Instructions For Form 2210 Line 8

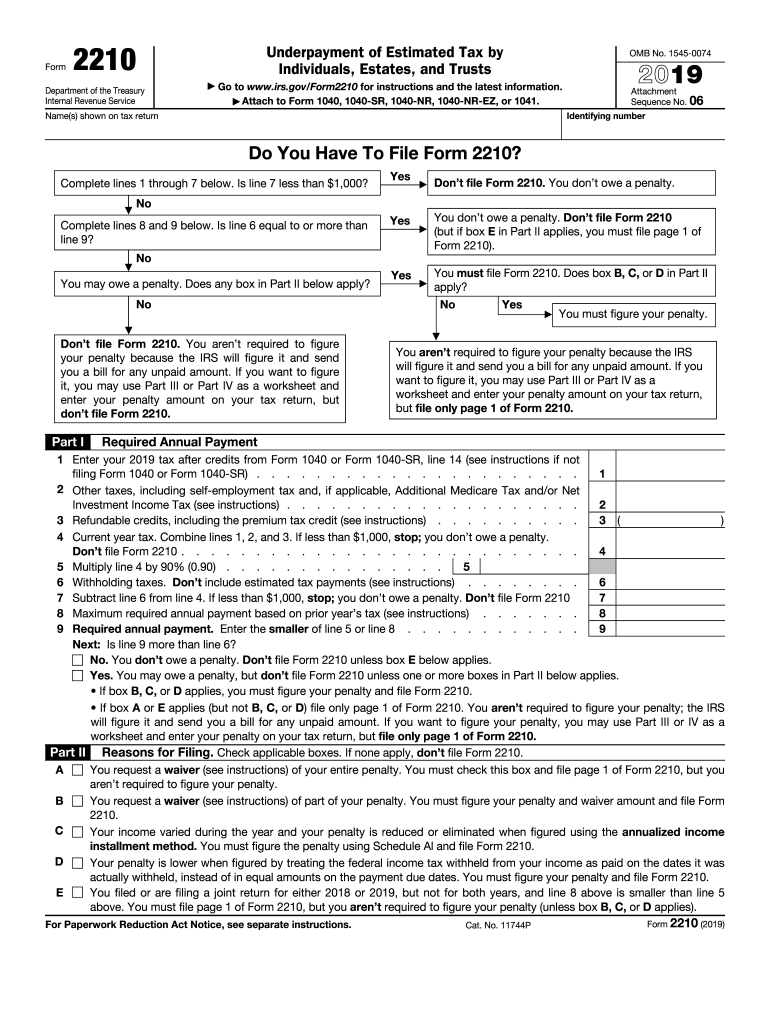

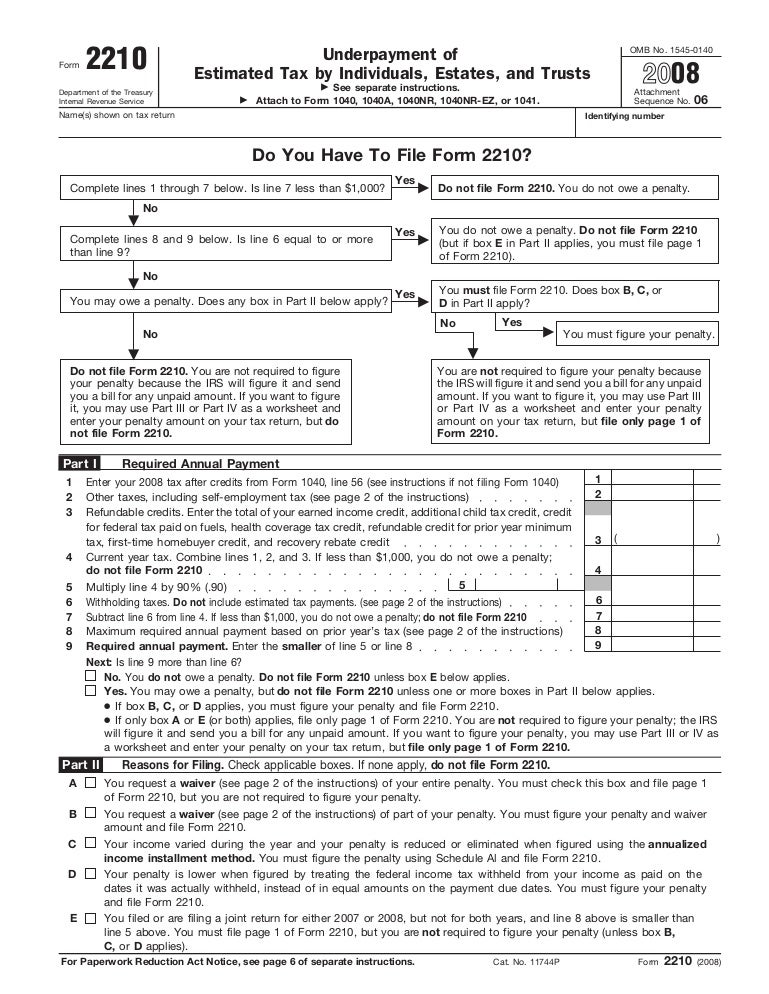

Instructions For Form 2210 Line 8 - Form 2210 is used by individuals (as well as estates and trusts) to. Qualified sick and family leave credits from schedule(s) h (schedule 3 (form 1040), lines 13b and 13h). Is line 4 or line 7 less than $1,000? Only the payments and credits specified in the irs. Web you filed or are filing a joint return for either 2011 or 2012, but not for both years, and line 8 above is smaller than line 5 above. Web follow the instructions below for filing form 2210 with your tax return. For line 9, enter the smaller amount on line 5 or line 8. Web for purposes of figuring the amount includible on line 1 of form 2210 only, you may refigure the amount you reported on form 1041, schedule g, line 3. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Credit for federal tax paid on fuels. You don’t owe a penalty. Web do you have to file form 2210? For line 9, enter the smaller amount on line 5 or line 8. Waiver (see instructions) of your entire. Premium tax credit (form 8962). For line 9, enter the smaller amount on line 5 or line 8. Web to complete form 2210, you must enter your prior year tax which is found on line 24 of your prior year 1040 and check any corresponding boxes if they relate to your situation. Web on line 8, enter the amount of maximum required annual payment based. Only the payments and credits specified in the irs. Web you filed or are filing a joint return for either 2011 or 2012, but not for both years, and line 8 above is smaller than line 5 above. If you have not done so, check your tax withholding now before it’s too late for your 2019 tax. No complete lines. Premium tax credit (form 8962). Web e you filed or are filing a joint return for either 2020 or 2021, but not for both years, and line 8 above is smaller than line 5 above. Web lacerte will automatically carry the payments and refundable credits from the tax return to form 2210. Web do you have to file form 2210?. Web you filed or are filing a joint return for either 2011 or 2012, but not for both years, and line 8 above is smaller than line 5 above. Credit for federal tax paid on fuels. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties.. Web do you have to file form 2210? Web refundable part of the american opportunity credit (form 8863, line 8). Qualified sick and family leave credits. Web on line 8, enter the amount of maximum required annual payment based on prior year’s tax. Refundable part of the american opportunity credit (form 8863, line 8). Web for purposes of figuring the amount includible on line 1 of form 2210 only, you may refigure the amount you reported on form 1041, schedule g, line 3. If yes, the taxpayer does not owe a penalty and will not. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting. Form 2210 ' 06 department of the treasury internal revenue service attachment sequence no. Qualified sick and family leave credits. Only the payments and credits specified in the irs. Premium tax credit (form 8962). Enter the penalty on form 2210, line 27, and on the “estimated tax penalty” line on your tax. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Web worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Web for purposes of figuring the amount includible on line 1 of form 2210 only, you may refigure the amount you reported on. Waiver (see instructions) of your entire. Complete lines 1 through 7 below. Hi, i'm trying to match my software's calculation of my underpayment penalty with instructions for form 2210 line. Qualified sick and family leave credits from schedule(s) h (schedule 3 (form 1040), lines 13b and 13h). You must file page 1 of form 2210, but you are. Web lacerte will automatically carry the payments and refundable credits from the tax return to form 2210. If none apply, do not. Web do you have to file form 2210? Premium tax credit (form 8962). Credit for federal tax paid on fuels. Premium tax credit (form 8962). Form 2210 ' 06 department of the treasury internal revenue service attachment sequence no. Web you filed or are filing a joint return for either 2011 or 2012, but not for both years, and line 8 above is smaller than line 5 above. Refundable part of the american opportunity credit (form 8863, line 8). You don’t owe a penalty. Enter the penalty on form 2210, line 27, and on the “estimated tax penalty” line on your tax. Web e you filed or are filing a joint return for either 2020 or 2021, but not for both years, and line 8 above is smaller than line 5 above. If you have not done so, check your tax withholding now before it’s too late for your 2019 tax. Part ii reasons for filing. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Complete lines 1 through 7 below. Only the payments and credits specified in the irs. If yes, the taxpayer does not owe a penalty and will not. For line 9, enter the smaller amount on line 5 or line 8. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year.IRS Form 2210 A Guide to Underpayment of Tax

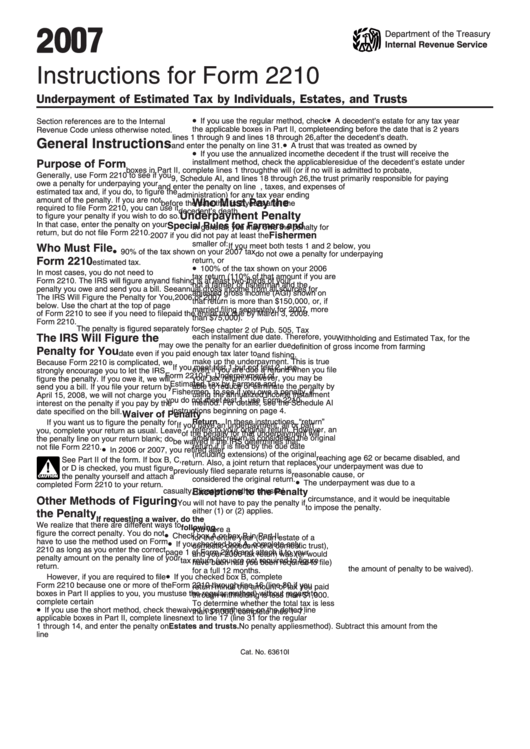

Instructions For Form 2210 Underpayment Of Estimated Tax By

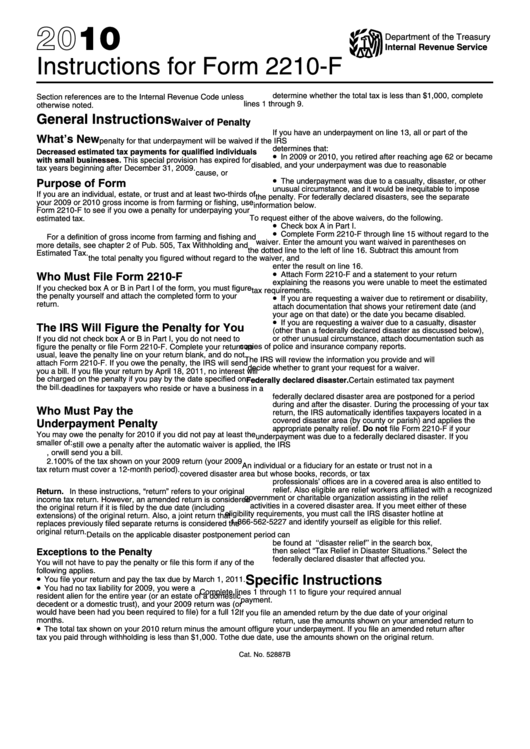

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

2210 Fill out & sign online DocHub

Form 2210Underpayment of Estimated Tax

Instructions For Form 2210 Underpayment Of Estimated Tax By

Ssurvivor Irs Form 2210 Ai Instructions

Instructions For Form 2210 Underpayment Of Estimated Tax By

Instructions for Form 2210

Instructions For Form 2210 Underpayment Of Estimated Tax By

Related Post: