Illinois Wage Garnishment Exemption Form

Illinois Wage Garnishment Exemption Form - The following money is exempt: Web such wages, money, and property are exempt from garnishment. Ask your circuit clerk for more information or visit www.illinoislegalaid.org. The certificate tells the employer. Scroll down below the chart for important information on how to fill out these forms, including the need for adobe and. Web you must meet income qualifications to use the program. Web you must send a certificate of judgment balance to the employer every january 1st, april 1st, july 1st, and october 1st until the debt is paid off. Web the personal property exemptions set forth in this section shall not apply to or be allowed against any money, salary, or wages due or to become due to the debtor that are. Web the maximum wages subject to garnishment is the lesser of 15% of gross wages; Who can garnish my wages in illinois? Web such wages, money, and property are exempt from garnishment. Web you must meet income qualifications to use the program. Web wage garnishment occurs when an employer must withhold and remit a percentage of an employee’s disposable earnings to a creditor. 12/01/20) ccg 0103 in the circuit court of cook county, illinois _____ v. Web you must send a certificate. Web the maximum wages subject to garnishment is the lesser of 15% of gross wages; Web you do this by claiming the money is protected by law (“exempt”) in your motion. Benefits and refunds payable by pension or retirement funds or systems and any assets of employees held by such funds or systems, and any. Use the collect a judgment. Martinez, clerk of the circuit court of cook county, illinois. Request a hearing to dispute the garnishment. Web you must send a certificate of judgment balance to the employer every january 1st, april 1st, july 1st, and october 1st until the debt is paid off. Web the personal property exemptions set forth in this section shall not apply to or. When a creditor initiates the process of garnishing your wages, they must send you a notice to that effect. Web wage garnishment occurs when an employer must withhold and remit a percentage of an employee’s disposable earnings to a creditor. Benefits and refunds payable by pension or retirement funds or systems and any assets of employees held by such funds. Web updated november 7, 2022. Scroll down below the chart for important information on how to fill out these forms, including the need for adobe and. Ask your circuit clerk for more information or visit www.illinoislegalaid.org. When a creditor initiates the process of garnishing your wages, they must send you a notice to that effect. Us legal forms has been. Web you must send a certificate of judgment balance to the employer every january 1st, april 1st, july 1st, and october 1st until the debt is paid off. Web such wages, money, and property are exempt from garnishment. If you did not use adobe acrobat or reader, your computer will select a software that will allow you to fill out. When a creditor initiates the process of garnishing your wages, they must send you a notice to that effect. Web all illinois courts must accept these forms. Web such wages, money, and property are exempt from garnishment. Ad fill, sign, email il452wc01 & more fillable forms, register and subscribe now! Web you must send a certificate of judgment balance to. Web this form is approved by the illinois supreme court and is required to be accepted in all illinois circuit courts. Web if you receive a notice of a wage garnishment order, you might be able to protect or exempt some or all of your wages by filing an exemption claim with the court or. The certificate tells the employer.. How do i know if my money is exempt? The certificate tells the employer. Web such wages, money, and property are exempt from garnishment. Web you do this by claiming the money is protected by law (“exempt”) in your motion. 12/01/20) ccg 0103 in the circuit court of cook county, illinois _____ v. If you did not use adobe acrobat or reader, your computer will select a software that will allow you to fill out the forms. Web all illinois courts must accept these forms. The certificate tells the employer. The judgment debtor may have other possible exemptions from garnishment under the law. Web you must meet income qualifications to use the program. Web you must meet income qualifications to use the program. How do i know if my money is exempt? Web if you receive a notice of a wage garnishment order, you might be able to protect or exempt some or all of your wages by filing an exemption claim with the court or. Web the personal property exemptions set forth in this section shall not apply to or be allowed against any money, salary, or wages due or to become due to the debtor that are. Web the maximum wages subject to garnishment is the lesser of 15% of gross wages; Who can garnish my wages in illinois? Martinez, clerk of the circuit court of cook county, illinois. Web such wages, money, and property are exempt from garnishment. The certificate tells the employer. More information about how to use the program can be found in this postcard or flyer. 12/01/20) ccg 0103 in the circuit court of cook county, illinois _____ v. The following money is exempt: Web for ordinary garnishments (i.e., those not for support, bankruptcy, or any state or federal tax), the weekly amount may not exceed the lesser of two figures: If you did not use adobe acrobat or reader, your computer will select a software that will allow you to fill out the forms. When a creditor initiates the process of garnishing your wages, they must send you a notice to that effect. Benefits and refunds payable by pension or retirement funds or systems and any assets of employees held by such funds or systems, and any. The judgment debtor has the right to request a hearing before the court to. Web you do this by claiming the money is protected by law (“exempt”) in your motion. Web you must send a certificate of judgment balance to the employer every january 1st, april 1st, july 1st, and october 1st until the debt is paid off. On the other hand, non.Fillable Online azcourts wage garnishment answers forms Fax Email Print

IRS Released Wage Garnishment in Peoria, IL 20/20 Tax Resolution

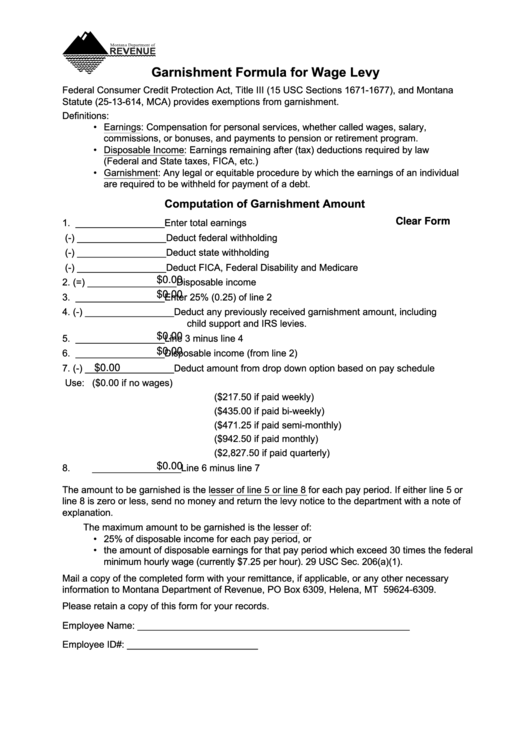

Fillable Garnishment Formula For Wage Levy Form printable pdf download

Wage Garnishment Worksheet Excel Fill Online, Printable, Fillable

Claim Of Exemption Wage Garnishment Indiana modesandesign

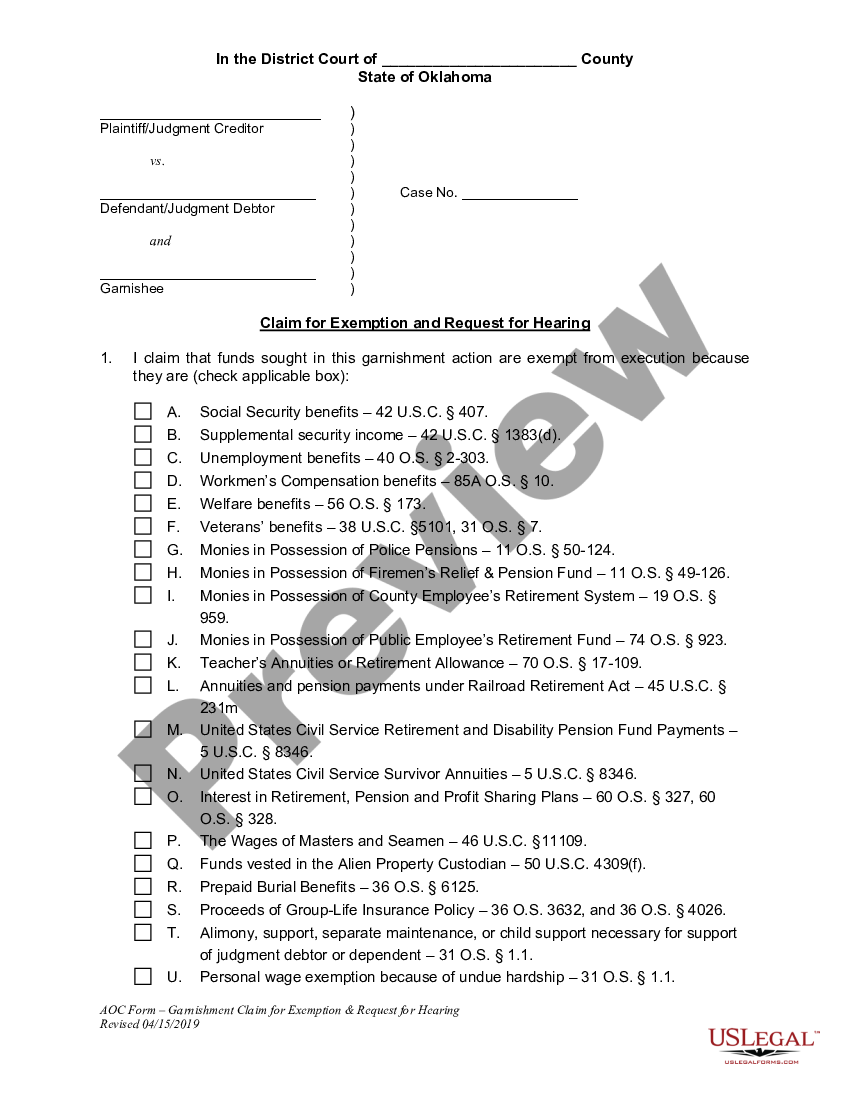

Oklahoma Garnishment Exemption Form US Legal Forms

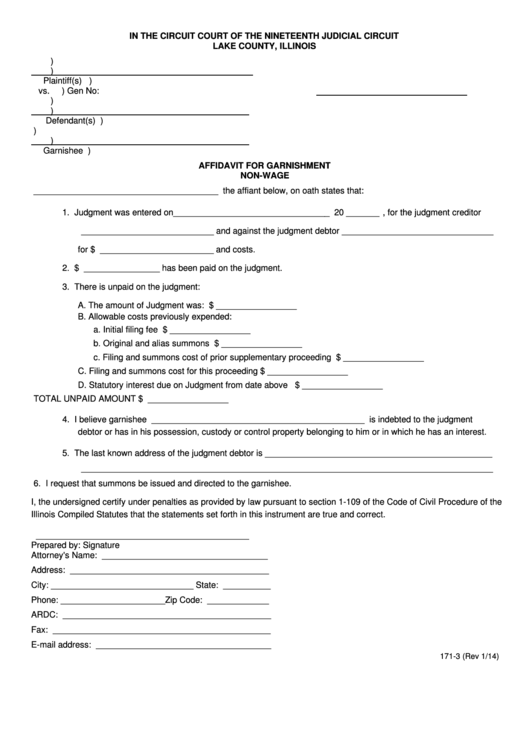

Fillable Affidavit For Garnishment NonWage Form Lake County

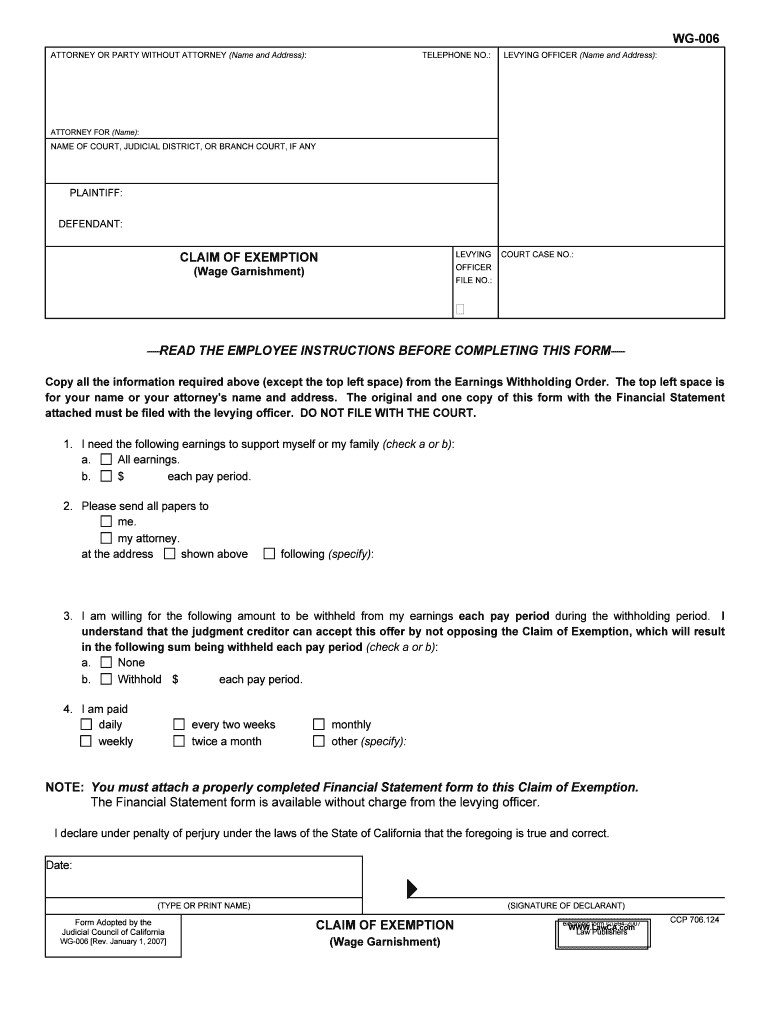

WG 006 Claim of Exemption Wage Garnishment Form Fill Out and Sign

Wage verification form illinois Fill out & sign online DocHub

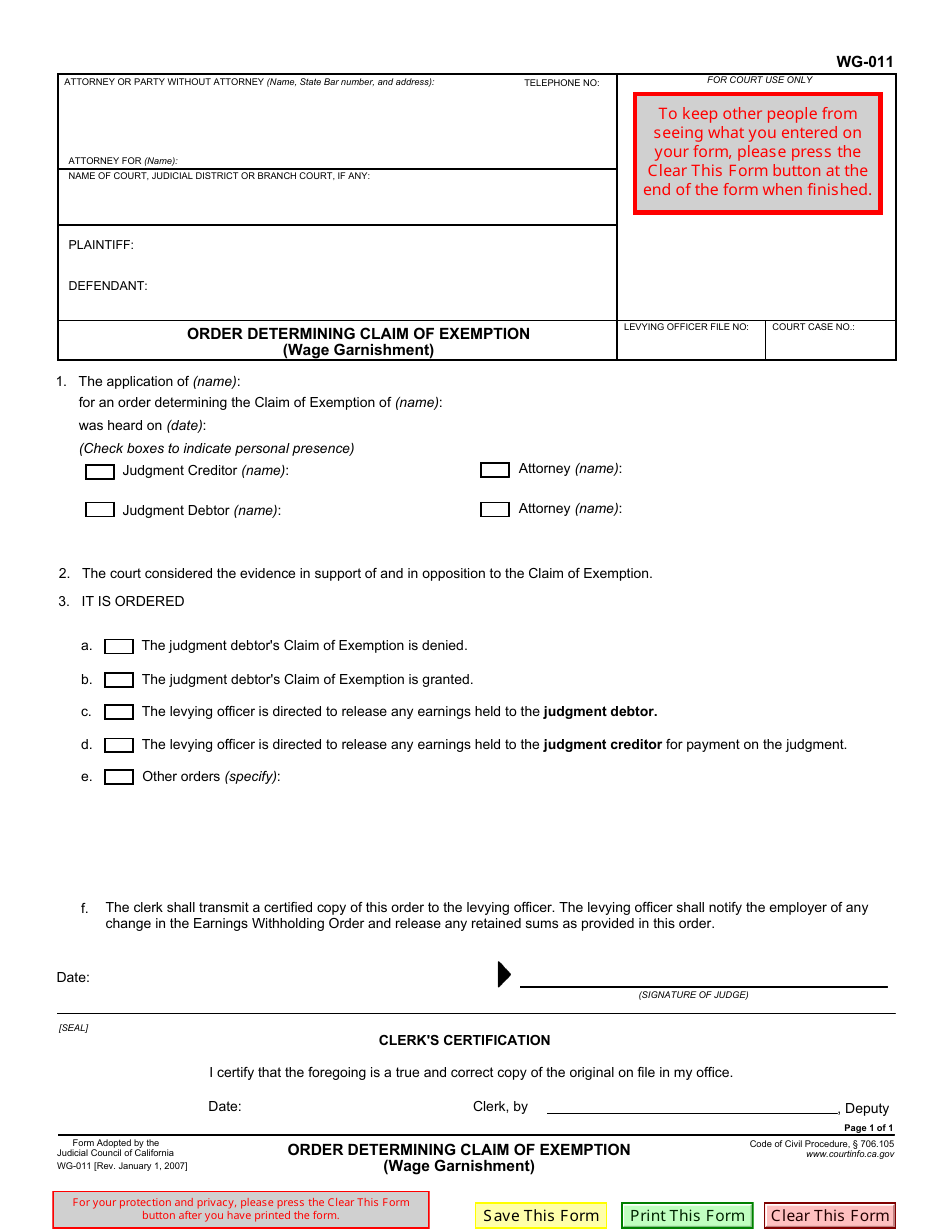

Form WG011 Download Fillable PDF or Fill Online Order Determining

Related Post: