Form 1120 Instruction

Form 1120 Instruction - Web you have to file form 1120 if your business is a(n): Use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. Foreign corporations that do maintain an office or place of business in the united states must generally pay any tax. Web mailing addresses for forms 1120. Bank or other final return, name change, financial institution, attach form 8050, address change, amended. For other form 1120 tutorials, see our playlist below: Ad easy guidance & tools for c corporation tax returns. Department of the treasury internal revenue service. However, an association with a fiscal year ending. For calendar year 2022 or tax year beginning, 2022, ending. Department of the treasury internal revenue service. Use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. What’s new increase in penalty for. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Corporation income tax return,. Property and casualty insurance company income tax return, to report the income, gains, losses, deductions,. For other form 1120 tutorials, see our playlist below: What’s new increase in penalty for. Web form 1120 is the u.s. Web corporations must generally make estimated tax payments if they expect their estimated tax (income tax less credits) to be $500 or more. Department of the treasury internal revenue service. It is an internal revenue service (irs) document that american corporations use to report their credits,. Web information about form 1120s and its account at a u.s. Web corporations must generally make estimated tax payments if they expect their estimated tax (income tax less credits) to be $500 or more. Bank or other. Web information about form 1120, u.s. Department of the treasury internal revenue service. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between. Use this form to report the. Web mailing addresses for forms 1120. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Foreign corporations that do maintain an office or place of business in the united states must generally pay any tax. Use this form to report the. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the.. Foreign corporations that do maintain an office or place of business in the united states must generally pay any tax. Department of the treasury internal revenue service. Web information about form 1120, u.s. C corporation that doesn’t elect s corporation taxation; • form 1120 tutorials for 2022 tax year how to fill out form 1120 for the 2021 tax year. C corporation that doesn’t elect s corporation taxation; Property and casualty insurance company income tax return, to report the income, gains, losses, deductions,. Corporation income tax return, including recent updates, related forms, and instructions on how to file. For calendar year 2022 or tax year beginning, 2022, ending. Use this form to report the. Department of the treasury internal revenue service. Web information about form 1120, u.s. Use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. Web developments related to form 1120 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1120. Corporation income. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Ad easy guidance & tools for c corporation tax returns. For calendar year 2022 or tax year beginning, 2022, ending. Use this form to report the. Web you have to file form 1120 if your business is a(n): Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the. Web information about form 1120, u.s. Web corporations must generally make estimated tax payments if they expect their estimated tax (income tax less credits) to be $500 or more. For calendar year 2022 or tax year beginning, 2022, ending. Use schedule g (form 1120). Llc that elects c corporation taxation; C corporation that doesn’t elect s corporation taxation; Foreign corporations that do maintain an office or place of business in the united states must generally pay any tax. It is an internal revenue service (irs) document that american corporations use to report their credits,. Web developments related to form 1120 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1120. For other form 1120 tutorials, see our playlist below: • form 1120 tutorials for 2022 tax year how to fill out form 1120 for the 2021 tax year. Property and casualty insurance company income tax return, to report the income, gains, losses, deductions,. However, an association with a fiscal year ending. If the corporation’s principal business, office, or agency is located in: Web corporations must generally make estimated tax payments if they expect their estimated tax (income tax less credits) to be $500 or more. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between. S corporations must make estimated tax. Web information about form 1120s and its account at a u.s. Web mailing addresses for forms 1120. For calendar year 2022 or tax year beginning, 2022, ending. Use this form to report the. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Web information about form 1120, u.s. Web corporations use form 1120, u.s.Instructions for IRS Form 1120S Schedule M3 (Loss Fill

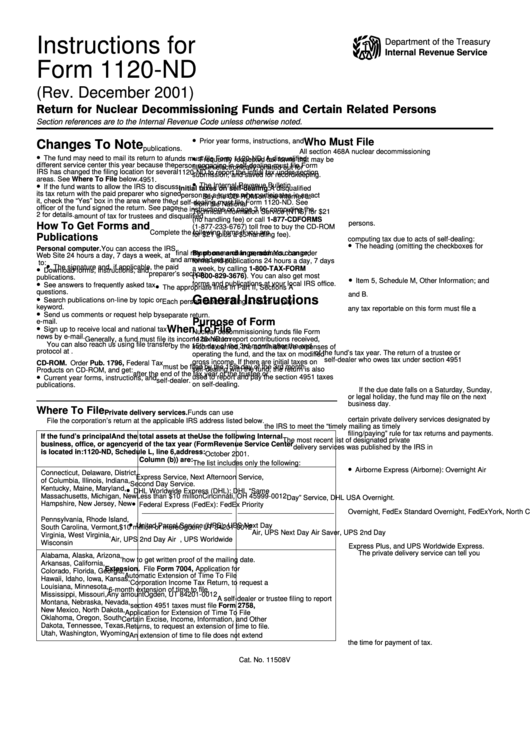

Instructions For Form 1120Nd 2001 printable pdf download

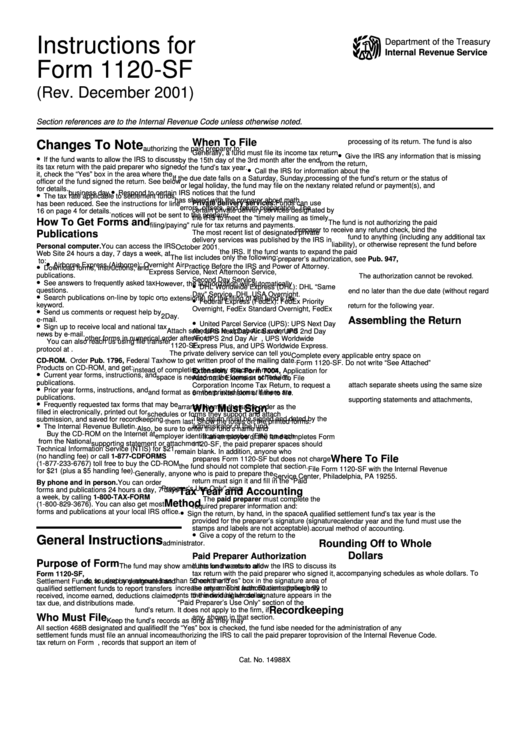

Instructions For Form 1120Sf (Rev. December 2001) printable pdf download

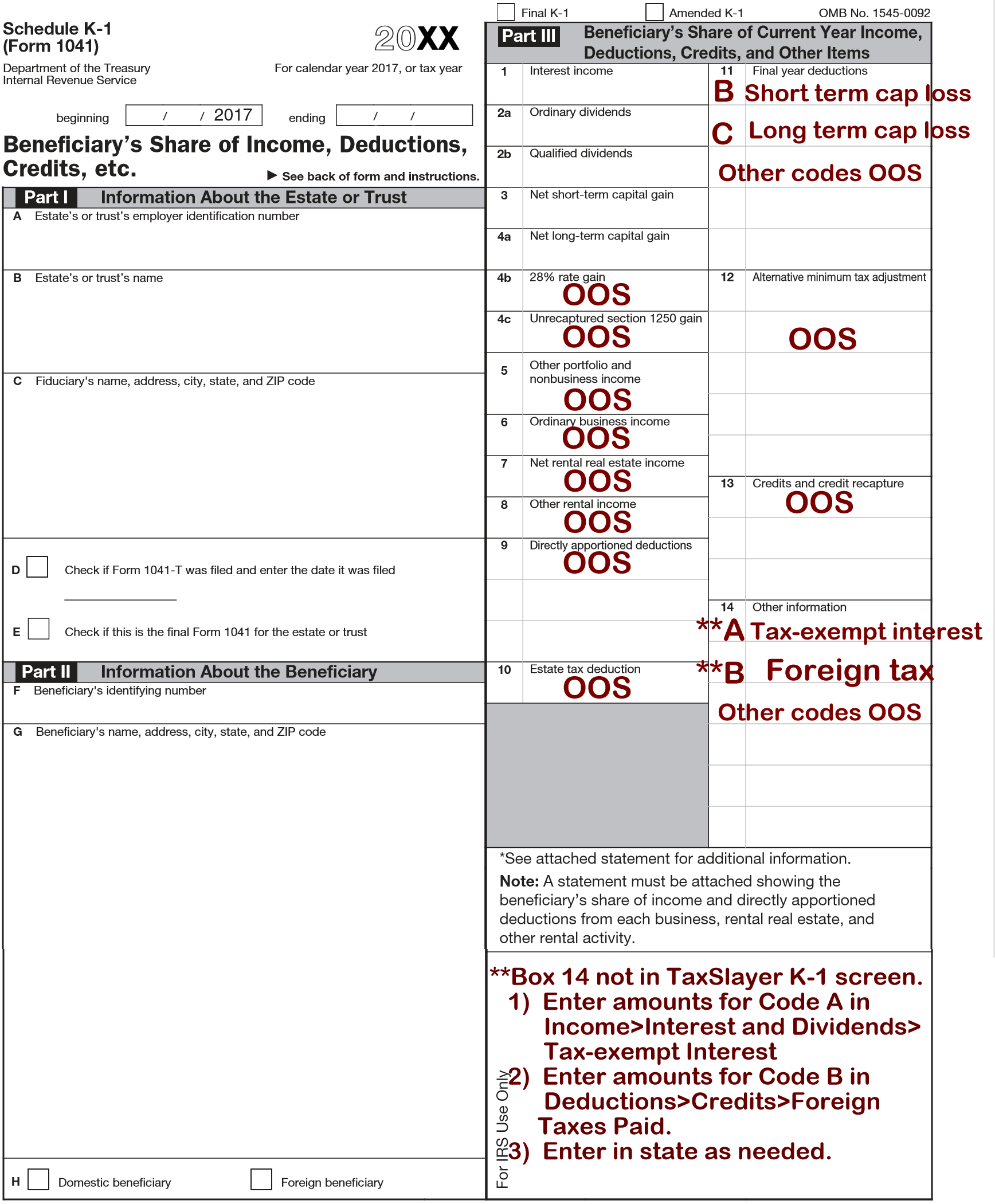

Form 1120S K 1 Instructions 2016 2018 Codes Line 17 —

Irs Instructions Form 1120s Fillable and Editable PDF Template

form 1120 schedule b instructions 2017 Fill Online, Printable

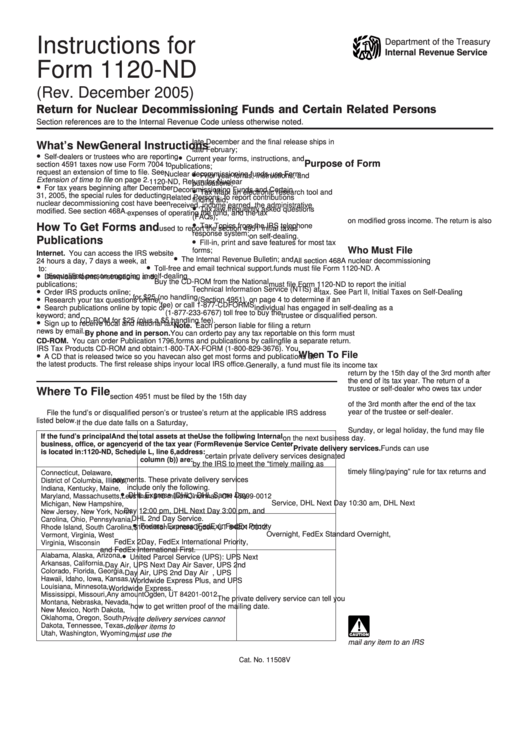

Instructions For Form 1120Nd 2005 printable pdf download

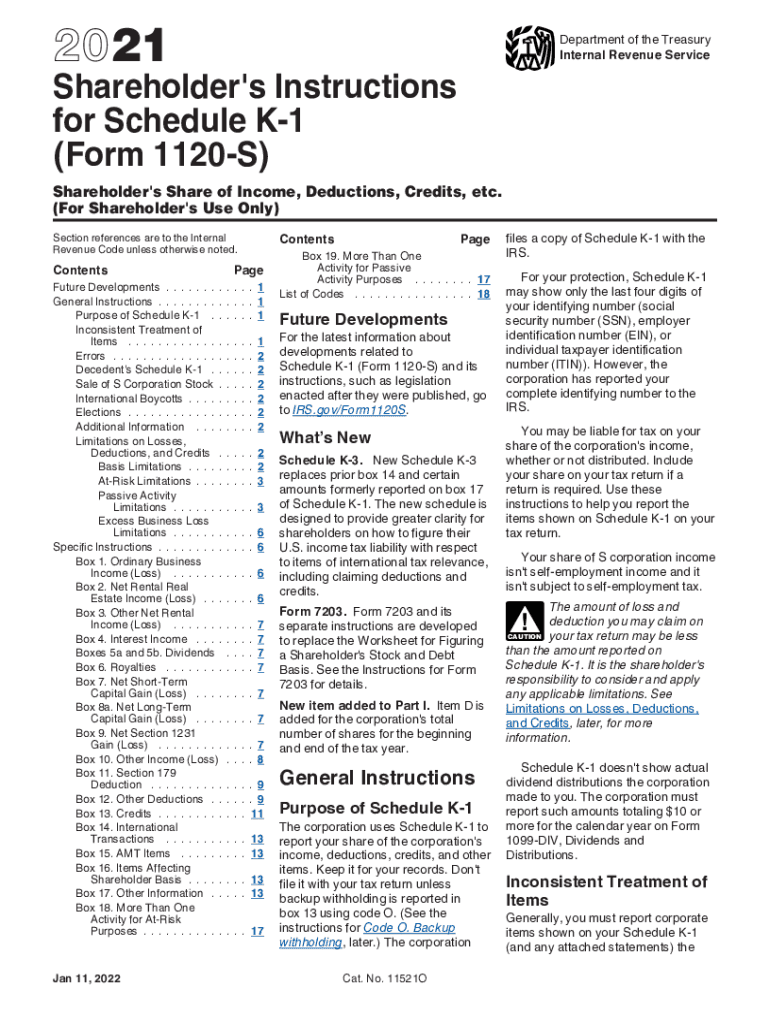

IRS Instruction 1120S Schedule K1 20212022 Fill and Sign

What is Form 1120S and How Do I File It? Ask Gusto

What is Form 1120S and How Do I File It? Ask Gusto

Related Post: