Instructions For Form M1Pr

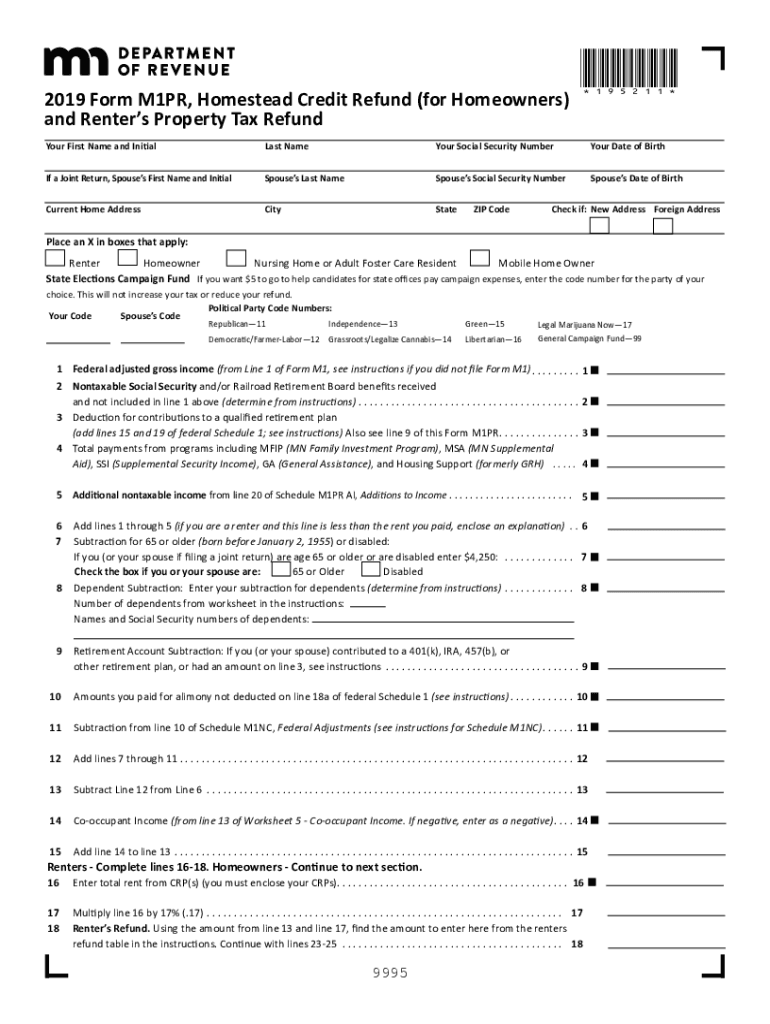

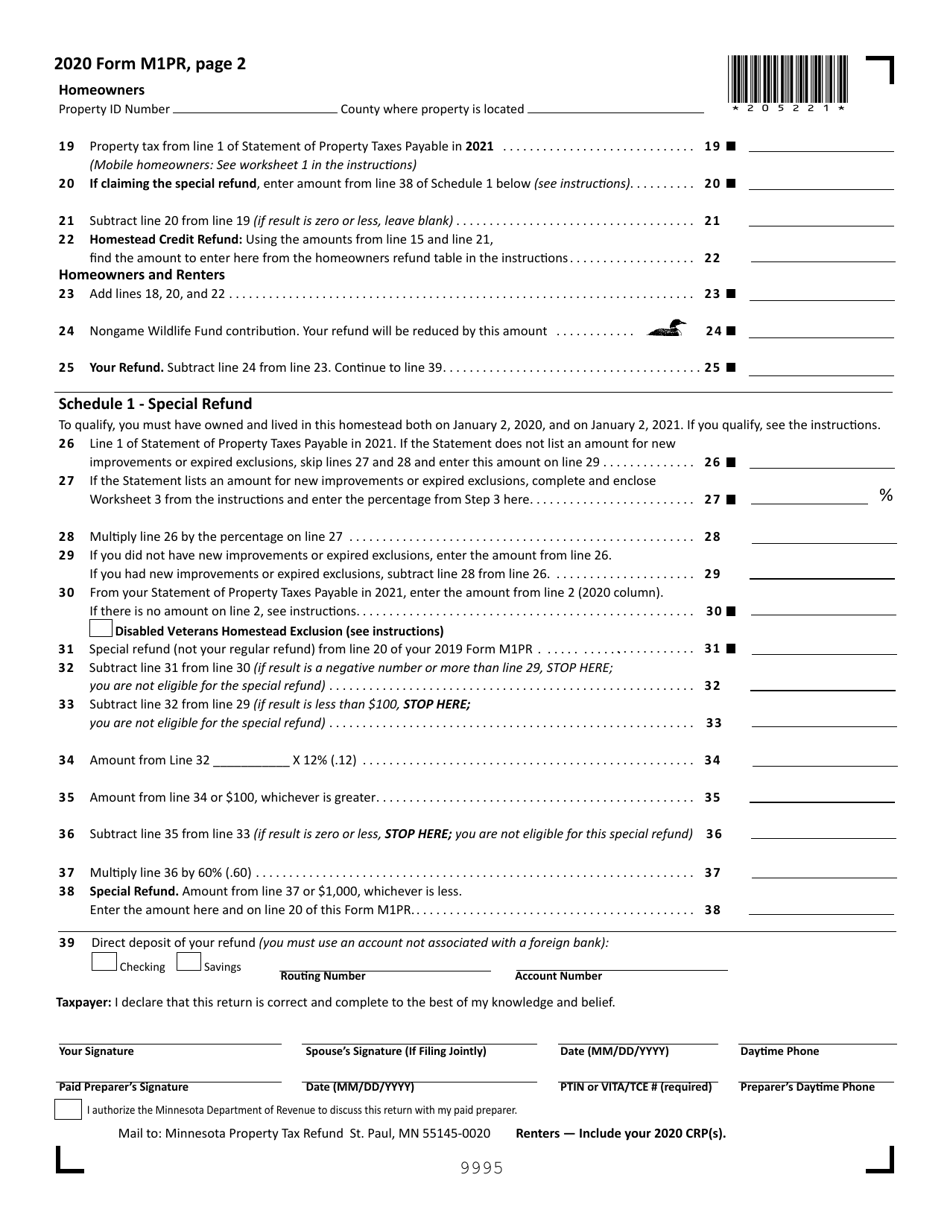

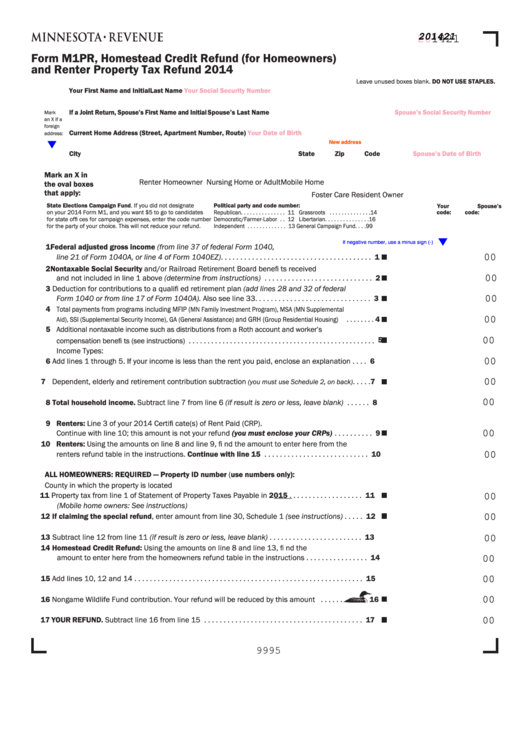

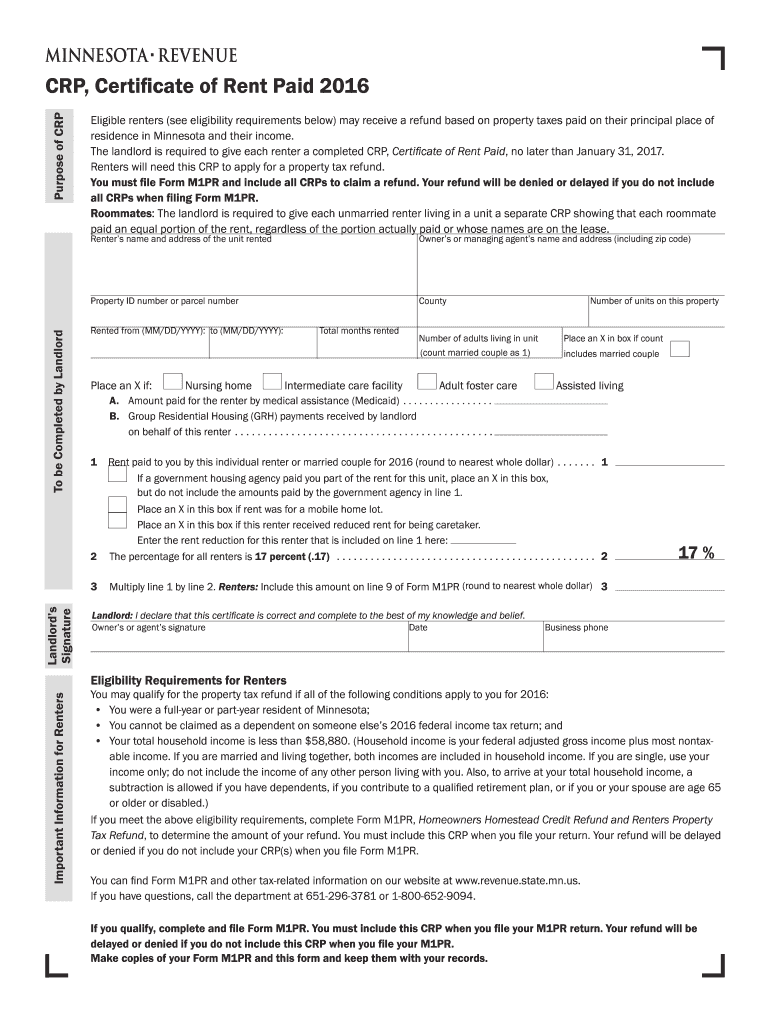

Instructions For Form M1Pr - Property tax from line 1 of statement of property taxes payable. Web continue to print form m1pr. Web the draft instructions include: These tax law changes effect the calculation of the minnesota property tax. Get deals and low prices on taxation forms at amazon Web file by august 13, 2021. Web minnesota legislature signed tax law changes for the tax year 2022 into effect on may, 24th 2023. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. 2021 form m1pr, homestead credit refund (for. 2020 form m1pr, homestead credit refund (for homeowners). You will not receive a refund. We'll make sure you qualify, calculate your minnesota property tax refund,. The last day you can file your 2021 m1pr. Property tax from line 1 of statement of property taxes payable. Streamlined document workflows for any industry. Get deals and low prices on taxation forms at amazon Web if there is no amount on line 2, see instructions. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue. Web 2022 m1pr, homestead credit refund (for homeowners) and renter’s property tax refund instructions | minnesota department of revenue. If you retain an ownership. Web refer to the instructions for lines 1 through 5 in the form m1pr instructions to complete these steps. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. (click image. Web forms and instructions > form m1pr. 2) filing situations for renters and homeowners; You will not receive a refund. Web if there is no amount on line 2, see instructions. Web 2022 m1pr, homestead credit refund (for homeowners) and renter’s property tax refund instructions | minnesota department of revenue. The last day you can file your 2022 m1pr return is august 15, 2024. Property tax from line 1 of statement of property taxes payable. Web refer to the instructions for lines 1 through 5 in the form m1pr instructions to complete these steps. Frequently asked questions about the m1pr. 2) filing situations for renters and homeowners; Mail it to the address provided on the screen. The last day you can file your 2021 m1pr. Ad choose from a wide range of informative business books, available at amazon. 2020 form m1pr, homestead credit refund (for homeowners). Web the draft instructions include: Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Get deals and low prices on taxation forms at amazon Web federal adjusted gross income (from line 1 of form m1, see instructions if you did not file form m1). Web refer to the instructions for lines 1 through 5 in the form m1pr instructions. Web federal adjusted gross income (from line 1 of form m1, see instructions if you did not file form m1). Web forms and instructions > form m1pr. 2020 form m1pr, homestead credit refund (for homeowners). Web file by august 13, 2021. This form is for income earned in tax year 2022, with tax returns. Disabled veterans homestead exclusion (see instructions) special refund (not your regular refund) from line 20 of your. Web continue to print form m1pr. Your 2020 form m1pr should be mailed, delivered, or electronically filed with the department by august 13, 2021. Web 2022 m1pr, homestead credit refund (for homeowners) and renter’s property tax refund instructions | minnesota department of revenue.. We'll make sure you qualify, calculate your minnesota property tax refund,. Your 2020 form m1pr should be mailed, delivered, or electronically filed with the department by august 13, 2021. Ad choose from a wide range of informative business books, available at amazon. (click image below for reference) you can check on the status of your property tax. Web 2022 m1pr,. Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. You will not receive a refund. Web continue to print form m1pr. Web 2022 m1pr, homestead credit refund (for homeowners) and renter’s property tax refund instructions | minnesota department of revenue. Web file by august 13, 2021. Filing deadlines for the m1pr. Web federal adjusted gross income (from line 1 of form m1, see instructions if you did not file form m1). Ad choose from a wide range of informative business books, available at amazon. If you are filing as a renter, include any certificates of. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. 2) filing situations for renters and homeowners; Web 1 federal adjusted gross income (from line 1 of form m1, see instructions if you did not file form m1). These tax law changes effect the calculation of the minnesota property tax. Web we last updated minnesota form m1pr instructions in february 2023 from the minnesota department of revenue. The last day you can file your 2022 m1pr return is august 15, 2024. If you retain an ownership. (click image below for reference) you can check on the status of your property tax. Web forms and instructions > form m1pr. Web for details, see the instructions for form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Web 2022 form m1pr, page 2.Fill Free fillable Minnesota Department of Revenue PDF forms

M1PR Instructions 2023 2024

MN DoR M1PR 20192022 Fill out Tax Template Online US Legal Forms

Fill Free fillable Minnesota Department of Revenue PDF forms

Form M1PR Download Fillable PDF or Fill Online Homestead Credit Refund

Fillable Form M1pr Minnesota Homestead Credit Refund (For Homeowners

Mn Dept Of Revenue Form M1pr Instructions essentially.cyou 2022

Form M1pr Homestead Credit Refund For Homeowners And Renters Property

2014 Form MN DoR M1PR Fill Online Printable Fillable Blank PdfFiller

M1pr Fillable Form Printable Forms Free Online

Related Post: