8615 Form Turbotax

8615 Form Turbotax - While there have been other changes to. Web form 8615 is for children who can be claimed as a dependent on another taxpayer's return. Web it means that if your child has unearned income more than $2,200, some of it will be taxed at estate and trust tax rates (for tax years 2018 and 2019) or at the parent’s highest. Web use form 8615 pdf to figure the child's tax on unearned income over $2,300 if the child is under age 18, and in certain situations if the child is older (see. Tax law & stimulus updates. Turbo tax says it will walk you through fixing it. Web i started a new return and watched more closely the status of forms required at each step. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's. For 2020, a child must file form 8615 if all of the following. I am coming to believe that the form 8615 is being 'required' as a result of. Select my account at the top of the page, then tools from the. Section references are to the internal revenue code unless otherwise noted. Web it means that if your child has unearned income more than $2,200, some of it will be taxed at estate and trust tax rates (for tax years 2018 and 2019) or at the parent’s highest.. Web i started a new return and watched more closely the status of forms required at each step. Click jump to child’s income; Web when is form 8615 required? Quickly prepare and file your 2022 tax return. Select my account at the top of the page, then tools from the. I am coming to believe that the form 8615 is being 'required' as a result of. Web log on to your turbo tax online account and open your return by clicking take me to my return. Quickly prepare and file your 2022 tax return. Web this turbotax help explains who must file irs form 8615: Tax returns in less time. The child is required to file a tax return. Web log on to your turbo tax online account and open your return by clicking take me to my return. Web department of the treasury internal revenue service. Ad do your 2021, 2020, 2019, 2018 all the way back to 2000 easy, fast, secure & free to try! Only certain taxpayers. Children who have unearned income that’s subject to the kiddie tax must file a form 8615 with their 1040 tax return. Turbo tax says it will walk you through fixing it. Ad do your 2021, 2020, 2019, 2018 all the way back to 2000 easy, fast, secure & free to try! Section references are to the internal revenue code unless. Ad from simple to advanced income taxes. The child is required to file a tax return. In the upper right corner, click my account > tools. Web i started a new return and watched more closely the status of forms required at each step. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's. Web 1 best answer. Web department of the treasury internal revenue service. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's. Web who's required to file form 8615? march 20, 2020 11:30 am. Web turbotax live en español. Ad prepare more tax returns with greater accuracy and efficiency with taxwise®. Open your return, if it's not already open. Web who's required to file form 8615? For 2020, a child must file form 8615 if all of the. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's. Web i started a new return and watched more closely the status of forms required at each step. Turbo tax tells me to wait until 3/20 to download updates (completed). Tax. For 2023, form 8615 needs to be filed if all of the following conditions apply: The child has more than $2,500 in unearned income;. Children who have unearned income that’s subject to the kiddie tax must file a form 8615 with their 1040 tax return. Web log on to your turbo tax online account and open your return by clicking. Web i started a new return and watched more closely the status of forms required at each step. Web this turbotax help explains who must file irs form 8615: Web purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed at the parent's rate if the parent's. Tax for certain children who have unearned income. Max refund and 100% accuracy are guaranteed. The child is required to file a tax return. The child had more than $2,200 of. Do your 2021, 2020, 2019, all the way back to 2000 easy, fast, secure & free to try! Click jump to child’s income; Ad prepare more tax returns with greater accuracy and efficiency with taxwise®. Select my account at the top of the page, then tools from the. Web log on to your turbo tax online account and open your return by clicking take me to my return. Web form 8615 must be filed for any child who meets all of the following conditions. Children who have unearned income that’s subject to the kiddie tax must file a form 8615 with their 1040 tax return. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Web it means that if your child has unearned income more than $2,200, some of it will be taxed at estate and trust tax rates (for tax years 2018 and 2019) or at the parent’s highest. The child has more than $2,500 in unearned income;. For 2020, a child must file form 8615 if all of the. Web use form 8615 pdf to figure the child's tax on unearned income over $2,300 if the child is under age 18, and in certain situations if the child is older (see. Web 1 best answer.What Is IRS Form 8615 Tax For Certain Children Who Have TurboTax

Your Federal Tax

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

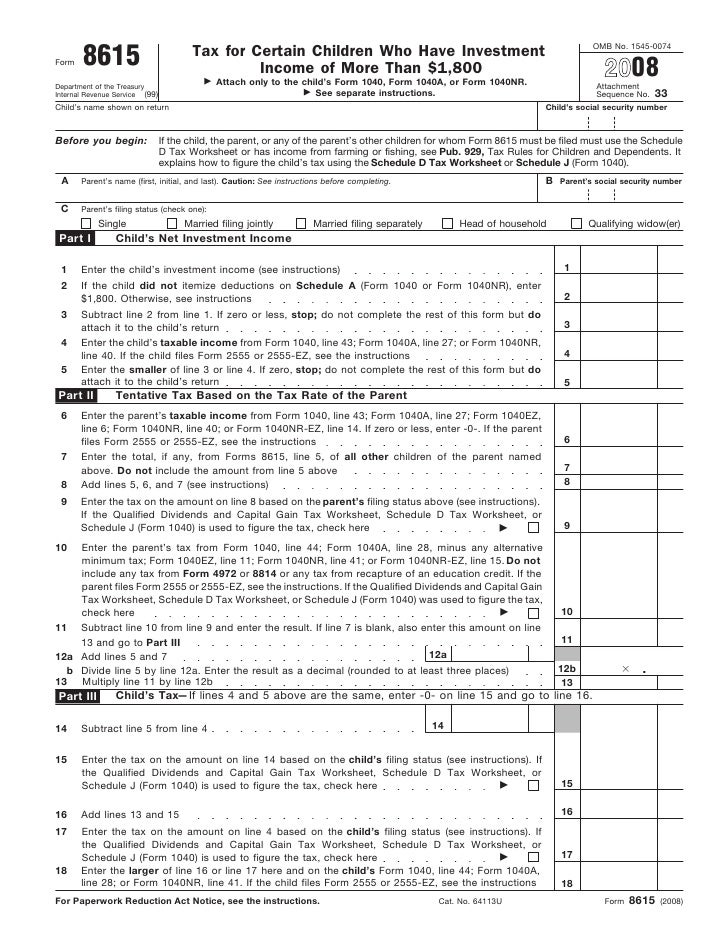

Form 8615Tax for Children Under Age 14 With Investment of Mor…

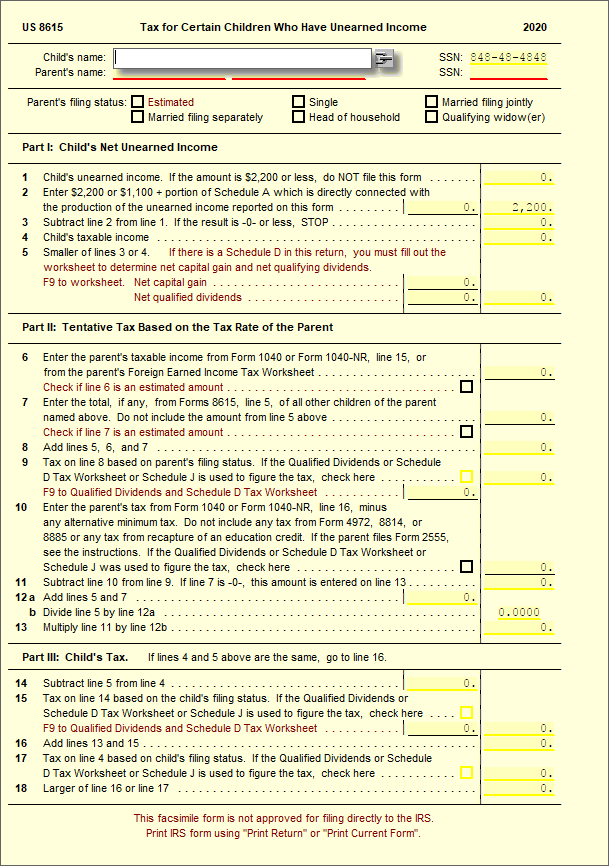

Download Form 8615 Tax for Children Who Has Unearned

8615 Tax for Certain Children Who Have Unearned UltimateTax

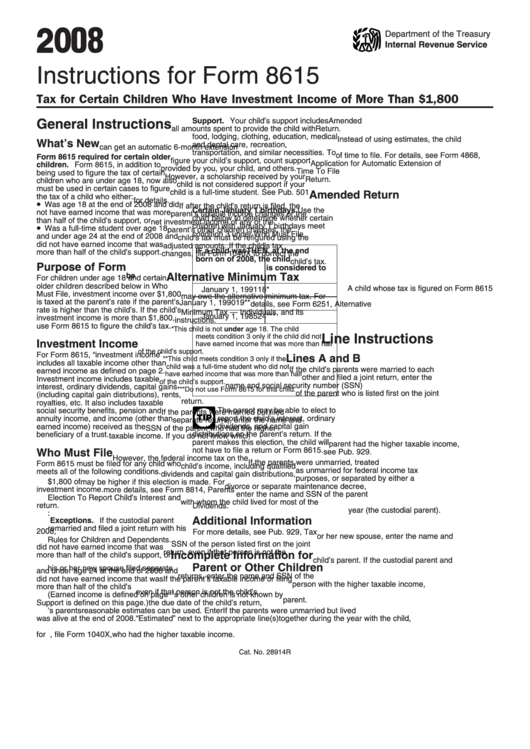

Instructions For Form 8615 Tax For Certain Children Who Have

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

Form 8615 Tax for Certain Children with Unearned Jackson Hewitt

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

Related Post: