Form 4562 Line 11

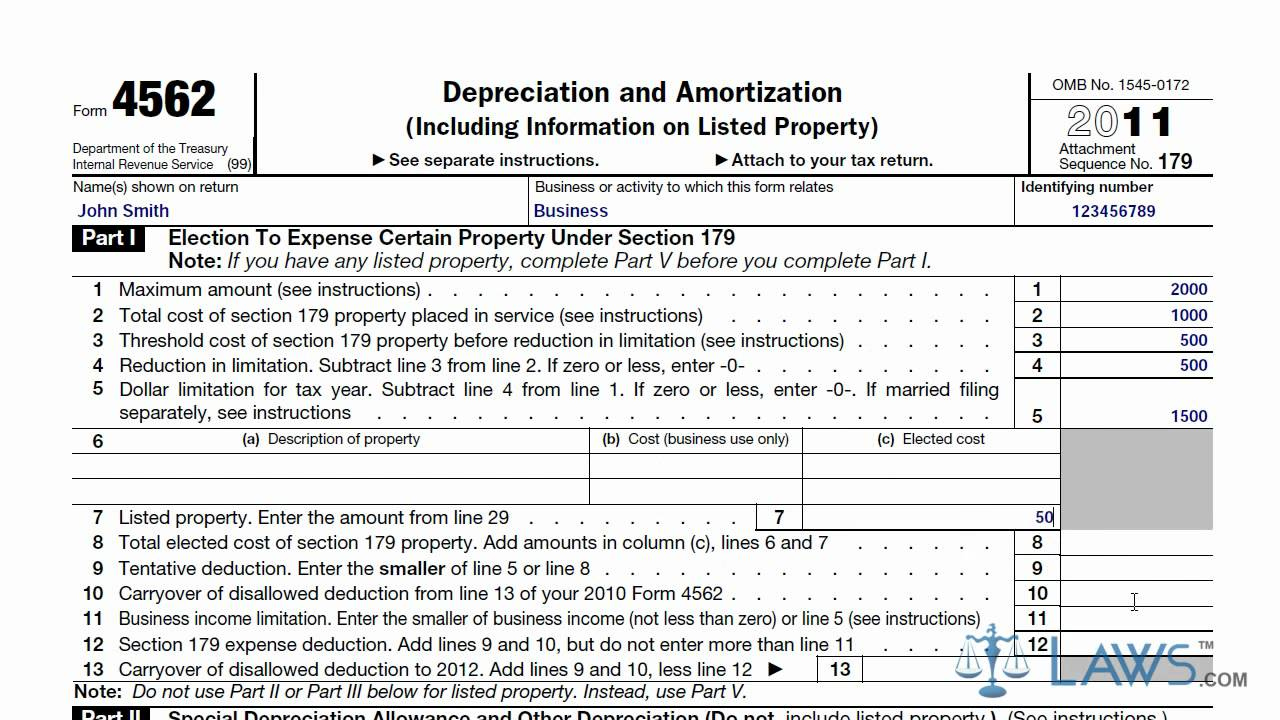

Form 4562 Line 11 - To complete form 4562, you'll need to know the cost of assets like. Per the irs instructions for form 4562: Web home about form 4562, depreciation and amortization (including information on listed property) use form 4562 to: Net income or loss from trade. Web if the amount on form 4562, line 11 is less than the amount on line 5, ultratax cs prints a not required statement that details the calculation of the business income limitation for. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. Web line 11 the total cost you can deduct is limited to your taxable income from the active conduct of a trade or business during the year. The expensing deduction is limited to the aggregate taxable income derived from the. Updated for tax year 2022 • june 2, 2023 8:54 am. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web irs form 4562 is used to claim deductions for the depreciation or amortization of tangible or intangible property. Web written by a turbotax expert • reviewed by a turbotax cpa. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web to see the details of the calculation of form 4562, line 11,. Web home about form 4562, depreciation and amortization (including information on listed property) use form 4562 to: The maximum amount you can deduct is $1,000,000. Assets such as buildings, machinery,. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Enter the smaller of line 5 or the total taxable income from any trade. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. Web irs instructions for form 4562, line 11. Web to see the details of the calculation of form 4562, line 11, go to print > preview and view the not required statements.. Assets such as buildings, machinery,. Enter the smaller of line 5 or the total taxable income from any trade or business you actively conducted,. Net income or loss from trade. Web why does form 4562 line 11 show as zero? Web home about form 4562, depreciation and amortization (including information on listed property) use form 4562 to: Web line 11 the total cost you can deduct is limited to your taxable income from the active conduct of a trade or business during the year. To complete form 4562, you'll need to know the cost of assets like. Enter the smaller of line 5 or the total taxable income from any trade or business you actively conducted,. Per. Web the irs allows businesses to claim a deduction for both amortization and deprecation by filing irs form 4562, the depreciation and amortization form. Web home about form 4562, depreciation and amortization (including information on listed property) use form 4562 to: Per the irs instructions for form 4562: Enter the smaller of business income (not less than zero) or. Web. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. Keep copies of all paperwork to support the claim. Web how is the amount of business. Web why does form 4562 line 11 show as zero? You are considered to actively conduct a. Enter the smaller of business income (not less than zero) or. Web home about form 4562, depreciation and amortization (including information on listed property) use form 4562 to: Web how is the business income calculated for line 11 of the form 4562 in. To complete form 4562, you'll need to know the cost of assets like. Read and follow the directions for every section, by recording the value as directed on the form 4562. Web the irs allows businesses to claim a deduction for both amortization and deprecation by filing irs form 4562, the depreciation and amortization form. Web to see the details. To complete form 4562, you'll need to know the cost of assets like. The total cost you can deduct is. Web to see the details of the calculation of form 4562, line 11, go to print > preview and view the not required statements. Web home about form 4562, depreciation and amortization (including information on listed property) use form 4562. The expensing deduction is limited to the aggregate taxable income derived from the. I am trying to use section 179 to expense appliances i replaced in four of my rentals in 2020, but i'm getting business. Web if the amount on form 4562, line 11 is less than the amount on line 5, ultratax cs prints a not required statement that details the calculation of the business income limitation for. Web the irs allows businesses to claim a deduction for both amortization and deprecation by filing irs form 4562, the depreciation and amortization form. Claim your deduction for depreciation. Web written by a turbotax expert • reviewed by a turbotax cpa. For assets over $2,500,000, you have. Keep copies of all paperwork to support the claim. The program will limit the section 179 on form 4562, line 11. Web irs instructions for form 4562, line 11. The maximum amount you can deduct is $1,000,000. Web line 11 of form 4562 is calculated by totaling the net income and losses from all trades and businesses you actively conducted during the year. Assets such as buildings, machinery,. The tax application calculates the amount of aggregate. Web 10 carryover of disallowed deduction from line 13 of your 2020 form 4562. Web how is the business income calculated for line 11 of the form 4562 in an individual return? The total cost you can deduct is. Web home about form 4562, depreciation and amortization (including information on listed property) use form 4562 to: Web why does form 4562 line 11 show as zero? Updated for tax year 2022 • june 2, 2023 8:54 am.2021 Form IRS 4562 Instructions Fill Online, Printable, Fillable, Blank

Irs Form 4562 Instructions Universal Network

Learn How To Fill The Form 4562 Depreciation And 2021 Tax Forms 1040

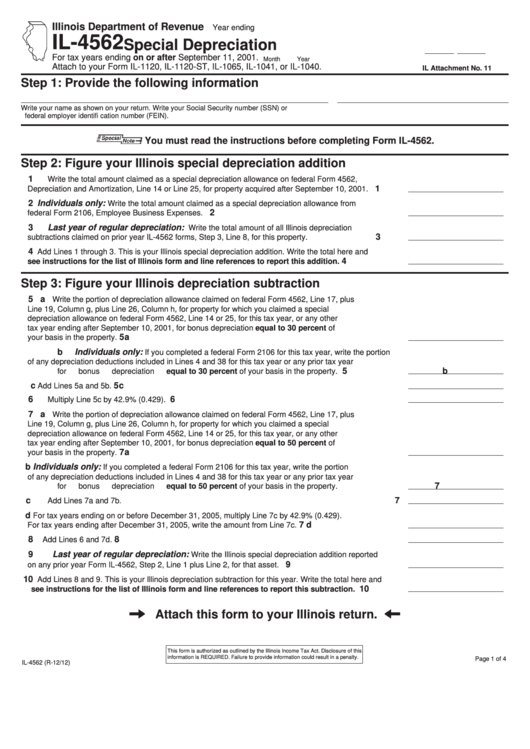

Form Il4562 Special Depreciation printable pdf download

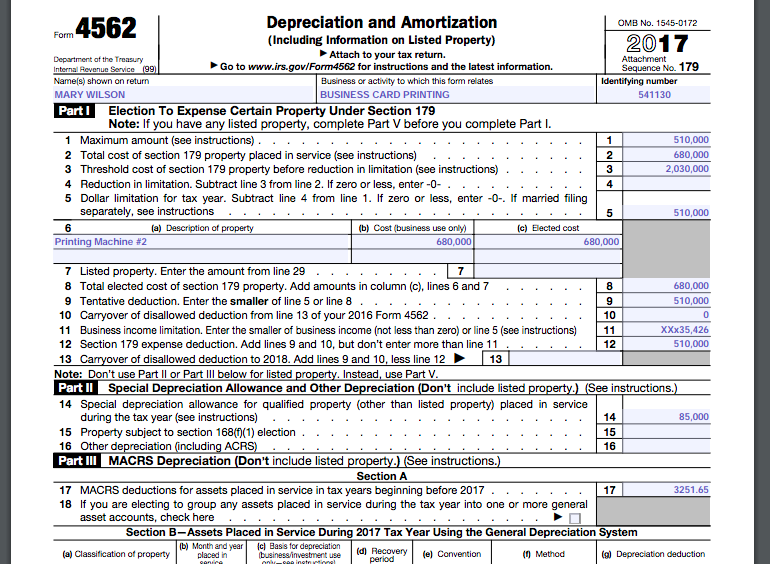

How do I fill out Irs Form 4562 for this computer.

Need Help filling out the first part of the form

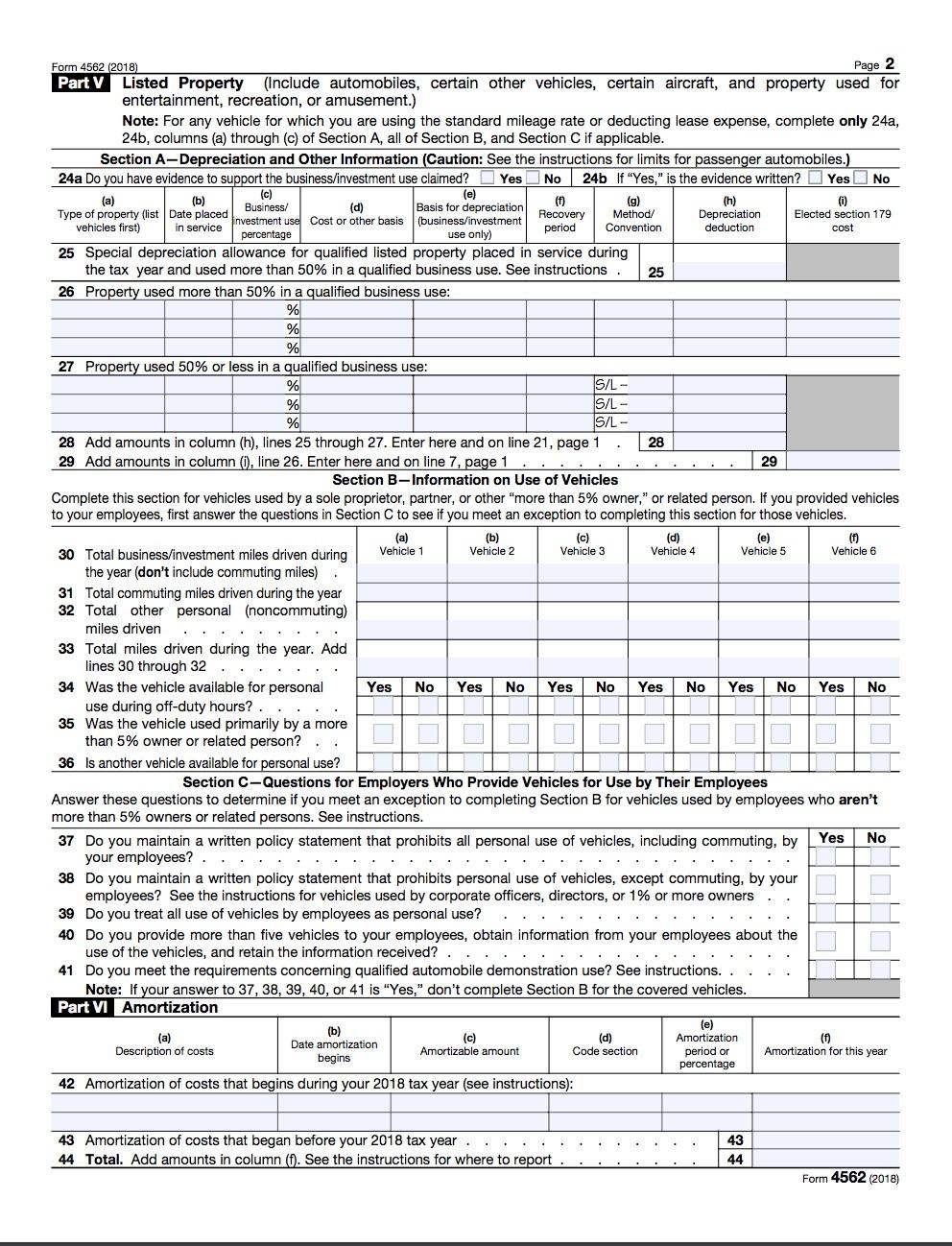

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

4562 Form 2022 2023

2012 Form 4562 Instructions Universal Network

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

Related Post: