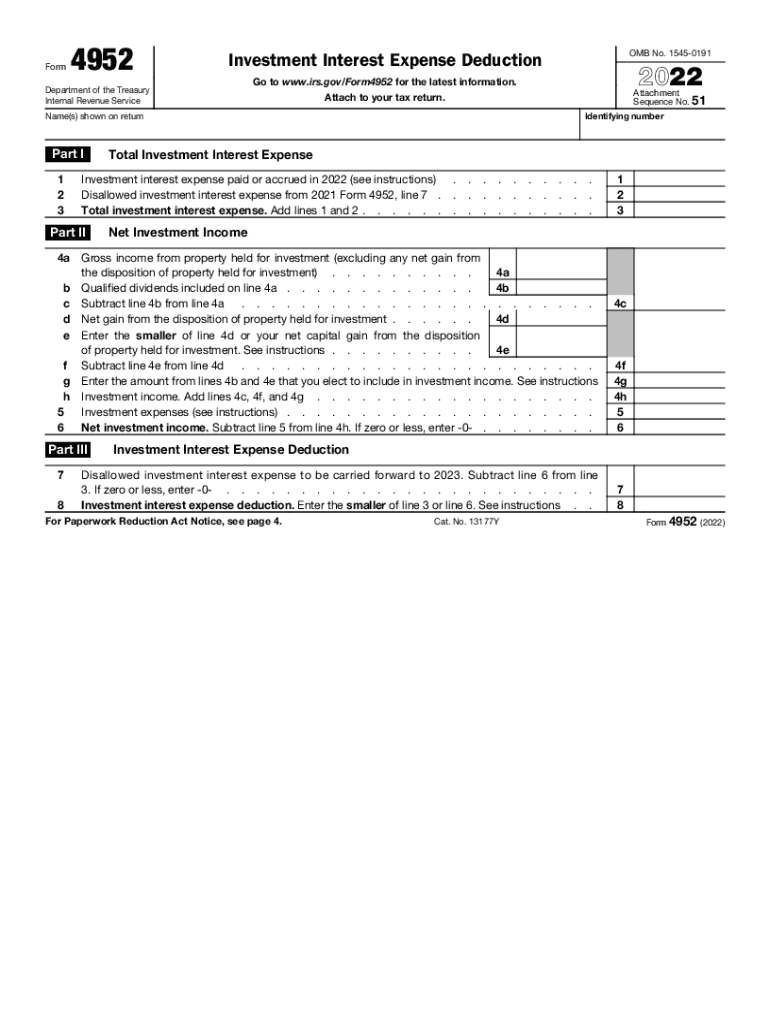

Instructions Form 4952

Instructions Form 4952 - Fill in all needed lines in the doc utilizing our powerful pdf editor. Web trusts, and other persons under sections 4951, 4952, and 4953. Web form must be explained in box 10 of the form 4852. Amount of investment interest you can deduct; A taxpayer may elect to include any amount of. On this form, figure these: Web the form 4952 calculates before the form 6198. Be prepared to read the instructions closely, or enlist. Web information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on how to file. Web even though form 4952 looks quite straightforward, there are still a lot of rules and restrictions related to it. Use this form to figure the amount of investment interest expense you can deduct for the current year and. This form is for income earned in tax year 2022, with tax returns due in april. Select the button get form to open it and start editing. Web trusts, and other persons under sections 4951, 4952, and 4953. Web investment interest. On this form, figure these: Use this form to figure the amount of investment interest expense you can deduct for the current year and. Amount of investment interest you can deduct; Web form 4952, investment interest expense deduction, concerns both: Disallowed investment interest expense from 2021 form 4952, line 7. Web the form 4952 calculates before the form 6198. Web information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on how to file. Web use form 4952 to figure the amount of investment interest expense you can deduct for 2022 and the amount you can carry forward to future years. Web form must be. Web we last updated federal form 4952 in december 2022 from the federal internal revenue service. A taxpayer may elect to include any amount of. Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. the taxpayer has $60,000 in investment. See the instructions for form 990 for. Web for purposes of irs form 4952, qualified dividend income is not considered investment income. Web we last updated federal form 4952 in december 2022 from the federal internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Web use form 4952 to figure the amount of investment interest expense you can deduct for. Ad a tax advisor will answer you now! Get ready for tax season deadlines by completing any required tax forms today. Web form 4952, investment interest expense deduction, concerns both: Be prepared to read the instructions closely, or enlist. Web use form 4952 to figure the amount of investment interest expense you can deduct for 2022 and the amount you. Department of the treasury internal revenue service (99) investment interest expense deduction. Web investment interest expense paid or accrued in 2022 (see instructions). A taxpayer may elect to include any amount of. Ad download or email irs 4952 & more fillable forms, register and subscribe now! Ago to www.irs.gov/form4952 for the latest information. On this form, figure these: This form is for income earned in tax year 2022, with tax returns due in april. Get ready for tax season deadlines by completing any required tax forms today. Web if you filled out form 4952, investment interest expense deduction, for your regular tax, you will need to fill out a second form 4952 for. Questions answered every 9 seconds. Web form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. A taxpayer may elect to include any amount of. This form is for income earned in tax year 2022, with tax returns due in april.. Web form must be explained in box 10 of the form 4852. Department of the treasury internal revenue service (99) investment interest expense deduction. On this form, figure these: Web how to compute investment interest expense for a taxpayer that has margin interest on their brokerage account. Use this form to figure the amount of investment interest expense you can. Web use form 4952 to figure the amount of investment interest expense you can deduct for 2022 and the amount you can carry forward to future years. Questions answered every 9 seconds. Web investment interest expense paid or accrued in 2022 (see instructions). Ad download or email irs 4952 & more fillable forms, register and subscribe now! Use this form to figure the amount of investment interest expense you can deduct for the current year and. Fill in all needed lines in the doc utilizing our powerful pdf editor. Ad a tax advisor will answer you now! Web information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on how to file. Web form must be explained in box 10 of the form 4852. Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. the taxpayer has $60,000 in investment. Web form 4952, investment interest expense deduction, concerns both: A taxpayer may elect to include any amount of. Web even though form 4952 looks quite straightforward, there are still a lot of rules and restrictions related to it. Web if you filled out form 4952, investment interest expense deduction, for your regular tax, you will need to fill out a second form 4952 for the amt as follows. Get ready for tax season deadlines by completing any required tax forms today. See the instructions for form 990 for more information. On this form, figure these: Amount of investment interest you can deduct; Select the button get form to open it and start editing. Web general instructions purpose of form use form 4952 to figure the amount of investment interest expense you can deduct for 2022 and the amount you can carry forward to future.IRS Form 4952 Investment Interest Expense Deduction

Fill Free fillable F4952 2019 Form 4952 PDF form

IRS Form 4952 Instructions Investment Interest Deduction

Form 4952 Investment Interest Expense Deduction (2015) Free Download

Form 4952Investment Interest Expense Deduction

Form 4952 Investment Interest Expense Deduction Stock Photo Image of

Instructions For Arizona Form 140x Individual Amended Return

Form 4952 Investment Interest Expense Deduction (2015) Free Download

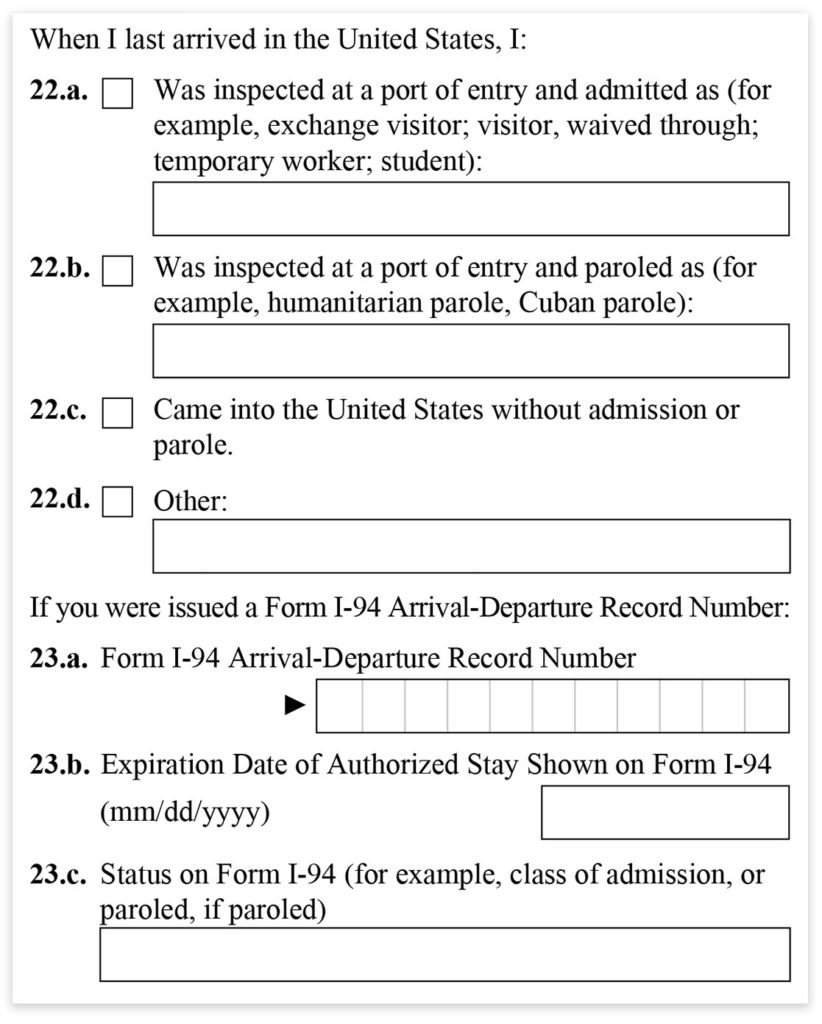

Form I 12 New Version 12 Reasons Why People Like Form I 12 New Version

Form 4952 Fill Out and Sign Printable PDF Template signNow

Related Post: