Airbnb 1099 Form

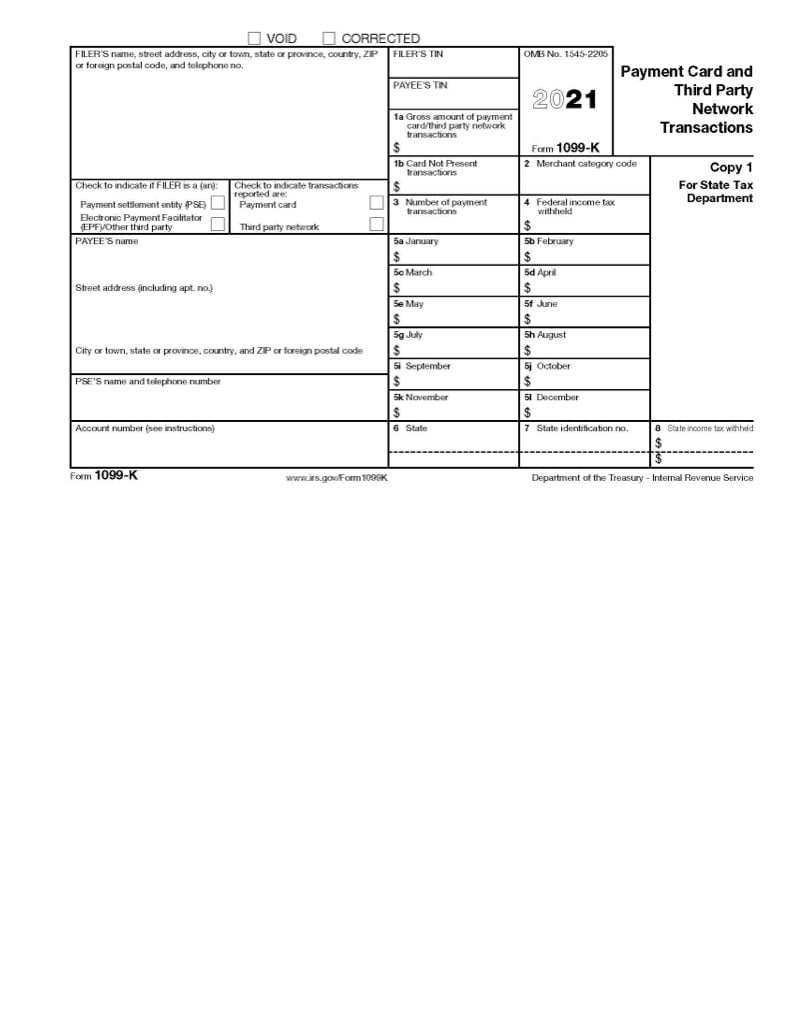

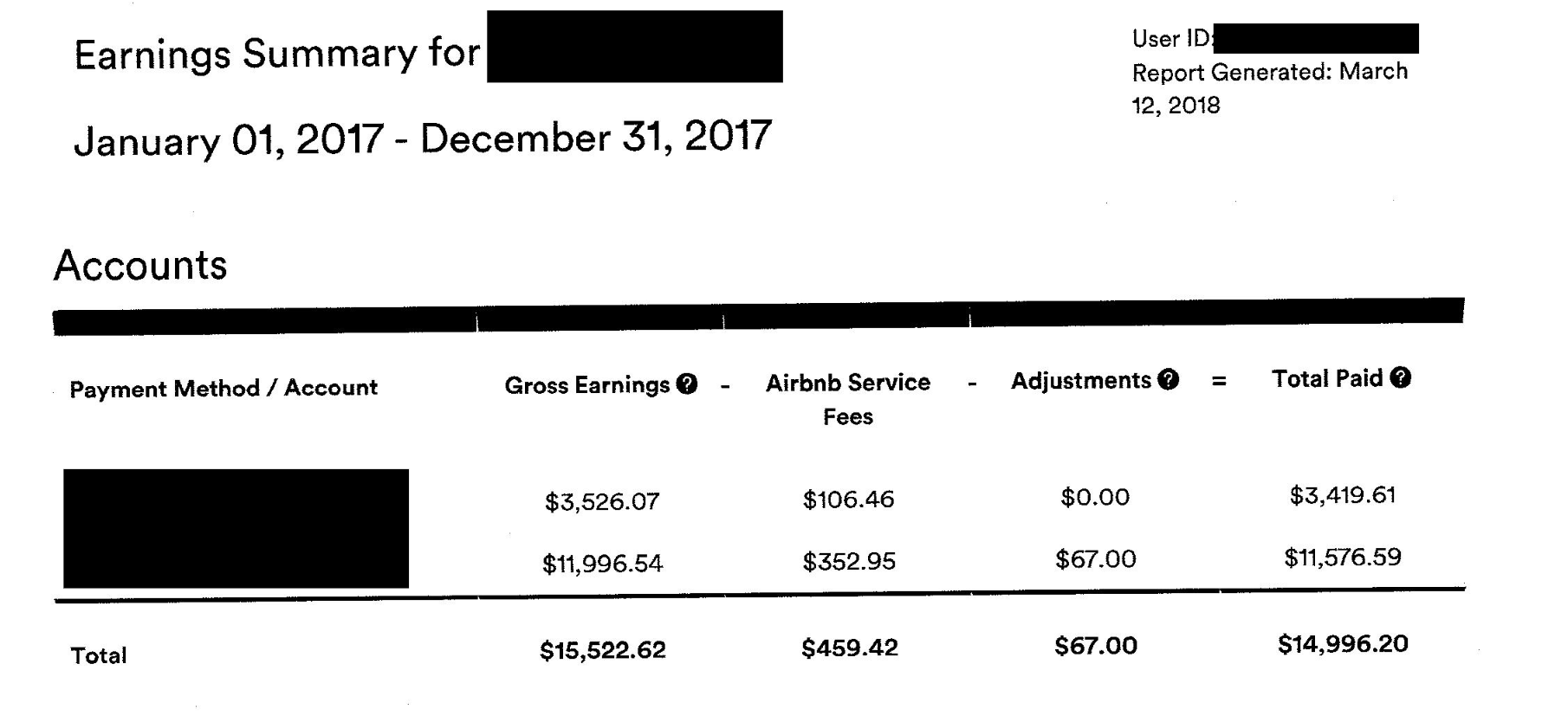

Airbnb 1099 Form - Notably, airbnb in the past was required to report gross earnings for all us users who earn over $20,000. In addition, if you had. Payroll seamlessly integrates with quickbooks® online. Ad shop our selection of 1099 forms, envelopes, and software for tax reporting. Web • form 1099 delivered/available for download on or before january 31, 2023. The advantage to reporting your income as a schedule e is that there is no self. You’ve earned more than $20,000 in rental income. If you were paid dividends or earned interest over $10. What do i need to report. Should i expect to receive a tax form from airbnb? Should i expect to receive a tax form from airbnb? Ad approve payroll when you're ready, access employee services & manage it all in one place. Order 1099 forms, envelopes, and software today. Web we view the payout beneficiary associated with the payout method on your account as the person or business we will issue a form 1099 to which. Airbnb has an entire page dedicated to u.s. Web unless you have over $20,000 and over 200+ reservations airbnb does not issue a 1099 tax form. In addition, if you had. Web airbnb schedule e (passive rental activity) schedule e is how almost all rental income is reported. Web we view the payout beneficiary associated with the payout method on. What do i need to report. Web if you meet the reporting requirements, we use this tax information to prepare your annual us information documentation (form 1099) for filing with the irs and/or your state. Airbnb has an entire page dedicated to u.s. The advantage to reporting your income as a schedule e is that there is no self. Ad. Web whether you’re looking for detailed information on a specific transaction or a static report, you can view your earnings at any time from your airbnb account. Airbnb has an entire page dedicated to u.s. Web if you meet the reporting requirements, we use this tax information to prepare your annual us information documentation (form 1099) for filing with the. Payroll seamlessly integrates with quickbooks® online. Notably, airbnb in the past was required to report gross earnings for all us users who earn over $20,000. You’ve earned more than $20,000 in rental income. Generally, this form will report. Web unless you have over $20,000 and over 200+ reservations airbnb does not issue a 1099 tax form. Payroll seamlessly integrates with quickbooks® online. Web airbnb schedule e (passive rental activity) schedule e is how almost all rental income is reported. Web whether you’re looking for detailed information on a specific transaction or a static report, you can view your earnings at any time from your airbnb account. In addition, if you had. Should i expect to receive. Ad approve payroll when you're ready, access employee services & manage it all in one place. Payroll seamlessly integrates with quickbooks® online. Order 1099 forms, envelopes, and software today. Web if you meet the reporting requirements, we use this tax information to prepare your annual us information documentation (form 1099) for filing with the irs and/or your state. Web •. You’ve earned more than $20,000 in rental income. Web • form 1099 delivered/available for download on or before january 31, 2023. If you received unemployment benefits. In addition, if you had. Web if you meet the reporting requirements, we use this tax information to prepare your annual us information documentation (form 1099) for filing with the irs and/or your state. Web when it comes to the tax on rental income, airbnb might not give you an earnings form if you only earned less than $20,000 in a year. Should i expect to receive a tax form from airbnb? Ad amazon.com has been visited by 1m+ users in the past month Web unless you have over $20,000 and over 200+ reservations. What do i need to report. Payroll seamlessly integrates with quickbooks® online. Web • form 1099 delivered/available for download on or before january 31, 2023. Web if you meet the reporting requirements, we use this tax information to prepare your annual us information documentation (form 1099) for filing with the irs and/or your state. Web airbnb schedule e (passive rental. Airbnb has an entire page dedicated to u.s. Ad approve payroll when you're ready, access employee services & manage it all in one place. Prepare for irs filing deadlines. If you were paid dividends or earned interest over $10. Ad amazon.com has been visited by 1m+ users in the past month If you received unemployment benefits. Order 1099 forms, envelopes, and software today. Web airbnb schedule e (passive rental activity) schedule e is how almost all rental income is reported. Web if you meet the reporting requirements, we use this tax information to prepare your annual us information documentation (form 1099) for filing with the irs and/or your state. Payroll seamlessly integrates with quickbooks® online. Should i expect to receive a tax form from airbnb? Generally, this form will report. You’ve earned more than $20,000 in rental income. Ad shop our selection of 1099 forms, envelopes, and software for tax reporting. In addition, if you had. Web when it comes to the tax on rental income, airbnb might not give you an earnings form if you only earned less than $20,000 in a year. Web whether you’re looking for detailed information on a specific transaction or a static report, you can view your earnings at any time from your airbnb account. What do i need to report. This is a form where self. Web we view the payout beneficiary associated with the payout method on your account as the person or business we will issue a form 1099 to which will also be filed with the irs.Do credit card processors report IRS? Leia aqui Are credit cards

Airbnb 1099 Tax Form Filing Requirements and Steps

Airbnb 1099 Forms Everything You Need to Know Shared Economy Tax

How To Fill Out A 1099 B Tax Form Universal Network

Form 1099K LastMinute IRS Changes & Tax Filing Requirements [Updated

1099 for AirBnB HomeAway VRBO HomeSharers in 2020 YouTube

Guide Airbnb 1099 Forms by accounting advice on Dribbble

How To Add Airbnb on Your Tax Return VacationLord

How To Add Airbnb on Your Tax Return VacationLord

How To Get Airbnb Tax 1099 Forms 🔴 YouTube

Related Post: