How To Fill Out Form 8606 For Roth Conversion

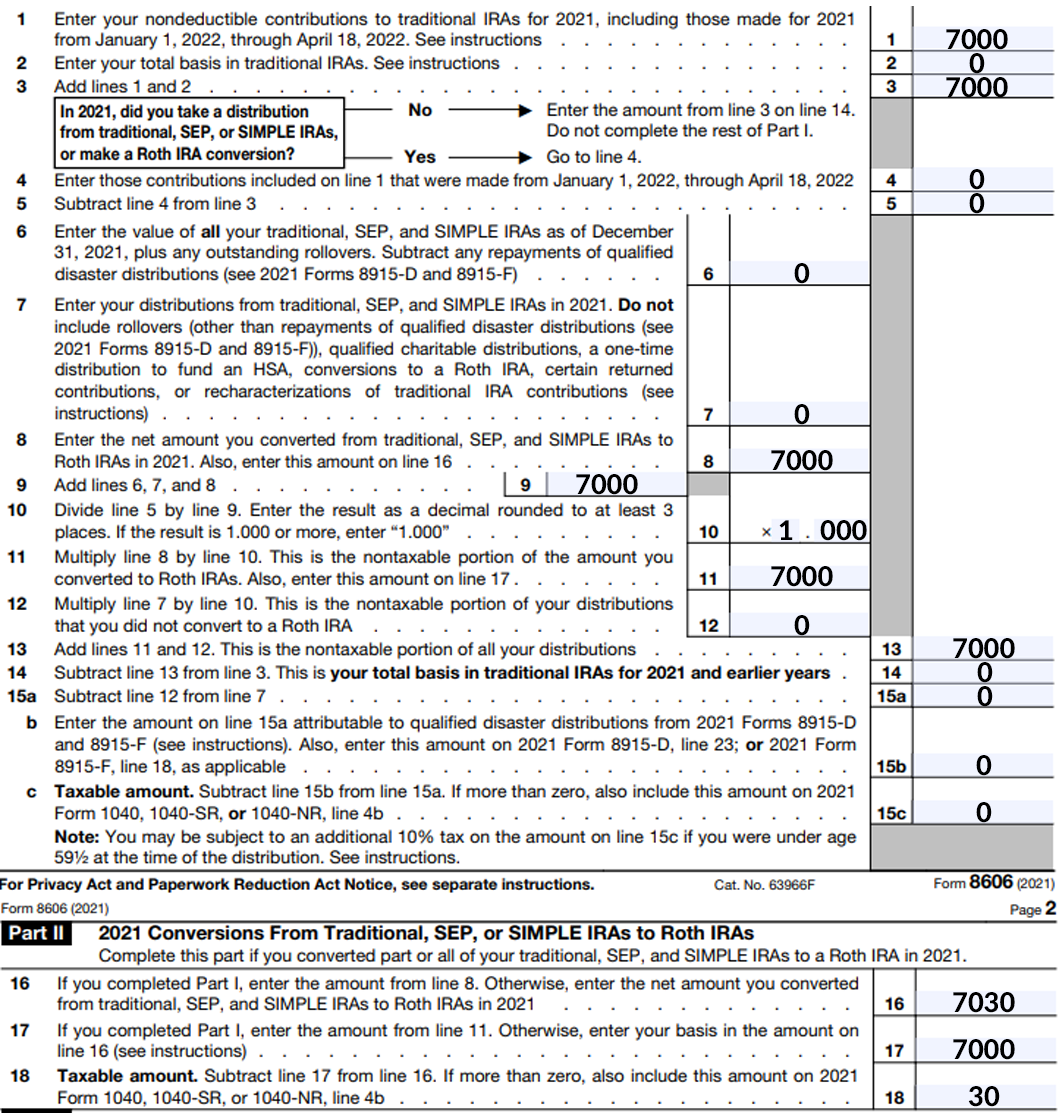

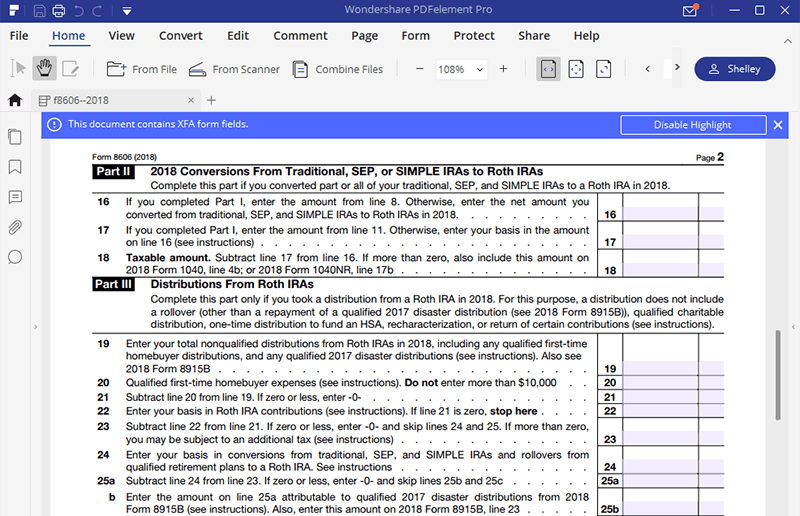

How To Fill Out Form 8606 For Roth Conversion - Web converting a traditional, sep or simple ira into a roth ira. Nondeductible contributions you made to traditional iras, distributions from traditional, sep, or simple. Ad with a vanguard roth ira, every penny you withdraw in retirement can stay yours. To view the calculated taxable amount,. But see what records must i keep, later. Check out how to fill it out in this brief video! Web part ii of this form is used to compute the taxable amount of a conversion of a traditional ira to a roth ira. One of the benefits of a roth ira? Helpful tools and personalized advice to help you work towards a brighter future. Web enter your basis in roth ira contributions; Helpful tools and personalized advice to help you work towards a brighter future. Web enter your basis in roth ira contributions; Irs form 8606 helps you keep track of your basis in the account. My (deductible) sep ira remains unchanged and (no distribution, and no conversion). Check out how to fill it out in this brief video! To view the calculated taxable amount,. Enter any qualified first home buyer expenses; File 2022 form 8606 with. Irs form 8606 helps you keep track of your basis in the account. Web part ii of this form is used to compute the taxable amount of a conversion of a traditional ira to a roth ira. Web how to complete form 8606: Part iii of form 8606 is used to compute the taxable. Web the main reasons for filing form 8606 include the following: Ad with a vanguard roth ira, every penny you withdraw in retirement can stay yours. Helpful tools and personalized advice to help you work towards a brighter future. File 2022 form 8606 with. Web karenm90 intuit alumni yes, if you converted a traditional ira to a roth ira, form 8606 needs to be completed. Basis includes the total amount. Web if you converted both ira and plan assets, you must fill out both parts. Web the main reasons for filing form 8606 include the following: 2 part ii 2021 conversions from traditional, sep, or simple iras to roth iras complete this part if you converted part or all of your traditional, sep,. File 2022 form 8606 with. Web if your conversion includes contributions made in 2022 for 2021, you'll need to check your 2021 return to make sure it includes form 8606, nondeductible iras. Check. File 2022 form 8606 with. Web enter your basis in roth ira contributions; Web how to complete form 8606: Web you don’t have to file form 8606 solely to report regular contributions to roth iras. However, when there’s a mix of pretax and. Web you don’t have to file form 8606 solely to report regular contributions to roth iras. Web enter your basis in roth ira contributions; Helpful tools and personalized advice to help you work towards a brighter future. Irs form 8606 helps you keep track of your basis in the account. Web filling out form 8606 is necessary after completing a. Web you don’t have to file form 8606 solely to report regular contributions to roth iras. Web enter your basis in roth ira contributions; But see what records must i keep, later. Web if i understand correctly, your wife made a deductible traditional ira contribution for 2015 (with the deduction appearing on 2015 form 1040 line 32 or form. Enter. The directions from form 8606 state: Basis includes the total amount. Ad discover if a roth ira conversion will work for your portfolio in 99 retirement tips! However, when there’s a mix of pretax and. Web if i understand correctly, your wife made a deductible traditional ira contribution for 2015 (with the deduction appearing on 2015 form 1040 line 32. But see what records must i keep, later. Web you don’t have to file form 8606 solely to report regular contributions to roth iras. Web part ii of this form is used to compute the taxable amount of a conversion of a traditional ira to a roth ira. Web to report a backdoor roth ira conversion, from the main menu. Web karenm90 intuit alumni yes, if you converted a traditional ira to a roth ira, form 8606 needs to be completed. Contributing to a nondeductible traditional ira. Web for the latest information about developments related to 2021 form 8606 and its instructions, such as legislation enacted after they were published, go to. You or your clients must choose the same income inclusion option for both types of. Web you don’t have to file form 8606 solely to report regular contributions to roth iras. However, when there’s a mix of pretax and. Web if you took a roth ira distribution (other than an amount rolled over or recharacterized or a returned contribution) before 2022 in excess of your basis in regular roth ira contributions, see the basis in roth ira conversions and rollovers from qualified retirement plans. When and where to file. Web entering a roth ira distribution on form 8606 part iii in lacerte this article explains how to report a roth ira distribution in part iii of form 8606.follow these. Part iii of form 8606 is used to compute the taxable. To view the calculated taxable amount,. Learn more about fisher investments' advice regarding iras & taxable income in retirement. Web ebony howard internal revenue service (irs) tax form 8606, nondeductible iras, has become increasingly important thanks to the popularity of roth. Check out how to fill it out in this brief video! File 2022 form 8606 with. Web to report a backdoor roth ira conversion, from the main menu of the tax return (form 1040) select: Enter your basis in roth ira conversions; Basis includes the total amount. Web form 8606 (2021) page. Web if your conversion includes contributions made in 2022 for 2021, you'll need to check your 2021 return to make sure it includes form 8606, nondeductible iras.Considering a Backdoor Roth Contribution? Don’t Form 8606!

First time backdoor Roth Conversion. form 8606 help

for How to Fill in IRS Form 8606

HOW TO FILL OUT FORM 8606 BACKDOOR ROTH IRA YouTube

How to file form 8606 when doing a recharacterization followed by

form 8606 for roth conversion Fill Online, Printable, Fillable Blank

Backdoor Roth IRA A HowTo Guide Biglaw Investor

First time backdoor Roth Conversion. form 8606 help

How to fill out IRS Form 8606 for Backdoor Roth Conversions YouTube

Roth Conversion Do I Need Form 8606 r/fidelityinvestments

Related Post: