How Do I File Form 8862 Electronically

How Do I File Form 8862 Electronically - Web married filing jointly vs separately; Save or instantly send your ready documents. Get your online template and fill it in using progressive features. Add certain credit click the green button to add information to claim a certain credit after disallowance. Starting with tax year 2021, electronically filed tax. Web form 8862 is required when the irs has previously disallowed one or more specific tax credits. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. File taxes with no income; Sign in to efile.com sign in to efile.com 2. Web 4.8 satisfied 38 votes how to fill out and sign form 8862 turbotax online? Your earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace. File taxes with no income; After you have finished entering the information for form. Log in to your signnow. Web go to the overview. Starting with tax year 2021, electronically filed tax. Web form 8862 is required when the irs has previously disallowed one or more specific tax credits. The h&r block online program supports most federal forms: Guide to head of household; Web how do i submit form 8862 online. Starting with tax year 2021, electronically filed tax. Web instructions on how to correct an electronically filed return that was rejected for a missing form 8962. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits. Web go to the overview. The h&r block online program supports most federal forms: Put your name and social security number on the statement and attach it at. Web you need to complete form 8862 and attach it to your tax return if: Do not enter the year the credit (s) was disallowed. Easily fill out pdf blank, edit, and sign them. Your earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Starting with tax year 2021, electronically filed tax. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner. Easily fill out pdf blank, edit, and sign them. Log in to your signnow account. If the only reason your eic was reduced or disallowed in the earlier year was because you. Web go to the overview. Put your name and social security number on the statement and attach it at. Starting with tax year 2021, electronically filed tax. File taxes with no income; Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Log in to your signnow account. Put your name and social security number on the statement and attach it at. Get your online template and fill it in using progressive features. Web enter the year for which you are filing this form to claim the credit. The h&r block online program supports most federal forms: If you haven’t made one yet, you can, through google or facebook. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web schedule eic exceptions click to expand eic requirements several standards must be met for you to claim the eic: Under form availability, choose view. Add certain credit click the green button to add information to claim a certain credit after disallowance. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner. The h&r block online program supports most federal forms: Web to enter information regarding form 8862 in the taxact program: Log in to. Web married filing jointly vs separately; Web schedule eic exceptions click to expand eic requirements several standards must be met for you to claim the eic: Filing this form allows you to reclaim credits for which you are now eligible. Web instructions on how to correct an electronically filed return that was rejected for a missing form 8962. Web to. (it is important to be in your actual return or the next steps will not. Web schedule eic exceptions click to expand eic requirements several standards must be met for you to claim the eic: Filing this form allows you to reclaim credits for which you are now eligible. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web married filing jointly vs separately; Web you need to complete form 8862 and attach it to your tax return if: Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits. Web go to the overview. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner. Save or instantly send your ready documents. Get your online template and fill it in using progressive features. Web to enter information regarding form 8862 in the taxact program: After you have finished entering the information for form. Web in the first line, enter the year for which you are filing the form. Put your name and social security number on the statement and attach it at. If you haven’t made one yet, you can, through google or facebook. Log in to your signnow account. Open (continue) your return if you don't already have it open. Web how do i submit form 8862 online. Ad download or email irs 8862 & more fillable forms, register and subscribe now!What Does Form 8862 Look Like Fill Online, Printable, Fillable, Blank

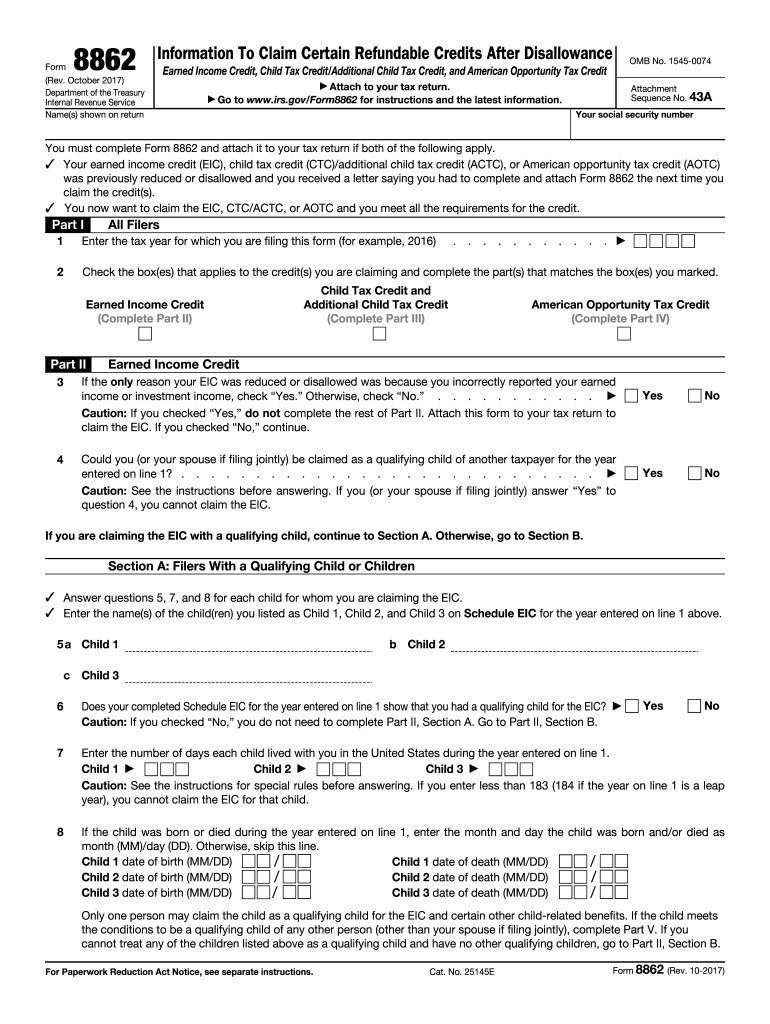

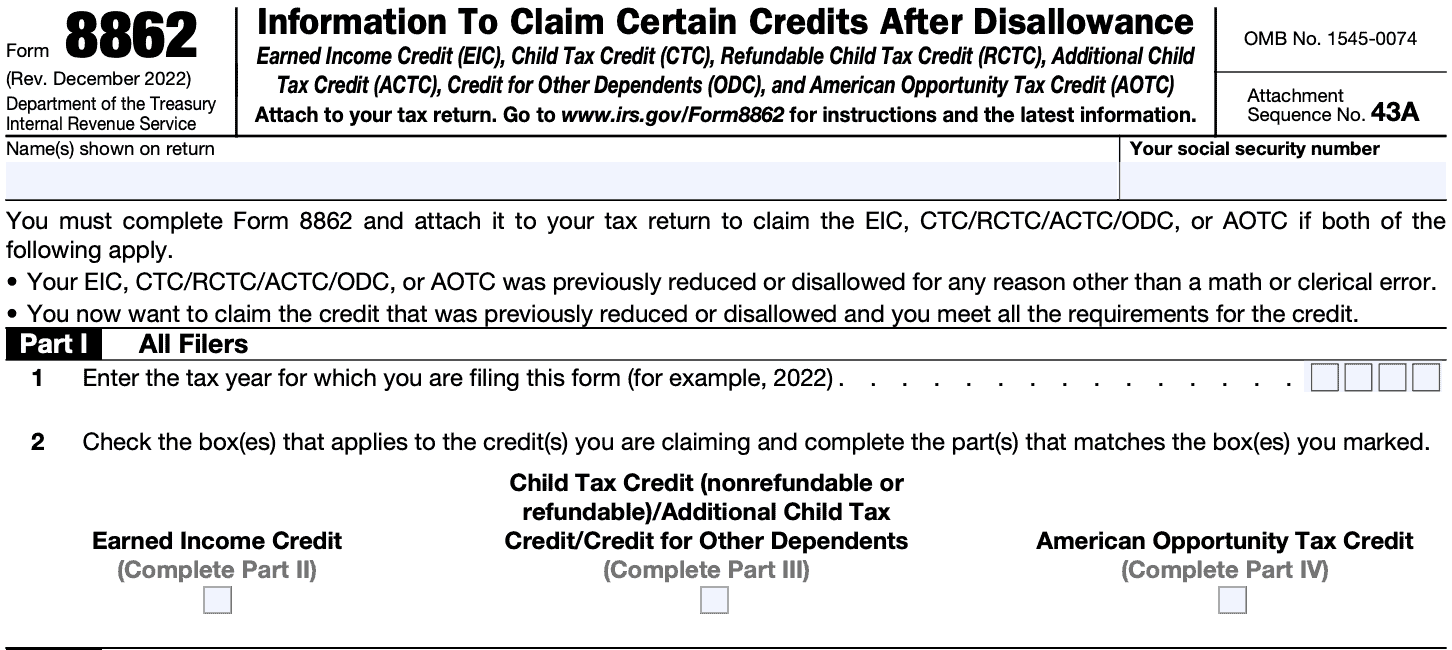

Form 8862Information to Claim Earned Credit for Disallowance

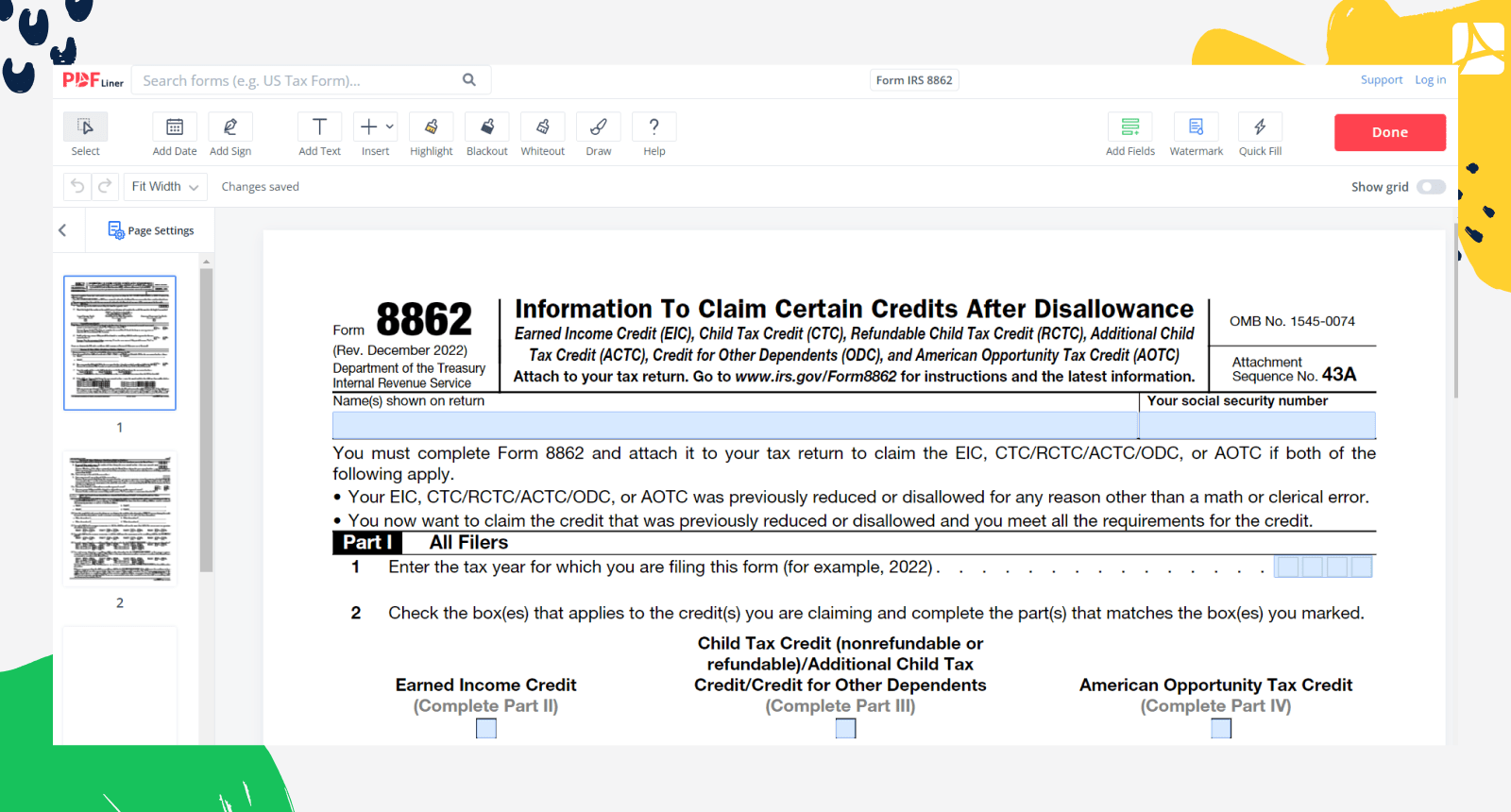

IRS Form 8862 Fill out & sign online DocHub

Form 8862 Information to Claim Earned Credit After

Form 8862 Printable Transform your tax workflow airSlate

IRS Form 8862 Instructions

Form IRS 8862 Printable and Fillable forms online — PDFliner

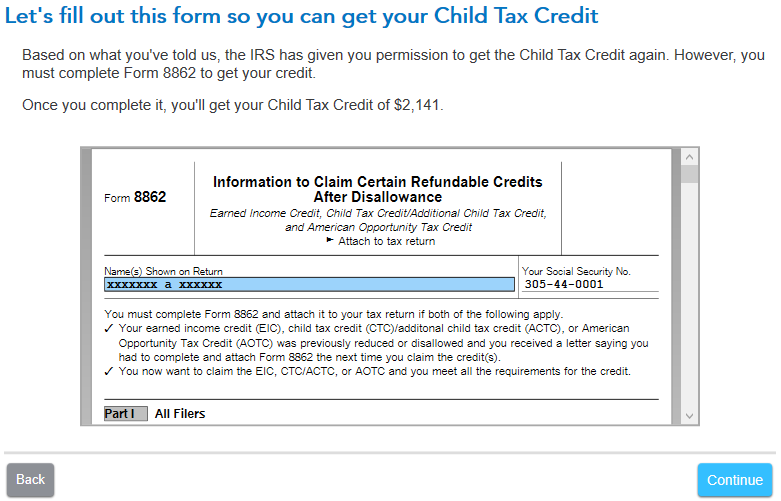

how do i add form 8862 TurboTax® Support

How to file form 8862 on TurboTax ? MWJ Consultancy turbotax YouTube

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Related Post:

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)