Nj Form 1040 Es

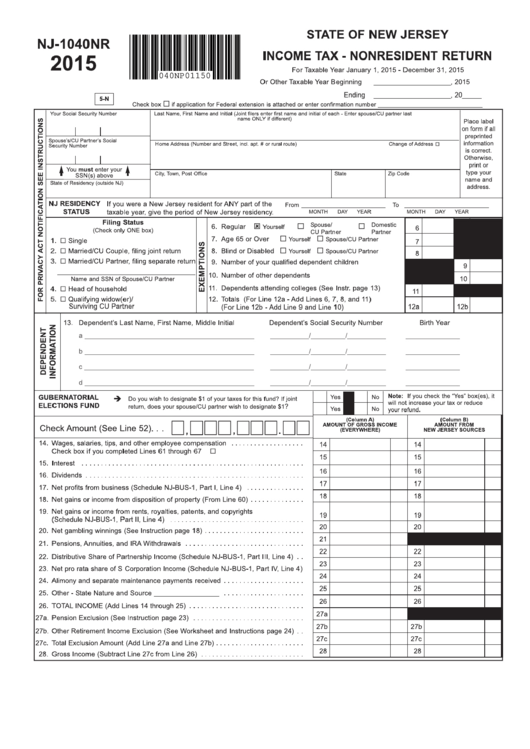

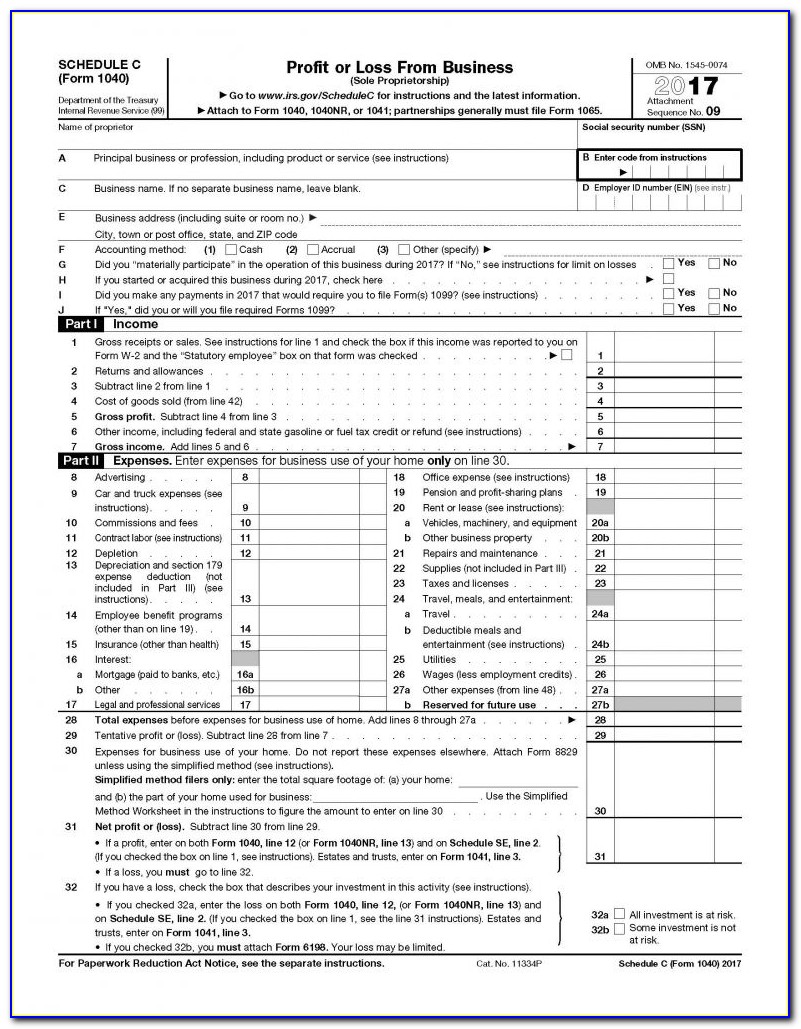

Nj Form 1040 Es - To begin the process, hit the orange button get form now. Web department of the treasury internal revenue service. Right now, you can start modifying your printable 2018 new jersey form nj 1040 es. Ad discover helpful information and resources on taxes from aarp. This form must be filed by all out of state or part time resident taxpayers who earned over $10,000. Ad a tax advisor will answer you now! Web if this is your first time filing a tax return with new jersey, you cannot use this portal to make a payment. Questions answered every 9 seconds. Social security number (required) spouse/cu partner social security number. Social security number (required) spouse/cu partner social security number. It appears you don't have a pdf plugin for this browser. Web inheritance and estate tax. Web application for extension of time to file income tax return. This form is used to calculate your state income tax liability and. Right now, you can start modifying your printable 2018 new jersey form nj 1040 es. Web inheritance and estate tax. Estimated income tax payment voucher for 2023. Enter your status, income, deductions and credits and estimate your total taxes. Nj 1040 es form is an important document for all new jersey taxpayers. This form is used to calculate your state income tax liability and. (property tax reimbursement) alcoholic beverage. Web inheritance and estate tax. This form is used to calculate your state income tax liability and. Nj gross income tax declaration of estimated tax. Social security number (required) spouse/cu partner social security number. Web department of the treasury internal revenue service. Use tax software you purchase, go to an online tax. Estimated tax is the method used. Web application for extension of time to file income tax return. This form must be filed by all out of state or part time resident taxpayers who earned over $10,000. Nj 1040 es form is an important document for all new jersey taxpayers. Ad a tax advisor will answer you now! This form is used to calculate your state income tax liability and. Social security number (required) spouse/cu partner social security number. For information on starting a payment plan, visit nj.gov/treasury/taxation/questions/ deferred1.shtml. Web inheritance and estate tax. Web department of the treasury internal revenue service. To begin the process, hit the orange button get form now. Estimated tax is the method used to pay tax on income that isn’t subject to withholding. Right now, you can start modifying your printable 2018 new jersey form nj 1040 es. If you are mailing a payment you must file a declaration of estimated. Ad discover helpful information and resources on taxes from aarp. Web department of the treasury internal revenue service. Estimated tax is the method used to pay tax on income that isn’t subject to withholding. This form is for income earned in tax year 2022, with tax returns. Web if this is your first time filing a tax return with new jersey, you cannot use this portal to make a payment. You can make an estimated payment online or by mail. Web how to make an estimated payment. Nj 1040 es form is an important document for all new jersey taxpayers. Ad read customer reviews & find best. Ad a tax advisor will answer you now! Web application for extension of time to file income tax return. Nj 1040 es form is an important document for all new jersey taxpayers. Nj gross income tax declaration of estimated tax. This form must be filed by all out of state or part time resident taxpayers who earned over $10,000. Estimated tax is the method used to pay tax on income that isn’t subject to withholding. Questions answered every 9 seconds. If you are mailing a payment you must file a declaration of estimated. Enter your status, income, deductions and credits and estimate your total taxes. This form is used to calculate your state income tax liability and. Web if this is your first time filing a tax return with new jersey, you cannot use this portal to make a payment. To begin the process, hit the orange button get form now. Nj 1040 es form is an important document for all new jersey taxpayers. Ad read customer reviews & find best sellers. Estimated tax is the method used. Nj gross income tax declaration of estimated tax. Social security number (required) spouse/cu partner social security number. Web inheritance and estate tax. For information on starting a payment plan, visit nj.gov/treasury/taxation/questions/ deferred1.shtml. Questions answered every 9 seconds. This form is used to calculate your state income tax liability and. Estimated income tax payment voucher for 2023. Web department of the treasury internal revenue service. Estimated tax is the method used to pay tax on income that isn’t subject to withholding. Use this form to figure and pay your estimated tax. If you are mailing a payment you must file a declaration of estimated. Enter your status, income, deductions and credits and estimate your total taxes. You can make an estimated payment online or by mail. Web application for extension of time to file income tax return. Ad a tax advisor will answer you now!Fillable Form Nj1040nr NonResident Tax Return 2015

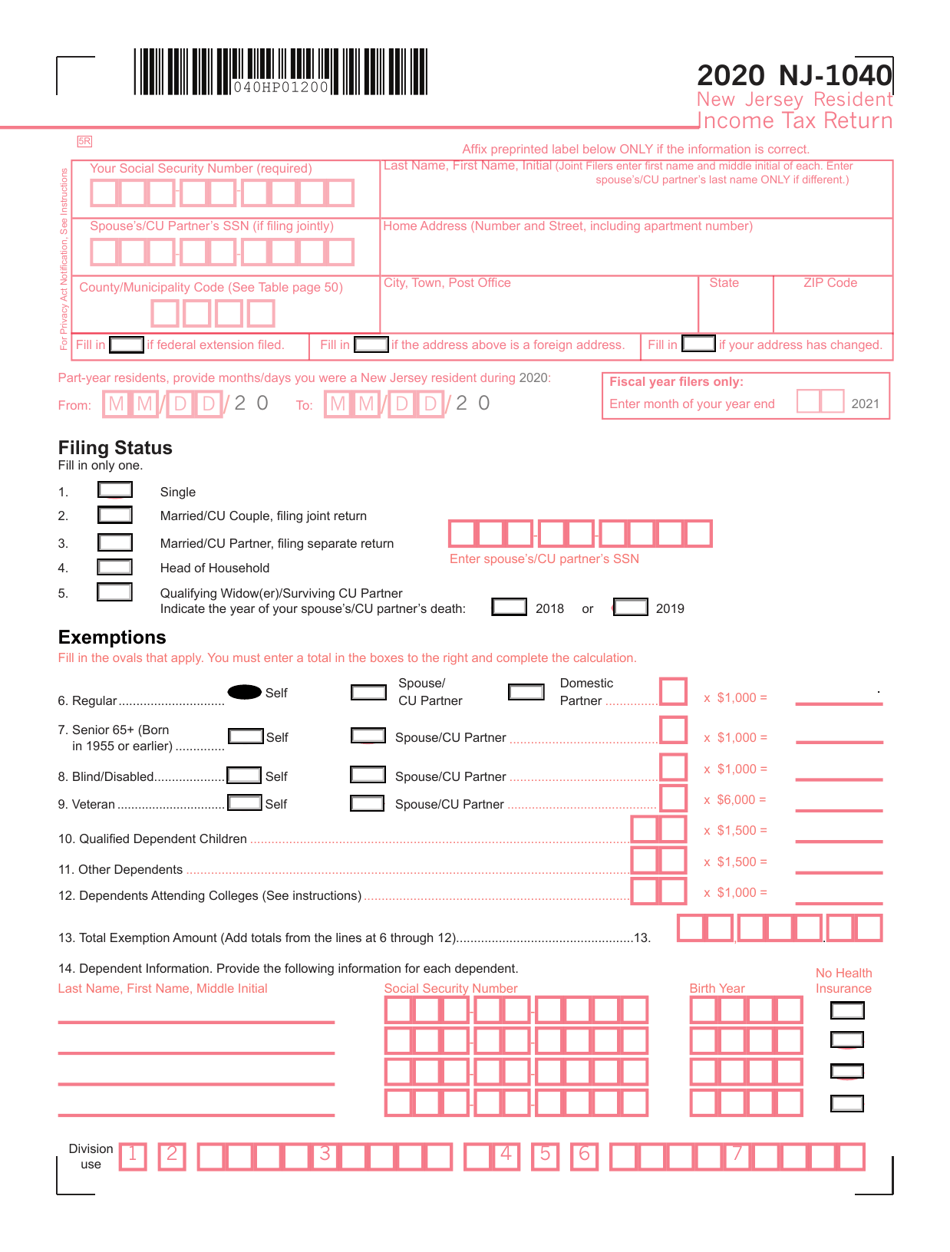

Form NJ1040 Download Fillable PDF or Fill Online New Jersey Resident

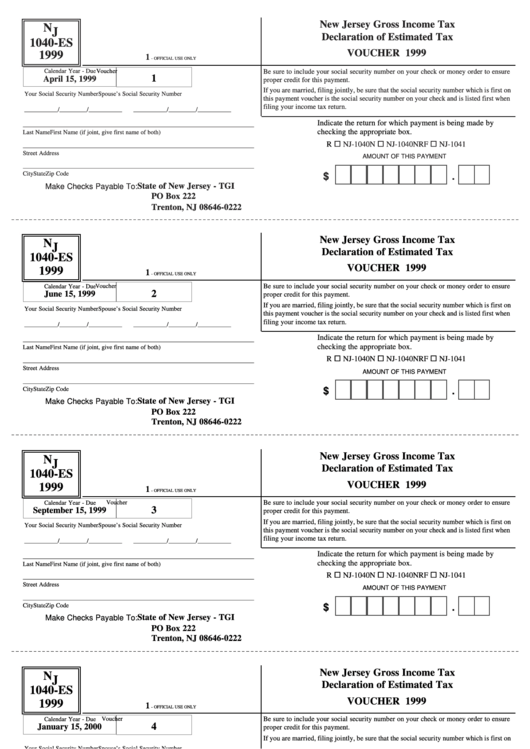

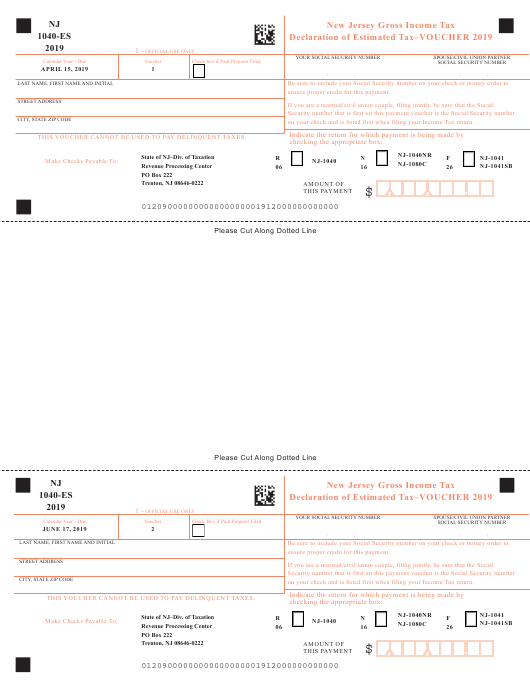

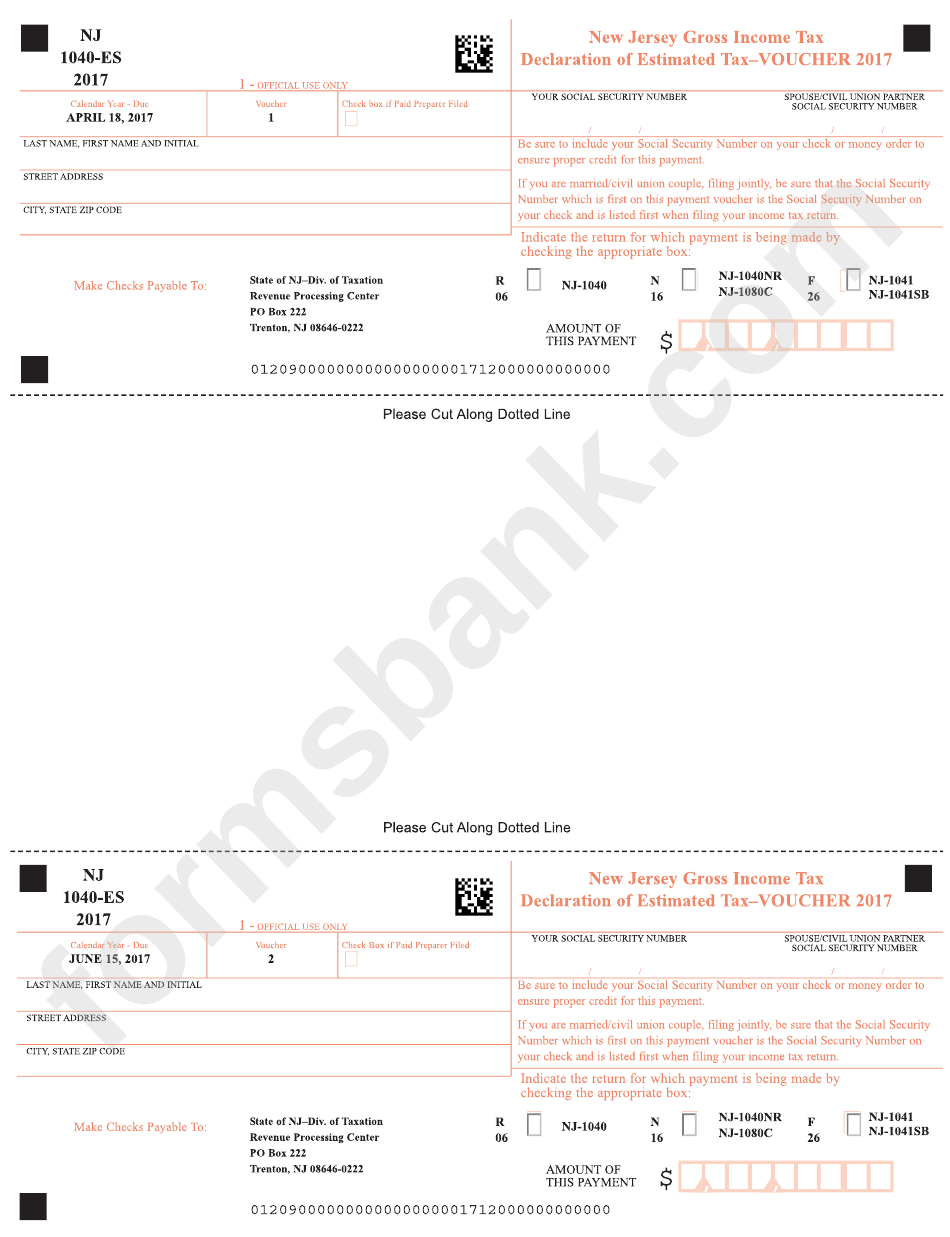

Fillable Form Nj 1040Es New Jersey Gross Tax Declaration Of

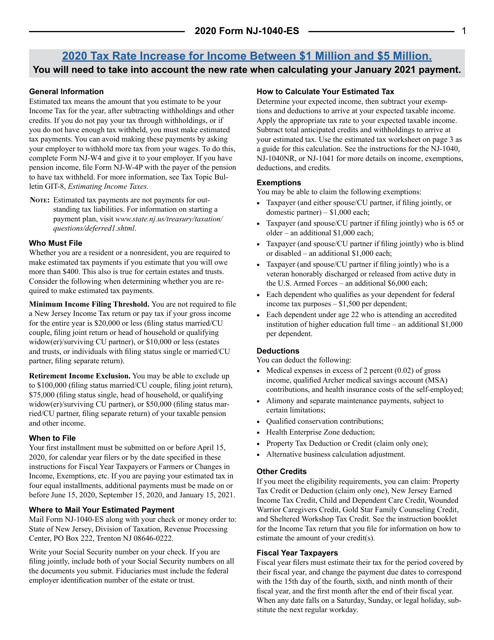

Nj 1040 Tax Form Instructions Form Resume Examples QJ9eA6P9my

1040 Es Online PDF Template

Download Instructions for Form NJ1040ES Estimated Tax Voucher PDF

Form NJ 1040 ES Download Fillable PDF Or Fill Online 2021 Tax Forms

Fillable Form Nj 1040Es Declaration Of Estimated Tax Voucher

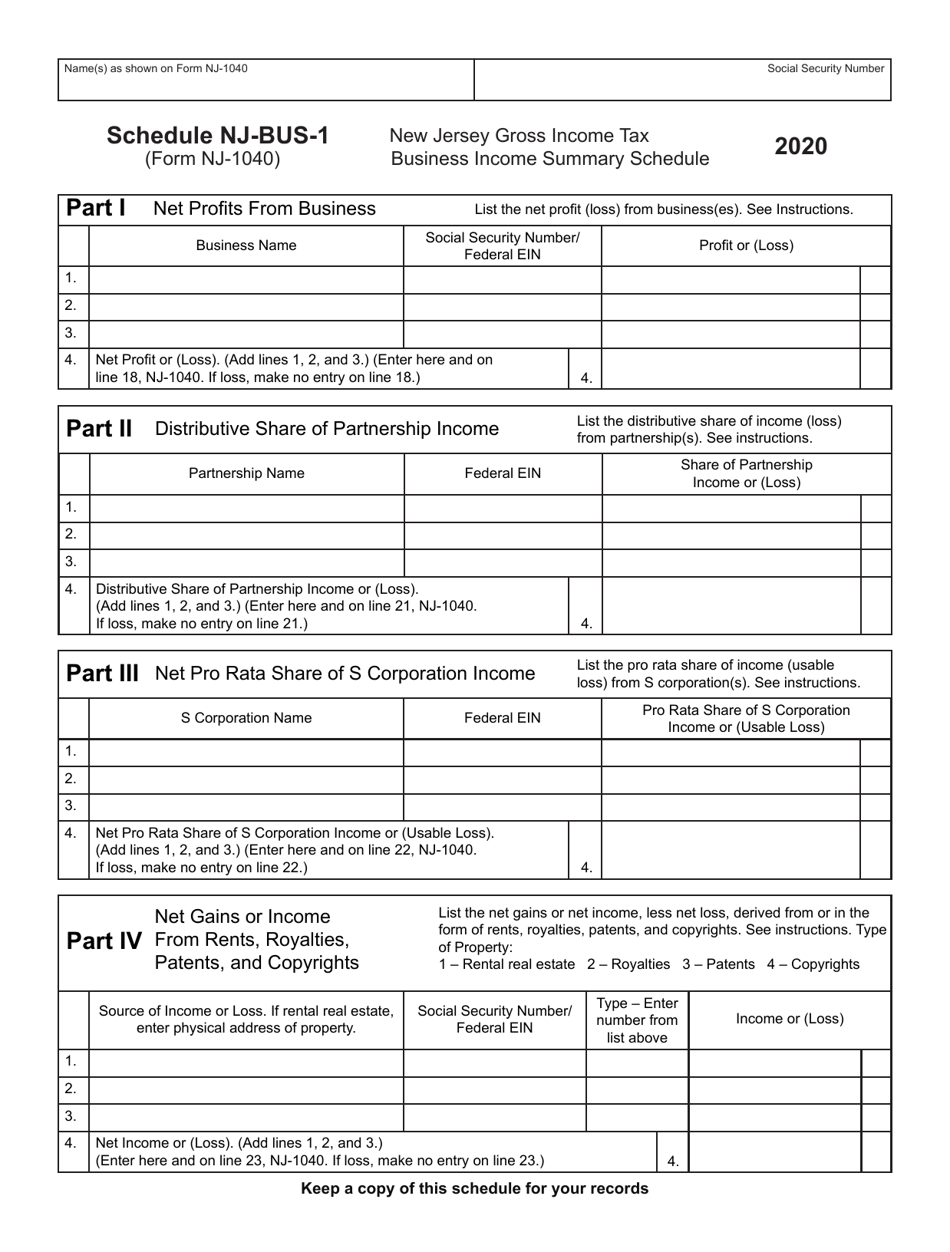

Form NJ1040 Schedule NJBUS1 Download Fillable PDF or Fill Online New

Nj Tax Form 1040 Es Form Resume Examples 7mk9Wq25GY

Related Post: