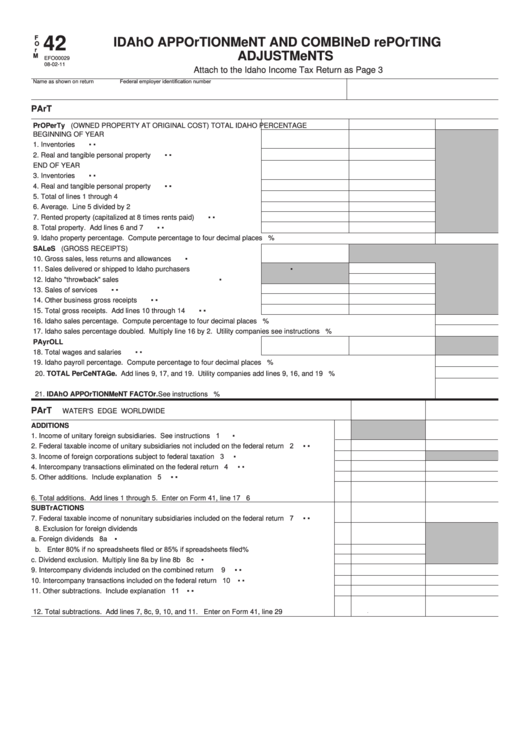

Idaho Form 42

Idaho Form 42 - In re the general adjudication of rights to. A claim that is incomplete will not be accepted and. Part i of this form provides the computation of the idaho apportionment factor and is used by. Web form 42 is used to show the total for the unitary group. Line 10 on form 42a is for everywhere. Web instructions for form no. Certificate of service rtf pdf. Pay the lowest amount of taxes possible with strategic planning and preparation Web idaho column on form 42. Affidavit verifying income rtf pdf. Web form 42 — instructions apportionment and combined reporting adjustments. Enter the apportionment factor from form. Pay the lowest amount of taxes possible with strategic planning and preparation Affidavit of service with orders rtf pdf. Multistate/multinational corporations complete and include form 42; Affidavit verifying income rtf pdf. Web we last updated idaho income tax instructions in february 2023 from the idaho state tax commission. Multistate/multinational corporations complete and include form 42; Web idaho has a state income tax that ranges between 1.125% and 6.925%. Corporations with all activity in idaho enter 100%. A claim that is incomplete will not be accepted and. If line 42 is less than line 50, subtract lines 42 and 52 from line 50. Web instructions for form no. Complete the claim form please complete all applicable items on the claim form. Affidavit of service with orders rtf pdf. If line 42 is less than line 50, subtract lines 42 and 52 from line 50. A claim that is incomplete will not be accepted and. Line 10 on form 42a is for everywhere. Web form 42—idaho supplemental schedule for multistate and multinational businesses form 44—idaho business income tax credits and credit recapture form 49—idaho. Web idaho has a state. Complete the claim form please complete all applicable items on the claim form. Web idaho column on form 42. Multistate/multinational corporations complete and include form 42; Web apportionment and combined reporting adjustments and instructions. Web we last updated idaho income tax instructions in february 2023 from the idaho state tax commission. Web instructions for form no. Web form 42 apportionment and combined reporting adjustments name as shown on return form 42 apportionment and combined reporting adjustments include. Web business activity that’s taxable in idaho and another state or country. If line 42 is less than line 50, subtract lines 42 and 52 from line 50. Web idaho column on form 42. Web instructions for form no. Web file a claim on form no. Acknowledgment of service by defendant rtf pdf. State of idaho, in and for the county of twin falls. Web form 402 — instructions individual apportionment for multistate businesses. If line 42 is less than line 50, subtract lines 42 and 52 from line 50. 2022 † idaho supplemental schedule of affiliated entities: Certificate of service rtf pdf. Part i of this form provides the computation of the idaho apportionment factor and is used by. Web form 402 — instructions individual apportionment for multistate businesses. Web idaho has a state income tax that ranges between 1.125% and 6.925%. Enter the apportionment factor from form. Multistate/multinational corporations complete and include form 42; Affidavit of service with orders rtf pdf. Web file a claim on form no. Web form 42 idaho apportionment and combined reporting adjustments questions: Completed at the end of the tax year. Line 10 on form 42a is for everywhere. Web in response to the federal tax reform provisions of the 2017 tax act,1 idaho has enacted legislation over the last several months that reduces income tax rates, amends idaho’s. Web we last updated. In re the general adjudication of rights to. Web in response to the federal tax reform provisions of the 2017 tax act,1 idaho has enacted legislation over the last several months that reduces income tax rates, amends idaho’s. Affidavit verifying income rtf pdf. Web apportionment and combined reporting adjustments and instructions. Complete the claim form please complete all applicable items on the claim form. Web file a claim on form no. Part i of this form provides the computation of the idaho apportionment factor and is used by. Affidavit of service with orders rtf pdf. Web we last updated idaho income tax instructions in february 2023 from the idaho state tax commission. Web form 42 idaho apportionment and combined reporting adjustments questions: Web form 42 apportionment and combined reporting adjustments name as shown on return form 42 apportionment and combined reporting adjustments include. Web idaho has a state income tax that ranges between 1.125% and 6.925%. Completed at the end of the tax year. Web form 42 is used to show the total for the unitary group. Acknowledgment of service by defendant rtf pdf. Line 10 on form 42a is for everywhere. Certificate of service rtf pdf. If line 42 is less than line 50, subtract lines 42 and 52 from line 50. This form is for income earned in tax year 2022, with tax returns due in. Multistate/multinational corporations complete and include form 42;Fillable Form 42 Idaho Apportionment And Combined Reporting

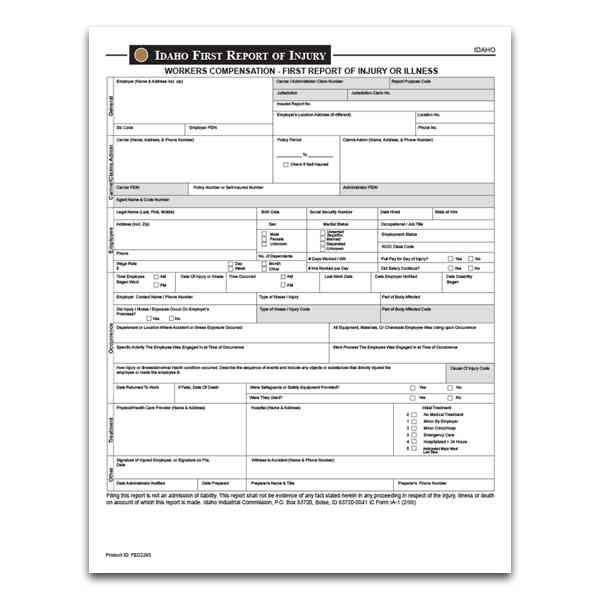

Idaho First Report of Injury Form from

Identification card application for minors under Virginia DMV

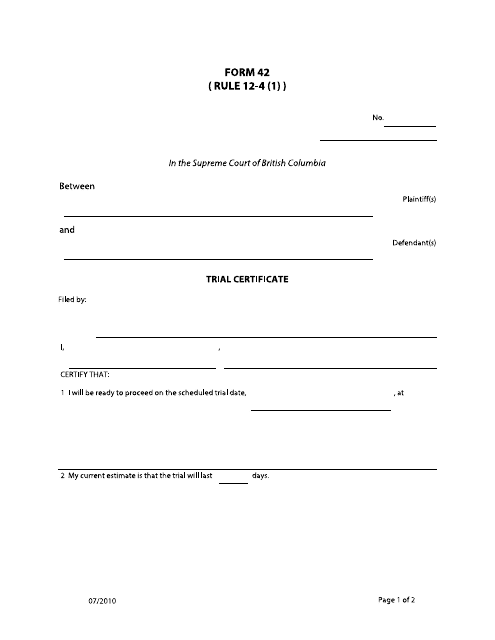

Form 42 Download Fillable PDF or Fill Online Trial Certificate British

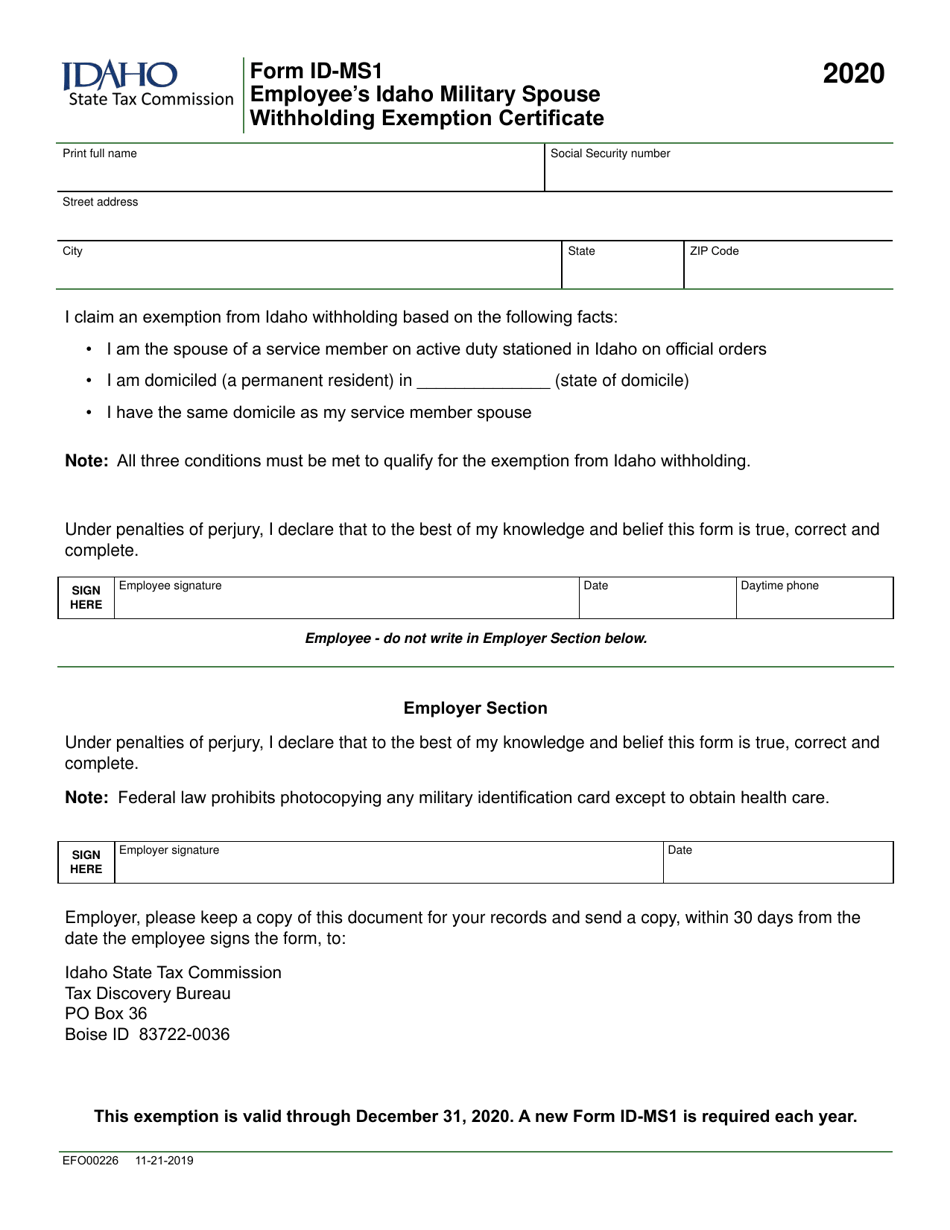

Form IDMS1 (EFO00226) Download Fillable PDF or Fill Online Employee's

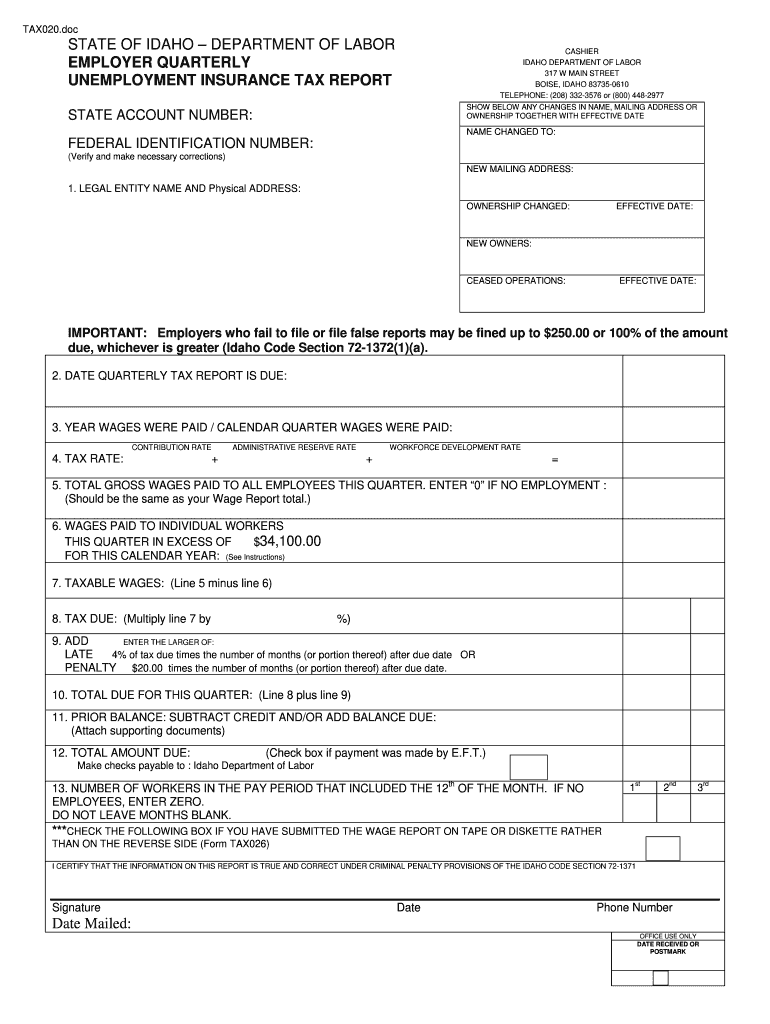

Idaho Effective Labor Form Fill Out and Sign Printable PDF Template

Form 42

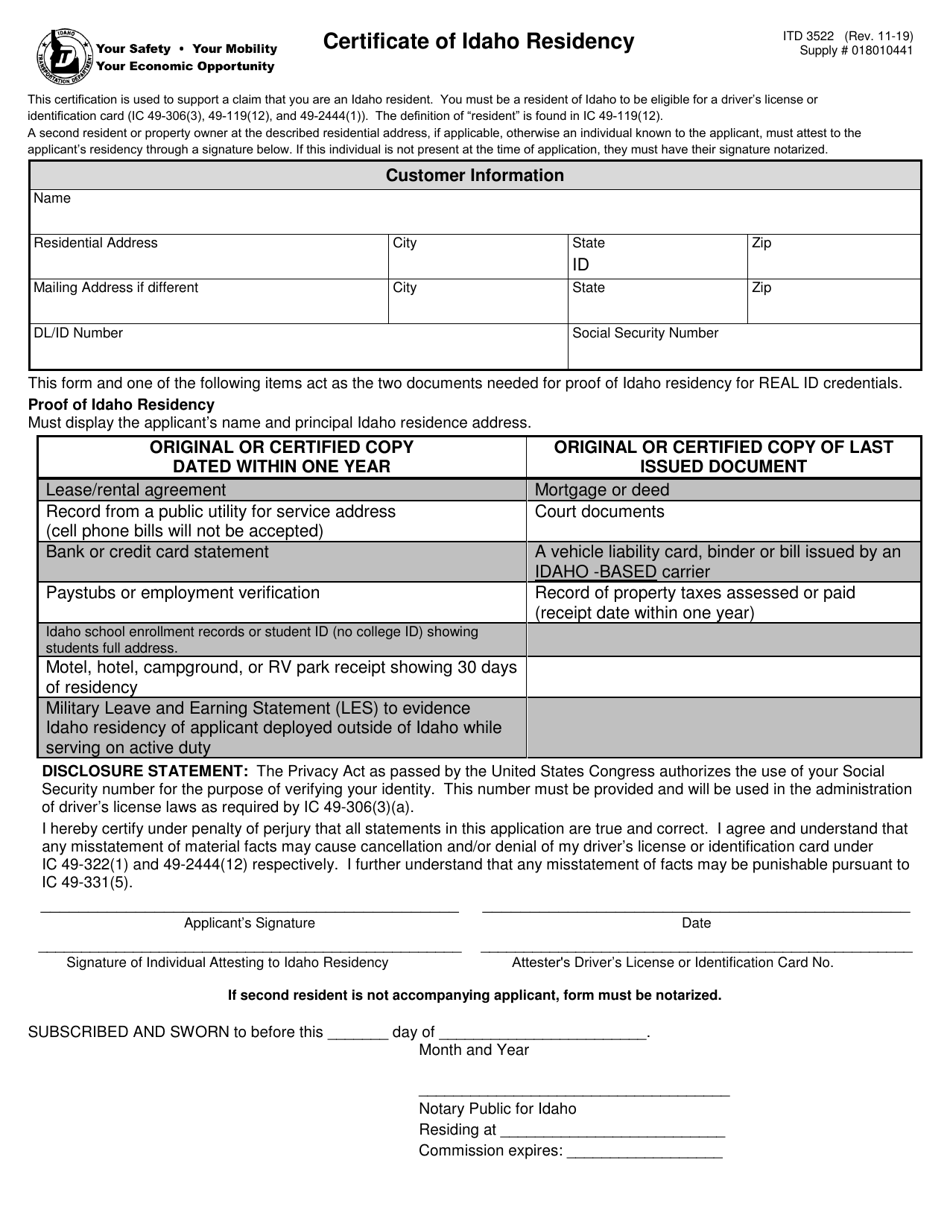

Form ITD3522 Download Fillable PDF or Fill Online Certificate of Idaho

Free Idaho Medicaid Prior (Rx) Authorization Form PDF eForms

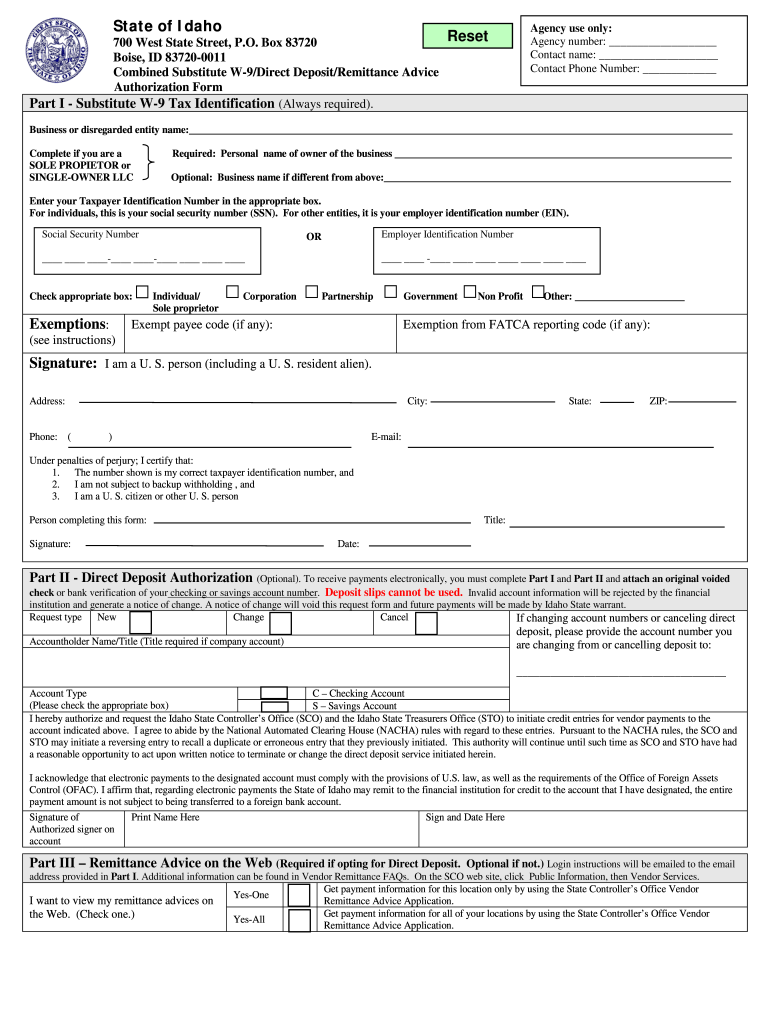

Idaho W9 Form Fill Out and Sign Printable PDF Template signNow

Related Post: