Idaho Form 51

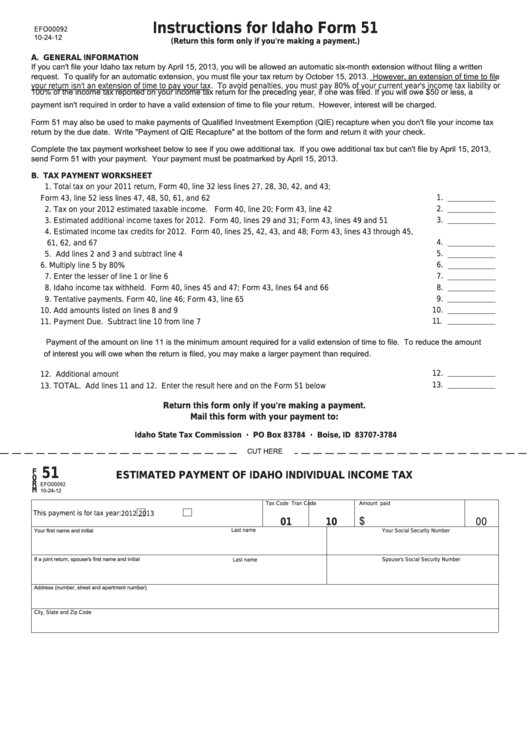

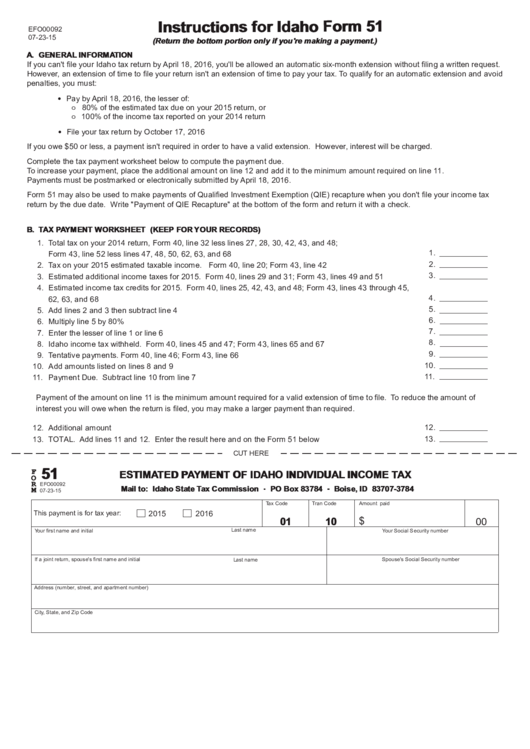

Idaho Form 51 - Web instructions for idaho form 51 a. If you are self employed and do not have tax withholding deducted from your salary you can file an estimated income tax. Web use form 51 to calculate any payment due for a valid tax year 2021 extension or make estimated payments for tax year 2022 (check the appropriate year on. If you can't file your idaho tax return by april 15, 2015, you will be allowed an automatic six. Web we last updated idaho form 51 in february 2023 from the idaho state tax commission. Web if the taxpayer needs to make a payment to avoid a penalty, file form 51, estimated payment of idaho income tax. Web form 51 can be used to make payments of qualified investment exemption (qie) recapture when you don't file your income tax return by the due date. Driver’s license/government issued photo identification:. Web start federal and idaho tax returns. Web to avoid a penalty, pay online at tax.idaho.gov/epay or mail your payment with form 51 by april 18, 2022. 2021 idaho form 51, estimated payment of individual income tax Recapture of qualified investment exemption from property tax and instructions 2022. This form is for income earned in tax year 2022, with tax returns due in april 2023. To make a payment and avoid a filing penalty, do one of the following: Web to see if you qualify for an. Estimated payment of idaho individual income tax 2014. Estimated payment of idaho individual income tax 2015. 2021 idaho form 51, estimated payment of individual income tax To make a payment and avoid a penalty, do one of the following: Web instructions for idaho form 51. Mail form 51 with your check or money order. Web use form 51 to calculate any payment due for a valid tax year 2022 extension or make estimated payments for tax year 2023 (check the appropriate year on. If you qualify for an extension to file your idaho return,. Web we last updated idaho form 51 in february 2023 from. Mail form 51 with your check or money order. Estimated payment of idaho individual income tax 2015. Web if the taxpayer needs to make a payment to avoid a penalty, file form 51, estimated payment of idaho income tax. Web you can find form 51 at tax.idaho.gov. Web instructions for idaho form 51 a. Web instructions for idaho form 51. Driver’s license/government issued photo identification:. To make a payment and avoid a filing penalty, do one of the following: Web printable idaho income tax form 51. 2021 idaho form 51, estimated payment of individual income tax To make a payment and avoid a penalty, do one of the following: Details on the form 51 payment voucher and. To make a payment and avoid a filing penalty, do one of the following: Mail form 51 with your check or money order. If you can't file your idaho tax return by april 15, 2015, you will be allowed. Details on the form 51 payment voucher and. Web instructions for idaho form 51. If you are self employed and do not have tax withholding deducted from your salary you can file an estimated income tax. This form is for income earned in tax year 2022, with tax returns due in april 2023. Estimated payment of idaho individual income tax. Web to see if you qualify for an extension, the tax commission asks idahoans to complete the worksheet on idaho form 51. Web you can find form 51 at tax.idaho.gov. Web instructions for idaho form 51 a. If you qualify for an extension to file your idaho return,. • 100% of the income tax. Estimated payment of idaho individual income tax 2014. Web instructions for idaho form 51 a. If you can't file your idaho tax return by april 15, 2015, you will be allowed an automatic six. Web the october 2023 sus address vulnerabilities responsibly reported to microsoft by security partners and found through microsoft’s internal processes. Web printable idaho income tax form. If you qualify for an extension to file your idaho return,. Web you can find form 51 at tax.idaho.gov. Web you can find form 51 at tax.idaho.gov. Web to avoid a penalty, pay online at tax.idaho.gov/epay or mail your payment with form 51 by april 18, 2022. Web we last updated idaho form 51 in february 2023 from the idaho. Web to avoid a penalty, pay online at tax.idaho.gov/epay or mail your payment with form 51 by april 18, 2022. Web you can find form 51 at tax.idaho.gov. To make a payment and avoid a filing. Estimated payment of idaho individual income tax 2014. Web the october 2023 sus address vulnerabilities responsibly reported to microsoft by security partners and found through microsoft’s internal processes. Driver’s license/government issued photo identification:. Web instructions for idaho form 51 a. 678 idaho tax forms and templates are collected for. If you are self employed and do not have tax withholding deducted from your salary you can file an estimated income tax. Details on the form 51 payment voucher and. Web form 51 can be used to make payments of qualified investment exemption (qie) recapture when you don't file your income tax return by the due date. To make a payment and avoid a filing penalty, do one of the following: If you’re unsure whether you owe idaho tax or you want to calculate. 2021 idaho form 51, estimated payment of individual income tax Web instead, idaho state tax commission provides form 51 solely to be used as a voucher to accompany an extension payment. Mail form 51 with your check or money order. Mail form 51 with your check or money order. Web use form 51 to calculate any payment due for a valid tax year 2021 extension or make estimated payments for tax year 2022 (check the appropriate year on. Web use form 51 to calculate any payment due for a valid tax year 2022 extension or make estimated payments for tax year 2023 (check the appropriate year on. If you can't file your idaho tax return by april 15, 2015, you will be allowed an automatic six.doublelsa Blog

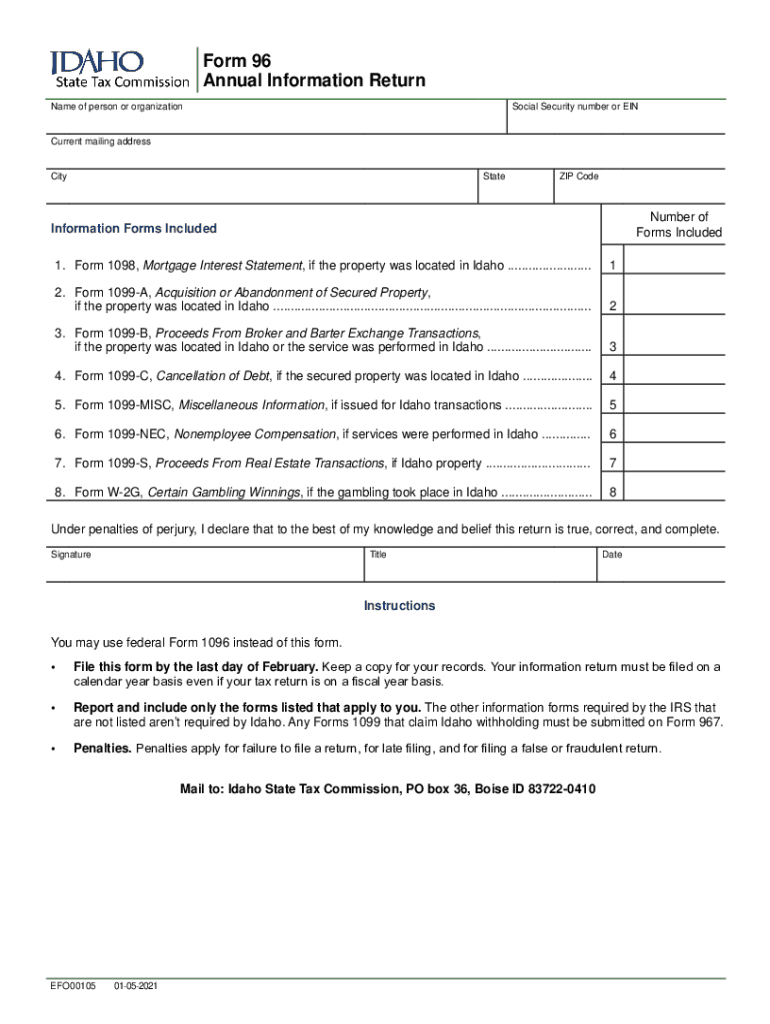

Idaho form 910 Fill out & sign online DocHub

Fillable Form 51 Estimated Payment Of Idaho Individual Tax

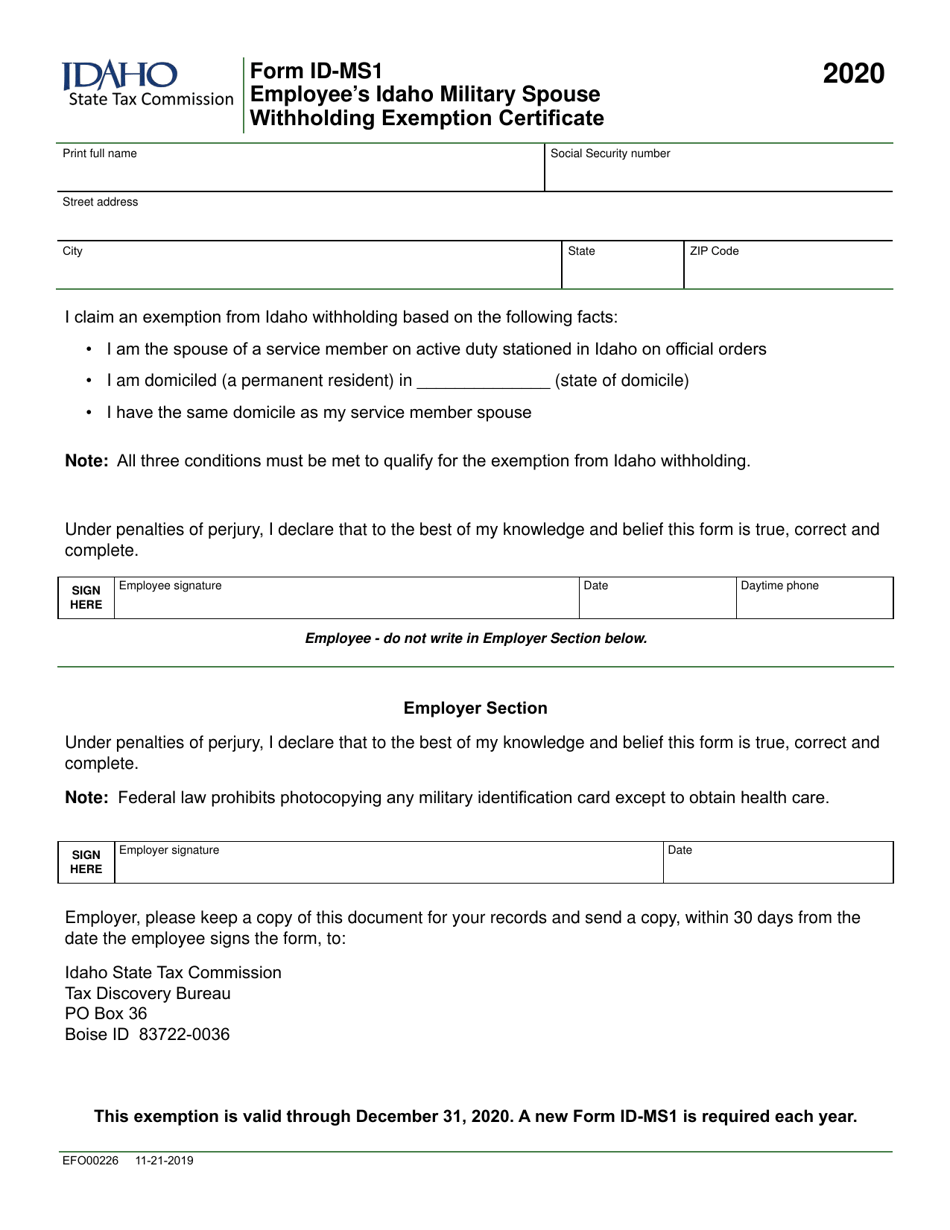

Form IDMS1 (EFO00226) Download Fillable PDF or Fill Online Employee's

W 9 Idaho Fill Online, Printable, Fillable, Blank pdfFiller

Idaho GMU 51 Map MyTopo

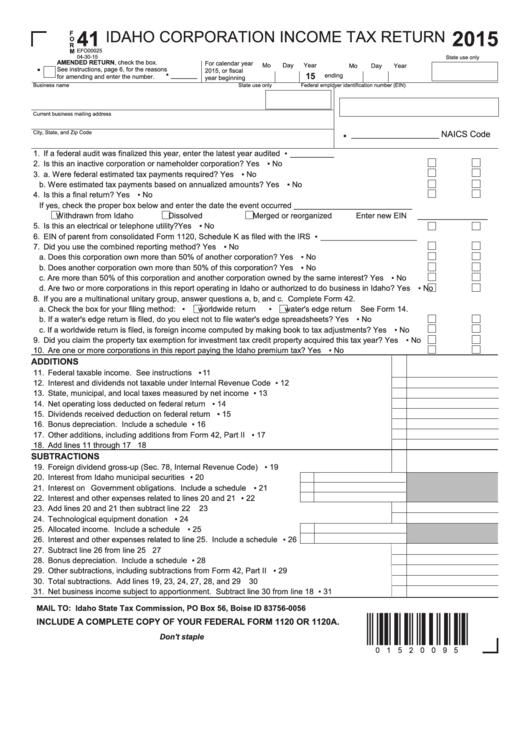

Fillable Form 41 Idaho Corporation Tax Return 2015 printable

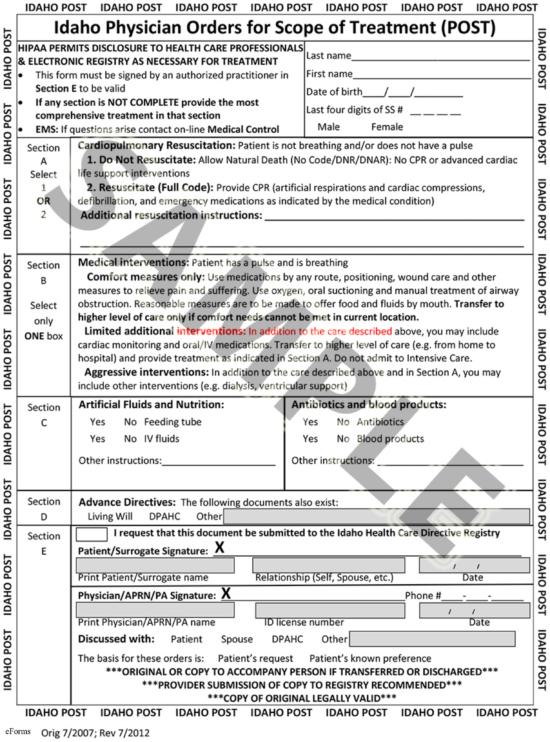

Download Idaho Do Not Resuscitate Form for Free Page 3 TidyTemplates

Fillable Idaho Form 51 (2015) Estimated Payment Of Idaho Individual

1+ Idaho Do Not Resuscitate Form Free Download

Related Post: