Form 4952 Instructions

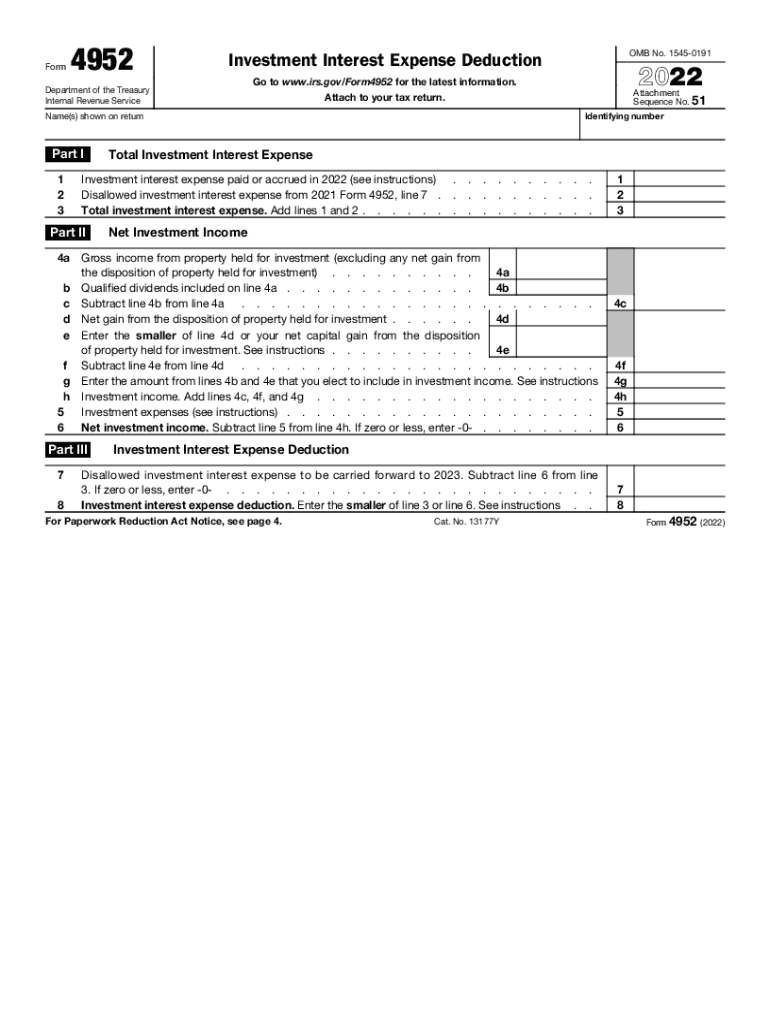

Form 4952 Instructions - Web general instructions purpose of form use form 4952 to figure the amount of investment interest expense you can deduct for 2022 and the amount you can carry forward to future. Be prepared to read the instructions closely, or enlist. Web investment interest expense paid or accrued in 2022 (see instructions). Questions answered every 9 seconds. Complete, edit or print tax forms instantly. Web to deduct investment interest, you must file a form 4952 with your return. You don't have to file this form if you meet three conditions: Go to the input returntab. Disallowed investment interest expense from 2021 form 4952, line 7. Get ready for tax season deadlines by completing any required tax forms today. Disallowed investment interest expense from 2021 form 4952, line 7. Web the irs also has some resources that provide examples and detailed explanations of the topics included in this article, including: Web investment interest expense paid or accrued in 2022 (see instructions). Web if you filled out form 4952, investment interest expense deduction, for your regular tax, you will need. Use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry. Web information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on how to file. A taxpayer may elect to include any amount of. Department of the treasury internal revenue service (99) investment. Ad a tax agent will answer in minutes! Web how do forms 4952 and 6198 calculate in the individual tax return? Ad download or email irs 4952 & more fillable forms, register and subscribe now! Web to report an investment interest expense: Use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the. Department of the treasury internal revenue service (99) investment interest expense deduction. Amount of investment interest you can deduct; Disallowed investment interest expense from 2021 form 4952, line 7. Ad download or email irs 4952 & more fillable forms, register and subscribe now! Web the irs also has some resources that provide examples and detailed explanations of the topics included. Per form 4952 instructions, the portion of the. Ad a tax agent will answer in minutes! Web you may also have to file form 4952, which provides details about your deduction. Go to the input returntab. Department of the treasury internal revenue service (99) investment interest expense deduction. Web to report an investment interest expense: Get ready for tax season deadlines by completing any required tax forms today. Per form 4952 instructions, the portion of the. Investment interest expense deduction has to be submitted by anybody wishing to deduct investment interest expense, including individuals, estates, or. Web if you filled out form 4952, investment interest expense deduction, for. Web there are certain circumstances where you will use irs form 4797, which is used for sales of business property, or your schedule d form instead of form 6252. Ad a tax agent will answer in minutes! Ago to www.irs.gov/form4952 for the latest information. Complete, edit or print tax forms instantly. Use form 4952 to figure the amount of investment. Web there are certain circumstances where you will use irs form 4797, which is used for sales of business property, or your schedule d form instead of form 6252. Web the irs also has some resources that provide examples and detailed explanations of the topics included in this article, including: Be prepared to read the instructions closely, or enlist. Department. Web for purposes of irs form 4952, qualified dividend income is not considered investment income. Web to report an investment interest expense: Web to deduct investment interest, you must file a form 4952 with your return. Questions answered every 9 seconds. Web investment interest expense paid or accrued in 2022 (see instructions). Web the irs also has some resources that provide examples and detailed explanations of the topics included in this article, including: Disallowed investment interest expense from 2021 form 4952, line 7. Investment interest expense deduction has to be submitted by anybody wishing to deduct investment interest expense, including individuals, estates, or. Web to report an investment interest expense: Ad a. Web investment interest expense paid or accrued in 2022 (see instructions). Web you may also have to file form 4952, which provides details about your deduction. Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. the taxpayer has $60,000 in investment. Web if you filled out form 4952, investment interest expense deduction, for your regular tax, you will need to fill out a second form 4952 for the amt as follows. Web there are certain circumstances where you will use irs form 4797, which is used for sales of business property, or your schedule d form instead of form 6252. Amount of investment interest you can deduct; The form 4952 calculates before the form 6198. Disallowed investment interest expense from 2021 form 4952, line 7. Ad a tax agent will answer in minutes! Web how do forms 4952 and 6198 calculate in the individual tax return? Web the irs also has some resources that provide examples and detailed explanations of the topics included in this article, including: Department of the treasury internal revenue service (99) investment interest expense deduction. Web information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on how to file. Investment interest expense deduction has to be submitted by anybody wishing to deduct investment interest expense, including individuals, estates, or. You don't have to file this form if you meet three conditions: A taxpayer may elect to include any amount of. Go to the input returntab. Per form 4952 instructions, the portion of the. Select deductions> itemized deductions (sch a)from the left menu. Use this form to figure the amount of investment interest expense you can deduct for the current year and.IRS Form 4952 Instructions Investment Interest Deduction

Form 4952 Investment Interest Expense Deduction (2015) Free Download

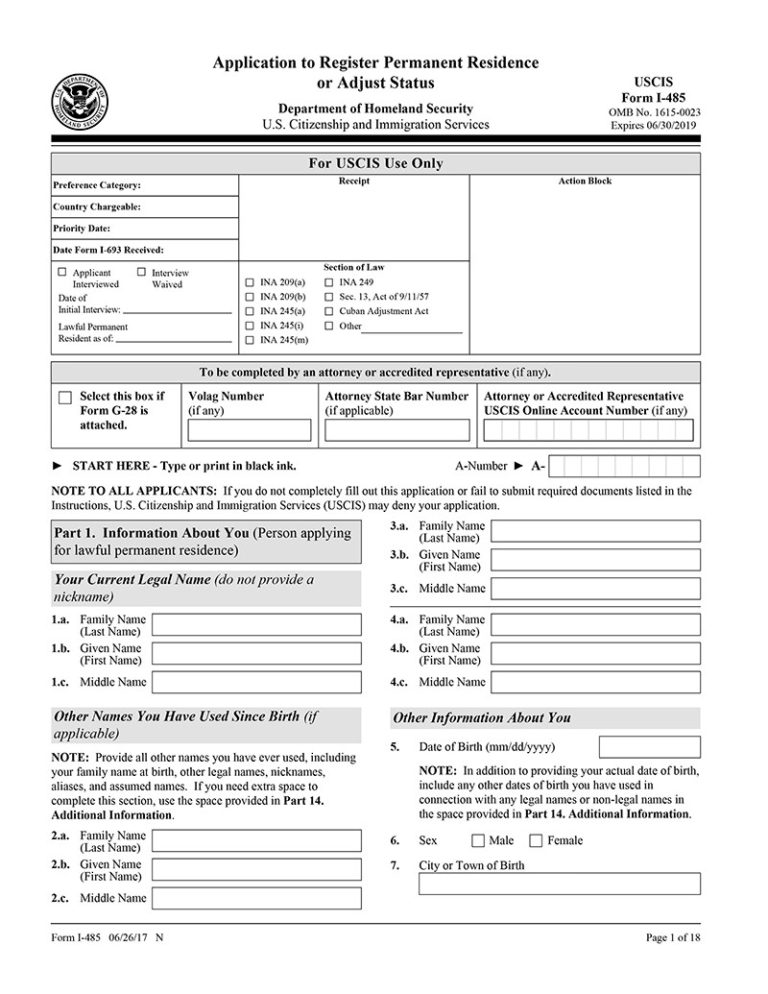

Form I485 Step by Step Instructions SimpleCitizen

IRS Form 8995 Instructions Your Simplified QBI Deduction

Form 4952Investment Interest Expense Deduction

Form 4952 Fill Out and Sign Printable PDF Template signNow

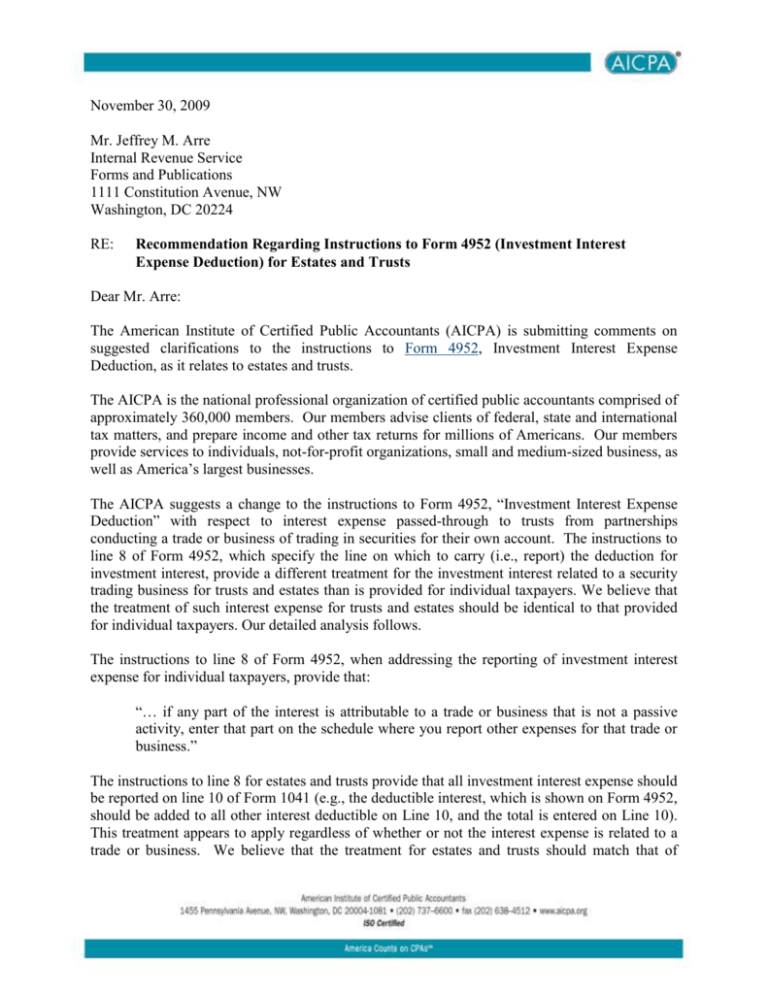

AICPA Letter to IRS on Form 4952 Regarding Investment Interest

Form 4952Investment Interest Expense Deduction

Fill Free fillable Investment Interest Expense Deduction 4952 PDF form

Form 4952 Finance Reference

Related Post: