Dts Hotel Tax Exempt Form

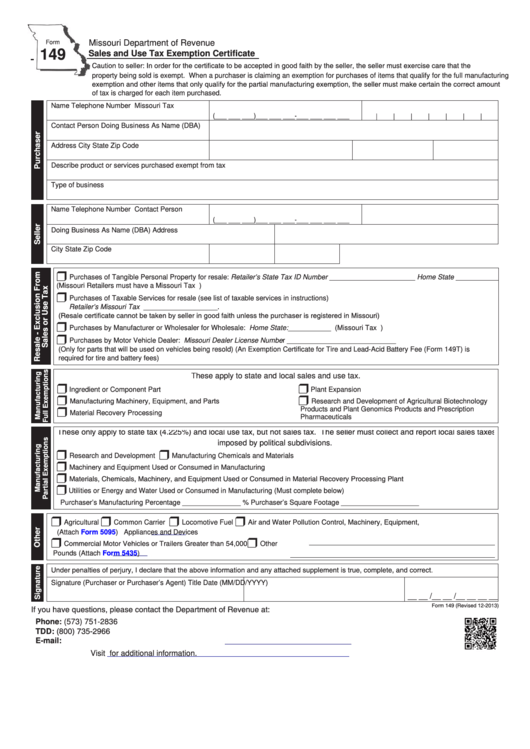

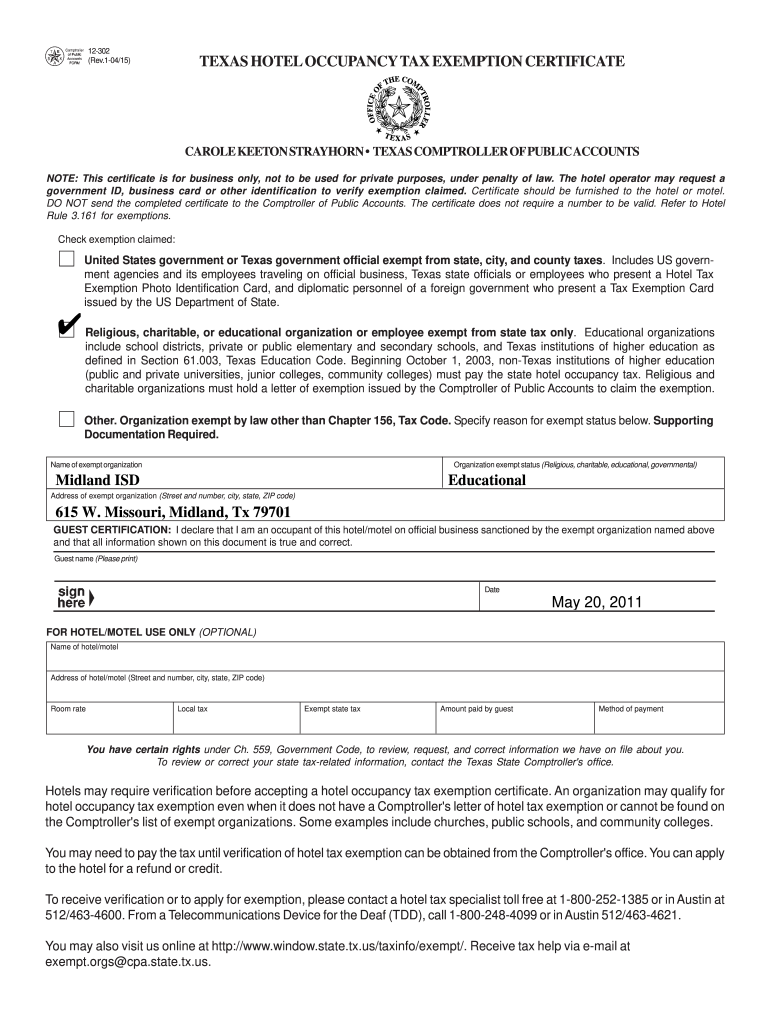

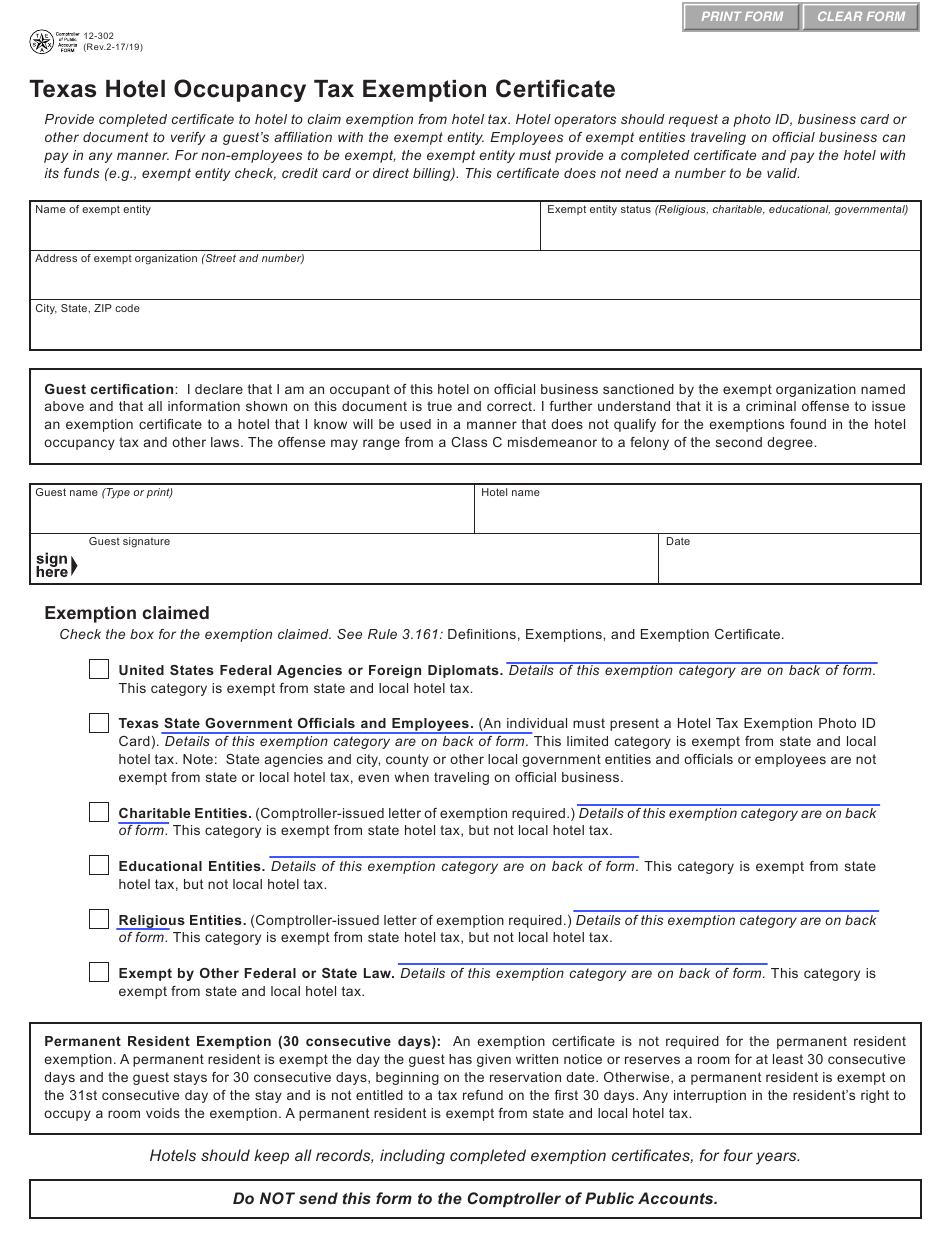

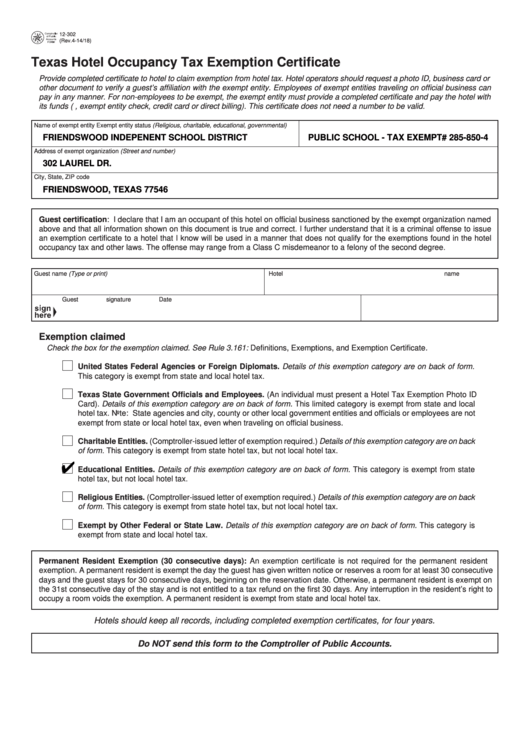

Dts Hotel Tax Exempt Form - Web dts will direct you to the lodging you should book automatically. Access the joint travel regulations and other travel. Web in other words, your primary responsibility on a voucher is to make changes to it, add the required receipts (i.e., all lodging and any expense of $75.00 or more), and attach. Web become a dod preferred hotel other commercial lodging policy & regulations. Web if a hotel or other vendor wishes to verify the eligibility for a tax exemption, foreign missions and their members should request that the vendor use the department’s online. Web united states tax exemption form. Report feedback received from dod. State and local sales and use tax; And are not duplicated in any part of the voucher (e.g., a rental car. United states tax exemption form; Web if you’re traveling on temporary duty, use fedrooms ® to find hotel accommodations. Web united states tax exemption form. Pay back any overpayment for improperly reimbursed lodging taxes. United states tax exemption form; Web dts will direct you to the lodging you should book automatically. Web dts will direct you to the lodging you should book automatically. Web communicate tax exemption status, provide exemption forms, and refund applicable taxes paid on tax exempt stays, if applicable; Web in other words, your primary responsibility on a voucher is to make changes to it, add the required receipts (i.e., all lodging and any expense of $75.00 or. United states tax exemption form; Web become a dod preferred hotel other commercial lodging policy & regulations. Save time at the airport and find out how you can participate for free. Web to be retained by operators of hotels, motels, and similar accomoda tions as evidence of exempt occupancy. Fedrooms ® provides hotel accommodations with no additional fees,. Web if you’re traveling on temporary duty, use fedrooms ® to find hotel accommodations. Web communicate tax exemption status, provide exemption forms, and refund applicable taxes paid on tax exempt stays, if applicable; Web in other words, your primary responsibility on a voucher is to make changes to it, add the required receipts (i.e., all lodging and any expense of. Web those purchasers set forth below may use this form in connection with the claim for exemption for the following taxes: Fedrooms ® provides hotel accommodations with no additional fees,. Access the joint travel regulations and other travel. Web if you’re traveling on temporary duty, use fedrooms ® to find hotel accommodations. Web become a dod preferred hotel other commercial. Web dfas form 9098 claim for temporary lodging expense (tle) allowance to partially pay for lodging/meal expenses incurred by a member/dependent (s) while. Report feedback received from dod. Web when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. Web in other words, your primary. Web sales tax information this guidance is useful for federal government employee travelers, vendors (hotels and restaurants) who provide services to federal government employee. Web to be retained by operators of hotels, motels, and similar accomoda tions as evidence of exempt occupancy. Web dts will direct you to the lodging you should book automatically. Web if a hotel or other. Web those purchasers set forth below may use this form in connection with the claim for exemption for the following taxes: Web in other words, your primary responsibility on a voucher is to make changes to it, add the required receipts (i.e., all lodging and any expense of $75.00 or more), and attach. Report feedback received from dod. Web united. State and local sales and use tax; Web to be retained by operators of hotels, motels, and similar accomoda tions as evidence of exempt occupancy. Web if taxes are charged in an exempt state or locality, contact the hotel and request a refund of the taxes. Web when you use your government travel charge card (gtcc) for official travel, your. Web if taxes are charged in an exempt state or locality, contact the hotel and request a refund of the taxes. Web become a dod preferred hotel other commercial lodging policy & regulations. Web sales tax information this guidance is useful for federal government employee travelers, vendors (hotels and restaurants) who provide services to federal government employee. Report feedback received. Web if taxes are charged in an exempt state or locality, contact the hotel and request a refund of the taxes. Web those purchasers set forth below may use this form in connection with the claim for exemption for the following taxes: State and local sales and use tax; Web sales tax information this guidance is useful for federal government employee travelers, vendors (hotels and restaurants) who provide services to federal government employee. Web select a state/us territory find out about state sales tax with information from each state taxation authority. Access the joint travel regulations and other travel. Fedrooms ® provides hotel accommodations with no additional fees,. Pay back any overpayment for improperly reimbursed lodging taxes. And are not duplicated in any part of the voucher (e.g., a rental car. Save time at the airport and find out how you can participate for free. Web to be retained by operators of hotels, motels, and similar accomoda tions as evidence of exempt occupancy. Web dts will direct you to the lodging you should book automatically. Web fedrooms provides federal travel regulation (ftr) compliant hotel accommodations at or below per diem with standardized amenities. Web if a hotel or other vendor wishes to verify the eligibility for a tax exemption, foreign missions and their members should request that the vendor use the department’s online. Web dfas form 9098 claim for temporary lodging expense (tle) allowance to partially pay for lodging/meal expenses incurred by a member/dependent (s) while. Web in other words, your primary responsibility on a voucher is to make changes to it, add the required receipts (i.e., all lodging and any expense of $75.00 or more), and attach. Web become a dod preferred hotel other commercial lodging policy & regulations. Web if you’re traveling on temporary duty, use fedrooms ® to find hotel accommodations. The civilian employee must submit a voucher to the servicing finance office, not through dts. Web united states tax exemption form.Fillable Hotel Tax Exempt Certificate printable pdf download

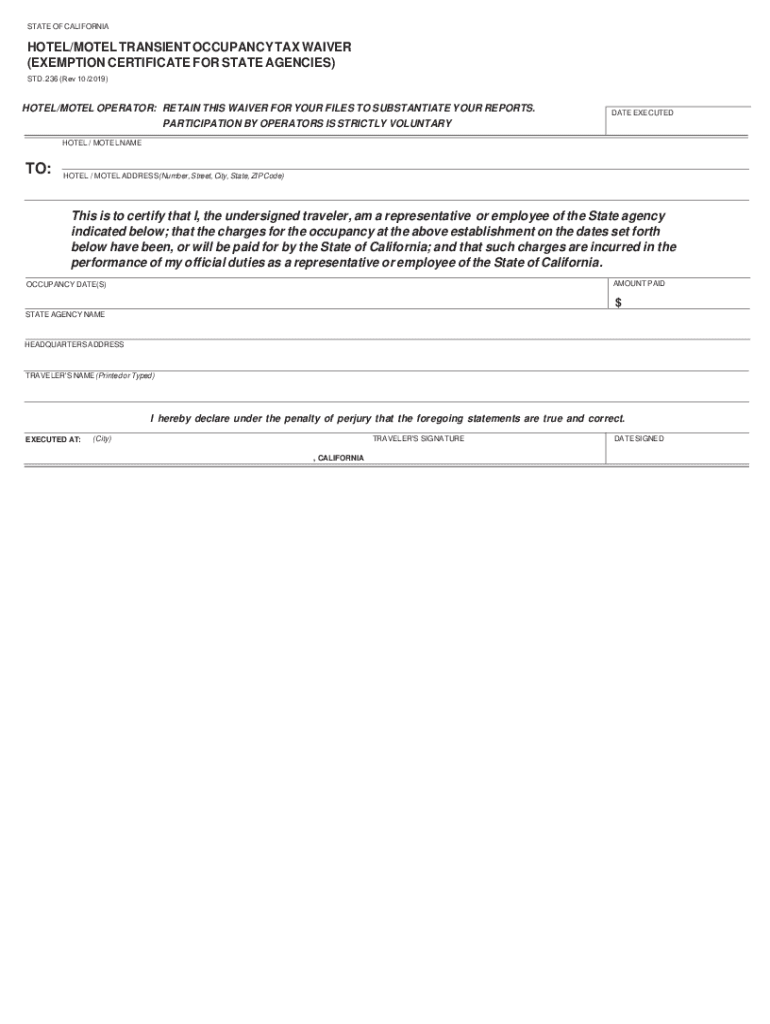

California hotel tax exempt form pdf Fill out & sign online DocHub

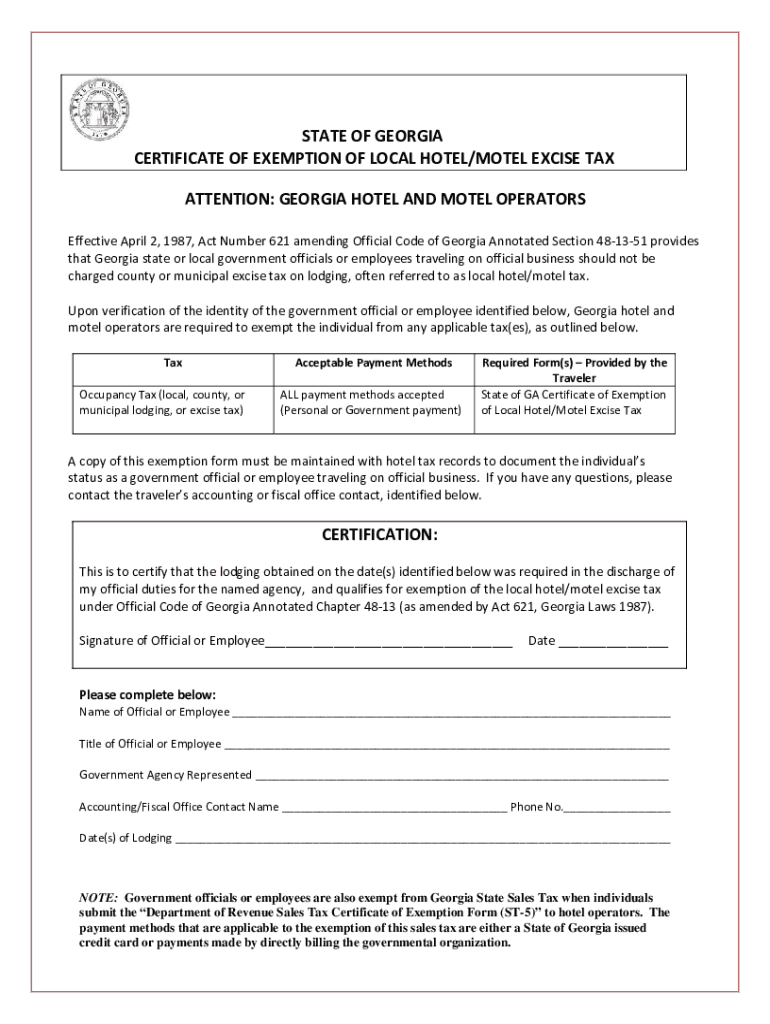

State of hotel tax exempt form Fill out & sign online DocHub

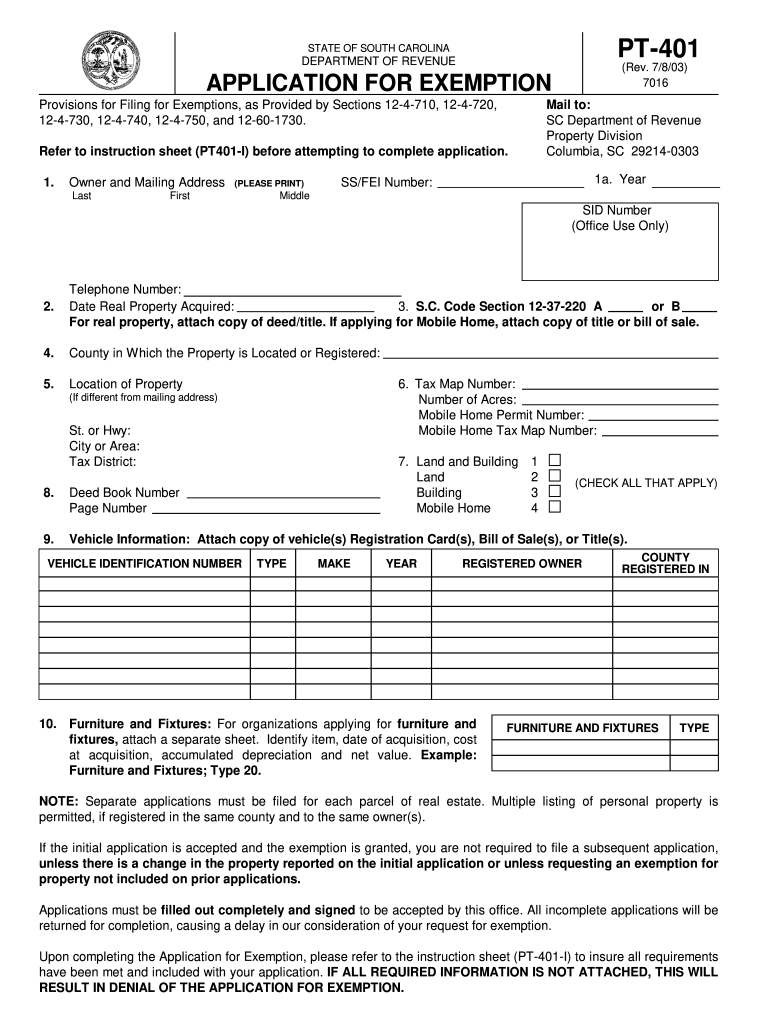

South Carolina Hotel Tax Exempt Form

South Carolina Hotel Tax Exempt Form

Tax exempt form louisiana Fill out & sign online DocHub

Hotel Tax Exempt Form

Florida Tax Exempt Form Hotel Fill Out and Sign Printable PDF

Texas State Tax Exempt Form Hotel

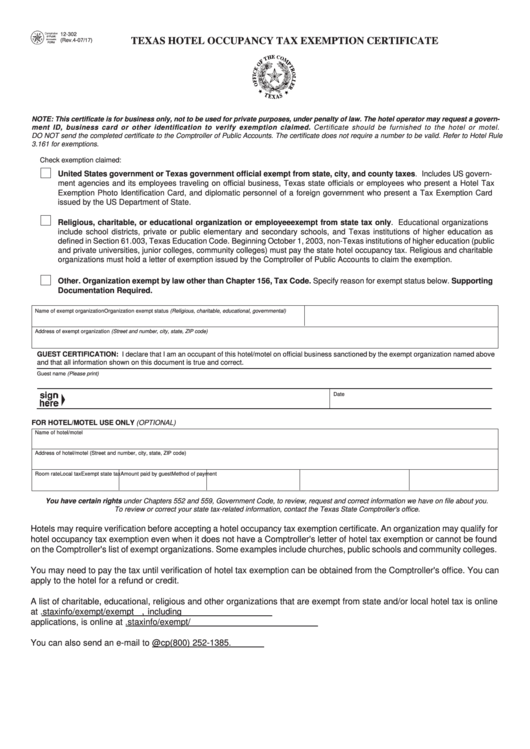

Fillable Texas Hotel Occupancy Tax Exemption Certificate Printable Pdf

Related Post: