Form 3893 California

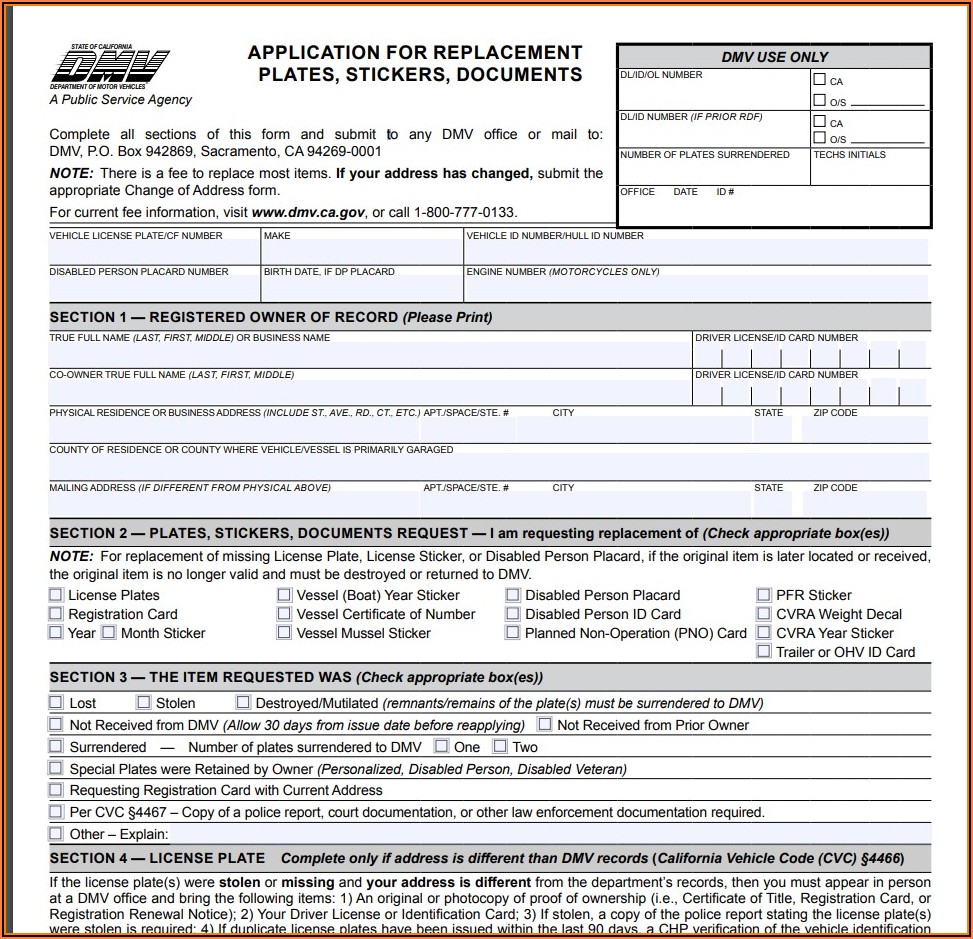

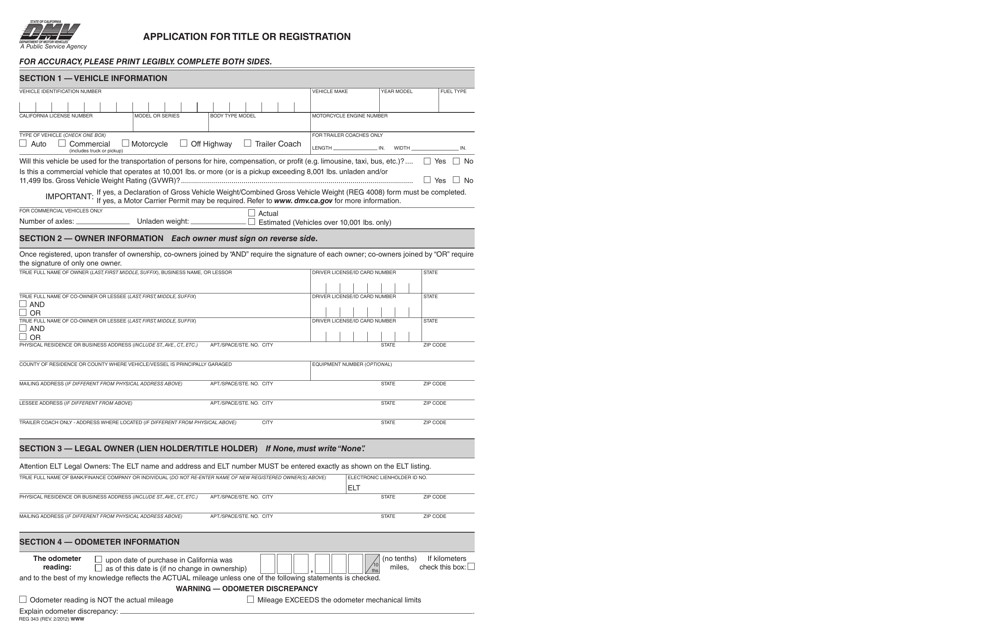

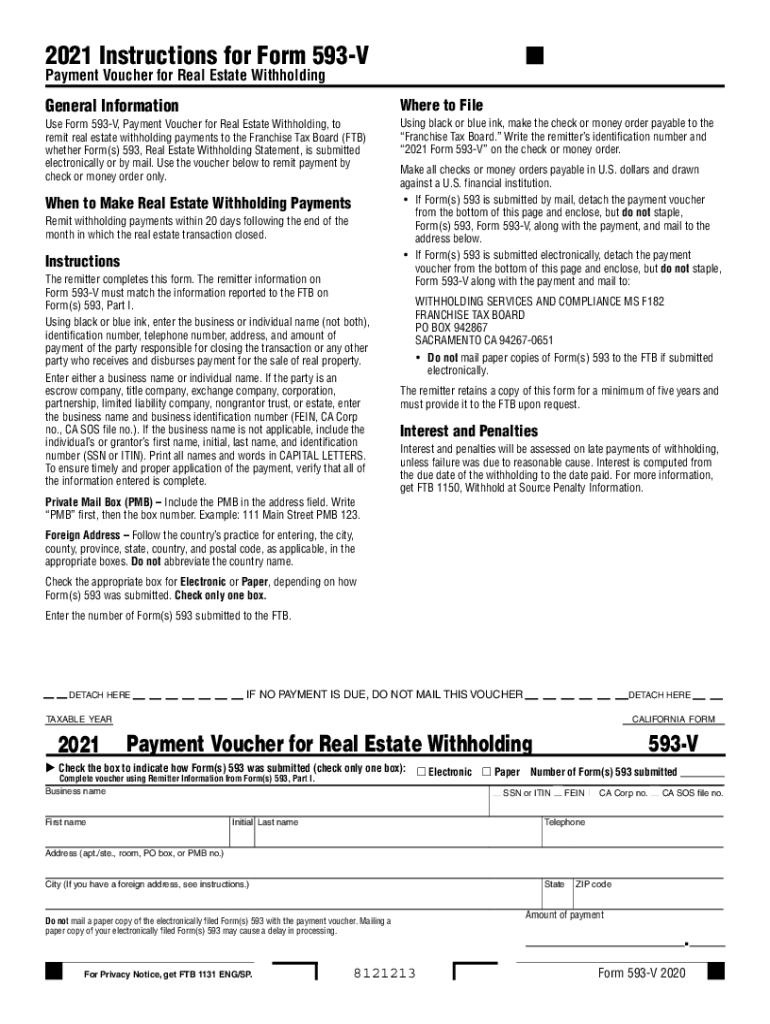

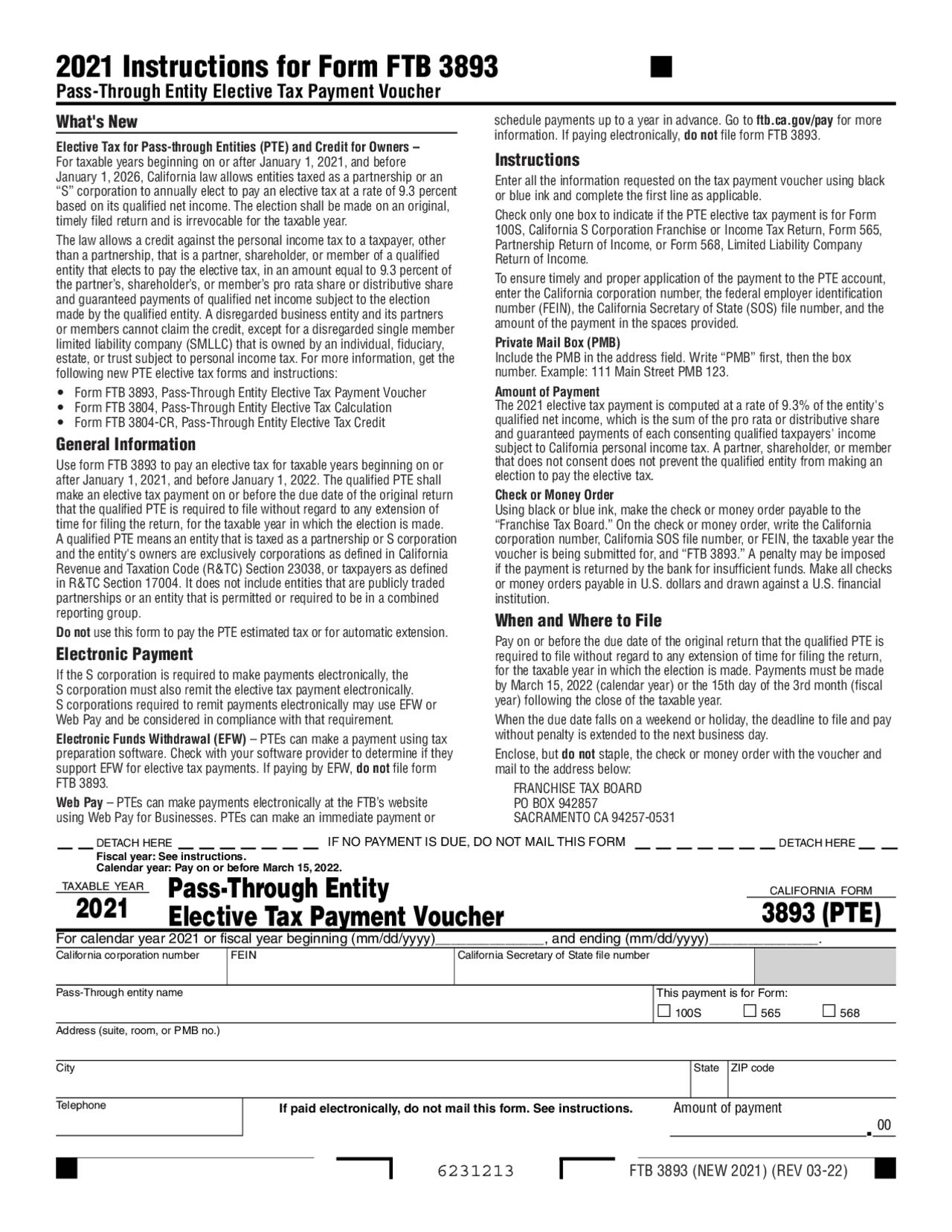

Form 3893 California - This form is for income earned in tax year. Web when to pay the elective tax. For taxable years beginning on or after january. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Ftb 3586 is the payment. Web go to california > ca26a. 3893 (2022) prepayment is simply half of the calculated 2021 amount. Write the california corporation number, fein, or ca sos file. Web the california franchise tax board dec. Web when california real estate is sold on an installment basis, the buyer/transferee is required to withhold on the principal portion of each installment payment, an amount based on. Web the california franchise tax board dec. Web go to california > ca26a. Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). The amount on ftb 3893 amount of payment carries to form 100s, page 2, line 35 as paid. Web find california form 593 instructions at esmart. The amount on ftb 3893 amount of payment carries to form 100s, page 2, line 35 as paid. Web form 3893 (2021) automatically activates when form 3804 is present. Web tax year 2022 ftb form 3893 automatically activates when 3893 (2021) is present. This form is for income earned in tax year. Web partnerships and s corporations may use ftb. 3893 (2022) prepayment is simply half of the calculated 2021 amount. If an entity does not make that first. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. For taxable years beginning on or after january. This form is for income. Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). How to claim your tax credit. If an entity does not make that first. 3893 (2022) prepayment is simply half of the calculated 2021 amount. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________,. If an entity does not make that first. This form is for income earned in tax year. Web when california real estate is sold on an installment basis, the buyer/transferee is required to withhold on the principal portion of each installment payment, an amount based on. The amount on ftb 3893 amount of payment carries to form 100s, page 2,. We anticipate the revised form 3893 will be available march 7, 2022. Write the california corporation number, fein, or ca sos file. This form is for income earned in tax year. Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). Web when to pay the elective tax. Web find california form 593 instructions at esmart tax today. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. Web the california franchise tax board dec. Web when california real estate is sold on an installment basis, the buyer/transferee is required. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. Web when to pay the elective tax. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022.. Web when to pay the elective tax. If an entity does not make that first. Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). 3893 (2022) prepayment is simply half of the calculated 2021 amount. Ftb 3586 is the payment. For taxable years beginning on or after january. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. 3893 (2022) prepayment is simply half of the calculated 2021 amount. Qualified entities can use the following tax form to. Using black or blue ink, make check. Using black or blue ink, make check or money order payable to the “franchise tax board.”. Write the california corporation number, fein, or ca sos file. Web when california real estate is sold on an installment basis, the buyer/transferee is required to withhold on the principal portion of each installment payment, an amount based on. Web find california form 593 instructions at esmart tax today. Ftb 3586 is the payment. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Web form 3893 (2021) automatically activates when form 3804 is present. How to claim your tax credit. We anticipate the revised form 3893 will be available march 7, 2022. However, the instructions to for ftb 3893 indicate. Web tax year 2022 ftb form 3893 automatically activates when 3893 (2021) is present. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. If an entity does not make that first. 3893 (2022) prepayment is simply half of the calculated 2021 amount. Web go to california > ca26a. The amount on ftb 3893 amount of payment carries to form 100s, page 2, line 35 as paid. This form is for income earned in tax year. Web when to pay the elective tax. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet.California Dba Form Pdf Form Resume Examples dP9l7Dw32R

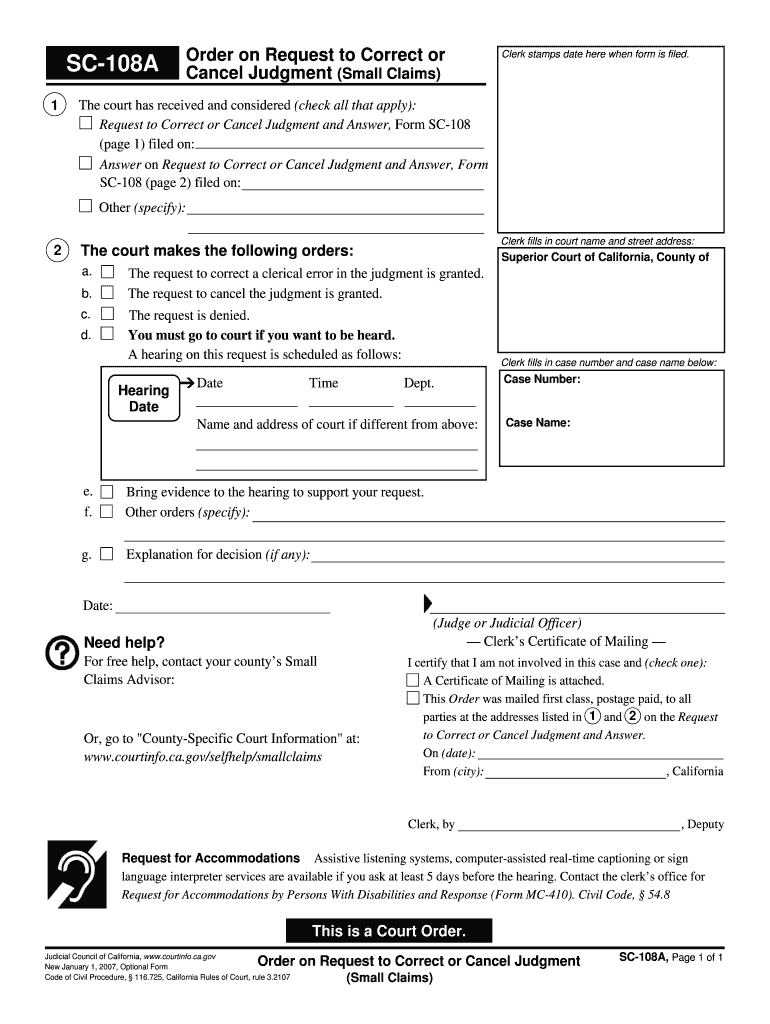

Small Claims Court Forms California Fill Online, Printable, Fillable

2023 Form 3893 Printable Forms Free Online

Vehicle Deposit Form California Free Download

2018 Form CA FTB 540Fill Online, Printable, Fillable, Blank pdfFiller

2023 Form 3893 Printable Forms Free Online

California Dmv Motor Carrier Permit

California Withholding Form 2021 2022 W4 Form

California Passthrough Entities Should Consider Making PTET Payments

2021 Instructions for Form 3893, PassThrough Entity Elective

Related Post: