How To Fill Out Form 535 Cra

How To Fill Out Form 535 Cra - You must file form t1135 since the total cost amount of all specified foreign property exceeds the $100,000 threshold ($75,000 + $35,000 = $110,000). Web undertaking and indemnity form. Web after consultations with external stakeholders, the canada revenue agency has implemented the following changes to f orm t1135, foreign income verification. Sudbury tax centre post office box 20000, station a sudbury on p3a 5c2; Canada revenue agency forms listed by number. Right under your cheques/pwgsc 535 form (within your uncashed cheques dashboard) is a. 1) if you have not received or have lost your cheque, please complete this form of undertaking and indemnity in ink and return. Instructions to fill out form 535. Web quickly see if you have any uncashed cra cheques. Web there is a mailing address but you can also just scan it and submit it digitally. You’ll need to fill out form pwgsc 535, print it off and mail it to revenue canada’s sudbury tax. A premium guide to editing the form 535. Right under your cheques/pwgsc 535 form (within your uncashed cheques dashboard) is a. Web undertaking and indemnity form. Web if you have any uncashed cheques, you’ll need to download, complete and submit the. The form requires the signature of a witness. At a minimum, the t1135 penalty is $25 per day for up to 100 days. Web 1142 rows canada revenue agency. Web what to do with form pwgsc 535? Filling out form 535 to get some old cheque’s i’m owed and in the bottom section it says “signature of witness” as well. Web there is a mailing address but you can also just scan it and submit it digitally. File by the deadline to avoid interruptions or delays to your benefit and credit payments. Select “uncashed cheques” on the my account “overview” page. Web if you do have an uncashed cheque, congratulations on your find! Web the canada revenue agency (cra) produces. Web after consultations with external stakeholders, the canada revenue agency has implemented the following changes to f orm t1135, foreign income verification. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Web a taxpayer who fails to file. Instructions to fill out form 535. Web for example, you are the director of a corporate creditor or the solicitor or accountant of the creditor, you sign this form as the creditor’s authorised agent (delete item 3a). Web quickly see if you have any uncashed cra cheques. Remember to protect your personal information if you are filling out this form. Canada revenue agency forms listed by number. Web 1142 rows canada revenue agency. The minimum penalty for failure to. You must file form t1135 since the total cost amount of all specified foreign property exceeds the $100,000 threshold ($75,000 + $35,000 = $110,000). Web if you have any uncashed cheques, you’ll need to download, complete and submit the cra’s form. The form requires the signature of a witness. If you have an uncashed cheque, fill out. Web you can enter your information directly into this form and save it as you go. Web filing your income tax and benefit return on paper. Send out signed form pwgsc 535 printable or print it. Sign and date the form. Enter your name and address under the signature. If you have an uncashed cheque, fill out. Web what to do with form pwgsc 535? Browse for the pwgsc 535 download. You’ll need to fill out form pwgsc 535, print it off and mail it to revenue canada’s sudbury tax. Print and fill out the form. Instructions to fill out form 535. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we. Web undertaking and indemnity form. Web after consultations with external stakeholders, the canada revenue agency has implemented the following changes to f orm t1135, foreign income verification. Web if you do have an uncashed cheque, congratulations on your find! Web 1142 rows canada revenue agency. Canada revenue agency forms listed by number. Remember to protect your personal information if you are filling out this form on a shared computer,. If you have an uncashed cheque, fill out. Web overview of the requirements and the process to submit documents online to the cra for taxpayers or their authorized representatives. A premium guide to editing the form 535. Fill & download for free. Web you can enter your information directly into this form and save it as you go. Browse for the pwgsc 535 download. Right under your cheques/pwgsc 535 form (within your uncashed cheques dashboard) is a. Canada revenue agency forms listed by number. Send out signed form pwgsc 535 printable or print it. Sudbury tax centre post office box 20000, station a sudbury on p3a 5c2; File by the deadline to avoid interruptions or delays to your benefit and credit payments. Once the form is filled out, you will. Web if you have any uncashed cheques, you’ll need to download, complete and submit the cra’s form pwgsc 535. Instructions to fill out form 535. 1) if you have not received or have lost your cheque, please complete this form of undertaking and indemnity in ink and return. Web a taxpayer who fails to file a t1135 form by the deadline will be penalized. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Filling out form 535 to get some old cheque’s i’m owed and in the bottom section it says “signature of witness” as well as their address. The minimum penalty for failure to.cra t2202a form Fill out & sign online DocHub

How To Fill Out Form 535 CRA

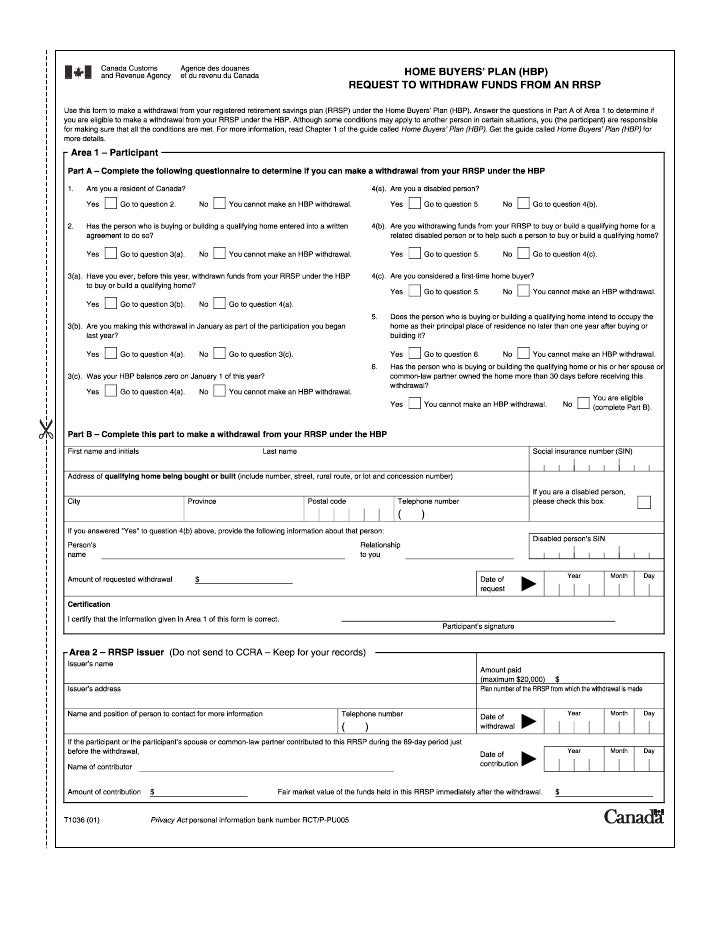

Home buyers plan

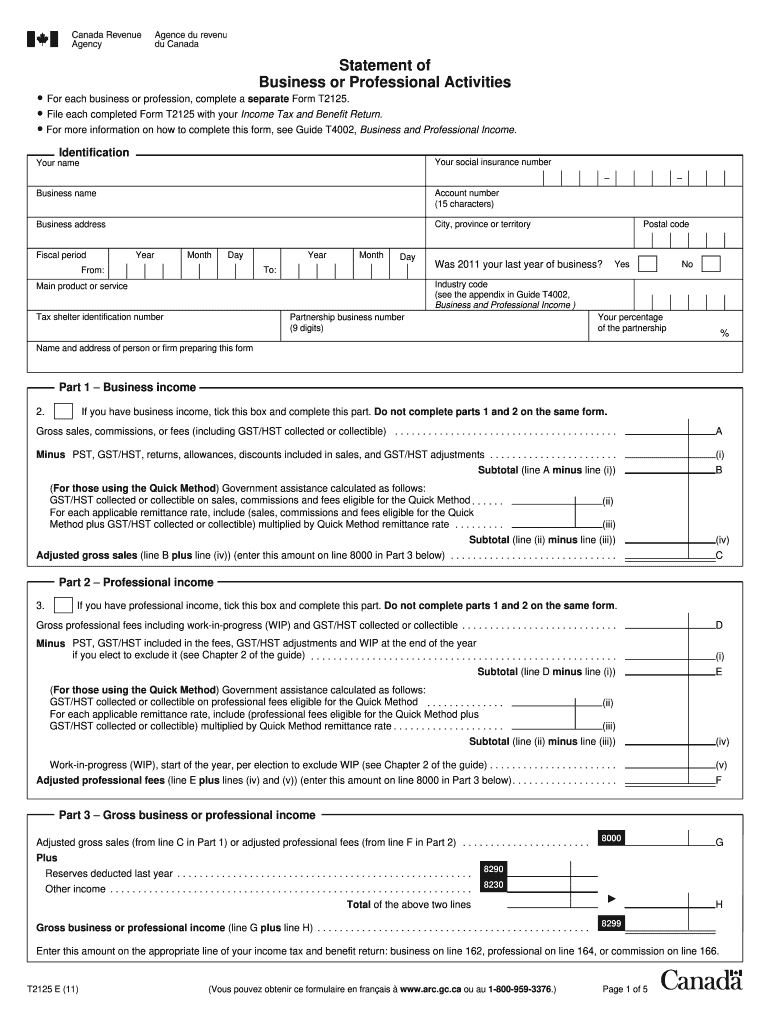

2011 t2125 form Fill out & sign online DocHub

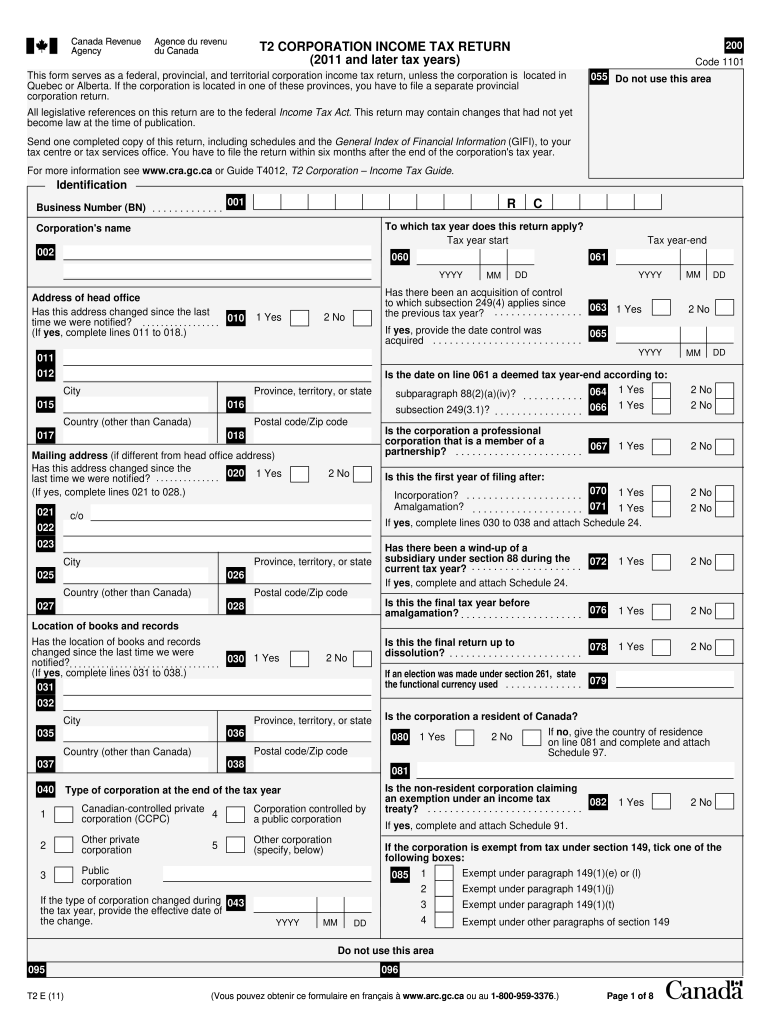

Cra T2 Short Fillable Form Printable Forms Free Online

PWGSC Form 535.PDF PDF Chèque Finance (Général)

Cra Business Gst Return Form Charles Leal's Template

Cra form t1013 Fill out & sign online DocHub

Fill Free fillable Government of Canada PDF forms

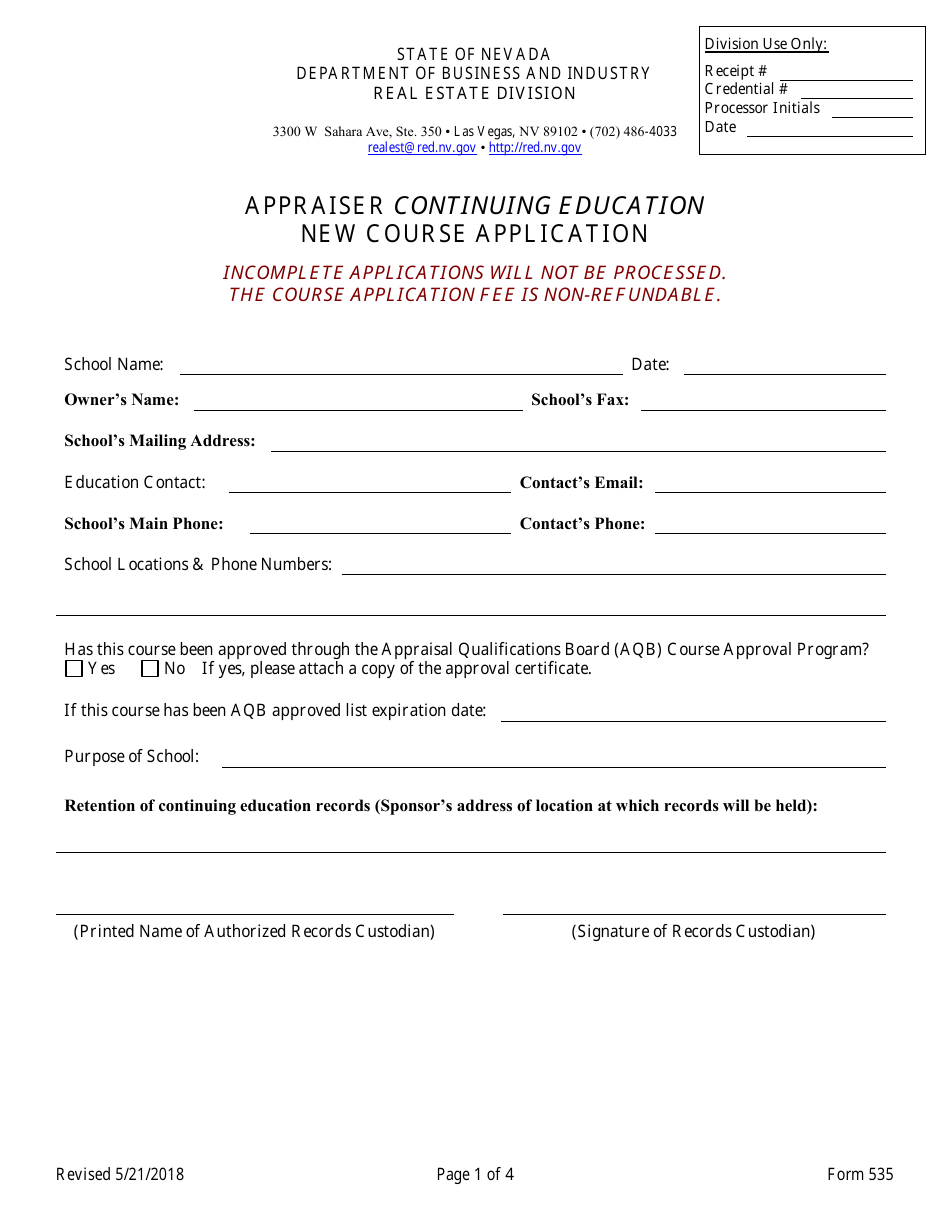

Form 535 Fill Out, Sign Online and Download Fillable PDF, Nevada

Related Post: