Instructions For Form 8582

Instructions For Form 8582 - From 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive. The passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Web purpose of form 1. Web instructions for form 8582 passive activity loss limitations department of the treasury internal revenue service section references are to the internal revenue code unless. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. You can download or print. In this article, we’ll walk. Enter losses form 8582 is used by noncorporate activity. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: Ad access irs tax forms. Web solved•by intuit•145•updated november 30, 2022. Web if you actively participated in a passive rental real estate activity, you may be able to deduct up to $25,000 of loss from the activity from your nonpassive income. Enter losses form 8582 is. Complete the passive activities adjustment. You do not qualify for the $25,000 special allowance for rental real estate with active participation. Get ready for tax season deadlines by completing any required tax forms today. Department of the treasury internal revenue service. Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: In this article, we’ll walk. For more information on passive. Web solved•by intuit•145•updated november 30, 2022. The passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Web see the irs instructions for form 8582 for more information. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: If you actively participated in a passive rental. Department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: The passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting. Web if you actively participated in a passive rental. Web solved•by intuit•145•updated november 30, 2022. Ad access irs tax forms. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: From 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive. For more information on passive. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: Ad uslegalforms.com has been visited by 100k+ users in the past month Department of the treasury internal revenue service. The passive activity loss should import in if you imported from your prior year taxact® return and can be found on. Web see the irs instructions for. Complete the passive activities adjustment. Web up to 10% cash back free downloads of customizable forms. The passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting. Department of the treasury internal revenue service. Ad uslegalforms.com has been visited by 100k+ users in the past month Complete, edit or print tax forms instantly. In this article, we’ll walk. You can download or print. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: You do not qualify for the $25,000 special allowance for rental real estate with active participation. You do not qualify for the $25,000 special allowance for rental real estate with active participation. A passive activity loss occurs when total. Enter losses form 8582 is used by noncorporate activity. You can download or print. The passive activity loss should import in if you imported from your prior year taxact® return and can be found on. If you actively participated in a passive rental real estate activity, you. The passive activity loss should import in if you imported from your prior year taxact® return and can be found on. The passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting. Ad access irs tax forms. Web solved•by intuit•145•updated november 30, 2022. In this article, we’ll walk. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: A passive activity loss occurs when total. A pal happens when the total losses of. Web get federal form 8582 for line instructions and examples. Web use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on your forms and schedules for 2022. From 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive. Web see the irs instructions for form 8582 for more information. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Web up to 10% cash back free downloads of customizable forms. Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. Web purpose of form 1. Web if you actively participated in a passive rental real estate activity, you may be able to deduct up to $25,000 of loss from the activity from your nonpassive income. You can download or print. Department of the treasury internal revenue service.Instructions for Form 8582CR, Passive Activity Credit Limitations

Form 8582Passive Activity Loss Limitations

Instructions for Form 8582CR, Passive Activity Credit Limitations

Instructions For Form 8582Cr Passive Activity Credit Limitations

Instructions For Form 8582Cr Passive Activity Credit Limitations

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Instructions For Form 8582 Passive Activity Loss Limitations 2017

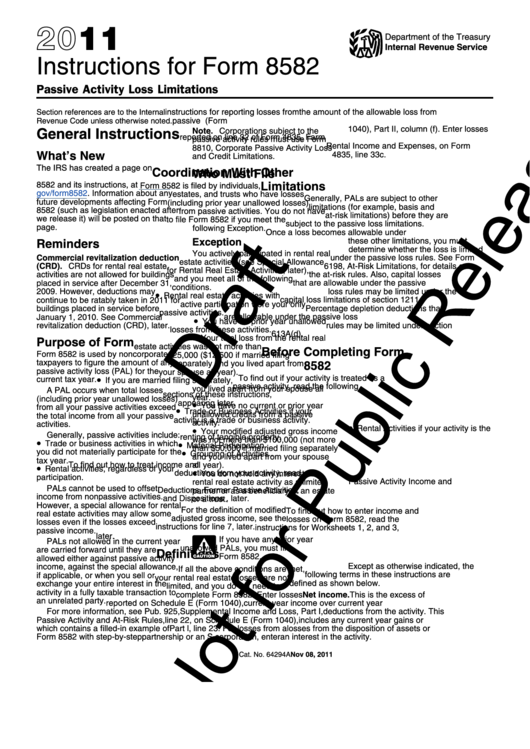

Instructions For Form 8582 Draft 2011 printable pdf download

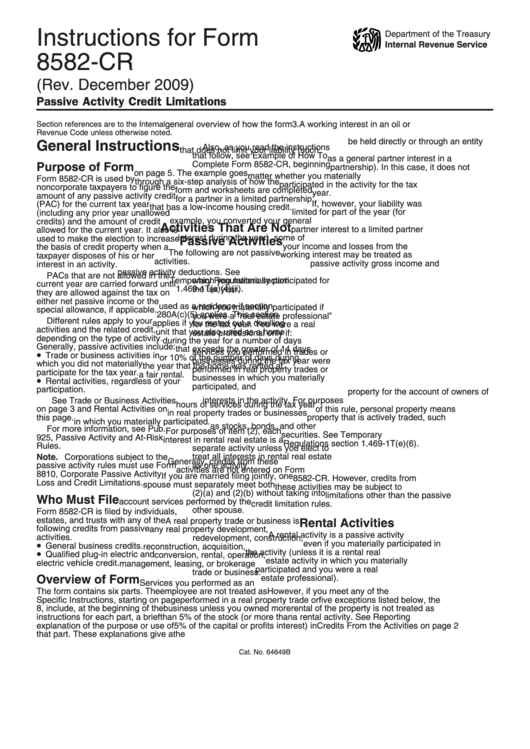

Instructions For Form 8582Cr (Rev. December 2009) printable pdf download

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Related Post: