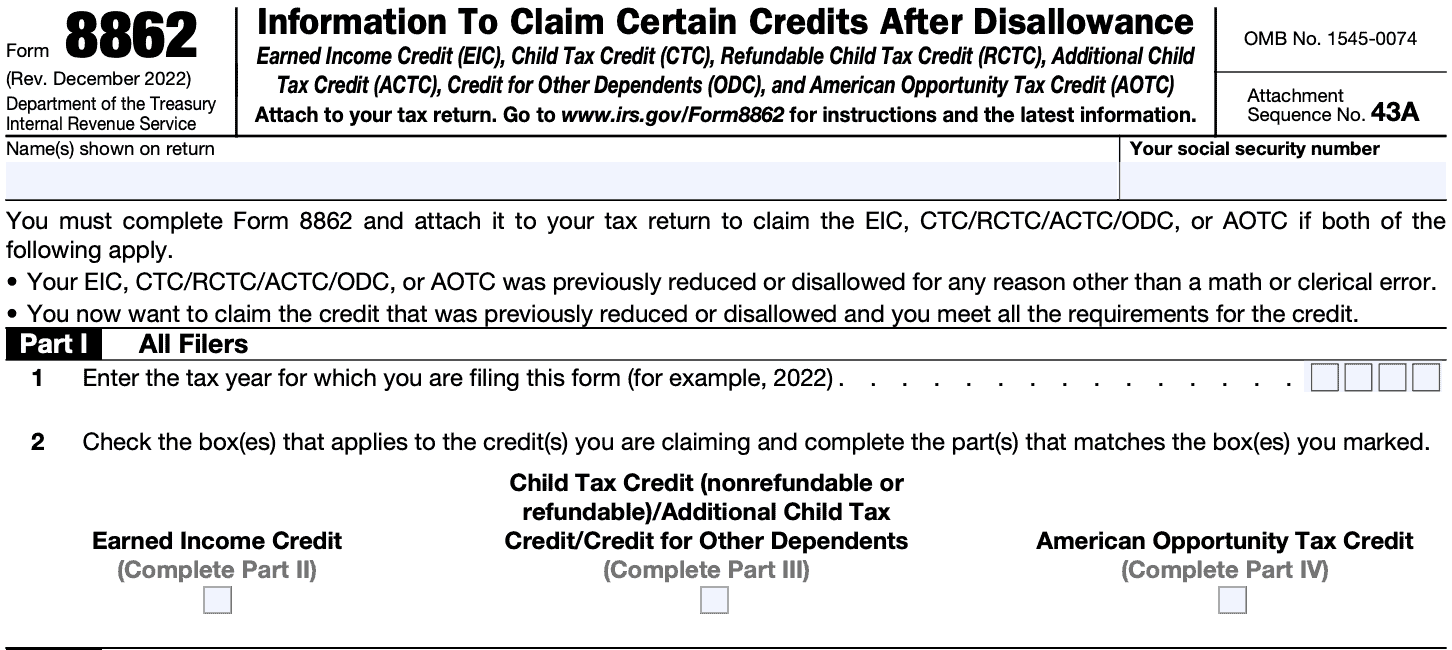

How To Fill Out Form 8862

How To Fill Out Form 8862 - Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. Information to claim earned income credit after disallowance. Ad access irs tax forms. Web earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american. Complete, edit or print tax forms instantly. Try it for free now! Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Who should use form 8862. View solution in original post. Use get form or simply click on the template preview to open it in the editor. Click the green button to add information to claim a certain credit after disallowance. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Web more about the federal form 8862 tax credit. Ad access irs. Open (continue) your return if you don't already have it. Form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed. Solved • by turbotax • 7270 • updated february 25, 2023. Web more about the federal form 8862 tax credit.. June 7, 2019 4:10 pm. Web how do i enter form 8862? How to fill out form 8862. Web how do i enter form 8862? Ad download or email irs 8862 & more fillable forms, register and subscribe now! Form 8962 is a form you must file with your federal income tax return for a year if you received an advanced. Web earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american. Form 8862 is required to be filed with a taxpayer’s tax return. Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. Web step 1 using a suitable browser on your computer, navigate to the irs homepage and click the form 8862 link. Try it for free now! Upload, modify or create. Try it for free now! Ad access irs tax forms. Information to claim earned income credit after disallowance. If you had a child tax credit (ctc) disallowed in a prior year, you likely received an irs cp79 tax notice. Open (continue) your return if you don't already have it. Web screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Ad access irs tax forms. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following. Web earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american. Open (continue) your return if you don't already have it. Enter the year for the tax year you. You can use the steps. Get ready for tax season deadlines by completing any required tax. Open (continue) your return if you don't already have it. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Information to claim earned income credit after disallowance. View solution in original post. Web you must. Enter your name and social security number at the top of form 8862 as it is shown on your current tax return. Web more about the federal form 8862 tax credit. This form comes in pdf format and is automatically. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Form 8962 is a form you. Solved • by turbotax • 7270 • updated february 25, 2023. Web if your return was efiled and rejected or still in progress, you can submit form 8862 online with your return. Written by a turbotax expert • reviewed by a turbotax cpa. Ad access irs tax forms. Web step 1 using a suitable browser on your computer, navigate to the irs homepage and click the form 8862 link. Web screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Complete, edit or print tax forms instantly. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Ad download or email irs 8862 & more fillable forms, register and subscribe now! 4.1k views 1 year ago #childtaxcredit. Web filing tax form 8862: You can use the steps. June 7, 2019 4:10 pm. Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. How to fill out form 8862. Information to claim earned income credit after disallowance. Upload, modify or create forms. Put your name and social security number on the statement and attach it at.Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Top 14 Form 8862 Templates free to download in PDF format

Form 8862Information to Claim Earned Credit for Disallowance

Printable Irs Form 8862 Printable Form 2021

Irs Form 8862 Printable Master of Documents

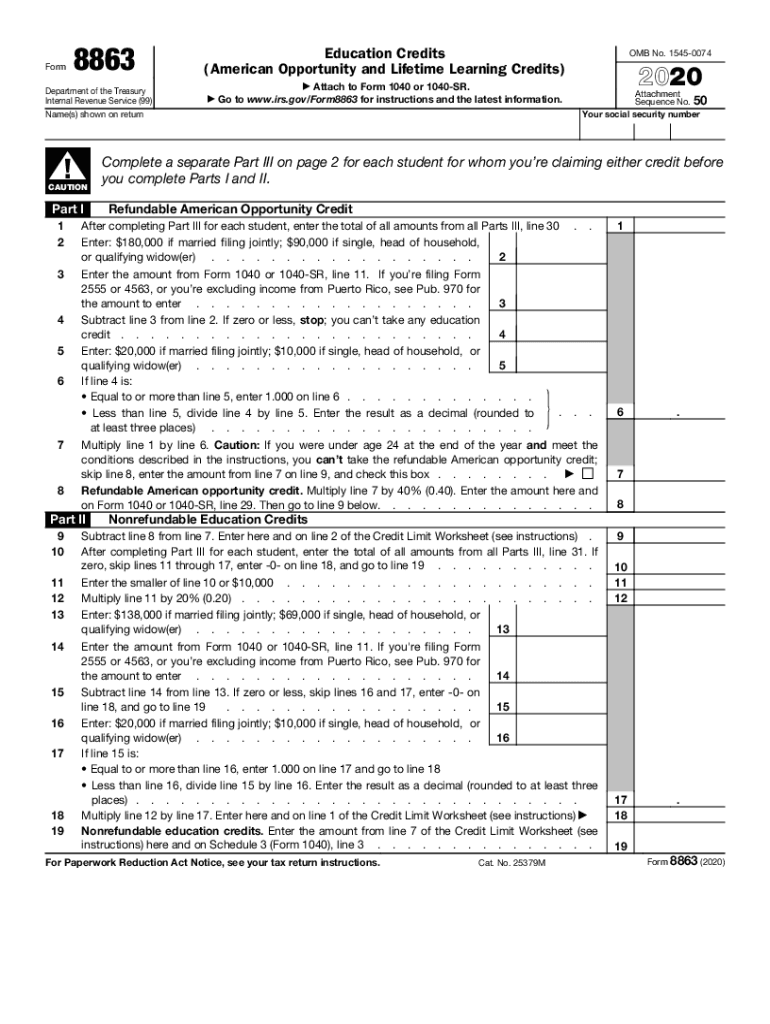

Form 8863 Fill out & sign online DocHub

IRS Form 8862 Instructions

Form 8862 For 2019 PERINGKAT

Form 8862 Information to Claim Earned Credit After

8862 Form Fill Out and Sign Printable PDF Template signNow

Related Post:

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/aaa.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-05-05at3.12.40PM-ad486e92d61441a9b09a3e39b758696c.png)