Illinois Income Tax Form

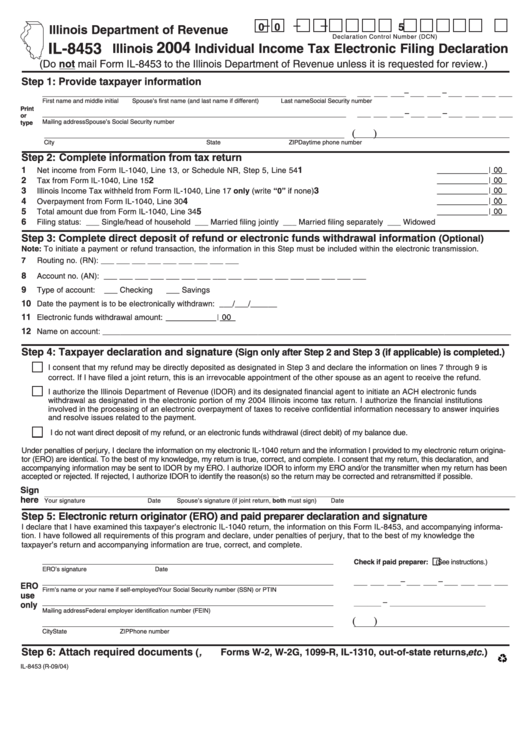

Illinois Income Tax Form - Web printable illinois state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Web individual income tax forms. Web enter the amount referenced by form type on the tables. The illinois income tax rate is 4.95 percent (.0495). Web illinois income tax forms. Click here to download the pdf form. For more information about the illinois. Web filing online is quick and easy! Web the state of illinois has a flat income tax, which means that everyone, regardless of income, is taxed at the same rate. Web illinois state income taxes were due on the same day as federal income taxes: For more information about the illinois. Web printable illinois state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. You can download or print. Web filing online is quick and easy! Web illinois state income taxes were due on the same day as federal income taxes: Documents are in adobe acrobat portable. Here is a comprehensive list of illinois. Web individual income tax forms. Click here to download the pdf form. Web illinois income tax forms. Sales & use tax forms. Web enter the amount referenced by form type on the tables. Documents are in adobe acrobat portable. Web view estimated payment details for your individual income tax return with mytax illinois. Web printable illinois state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. For more information about the illinois. The illinois income tax rate is 4.95 percent (.0495). Use mytax illinois to electronically file your original individual income tax return. Web 63 rows illinois has a flat state. For more information about the illinois. Request certain forms from idor. Details on how to only prepare and. Web the illinois tax rate. Web individual income tax return. April 18, 2023, for tax year 2022. Web view estimated payment details for your individual income tax return with mytax illinois. This form is used by illinois residents who file an individual income tax return. You can download or print. Complete, edit or print tax forms instantly. Request certain forms from idor. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. This form is used by illinois residents who file an individual income tax return. Web the illinois tax rate. You can download or print. Web individual income tax forms. April 18, 2023, for tax year 2022. Illinois income tax withheld enter the amount of illinois income tax withheld referenced by form type on. 2023 estimated income tax payments for individuals. Details on how to only prepare and. Web the state of illinois has a flat income tax, which means that everyone, regardless of income, is taxed at the same rate. Complete, edit or print tax forms instantly. Web printable illinois state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web view estimated payment details. Here is a comprehensive list of illinois. Click here to download the pdf form. Taxformfinder provides printable pdf copies of 76 current. You can download or print. Complete, edit or print tax forms instantly. Web individual income tax forms. Web enter the amount referenced by form type on the tables. This form is used by illinois residents who file an individual income tax return. Taxformfinder provides printable pdf copies of 76 current. You can download or print. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. The state's personal income tax rate is 4.95% for the 2021 tax year. For more information about the illinois. Web illinois income tax forms. Web printable illinois state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web view estimated payment details for your individual income tax return with mytax illinois. That makes it relatively easy to predict. 2023 estimated income tax payments for individuals. Here is a comprehensive list of illinois. Illinois income tax withheld enter the amount of illinois income tax withheld referenced by form type on. Use mytax illinois to electronically file your original individual income tax return. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Details on how to only prepare and. Web filing online is quick and easy!Form Il8453 Illinois Individual Tax Electronic Filing

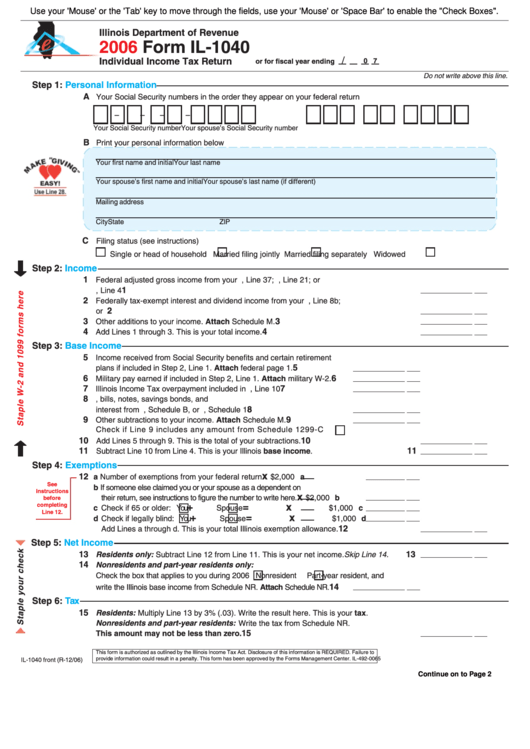

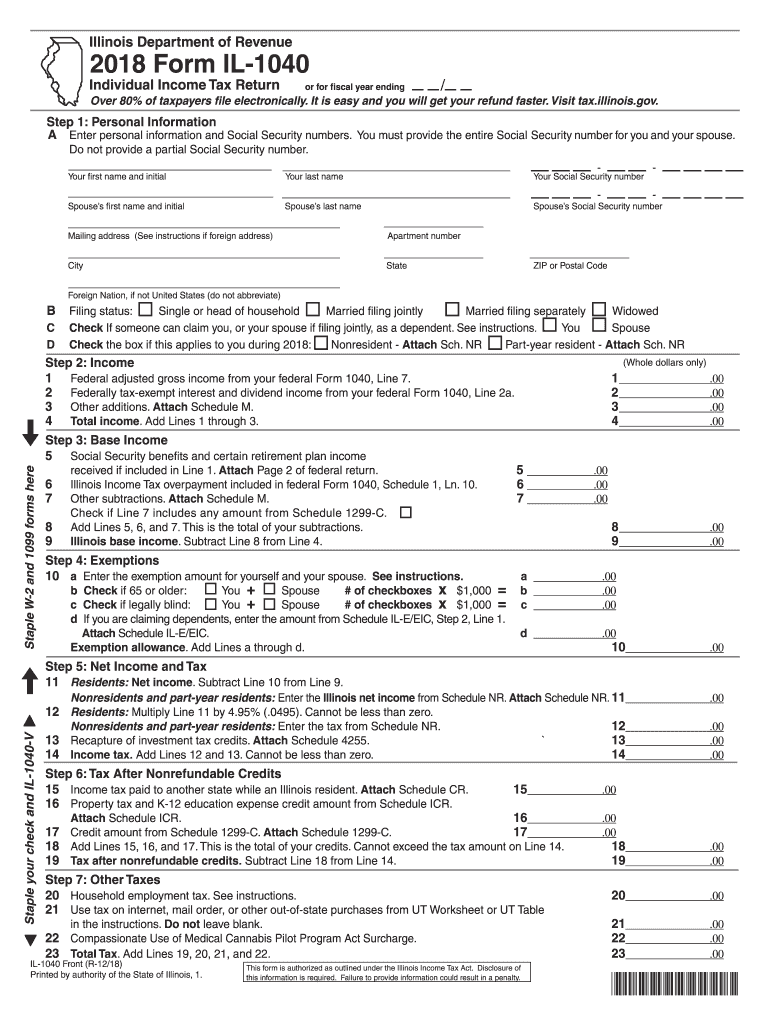

20172019 Form IL DoR IL1040 Fill Online, Printable, Fillable, Blank

Fillable Form Il1040 Individual Tax Return 2006 printable

IL DoR IL1040 Schedule M 20202022 Fill and Sign Printable Template

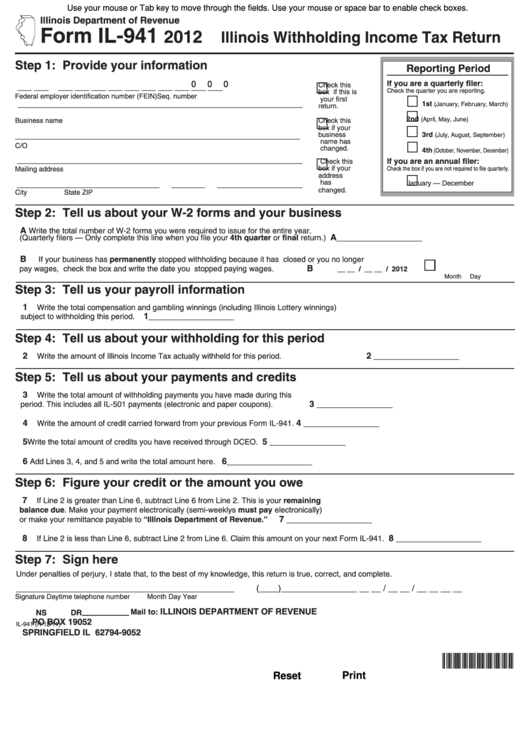

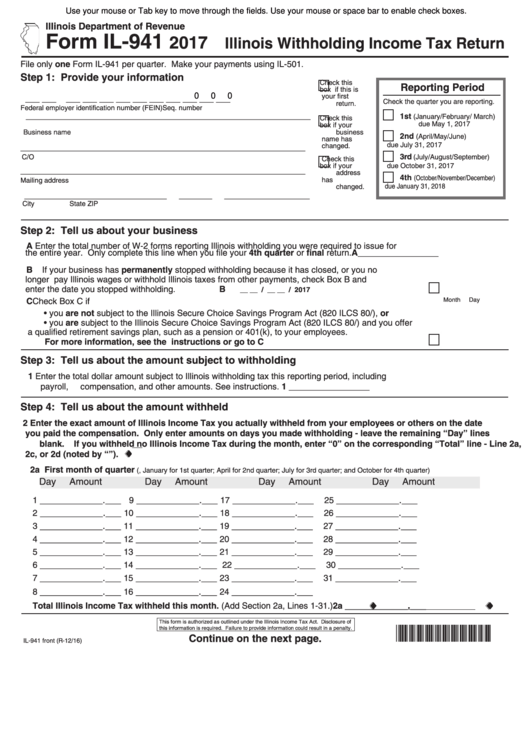

Fillable Form Il941 Illinois Withholding Tax Return 2012

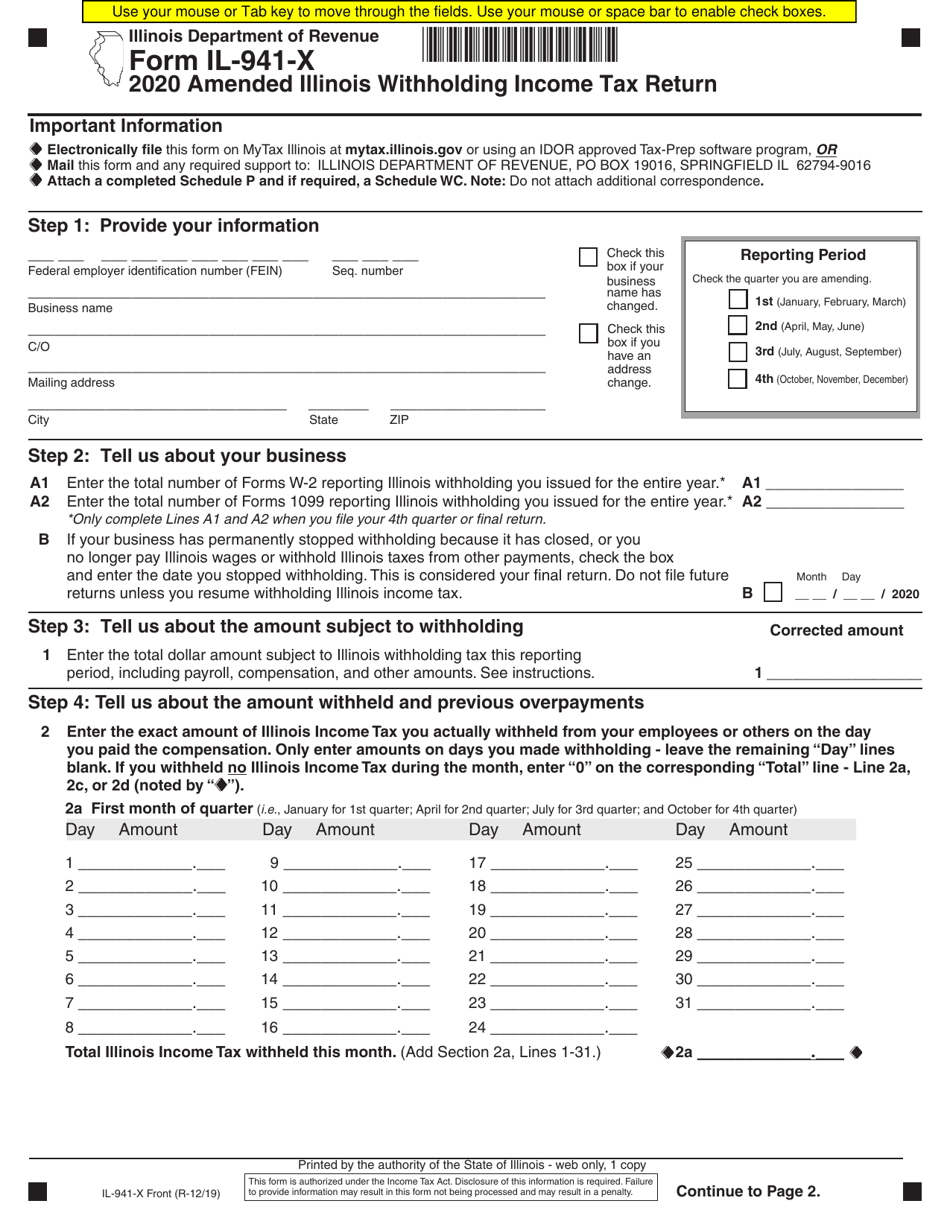

Form IL941X 2020 Fill Out, Sign Online and Download Fillable PDF

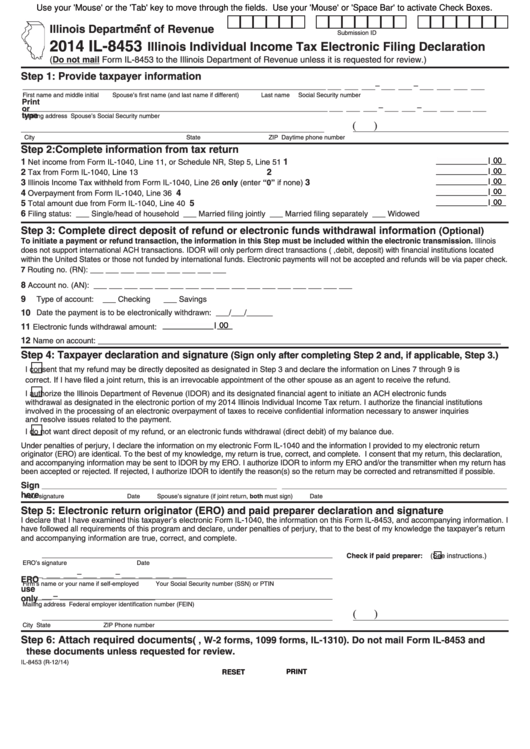

Fillable Form Il8453 Illinois Individual Tax Electronic

Illinois State Tax Form Fill Out and Sign Printable PDF

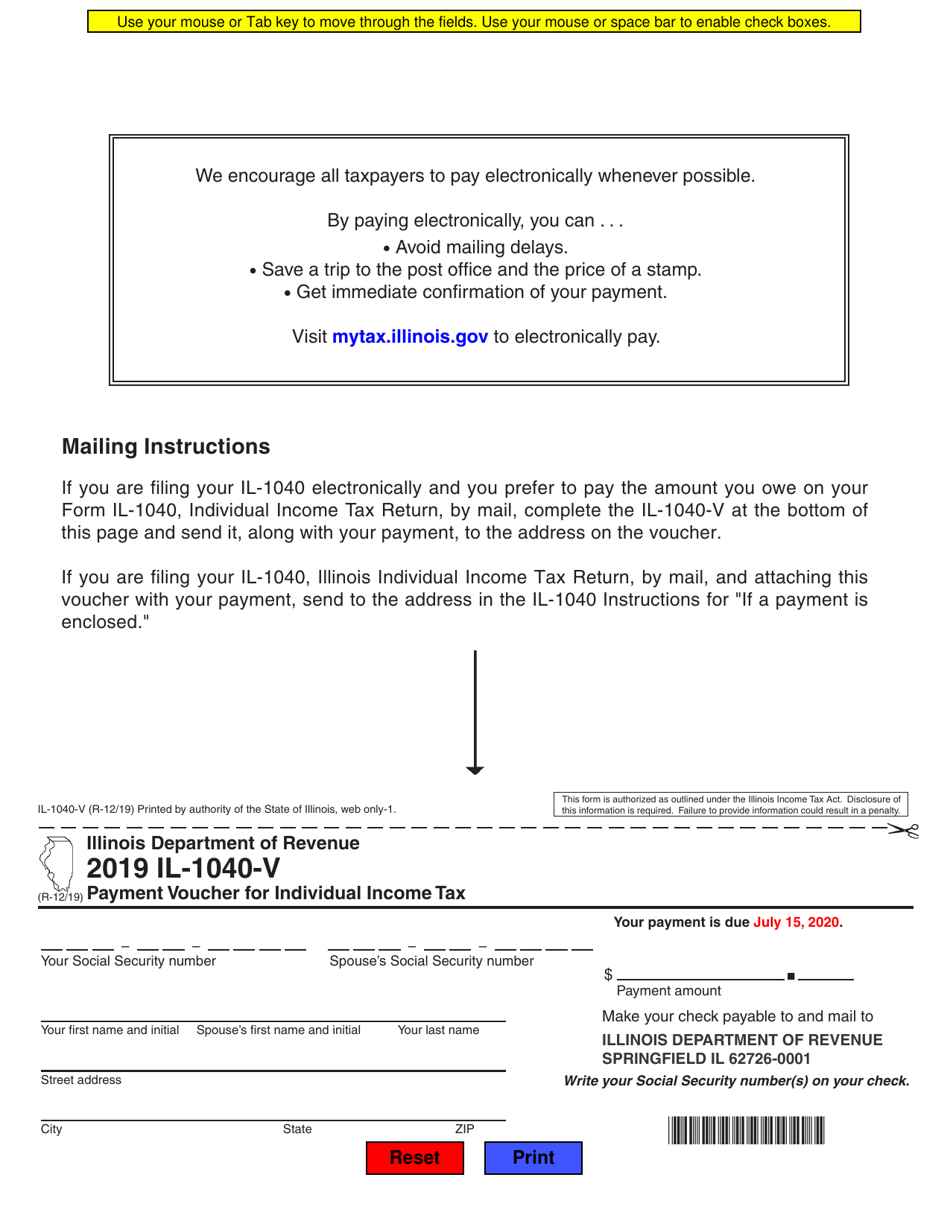

Form IL1040V Fill Out, Sign Online and Download Fillable PDF

Fillable Form Il941 Illinois Withholding Tax Return 2017

Related Post: