Inheritance Tax Waiver Form California

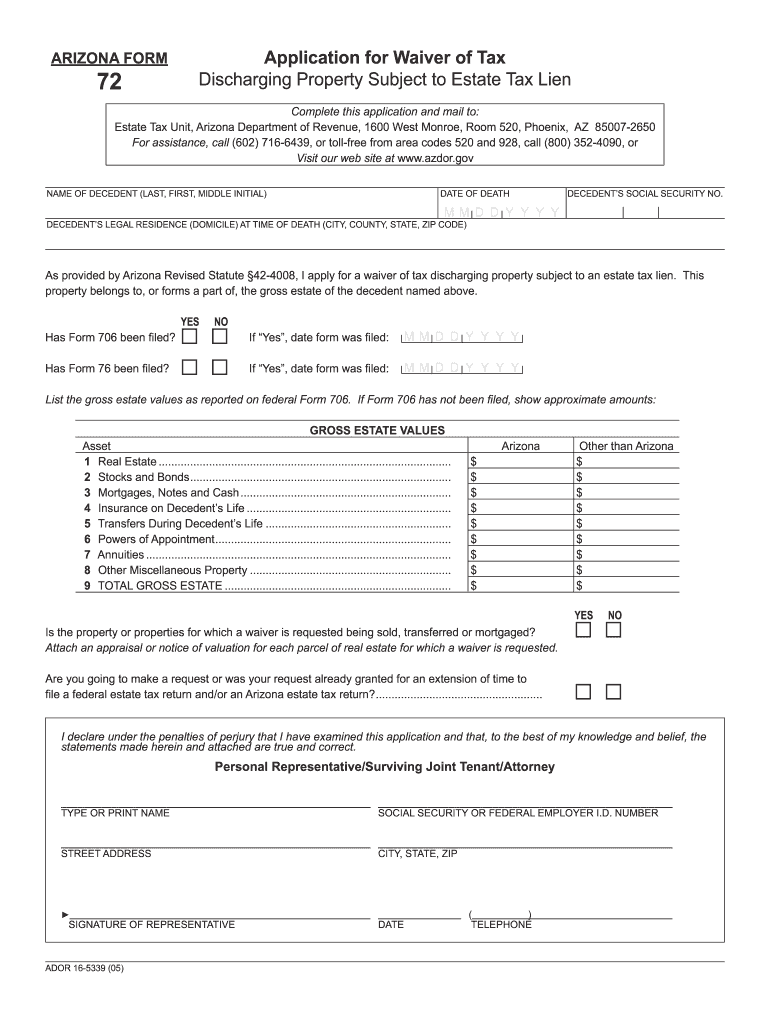

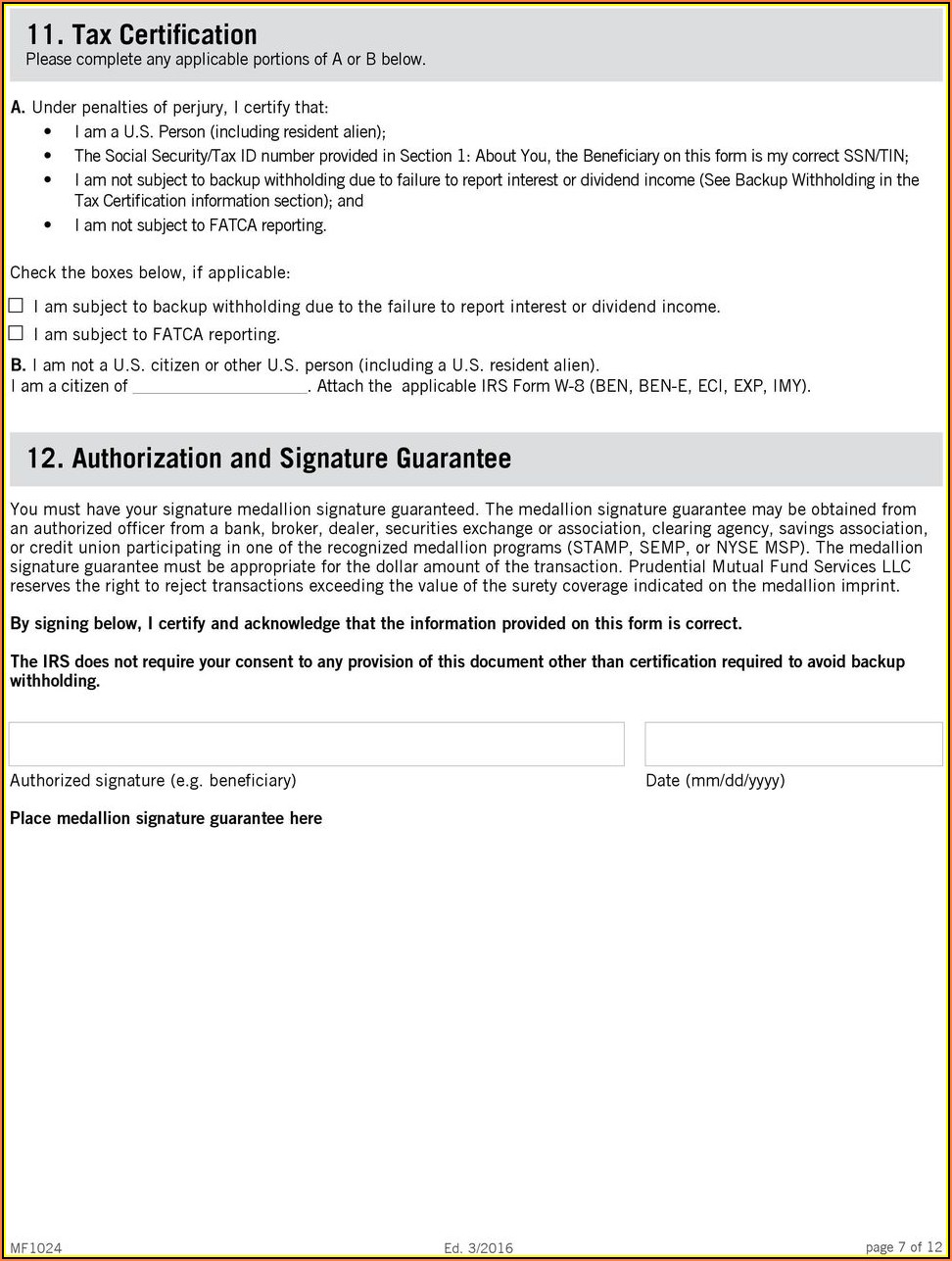

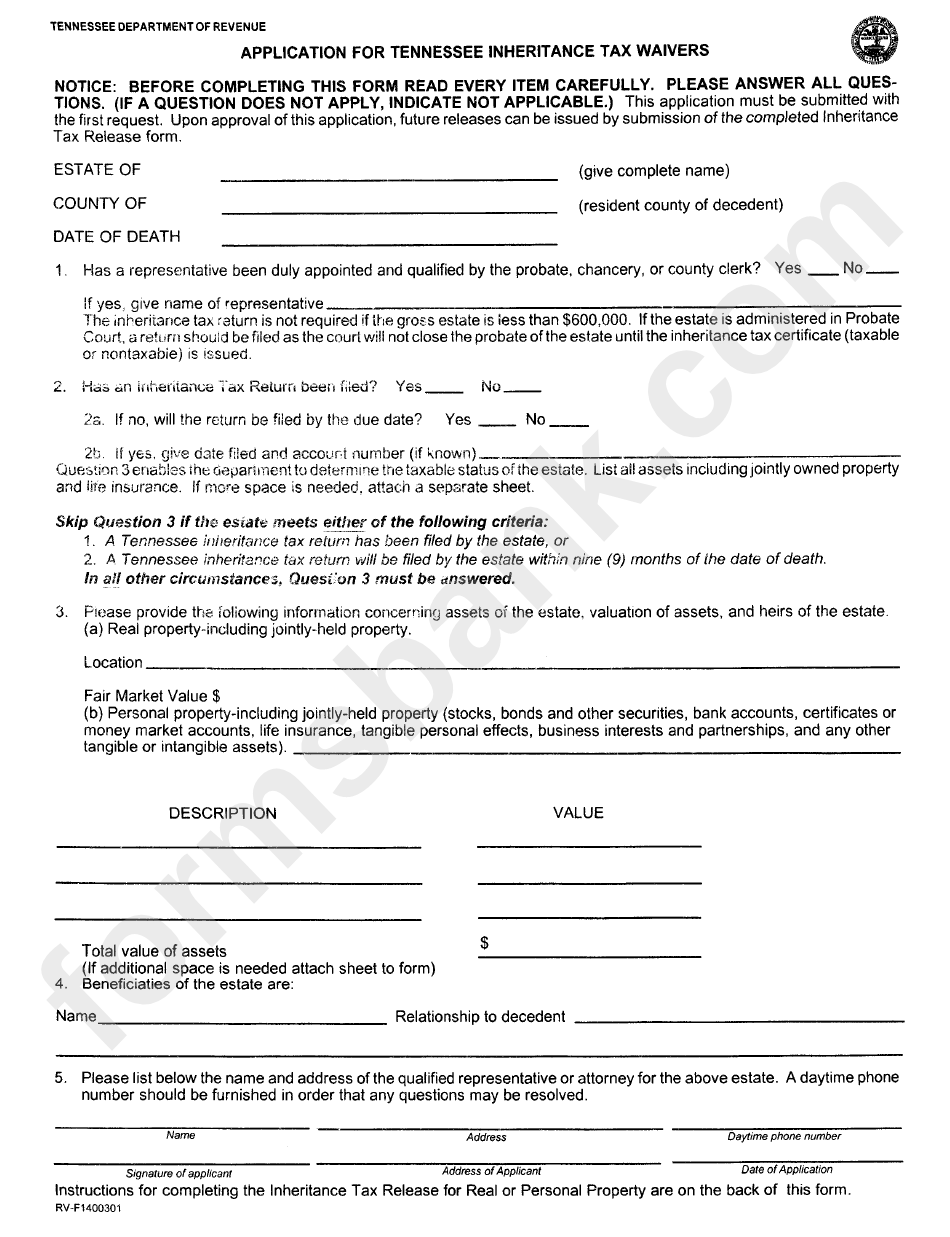

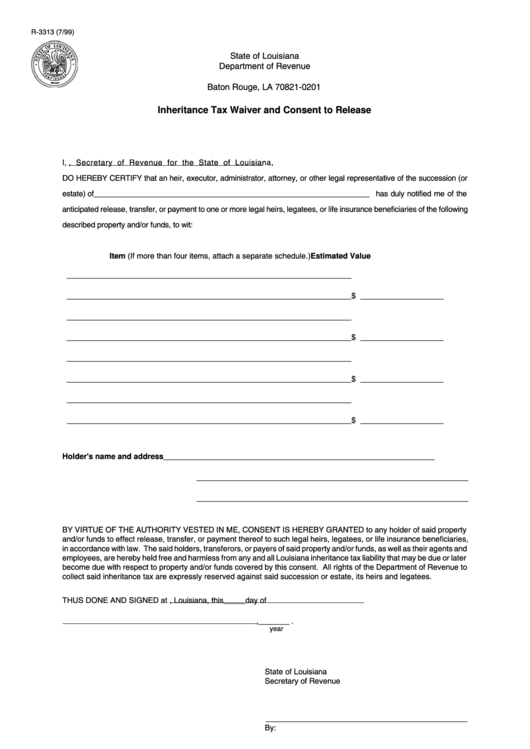

Inheritance Tax Waiver Form California - Web updated may 09, 2021. California inheritance tax exemption amount. This tax has full portability for. Web posted on apr 14, 2020. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source. You inherit and deposit cash that earns interest income. The executor may have to file a return if the estate meets any of these: The decedent was a california resident at the time of death. Web california inheritance tax waiver form. Web the information below summarizes the filing requirements for estate, inheritance, and/or gift tax: The decedent was a california resident at the time of death. Web no, california does not require an inheritance tax waiver form because there is no inheritance tax. Web posted on apr 14, 2020. An inheritance or estate waiver releases an heir from the right to receive assets from an estate, and the associated. If you received a gift or. However, when transferring stock ownership to an estate,. Web disaster victims also may receive free copies of their state returns to replace those lost or damaged. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source. If you received a gift or inheritance, do not include it in your income. Web. Web posted on apr 14, 2020. So you should be able to find it on your state's website. It’s a levy on assets inherited from a deceased person. An inheritance or estate waiver releases an heir from the right to receive assets from an estate, and the associated. Ad formswift.com has been visited by 100k+ users in the past month For decedents that die on or after january 1, 2005, there is no longer a. The executor may have to file a return if the estate meets any of these: Ad quick & easy waiver forms for parties, sporting events & more. (correct answer) alabama, alaska, arkansas, california, colorado, connecticut, delaware , district. Web the federal estate tax goes into. California inheritance tax exemption amount. However, if the gift or inheritance later produces income, you will need to pay tax on that income. Web i am in california and there is a form on the california website that you use to request the waiver. And dealing with the courts and the property of someone who has died is very complicated.. Web to transfer or inherit property after someone dies, you must usually go to court. Web updated may 09, 2021. An inheritance or estate waiver releases an heir from the right to receive assets from an estate, and the associated. For decedents that die on or after january 1, 2005, there is no longer a. So you should be able. Inheritance tax in california 2021. Web california inheritance tax waiver form. This tax has full portability for. California inheritance tax exemption amount. Ad quick & easy waiver forms for parties, sporting events & more. Web an inheritance tax is a tax imposed by some states on the recipients of inherited assets. California estates must follow the federal estate tax, which taxes certain large estates. Web what states require an inheritance tax waiver form? Web the information below summarizes the filing requirements for estate, inheritance, and/or gift tax: I agree with my colleagues: Web no, california does not require an inheritance tax waiver form because there is no inheritance tax. For decedents that die on or after january 1, 2005, there is no longer a. If you received a gift or inheritance, do not include it in your income. Online / digital waiver forms for parties, sporting events & more. Web the federal. Web no, california does not require an inheritance tax waiver form because there is no inheritance tax. There is no inheritance tax in california. For decedents that die on or after january 1, 2005, there is no longer a. Web california inheritance tax waiver form. And dealing with the courts and the property of someone who has died is very. Web california residents don’t need to worry about a state inheritance or estate tax as it’s 0%. Taxpayers may complete form ftb 3516 and write the name of the disaster. There is no inheritance tax in california. This goes up to $12.92 million in 2023. Web the information below summarizes the filing requirements for estate, inheritance, and/or gift tax: You may want to consult with a cpa or tax advisor regarding your. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source. Web to transfer or inherit property after someone dies, you must usually go to court. Web up to $40 cash back the arizona inheritance tax waiver is a document that may be required by the arizona department of revenue in order to release the assets of a deceased. Ad formswift.com has been visited by 100k+ users in the past month Inheritance tax in california 2021. I agree with my colleagues: The decedent was a california resident at the time of death. Web the instructions provided with california tax forms are a summary of california tax law and are only intended to aid taxpayers in preparing their state income tax returns. California inheritance tax exemption amount. The executor may have to file a return if the estate meets any of these: Web california inheritance tax waiver form. Web no, california does not require an inheritance tax waiver form because there is no inheritance tax. If you received a gift or inheritance, do not include it in your income. Ad quick & easy waiver forms for parties, sporting events & more.Arizona Inheritance Tax Form Fill Out and Sign Printable PDF Template

Inheritance Tax Waiver Form Form Resume Examples l6YNqRm93z

Inheritance Tax Waiver Form Ohio Form Resume Examples vq1PDb61kR

California Inheritance Tax Waiver Form Fill Online, Printable

Ca Waiver Release Form 20202022 Fill and Sign Printable Template

Application For Tennessee Inheritance Tax Waivers Tennessee

Inheritance Tax Waiver Form California Form Resume Examples Mj1vGyBKwy

California Tax Exempt Certificate Fill Online, Printable, Fillable

Fillable Form R3313 Inheritance Tax Waiver And Consent To Release

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

Related Post: