How To File Form 568 Online

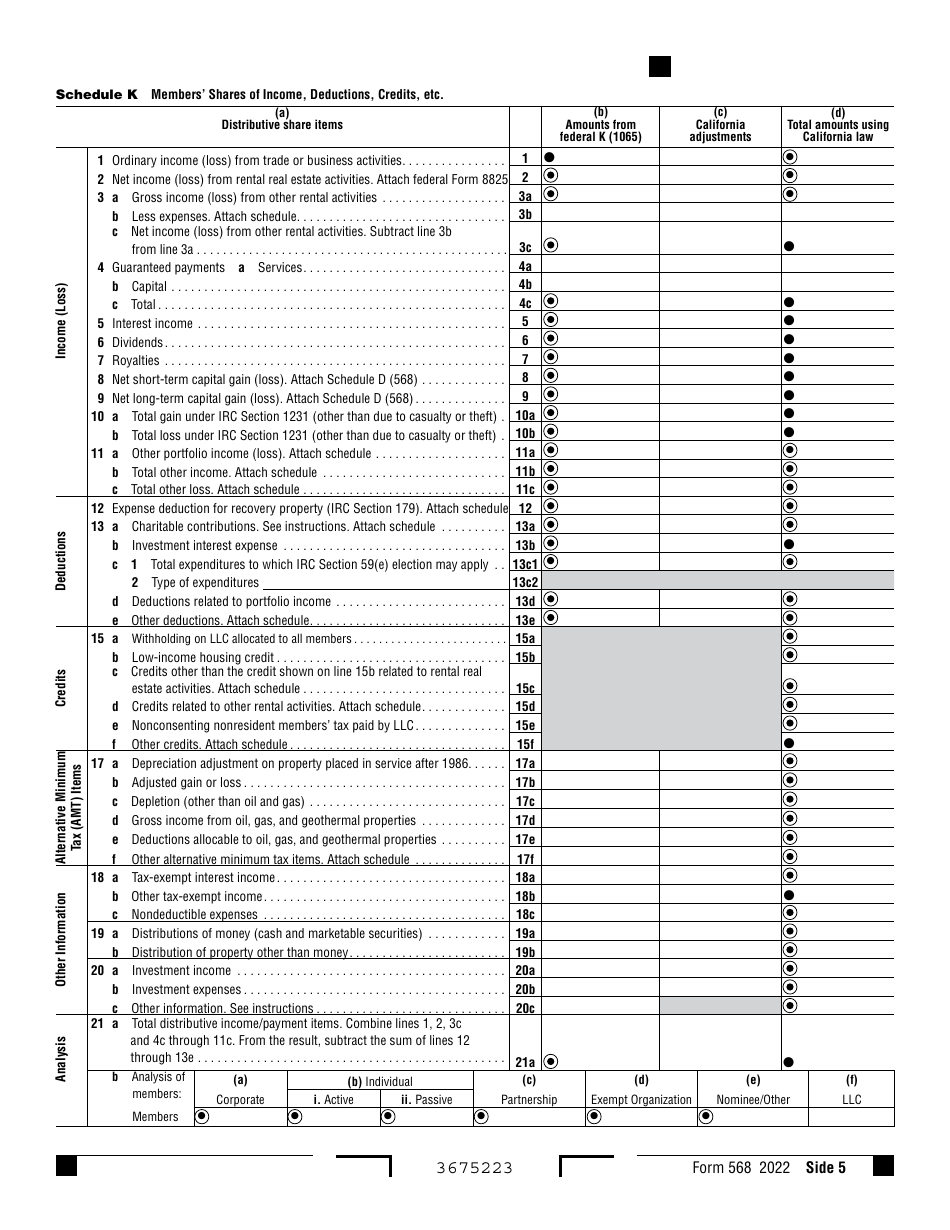

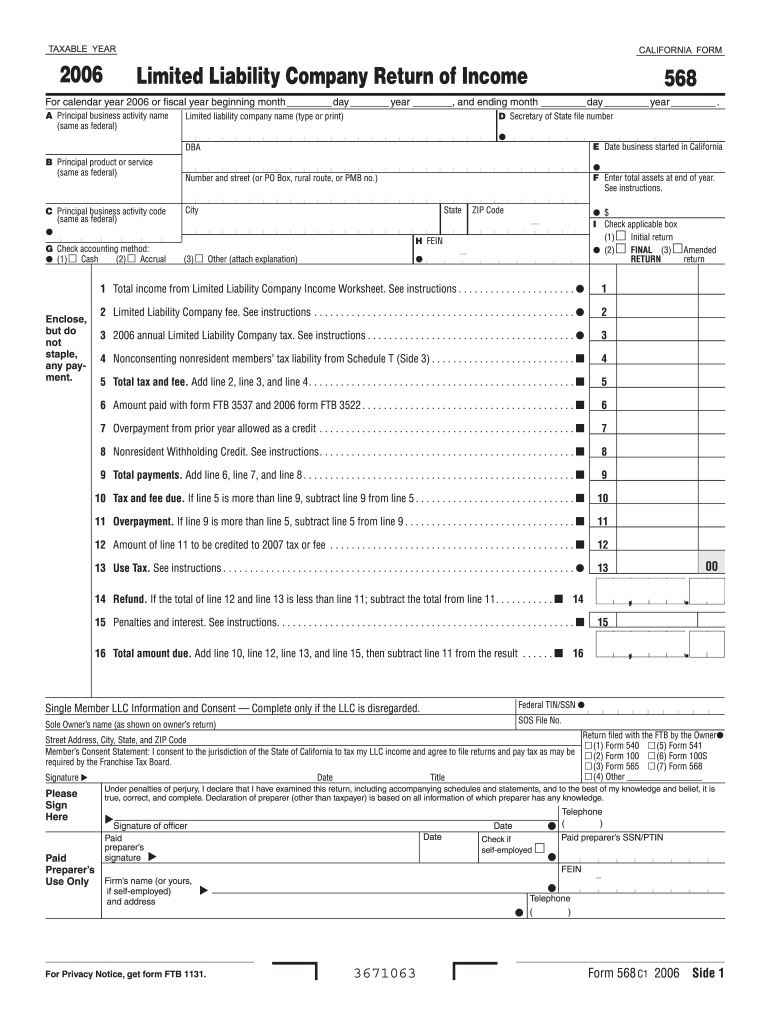

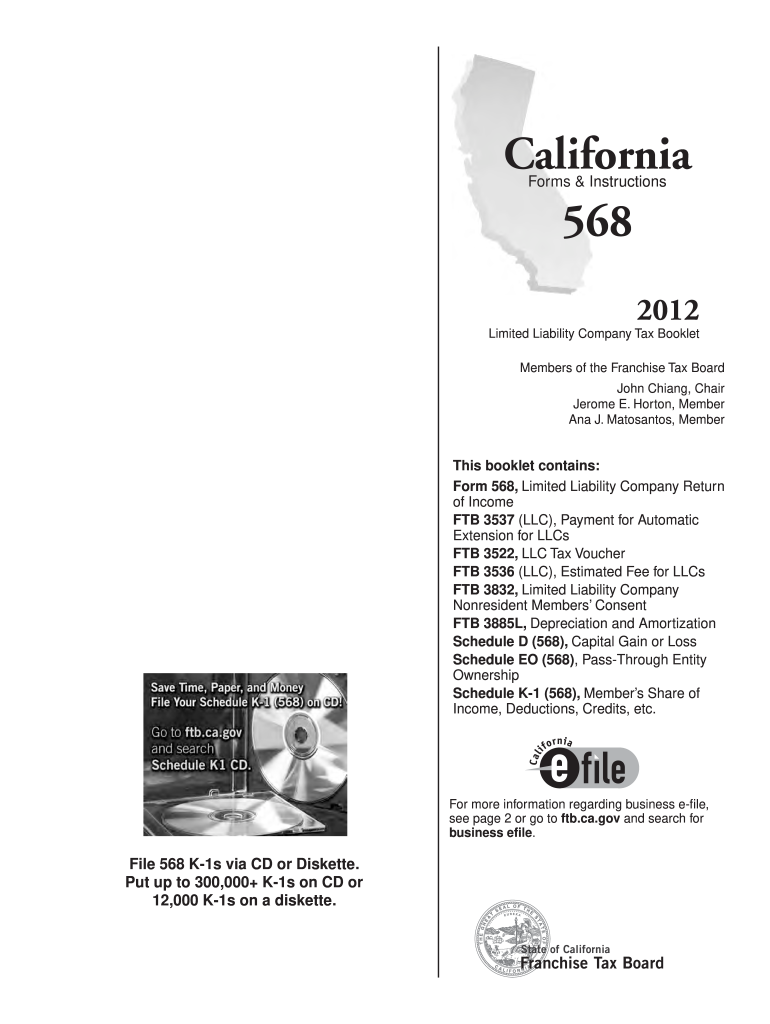

How To File Form 568 Online - Enjoy smart fillable fields and interactivity. Sign online button or tick the preview image of the form. Web along with form 3522, you will have to file ca form 568 if your llc tax status is either as a disregarded entity or a partnership. Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. Ad view all information of irs offices by county or by city for free online. Pay the lowest amount of taxes possible with strategic planning and preparation Web llc fee annual tax for the llc refunds withholding use tax property distributions members' shares of income, credits, deductions an llc is only required to. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. • form 568, limited liability company return of income • form 565, partnership return of income • form 100, california. Web october 31, 2022 form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Form 568 is due on march 31st following the end of the tax year. Sign online button or tick the preview image of the form. Thus, you will need to file both if you are running a. The advanced tools of the. Web how you can fill out the form568 2010 online: Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. If you have an llc, here’s how to fill in the california form 568:. Web form 568 due date. If your llc files on an extension, refer to payment for automatic extension for llcs. Pay the. Ad save time and money with professional tax planning & preparation services. If your using turbo tax. Web to enter the information for form 568 in the 1040 taxact ® program: While you can submit your state income tax return and federal income tax return by april 15,. Web how you can fill out the form568 2010 online: Web form 568 due date. Web llc fee annual tax for the llc refunds withholding use tax property distributions members' shares of income, credits, deductions an llc is only required to. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Form 568 must be filed by every llc that is not taxable. Web to enter the information for form 568 in the 1040 taxact ® program: We may grant a waiver if we determine the business entity is unable to comply with the requirements due to, but not limited to, the following reasons: Enjoy smart fillable fields and interactivity. Web up to $40 cash back do whatever you want with a 2021. Ad save time and money with professional tax planning & preparation services. Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. The llc must file the appropriate. Get your online template and fill it in using progressive features. How to fill in california form 568. Enjoy smart fillable fields and interactivity. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. The llc must file the appropriate. Web form 568 due date. If your llc files on an extension, refer to payment for automatic extension for llcs. If your using turbo tax. How to fill in california form 568. Web up to $40 cash back do whatever you want with a 2021 form 568 limited liability company return of income. The llc is doing business in california. The llc must file the appropriate. Web october 31, 2022 form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Web llcs classified as partnerships file form 568. Web llc fee annual tax for the llc refunds withholding use tax property distributions members' shares of income, credits, deductions an llc is only required to. If. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use. Web how you can fill out the form568 2010 online: How to fill in california form 568. Web to enter the information for form 568 in the 1040 taxact ® program:. Web how to fill out and sign ca form 568 online? Web form 568 due date. Thus, you will need to file both if you are running a. Enjoy smart fillable fields and interactivity. Get your online template and fill it in using progressive features. Web you still have to file form 568 if the llc is registered in california. While you can submit your state income tax return and federal income tax return by april 15,. Form 568 must be filed by every llc that is not taxable as a. Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Click here to check all the information you need for irs offices near you. Web along with form 3522, you will have to file ca form 568 if your llc tax status is either as a disregarded entity or a partnership. Web llcs classified as partnerships file form 568. If your llc files on an extension, refer to payment for automatic extension for llcs. From within your taxact return ( online or desktop), click state to expand, then click california (or ca ). • form 568, limited liability company return of income • form 565, partnership return of income • form 100, california. How to fill in california form 568. The llc must file the appropriate. Web this article will show you how to access california form 568 for a ca llc return in proseries professional.california form 568 for limited liability company ret. Web october 31, 2022 form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Pay the lowest amount of taxes possible with strategic planning and preparationForm 568 Instructions 2022 State And Local Taxes Zrivo

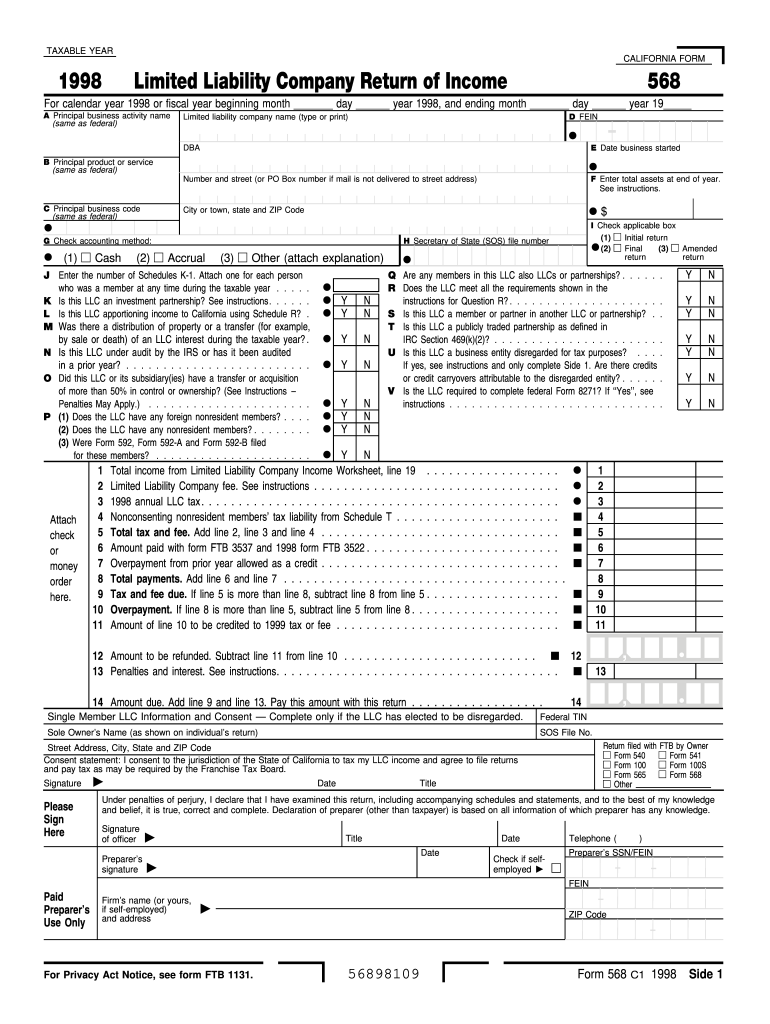

1998 form 568 Fill out & sign online DocHub

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Form 568 2015 Fill out & sign online DocHub

Form 568 Download Fillable PDF or Fill Online Limited Liability Company

2016 Form 568 Limited Liability Company Return Of Edit, Fill

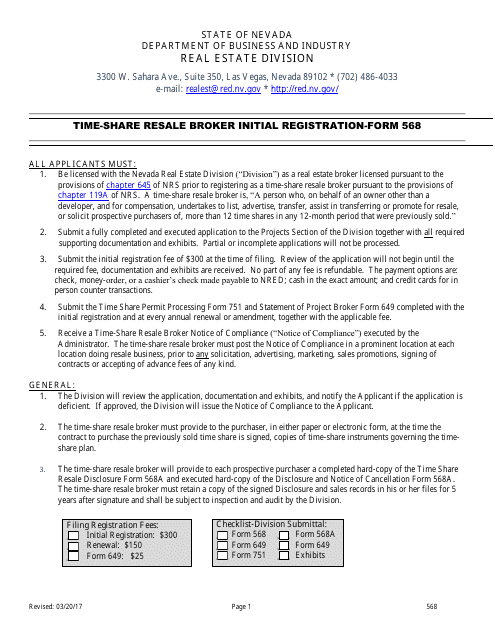

Form 568 Download Fillable PDF or Fill Online TimeShare Resale Broker

Fillable Online ftb ca section 568 final k 1 form Fax Email Print

Printable Form 568 Printable Forms Free Online

Form Ca 568 Instructions Fill Out and Sign Printable PDF Template

Related Post: