How To Get Tax Form From Crypto.com

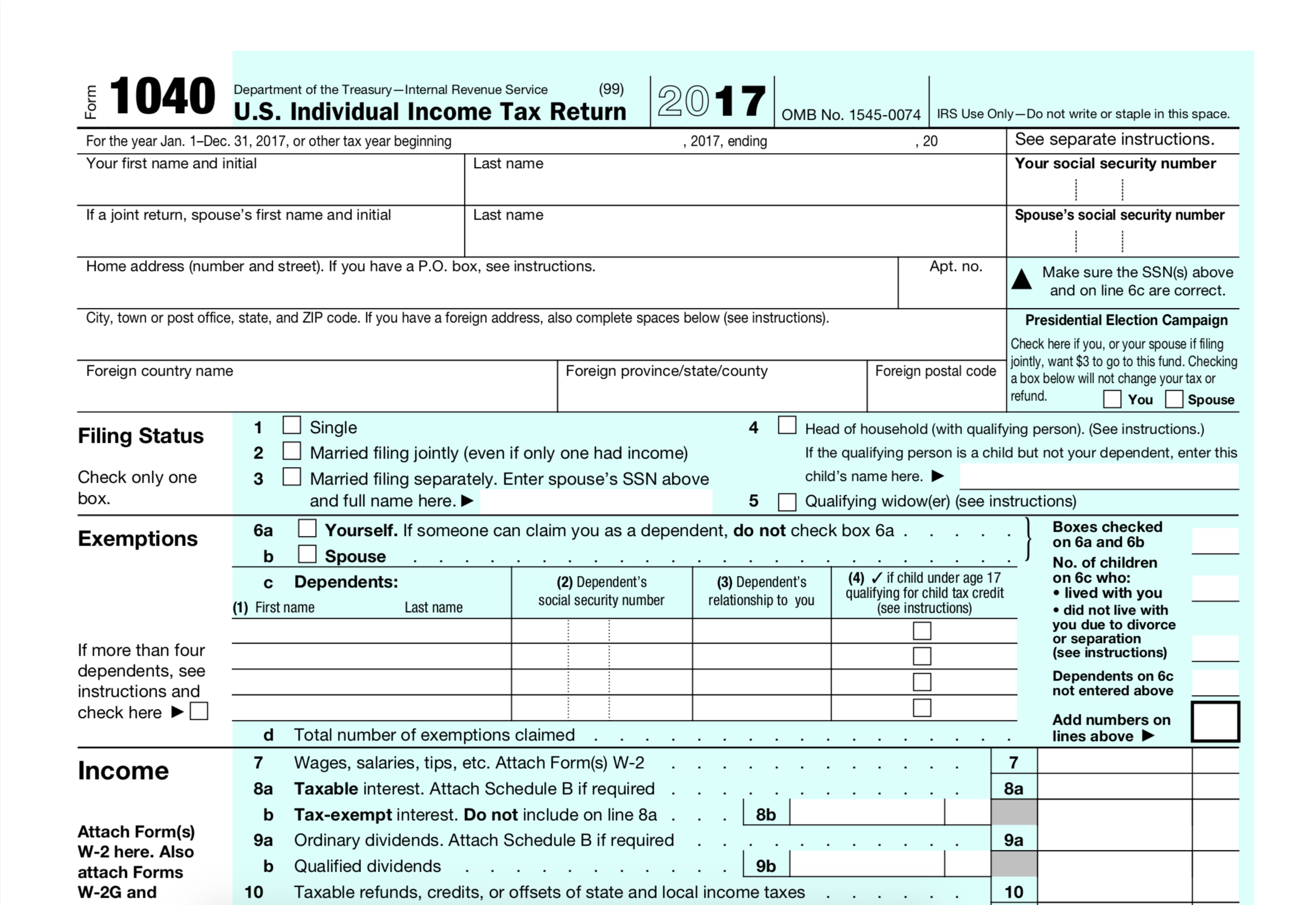

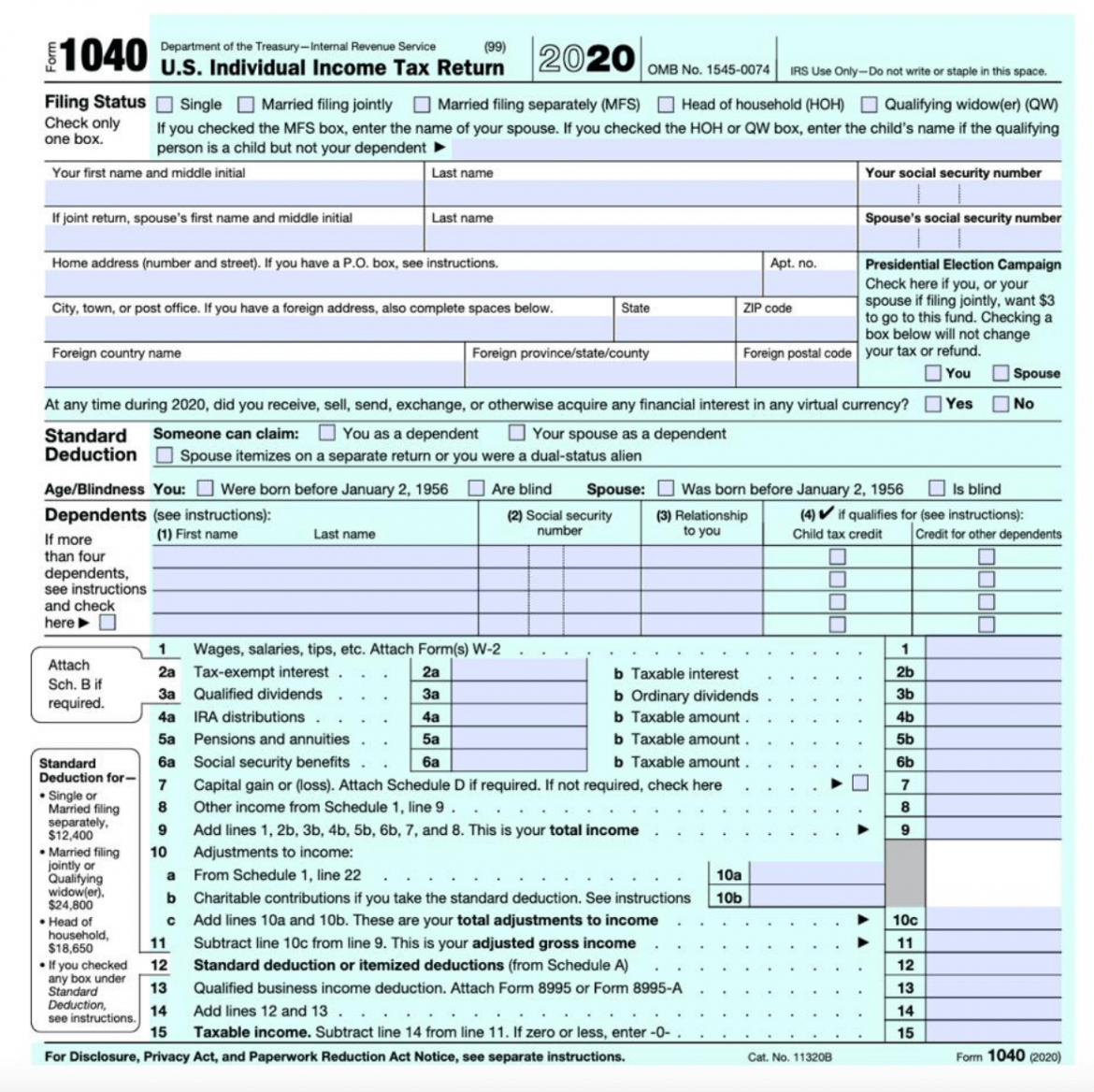

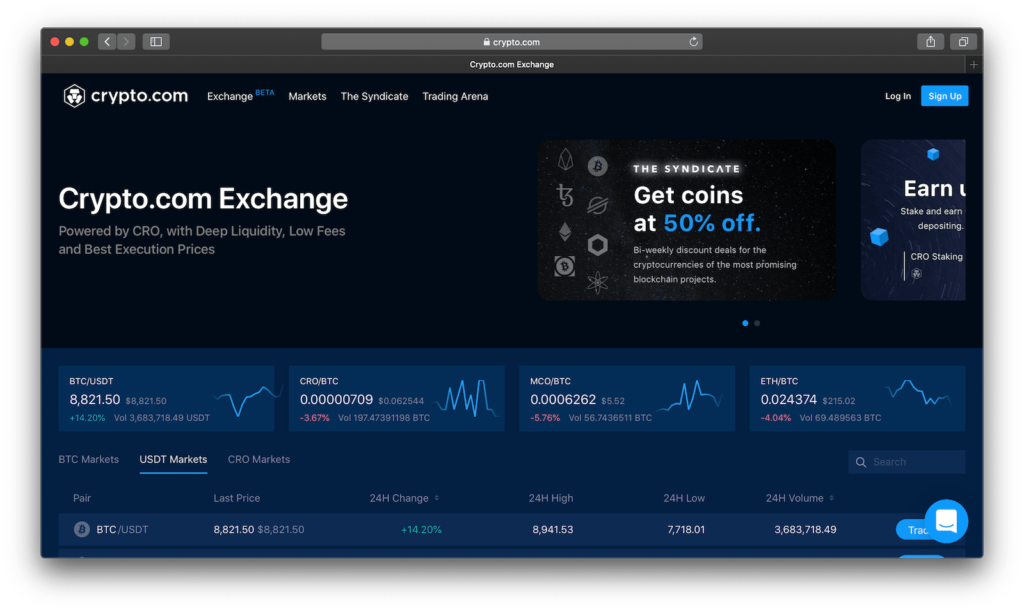

How To Get Tax Form From Crypto.com - One such tool is the crypto.com tax calculator. Crypto.com tax makes it easy. Go to the crypto.com tab and upload your csv file. This includes any income paid in crypto, as well as from mining, staking, and airdrops. Learn how to calculate your taxes and generate all required tax documents for crypto.com app quickly. Crypto.com tax supports over 30 popular exchanges and wallets. It's because crypto is viewed as property and not currency. Personal income tax and the corporation tax. It really doesn’t matter since you’re taxed on gains not transactions but generally yes, just holding a coin means 0 transactions and 0 gains to report so it’s “simpler” but doesn’t mean you pay less or more taxes. Web you may follow the below steps to finish the crypto tax filing: Taxpayers may complete form ftb 3516 and write the name of the disaster in blue or black ink at the top of the request. • you report your total capital gains or losses on your form 1040, line 7. Person who has earned usd $600 or more in rewards from crypto.com during the previous calendar year from lockup, earn, referrals,. • you report your total capital gains or losses on your form 1040, line 7. Crypto.com tax supports over 30 popular exchanges and wallets, allowing users to directly import every crypto transaction made in the. Import your crypto transactions in crypto.com tax. Circular 230 and ethics in tax practice: The law still remains unclear on defi transactions, like. This tool allows users to generate a tax report based on information about their transactions, including fiat currency conversions,. • you report your total capital gains or losses on your form 1040, line 7. Taxpayers may complete form ftb 3516 and write the name of the disaster in blue or black ink at the top of the request. Web generate. With crypto.com tax, filing crypto tax reports is easier than ever before. Api synchronization with the supported wallets/exchanges. Select the tax settings you’d like to generate your tax reports. How to do your crypto.com app taxes. You need to know your capital gains, losses, income and expenses. With crypto.com tax, filing crypto tax reports is easier than ever before. Web if you buy, sell or exchange cryptocurrency, you’re likely on the hook for paying crypto taxes. You need to know your capital gains, losses, income and expenses. Taxpayers may complete form ftb 3516 and write the name of the disaster in blue or black ink at the. Register your account in crypto.com tax. The platform is entirely free of charge and can be used by anyone. Api synchronization with the supported wallets/exchanges. Circular 230 and ethics in tax practice: This includes any income paid in crypto, as well as from mining, staking, and airdrops. Person who has earned usd $600 or more in rewards from crypto.com during the previous calendar year from lockup, earn, referrals, or certain other activities. The platform is entirely free of charge and can be used by anyone. Web make sure to download the transaction history report if you don’t see any kind of tax forms. • reporting your crypto. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to users in germany, australia, and the u.k. You need to know your capital gains, losses, income and expenses. • reporting your crypto activity requires using form 1040 schedule d as your crypto tax form to reconcile your capital gains and losses. Web disaster victims also may receive free copies of their state returns to replace those lost or damaged. You’ll then be able to create a tax report that includes all of your crypto.com transactions. Web people with an annual income below $73,000 can get free access to certain commercial tax software through the free file program, and elderly people and. Web you may follow the below steps to finish the crypto tax filing: Bid farewell to tax season jitters this year! Register your account in crypto.com tax. Web disaster victims also may receive free copies of their state returns to replace those lost or damaged. Go to the crypto.com tab and upload your csv file. Go to the wallets & exchanges page and import your transactions by the following methods: Import your crypto transactions in crypto.com tax. How you can stay out of trouble; The platform is entirely free of charge and can be used by anyone. Register a free account in crypto.com tax. Web best tax software for small business. Circular 230 and ethics in tax practice: Coinpanda integrates directly with crypto.com app to simplify your tax reporting. Web on monday, they updated and finalized that number, with the refund rising to $5.61 billion. In the coinledger platform, go to the ‘import’ step. Web people with an annual income below $73,000 can get free access to certain commercial tax software through the free file program, and elderly people and people with an annual income below $60,000. You may refer to this section on how to set up your tax settings page. Web if you buy, sell or exchange cryptocurrency, you’re likely on the hook for paying crypto taxes. Person who has earned usd $600 or more in rewards from crypto.com during the previous calendar year from lockup, earn, referrals, or certain other activities. Crypto.com tax supports over 30 popular exchanges and wallets. It really doesn’t matter since you’re taxed on gains not transactions but generally yes, just holding a coin means 0 transactions and 0 gains to report so it’s “simpler” but doesn’t mean you pay less or more taxes. How to generate crypto tax report with crypto.com tax | u.s. Crypto.com tax makes it easy. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to users in germany, australia, and the u.k. Bid farewell to tax season jitters this year!Where Can I Get IRS Tax Forms and Options to File Free

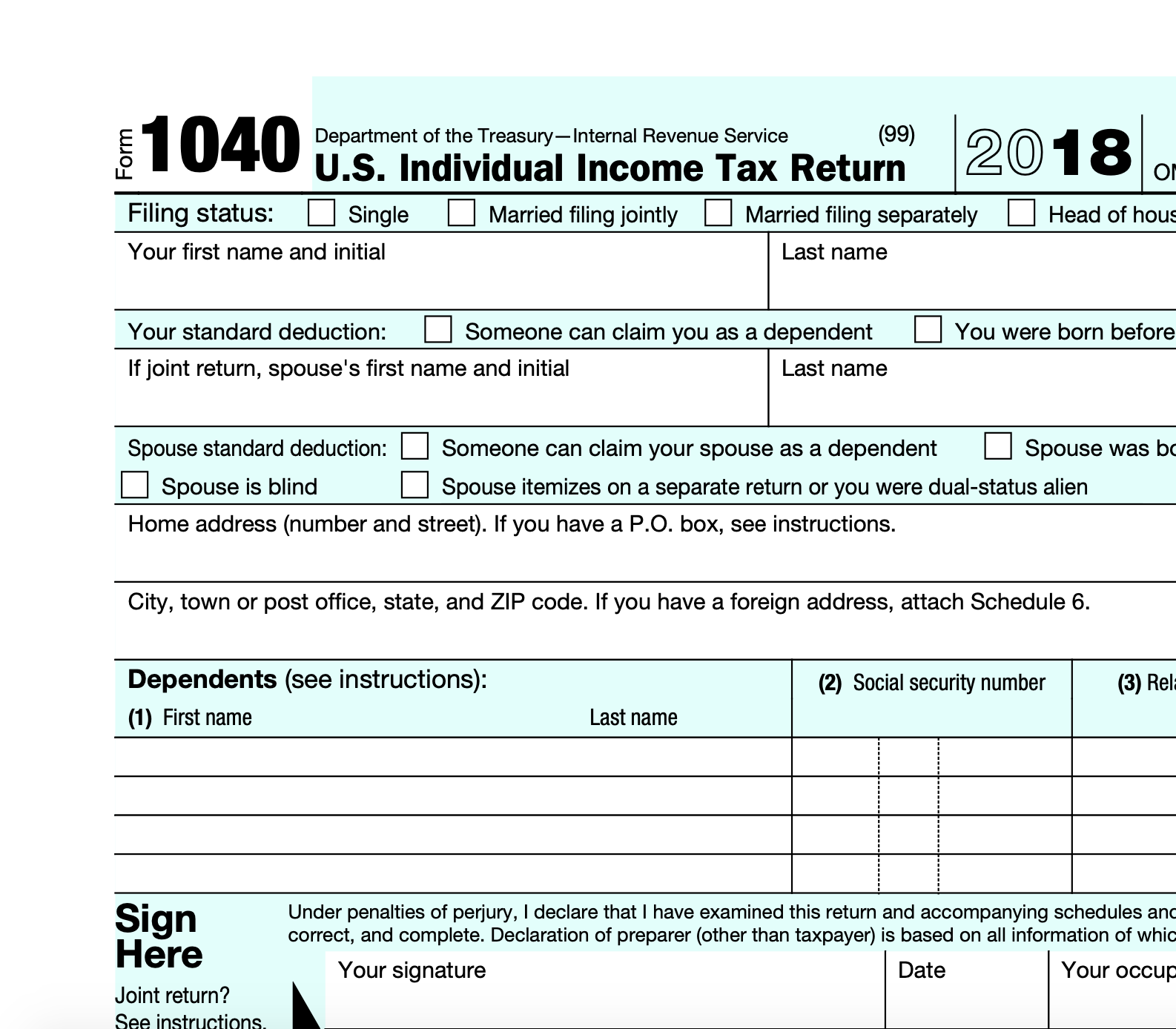

What Does A 1040 Form Look Like Seven Questions To Ask At 1040 Form

Cryptocurrency Taxes Overview How to Report Your Gains and Losses

Crypto Taxes Explained! YouTube

Irs Form W4V Printable Federal Form W 4v Voluntary Withholding

Taxes Tax Forms

Not Sure How to Report Crypto Taxes? Here’s how

How To Pick The Best Crypto Tax Software

Form 12 12a Five Ways On How To Prepare For Form 12 12a Tax forms

Seniors Get a New Simplified Tax Form for 2019 Americans Care

Related Post: