Nj Wr30 Form

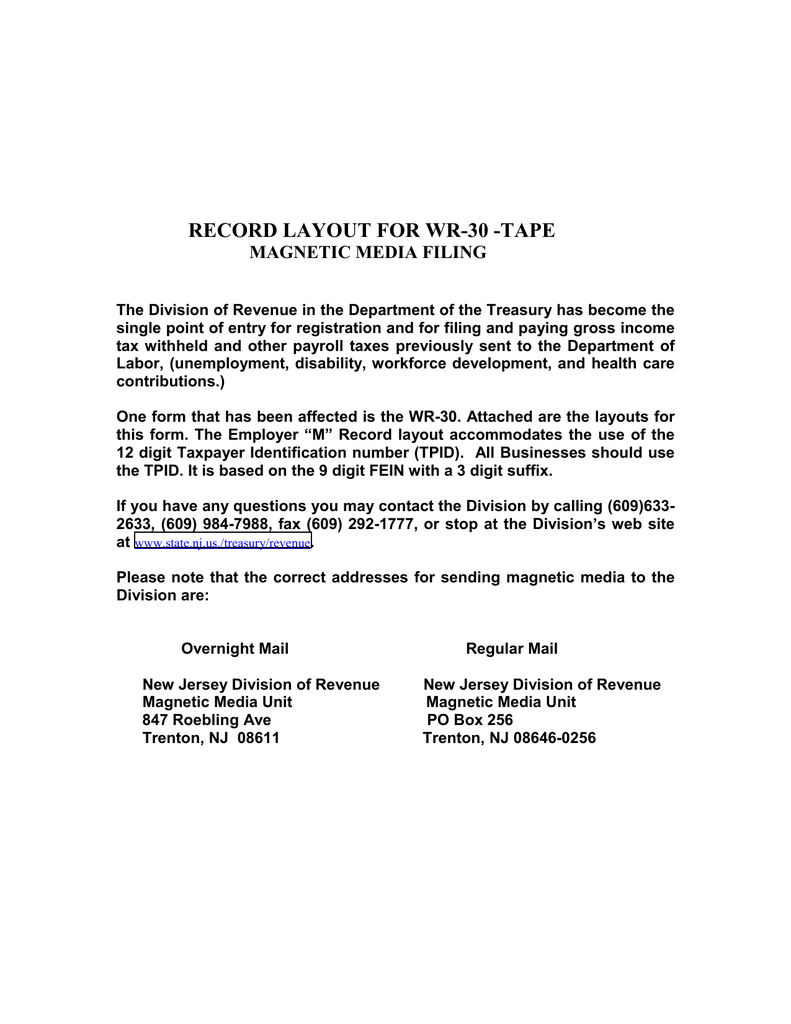

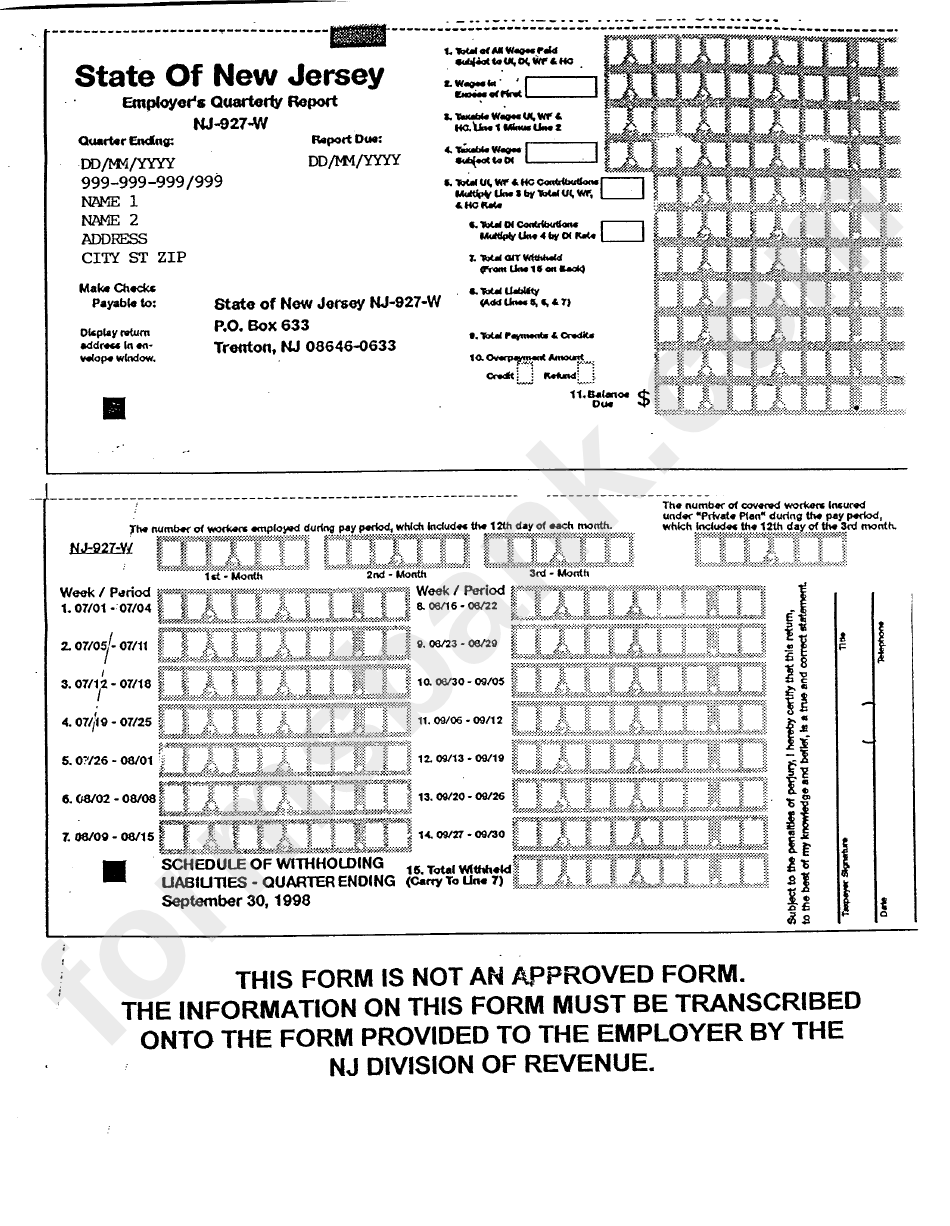

Nj Wr30 Form - Penalties range from $5.00 to $25.00 per. It is a paperless process, which. Web how it works open the wr 30 and follow the instructions easily sign the wr30 nj with your finger send filled & signed wr30 form or save what makes the wr 30 legally valid?. Web nj division of revenue and enterprise services. Section i • employer tpid (ein + 000) company name. We are dedicated to providing the highest quality services in the most efficient manner possible to the. The assessment of interest is. All liability other than the penalty for which abatement is being requested must be paid. This process will allow the division of revenue to validate the format you are using and. Web employer payroll tax electronic filing and reporting options. The change will be effective for next quarter's report. Web nj division of revenue and enterprise services. This process will allow the division of revenue to validate the format you are using and. All liability other than the penalty for which abatement is being requested must be paid. Request for authorization to report form wr30/nj927 electronically. You must complete the request for. It is a paperless process, which. Penalties range from $5.00 to $25.00 per. We are dedicated to providing the highest quality services in the most efficient manner possible to the. Web how it works open the wr 30 and follow the instructions easily sign the wr30 nj with your finger send filled & signed. Penalties range from $5.00 to $25.00 per. The assessment of interest is. Ad real estate forms, contracts, tax forms & more. Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Registration is required with the new jersey division of revenue to file electronically prior to sending your files. The change will be effective for next quarter's report. Web welcome to the division of revenue and enterprise services (dores). Employers must be registered with the state of new jersey for payroll tax purposes to file forms nj. Web nj division of revenue and enterprise services. Web employer payroll tax electronic filing and reporting options. Web nj division of revenue and enterprise services. Web employer payroll tax electronic filing and reporting options. Registration is required with the new jersey division of revenue to file electronically prior to sending your files. Section i • employer tpid (ein + 000) company name. Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: The change will be effective for next quarter's report. Web are you considering to get wr30 nj to fill? Ad real estate forms, contracts, tax forms & more. We are dedicated to providing the highest quality services in the most efficient manner possible to the. Employers must be registered with the state of new jersey for payroll tax purposes to. You must complete the request for. Employers must be registered with the state of new jersey for payroll tax purposes to file forms nj. Create, edit, and print your business and legal documents quickly and easily! Web are you considering to get wr30 nj to fill? Section i • employer tpid (ein + 000) company name. Web nj division of revenue and enterprise services. Employers must be registered with the state of new jersey for payroll tax purposes to file forms nj. All liability other than the penalty for which abatement is being requested must be paid. Create, edit, and print your business and legal documents quickly and easily! You must complete the request for. We are dedicated to providing the highest quality services in the most efficient manner possible to the. It is a paperless process, which. Web welcome to the division of revenue and enterprise services (dores). Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Web are you considering to get wr30 nj to fill? Web welcome to the division of revenue and enterprise services (dores). This process will allow the division of revenue to validate the format you are using and. We are dedicated to providing the highest quality services in the most efficient manner possible to the. Cocodoc is the best website for you to go, offering you a convenient and customizable version. It is a paperless process, which. Ad real estate forms, contracts, tax forms & more. Web are you considering to get wr30 nj to fill? We are dedicated to providing the highest quality services in the most efficient manner possible to the. Web nj division of revenue and enterprise services. Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Cocodoc is the best website for you to go, offering you a convenient and customizable version of wr30 nj as you want. This process will allow the division of revenue to validate the format you are using and. Penalties range from $5.00 to $25.00 per. Employers must be registered with the state of new jersey for payroll tax purposes to file forms nj. Request for authorization to report form wr30/nj927 electronically. Web welcome to the division of revenue and enterprise services (dores). All liability other than the penalty for which abatement is being requested must be paid. Registration is required with the new jersey division of revenue to file electronically prior to sending your files. The change will be effective for next quarter's report. The assessment of interest is. Web employer payroll tax electronic filing and reporting options. Section i • employer tpid (ein + 000) company name. You must complete the request for. Web how it works open the wr 30 and follow the instructions easily sign the wr30 nj with your finger send filled & signed wr30 form or save what makes the wr 30 legally valid?.record layout for wr30 tape

Uct 6 Fillable Form Printable Forms Free Online

Form r 3 Fill out & sign online DocHub

What Does a WR30 Look Like & How Do I Do It? Paladini Law

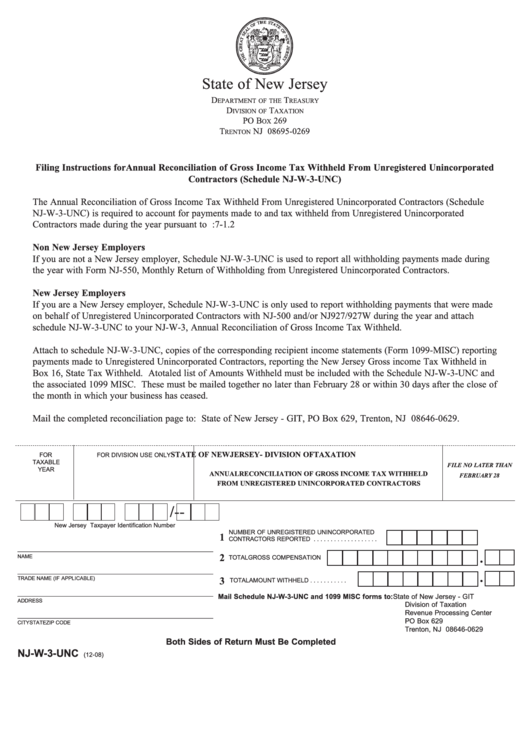

Fillable Form NjW3Unc Annual Reconcilliation Of Gross Tax

Nj Wr 30 Form Pdf Fill Online, Printable, Fillable, Blank pdfFiller

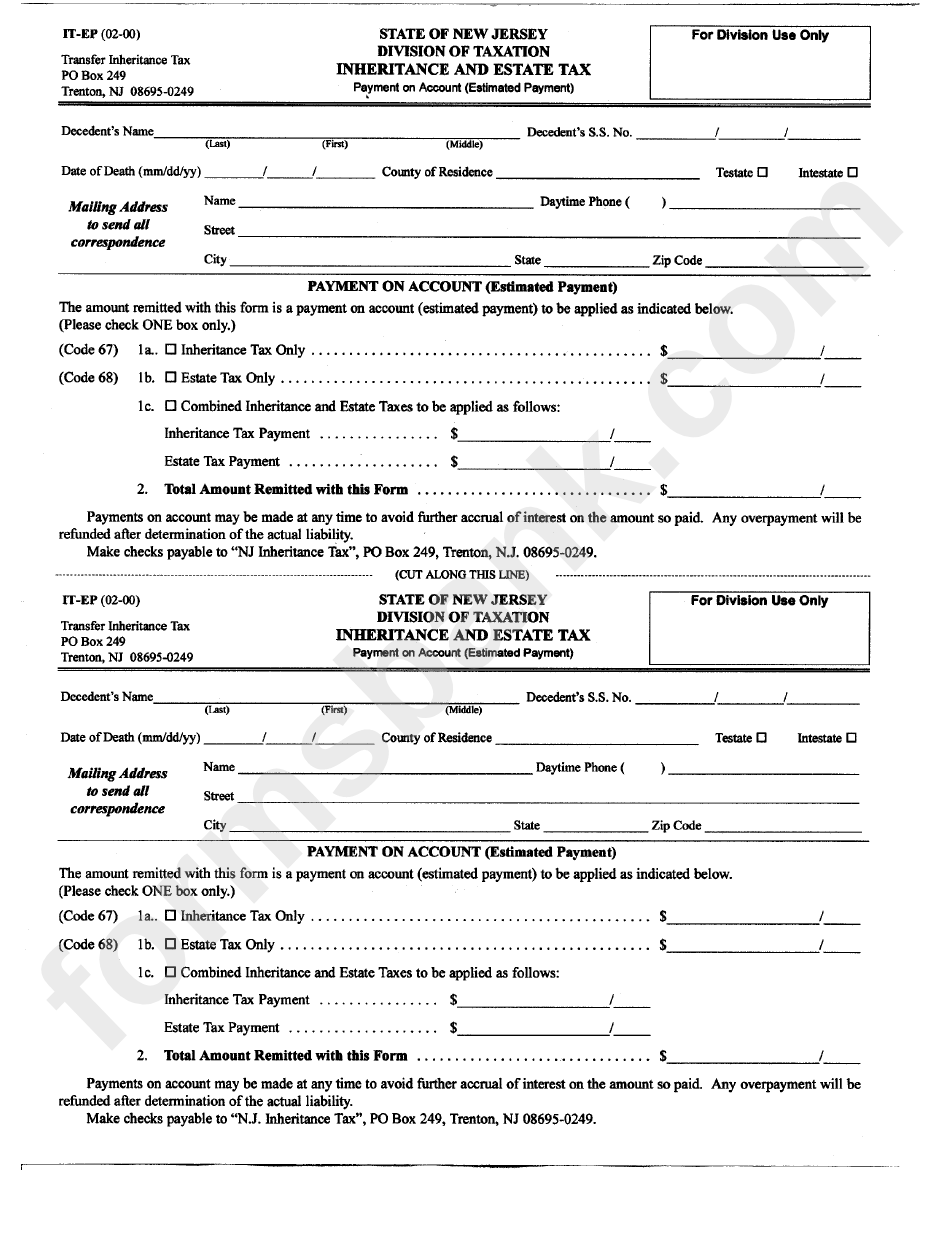

Form ItEp State Of New Jersey Division Of Taxation Inheritance And

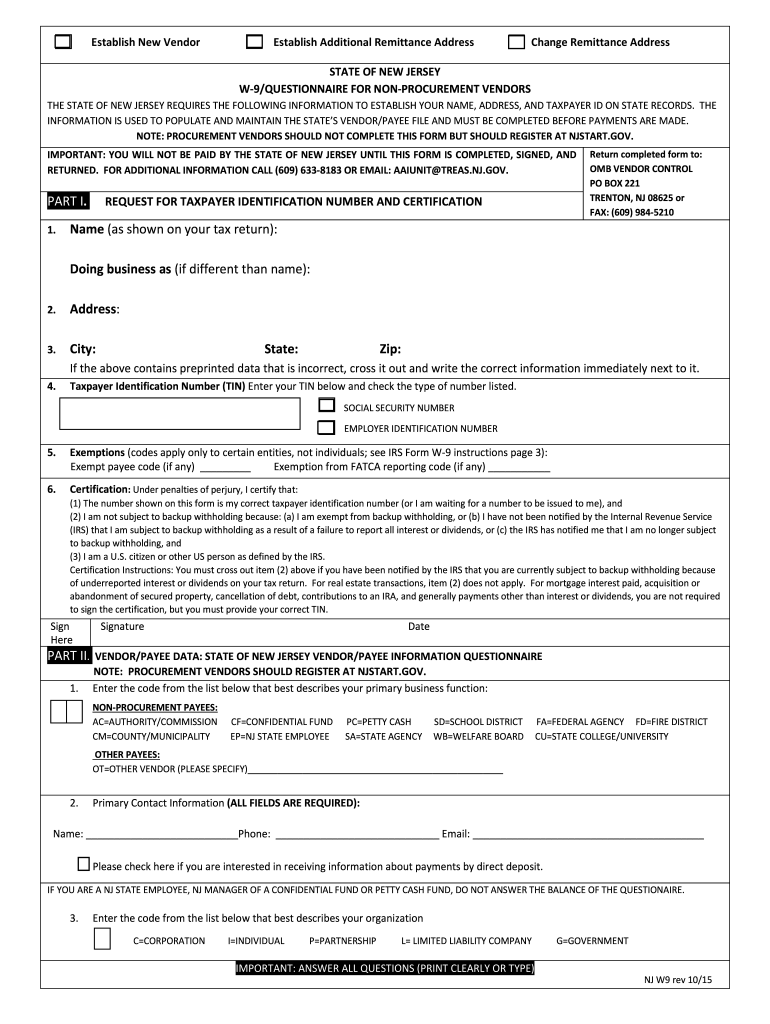

nj w9 form no No Download Needed needed Fill out & sign online DocHub

NJ WR30 Fill out Tax Template Online US Legal Forms

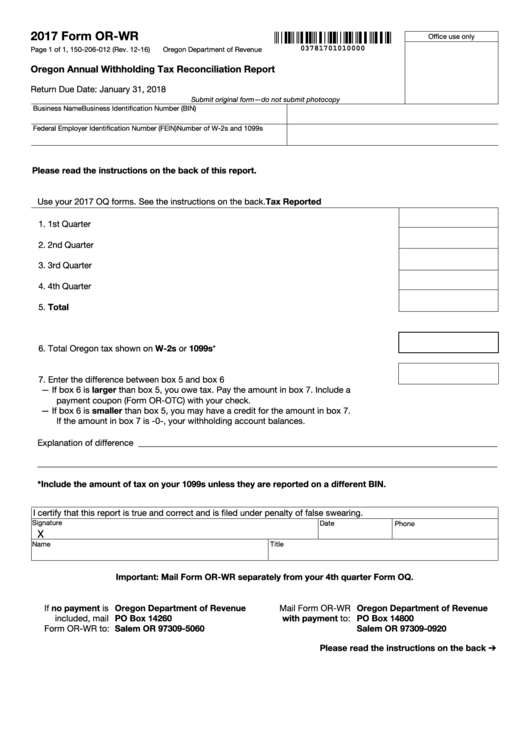

Form Wr Oregon Annual Withholding Tax Reconciliation Report 2022

Related Post: