Illinois Form 1040 Instructions

Illinois Form 1040 Instructions - 2023 estimated income tax payments for individuals. Use this form for payments that. Try it for free now! The illinois income tax rate is 4.95 percent (.0495). Ad discover helpful information and resources on taxes from aarp. Taxpayer answer center find an answer to your. Complete form 8962 to claim the credit and to reconcile your advance credit payments. Filing online is quick and easy! Amended individual income tax return. Click here to download the pdf form. Complete form 8962 to claim the credit and to reconcile your advance credit payments. Enter your status, income, deductions and credits and estimate your total taxes. Web page last reviewed or updated: Income tax rate the illinois income tax rate is 4.95 percent. If you or someone in your family was. Estimated income tax payments for individuals: Taxpayer answer center find an answer to your. Web popular forms & instructions; Ad discover helpful information and resources on taxes from aarp. Complete, edit or print tax forms instantly. 2023 estimated income tax payments for individuals. Individual tax return form 1040 instructions; Taxpayer answer center find an answer to your. Amended individual income tax return. Web popular forms & instructions; Complete form 8962 to claim the credit and to reconcile your advance credit payments. If you or someone in your family was. Taxpayer answer center find an answer to your. The illinois income tax rate is 4.95 percent (.0495). Use this form for payments that. Estimated income tax payments for individuals: Complete form 8962 to claim the credit and to reconcile your advance credit payments. Try it for free now! Upload, modify or create forms. This form is used by illinois residents who file an individual income tax return. 2023 estimated income tax payments for individuals. Complete form 8962 to claim the credit and to reconcile your advance credit payments. Use this form for payments that. Click here to download the pdf form. You were not required to file a federal income tax return, but your illinois. Enter your status, income, deductions and credits and estimate your total taxes. Try it for free now! Filing online is quick and easy! Amended individual income tax return. Estimated income tax payments for individuals: Complete form 8962 to claim the credit and to reconcile your advance credit payments. Complete form 8962 to claim the credit and to reconcile your advance credit payments. Web page last reviewed or updated: Estimated income tax payments for individuals: Taxpayer answer center find an answer to your. Taxpayer answer center find an answer to your. 2023 estimated income tax payments for individuals. Web popular forms & instructions; Complete, edit or print tax forms instantly. Estimated income tax payments for individuals: 2023 estimated income tax payments for individuals. You were required to file a federal income tax return, or. Income tax rate the illinois income tax rate is 4.95 percent. You were not required to file a federal income tax return, but your illinois. If you or someone in your family was. Web popular forms & instructions; Ad discover helpful information and resources on taxes from aarp. Amended individual income tax return. Filing online is quick and easy! Upload, modify or create forms. Complete, edit or print tax forms instantly. Try it for free now! The illinois income tax rate is 4.95 percent (.0495). Use this form for payments that. You were not required to file a federal income tax return, but your illinois. Web page last reviewed or updated: Click here to download the pdf form. 2023 estimated income tax payments for individuals. Enter your status, income, deductions and credits and estimate your total taxes. Complete form 8962 to claim the credit and to reconcile your advance credit payments. Web illinois department of revenue. Individual tax return form 1040 instructions; This form is used by illinois residents who file an individual income tax return. Income tax rate the illinois income tax rate is 4.95 percent. If you or someone in your family was.Il 1040 Printable Form Printable Forms Free Online

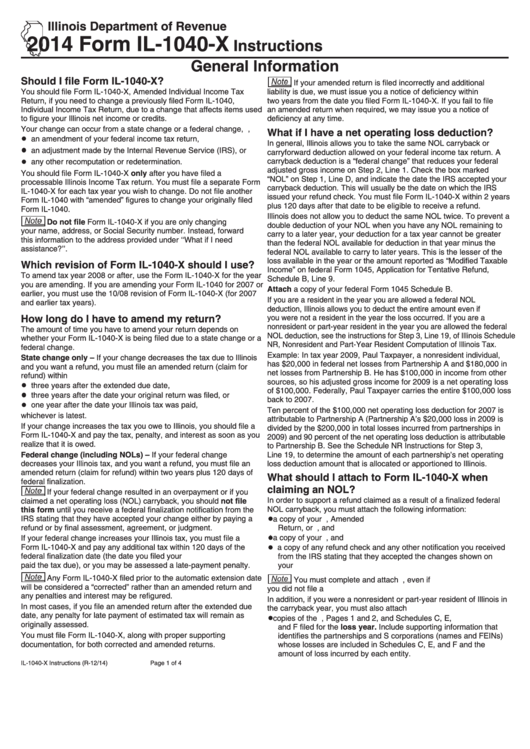

2014 Form Il1040X Instructions printable pdf download

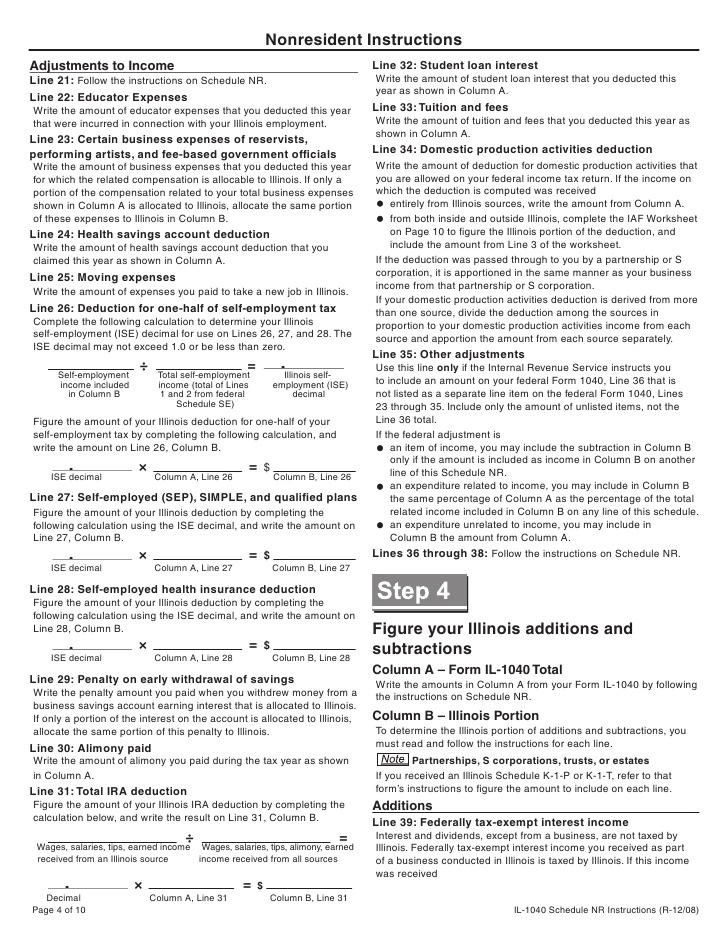

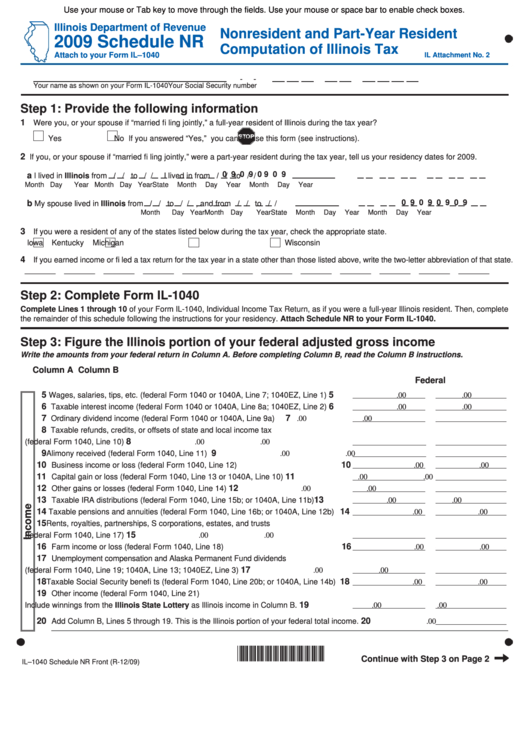

Illinois Form 1040 Schedule Nr Instructions 2021 Tax Forms 1040 Printable

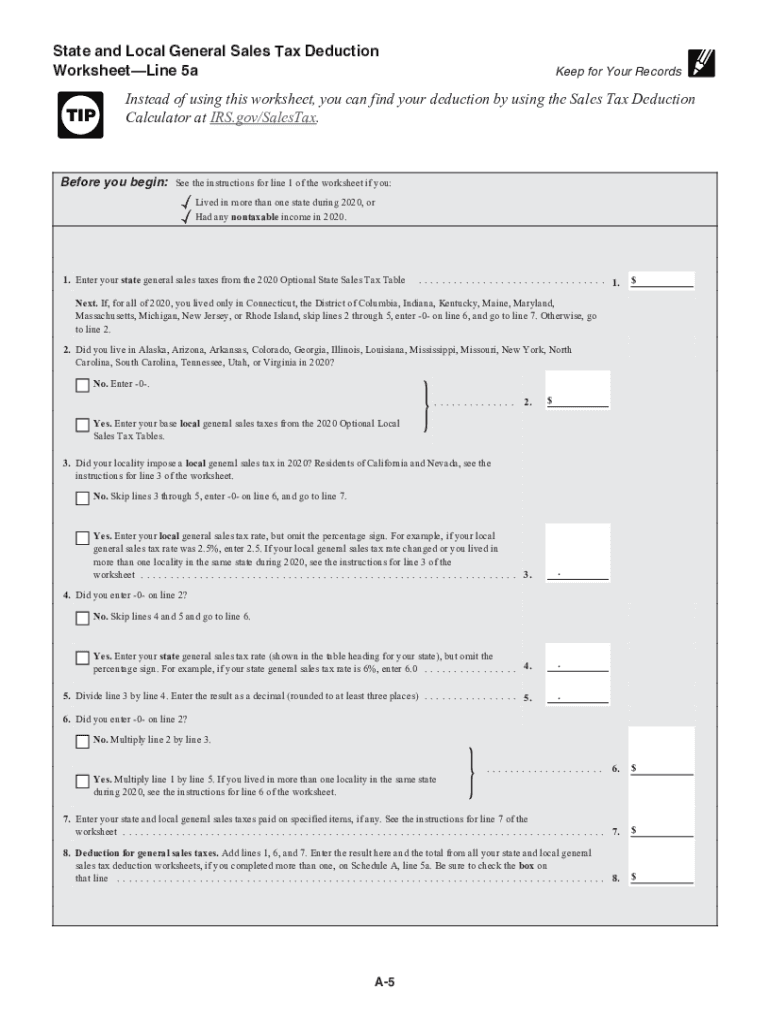

2020 Form IRS Instructions 1040 Schedule A Fill Online, Printable

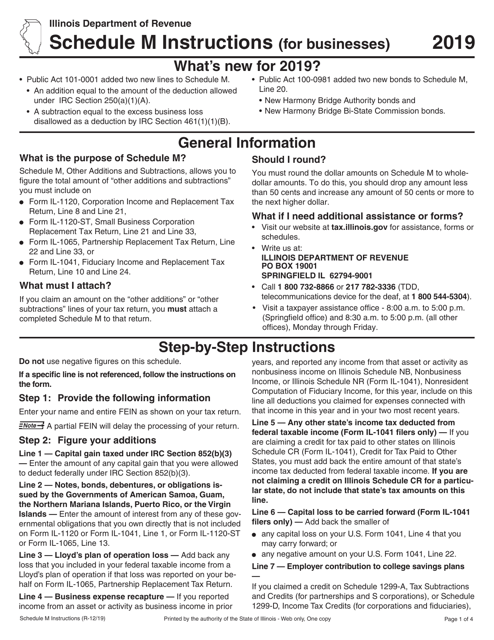

Download Instructions for Form IL1040 Schedule M Other Additions and

IL DoR IL1040X 20212022 Fill and Sign Printable Template Online

Il 1040 Fill Out and Sign Printable PDF Template signNow

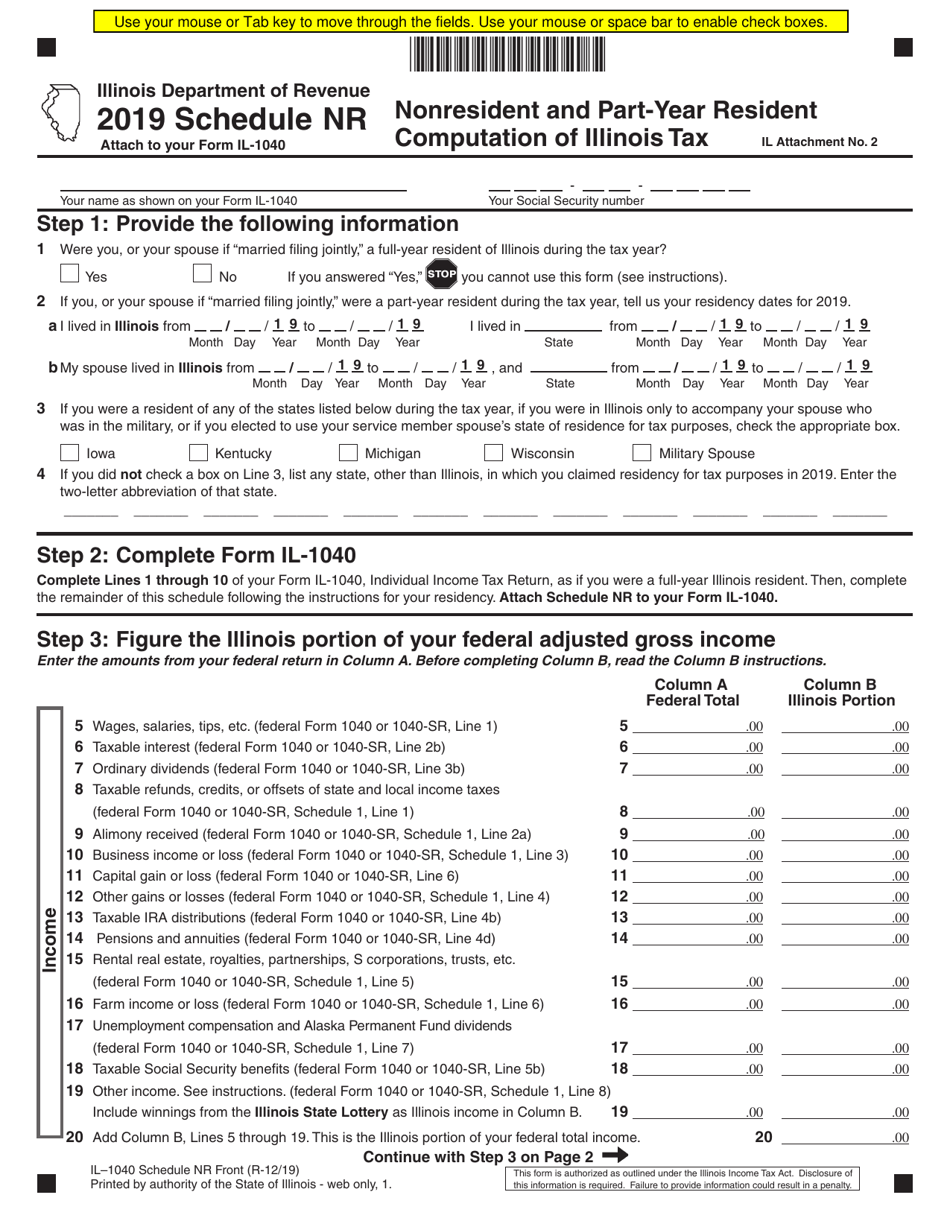

Form IL1040 Schedule NR Fill Out, Sign Online and Download Fillable

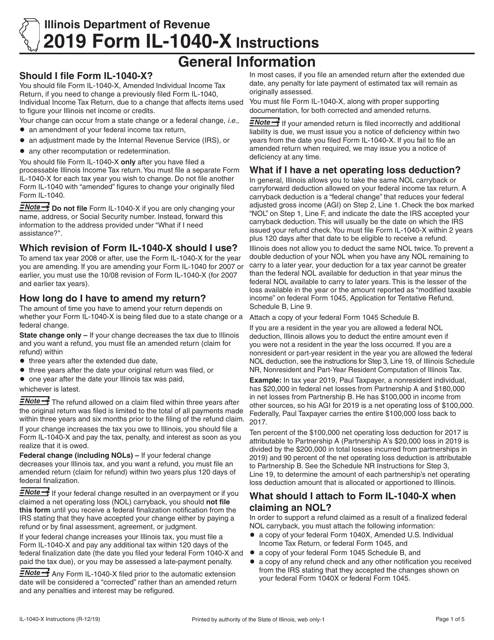

Download Instructions for Form IL1040X Amended Individual Tax

Fillable Form Il1040 Schedule Nr Nonresident And PartYear

Related Post: