Form 3921 Carta

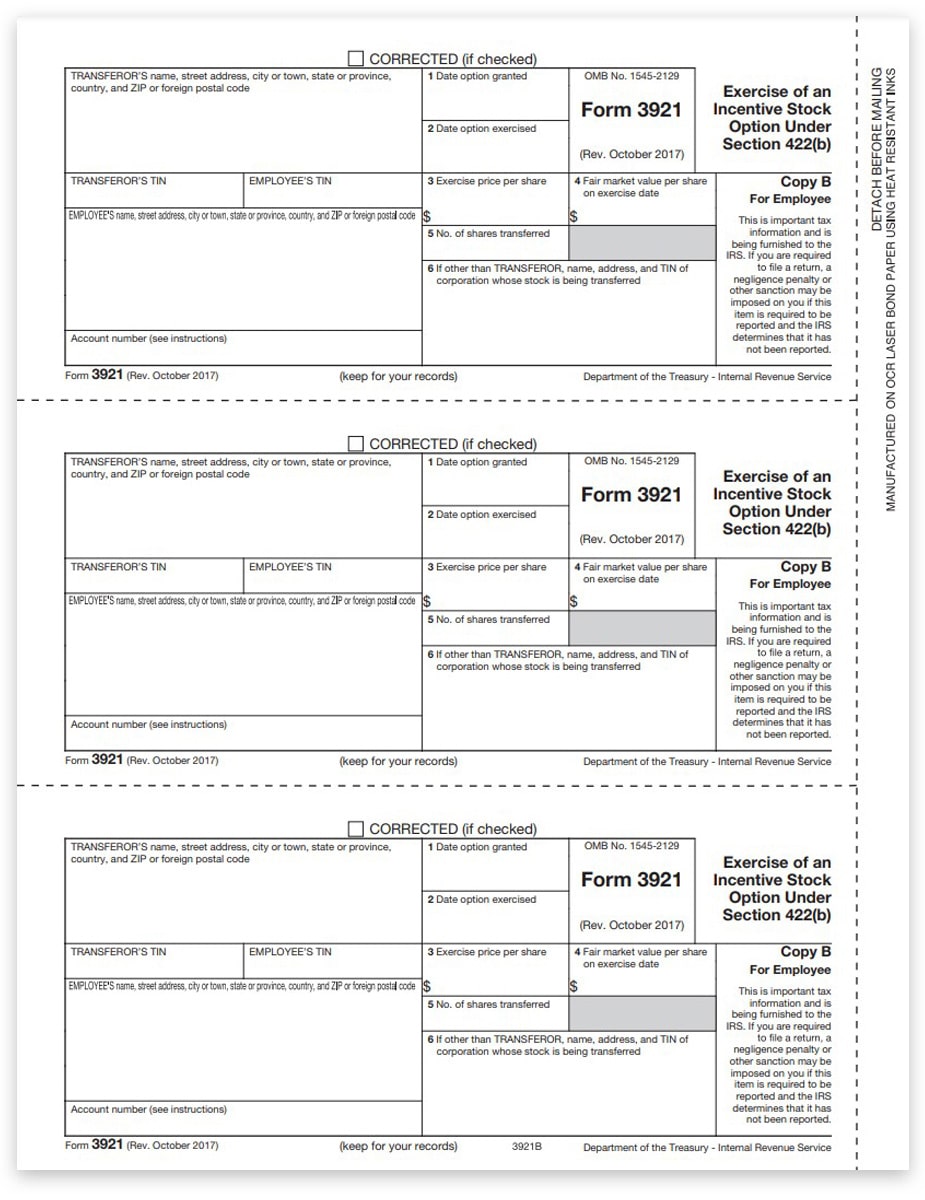

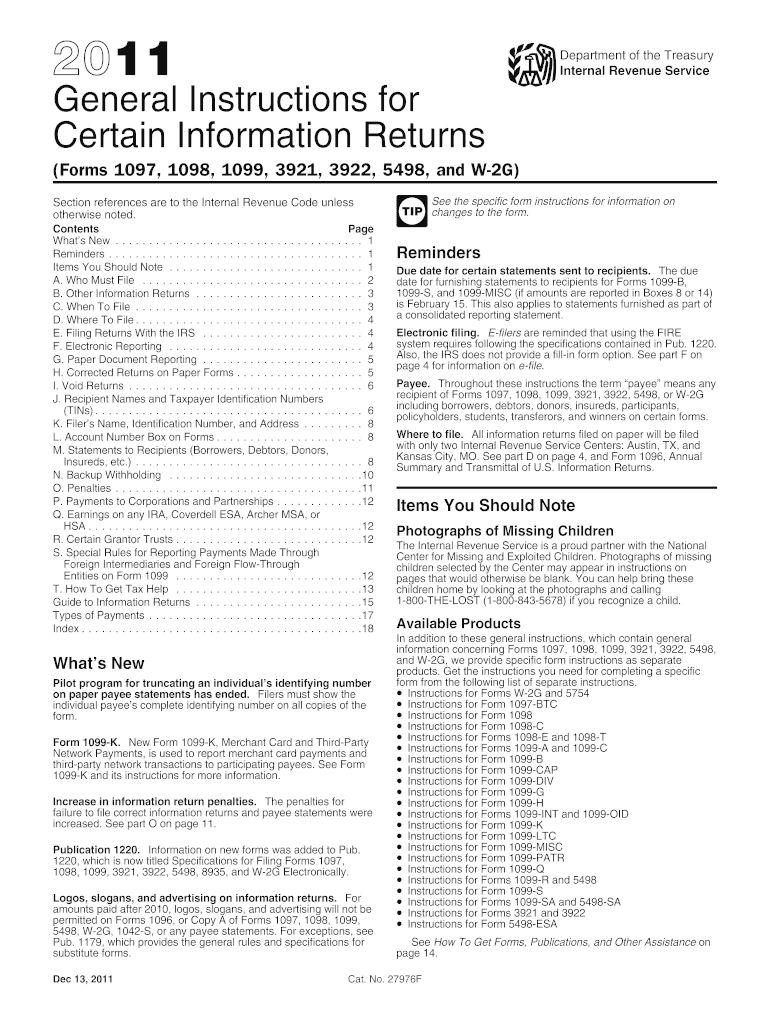

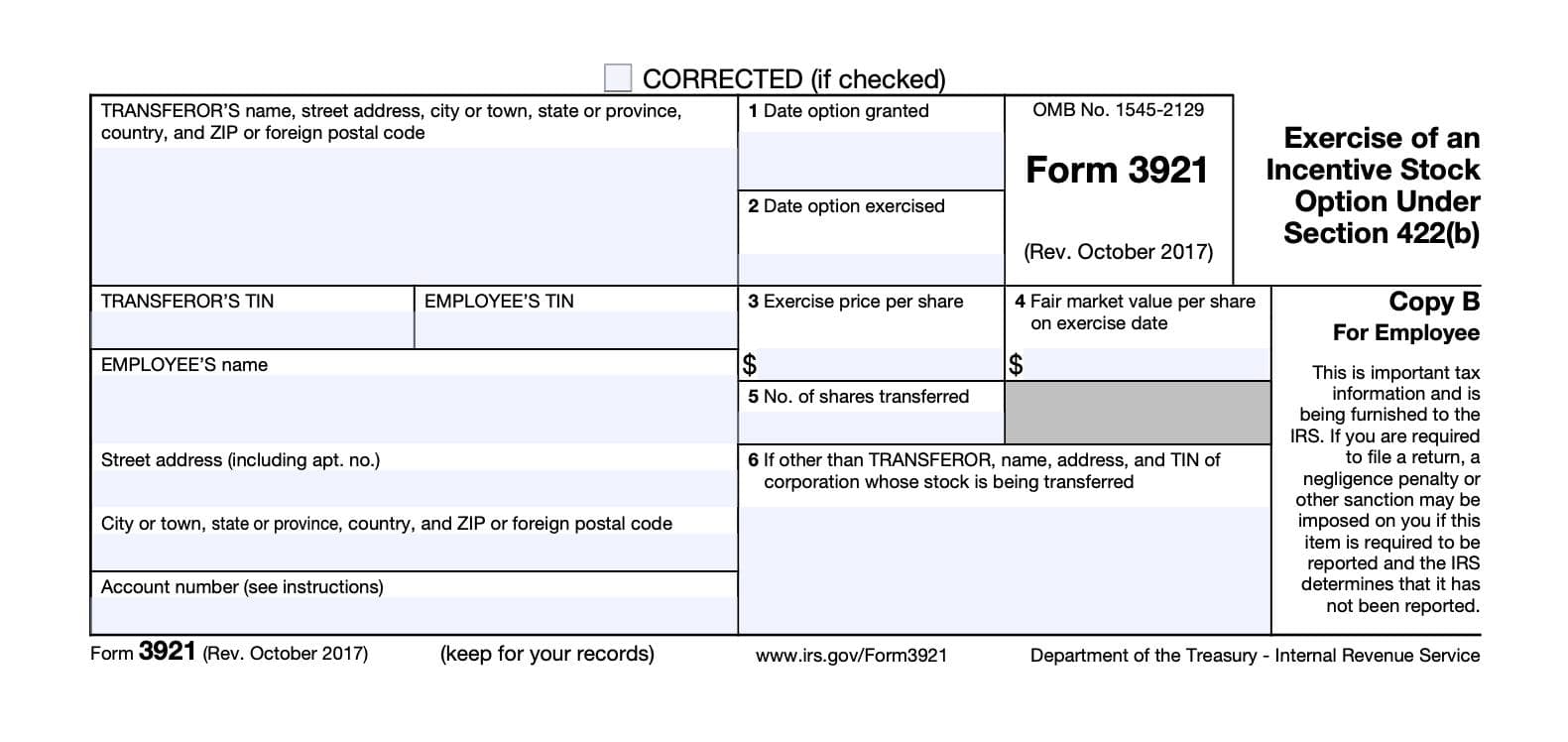

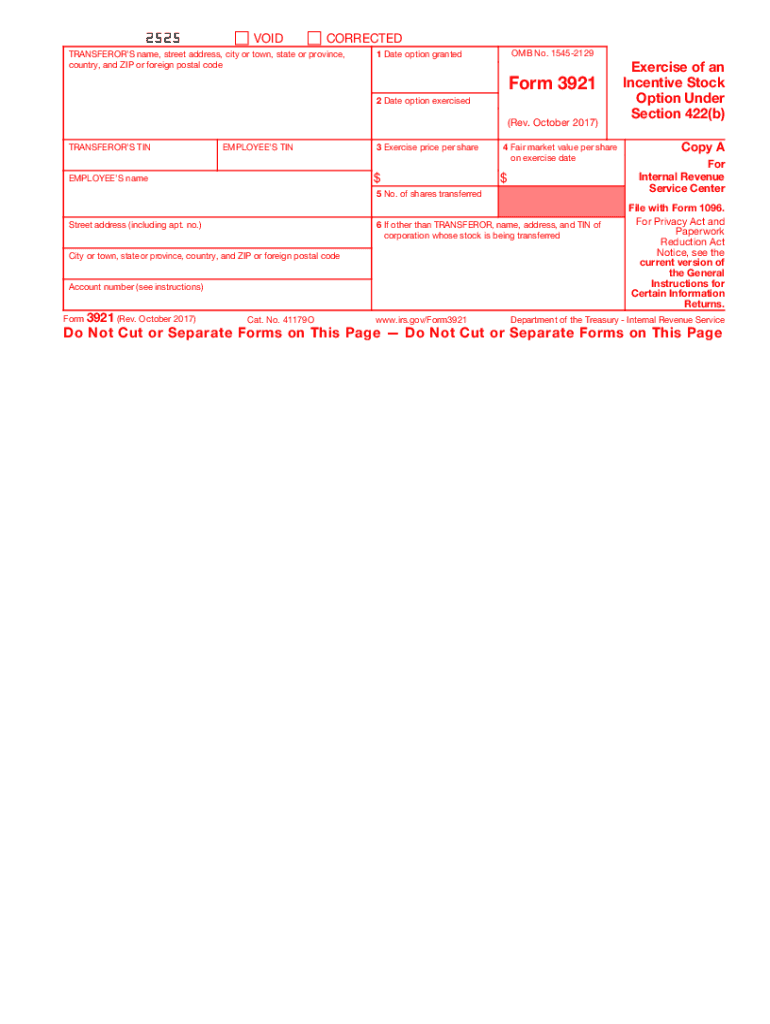

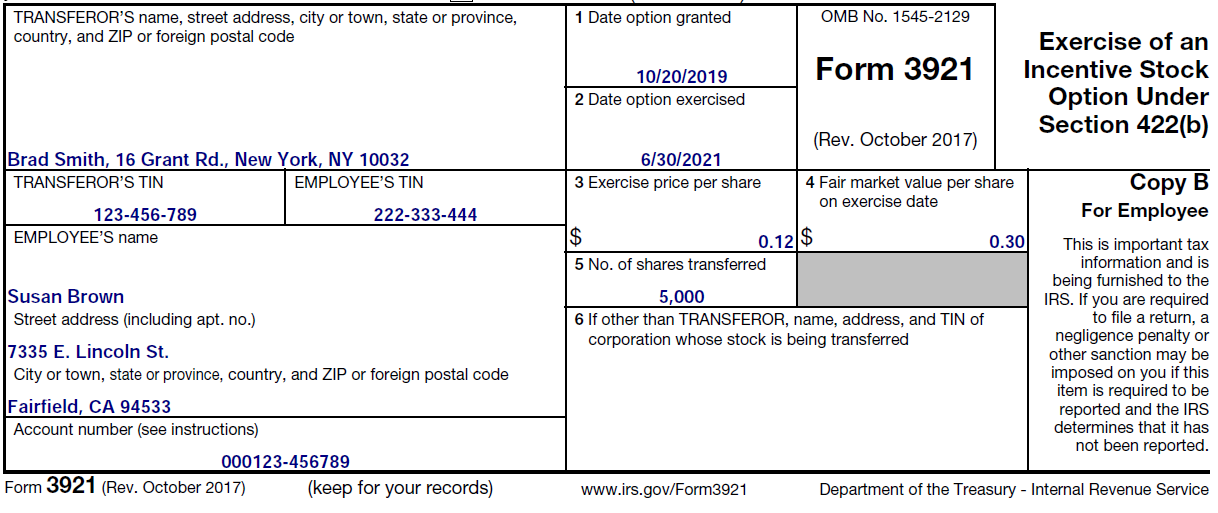

Form 3921 Carta - Section 6039 of the internal revenue code requires companies to provide 3921 forms to the employee. Web your company is required to file an irs form 3921 for every employee that exercised iso within the last tax year. See how carta can help streamline the process. You have received this form because your employer (or transfer agent) transferred your employer’s stock to you pursuant to your exercise of an incentive. Web form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records. Rate the tax form 3921. Enter your tcc in the company details section. Form 3921 is an irs form that is filed when an employee has exercised shares including incentive stock options (isos) in the last tax year, and informs the irs. Web form 3921 is a form that companies have to file with the irs when a shareholder exercises their incentive stock option (iso). Form 3921 is an irs form that must be filed by a company when an employee has exercised an incentive stock option (iso) in the last tax year. Web form 3921 is a form that companies have to file with the irs when a shareholder exercises their incentive stock option (iso). From idea to ipo, carta supports innovators at every stage and in every role. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an. There are a few things you should note here: Ad pdffiller.com has been visited by 1m+ users in the past month Web your company is required to file an irs form 3921 for every employee that exercised iso within the last tax year. Save your changes and share 3921 form carta. This form can be shared with your tax consultant. Form 3921 is an irs form that is used by. Web in order to file your 3921s on carta, you will first need to apply for a tcc (transmitter control code) with form 4419. Web form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records. Web. Reach out to your csm to enable form. Click into the profile tab. For the latest information about developments related to. Form 3921 informs the irs which shareholders received iso compensation. Web after receiving the tcc, log into carta and navigate to company settings. Form 3921 informs the irs which shareholders received iso compensation. Ad pdffiller.com has been visited by 1m+ users in the past month Click into the profile tab. Web form 3921 is a form that companies have to file with the irs when a shareholder exercises their incentive stock option (iso). Web in order to file your 3921s on carta, you. Web in order to file your 3921s on carta, you will first need to apply for a tcc (transmitter control code) with form 4419. The form has to be filed in the. Web page last reviewed or updated: Web your company is required to file an irs form 3921 for every employee that exercised iso within the last tax year.. Web your company is required to file an irs form 3921 for every employee that exercised iso within the last tax year. The form has to be filed in the. It does not need to be entered into. Form 3921 is an irs form that is filed when an employee has exercised shares including incentive stock options (isos) in the. Reach out to your csm to enable form. Rate the tax form 3921. Form 3921 is an irs form that is used by. Web in order to file your 3921s on carta, you will first need to apply for a tcc (transmitter control code) with form 4419. Web form 3921 exercise of an incentive stock option under section 422 (b),. See how carta can help streamline the process. Ad pdffiller.com has been visited by 1m+ users in the past month This form can be shared with your tax consultant for. It does not need to be entered into. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of. There are a few things you should note here: Reach out to your csm to enable form. Web if employees exercised incentive stock options (isos) last tax year, the issuing company will need to file irs form 3921 in the first quarter of every calendar. Section 6039 of the internal revenue code requires companies to provide 3921 forms to the. Form 3921 is an irs form that is used by. Save your changes and share 3921 form carta. A startup is required to file one. Web your company is required to file an irs form 3921 for every employee that exercised iso within the last tax year. Web after receiving the tcc, log into carta and navigate to company settings. Section 6039 of the internal revenue code requires companies to provide 3921 forms to the employee. Web if employees exercised incentive stock options (isos) last tax year, the issuing company will need to file irs form 3921 in the first quarter of every calendar. You have received this form because your employer (or transfer agent) transferred your employer’s stock to you pursuant to your exercise of an incentive. Web form 3921 is a form that companies have to file with the irs when a shareholder exercises their incentive stock option (iso). It does not need to be entered into. This form can be shared with your tax consultant for. Web downloading and delivering 3921 forms (admin) jan 10, 2023. Web the new form 3921 dashboard is available now to all companies subscribed to this feature. Click into the profile tab. Reach out to your csm to enable form. For the latest information about developments related to. See how carta can help streamline the process. Form 3921 is a tax form that helps the irs keep track of when and how employees exercise their incentive stock options (isos). Ad pdffiller.com has been visited by 1m+ users in the past month Information about form 3921, exercise of an incentive stock option under section 422 (b), including recent.3921 Forms for Incentive Stock Option, Employee Copy B DiscountTaxForms

Carta Form 3921 Fill Out and Sign Printable PDF Template signNow

· IRS Form 3921 Toolbx

Form 3921 Everything you need to know

Requesting your TCC for Form 3921 & 3922

Updated Form 3921 Dashboard with Consolidated 3921 Statements

20172023 Form IRS 3921Fill Online, Printable, Fillable, Blank pdfFiller

Form 3921 Fill Out and Sign Printable PDF Template signNow

File Form 3921 Eqvista

Form 3921 and FMVs

Related Post: