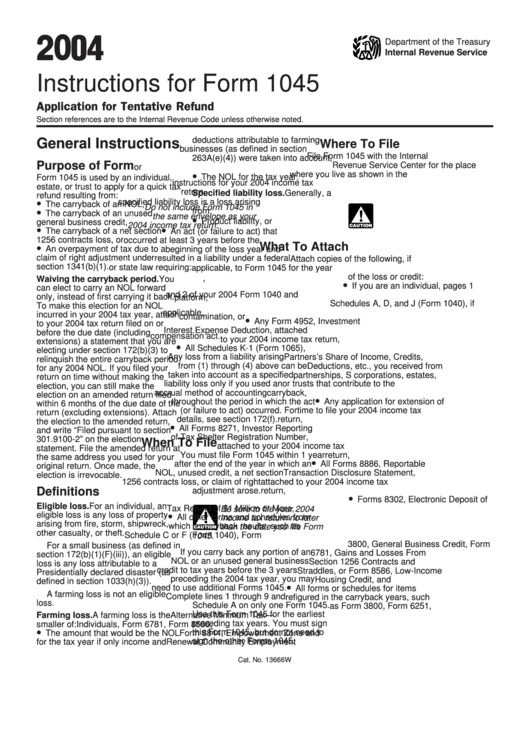

Instructions Form 1045

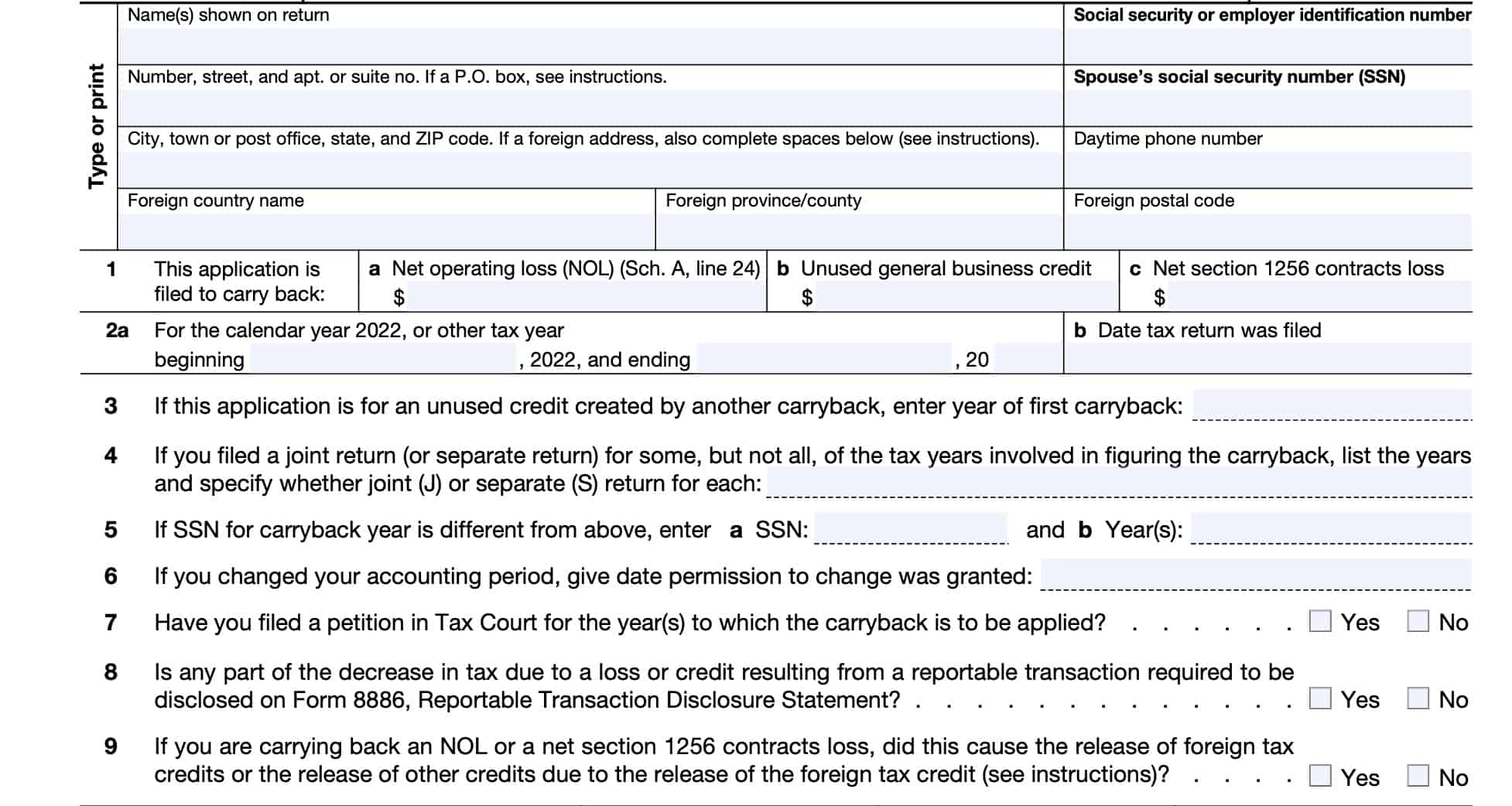

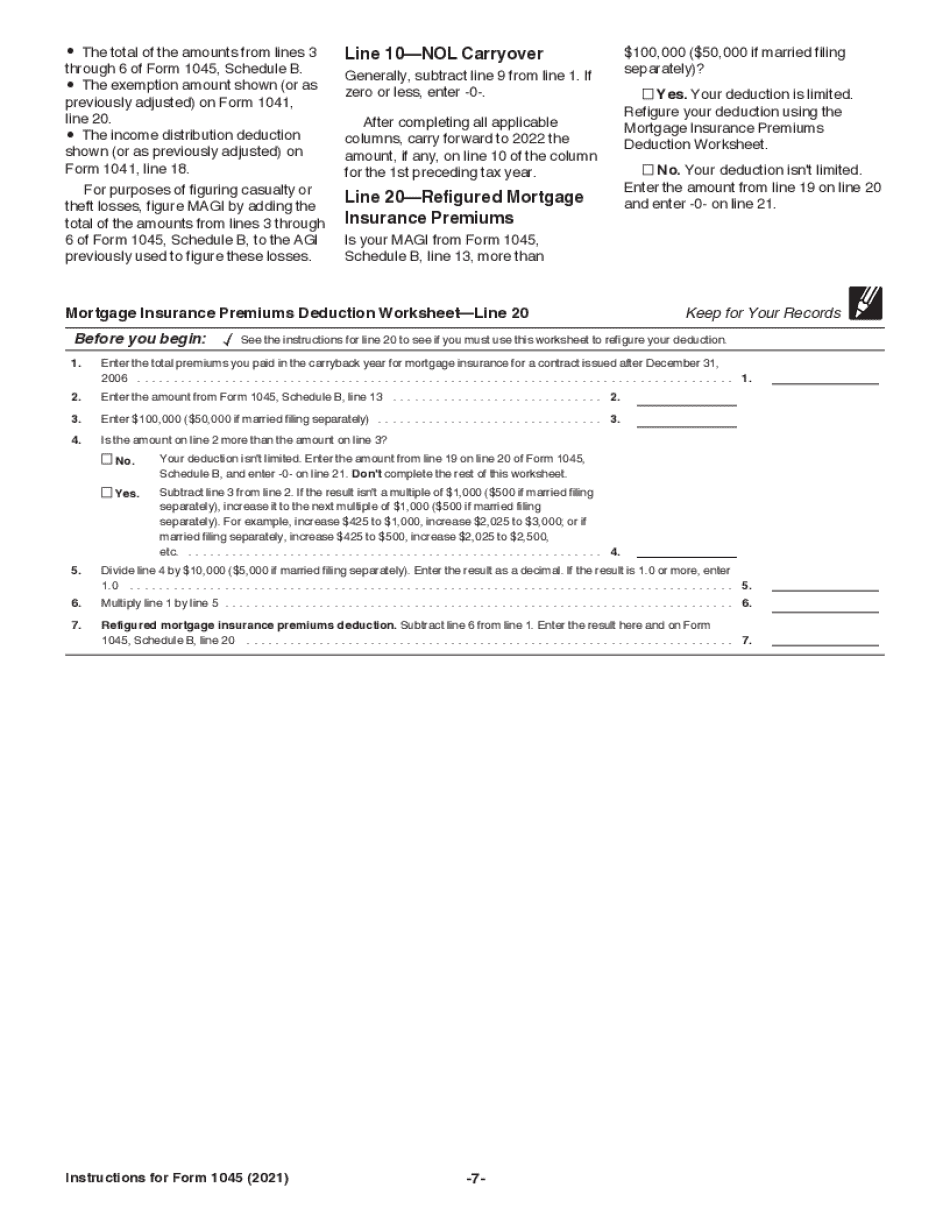

Instructions Form 1045 - Web complete irs instruction 1045 2020 online with us legal forms. Web tax credit on form 1045, computation of decrease in tax, line 17, and include the child tax credits on form 1045, computation of decrease in tax, line 21. From within your taxact return ( online ), click the tools dropdown, then click forms assistant. Form 1045 is used by an individual, estate, or trust to apply for a quick tax refund resulting from: Ad register and subscribe now to work on your irs instruction 1045 & more fillable forms. This form is to request a refund of overpayment of tax liability, and must file. Web we last updated the application for tentative refund in december 2022, so this is the latest version of form 1045, fully updated for tax year 2022. Web the irs uses form 1045 to process tentative refunds for individual taxpayers. Generally, you must file form 1045 within 1 year after the end of the year in which an nol, unused credit, net section 1256 contracts loss, or claim of right. Add lines 1 and 2. Generally, you must file form 1045 within 1 year after the end of the year in which an nol, unused credit, net section 1256 contracts loss, or claim of right. Add lines 1 and 2. Web we last updated the application for tentative refund in december 2022, so this is the latest version of form 1045, fully updated for tax. Ad register and subscribe now to work on your irs instruction 1045 & more fillable forms. Web tax credit on form 1045, computation of decrease in tax, line 17, and include the child tax credits on form 1045, computation of decrease in tax, line 21. Add lines 1 and 2. From within your taxact return ( online ), click the. Web limitation on excess business losses of noncorporate taxpayers. Generally, you must file form 1045 on or after the date you file your tax return for the nol year, but not later than one year after the end of the nol year. The carryback of a net operating loss (nol), the carryback. Generally, you must file form 1045 within 1. Web limitation on excess business losses of noncorporate taxpayers. Ad register and subscribe now to work on your irs instruction 1045 & more fillable forms. Generally, you must file form 1045 within 1 year after the end of the year in which an nol, unused credit, net section 1256 contracts loss, or claim of right. From within your taxact return. For purposes of column (a), if the ale member offered. Refer to irs instructions for form 1045 for additional information about where. Separate instructions and additional information are available at irs.gov/form1045. Ad register and subscribe now to work on your irs instruction 1045 & more fillable forms. Easily fill out pdf blank, edit, and sign them. Most entries will be manual. Department of the treasury internal revenue service. Generally, you must file form 1045 on or after the date you file your tax return for the nol year, but not later than one year after the end of the nol year. If total taxes are $2,500 or more, the amount reported on line 3. Web in. Add lines 1 and 2. Department of the treasury internal revenue service. For individuals, estates, or trusts. Web tax credit on form 1045, computation of decrease in tax, line 17, and include the child tax credits on form 1045, computation of decrease in tax, line 21. Easily fill out pdf blank, edit, and sign them. If total taxes are $2,500 or more, the amount reported on line 3. Easily fill out pdf blank, edit, and sign them. Web proseries doesn't automatically generate form 1045. Ad download or email irs 1045 & more fillable forms, register and subscribe now! For individuals, estates, or trusts. Web proseries doesn't automatically generate form 1045. Web in drake tax, form 1045 is only able to be generated for carryback of a nol. This form is to request a refund of overpayment of tax liability, and must file. If you need to carry back a general business credit or section 1256 loss on form 1045, you will have to.. Web we last updated the application for tentative refund in december 2022, so this is the latest version of form 1045, fully updated for tax year 2022. Generally, you must file form 1045 on or after the date you file your tax return for the nol year, but not later than one year after the end of the nol year.. Department of the treasury internal revenue service. Web proseries doesn't automatically generate form 1045. For individuals, estates, or trusts. Web tax credit on form 1045, computation of decrease in tax, line 17, and include the child tax credits on form 1045, computation of decrease in tax, line 21. For individuals, estates, or trusts. Web we last updated the application for tentative refund in december 2022, so this is the latest version of form 1045, fully updated for tax year 2022. If total taxes are $2,500 or more, the amount reported on line 3. Most entries will be manual. Web in drake tax, form 1045 is only able to be generated for carryback of a nol. If you need to carry back a general business credit or section 1256 loss on form 1045, you will have to. Generally, you must file form 1045 on or after the date you file your tax return for the nol year, but not later than one year after the end of the nol year. For purposes of column (a), if the ale member offered. Ad download or email irs 1045 & more fillable forms, register and subscribe now! You can download or print current. Web generally, you must file form 1045 within 1 year after the end of the year in which an nol, unused credit, net section 1256 contracts loss, or claim of right adjustment. Generally, you must file form 1045 within 1 year after the end of the year in which an nol, unused credit, net section 1256 contracts loss, or claim of right. From within your taxact return ( online ), click the tools dropdown, then click forms assistant. Web limitation on excess business losses of noncorporate taxpayers. The carryback of a net operating loss (nol), the carryback. Ad register and subscribe now to work on your irs instruction 1045 & more fillable forms.Instructions For Form 1045 Application For Tentative Refund 2009

Instructions For Form 1045 Application For Tentative Refund 2009

Instructions For Form 1045 Application For Tentative Refund 2017

Instructions For Form 1045 Application For Tentative Refund 2011

Instructions For Form 1045 2004 printable pdf download

IRS Form 1045 Instructions Applying For A Tentative Refund

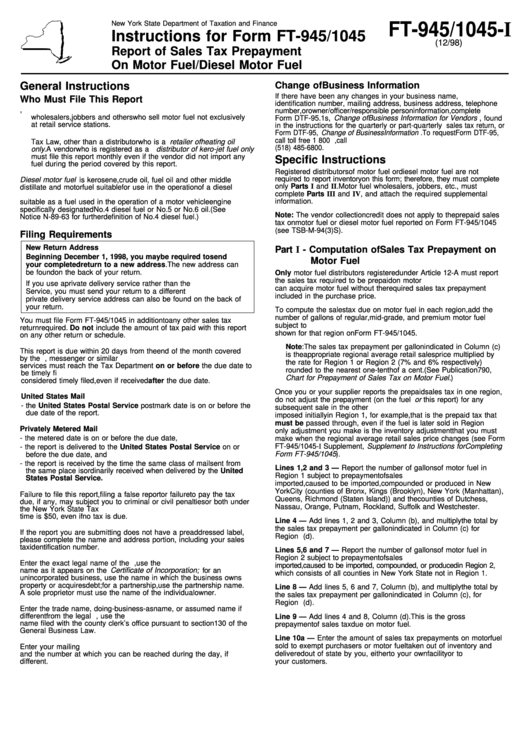

Instructions For Form Ft945/1045 Report Of Sales Tax Prepayment On

20212023 form 1045 instructions Fill online, Printable, Fillable Blank

form 1045 instructions 20202022 Fill Online, Printable, Fillable

Form 1045, page 1

Related Post: