Hotel Tax Exemption Form Texas

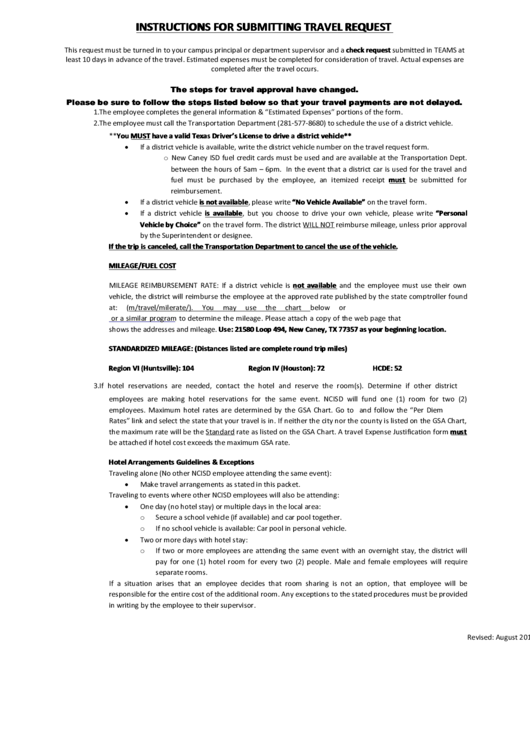

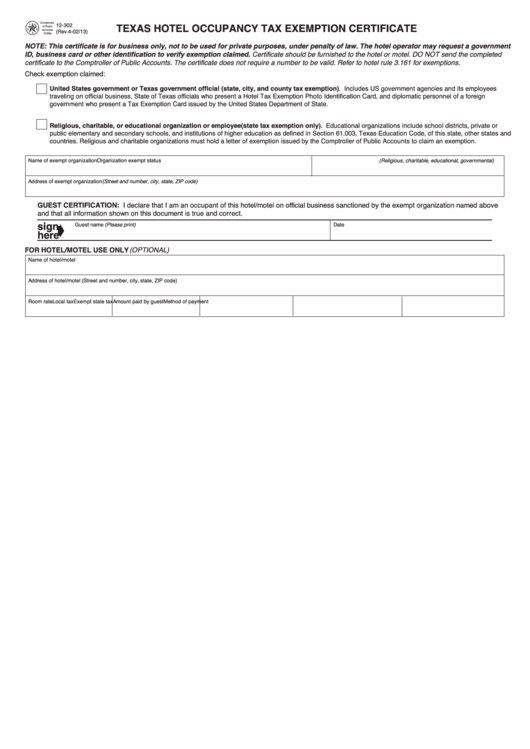

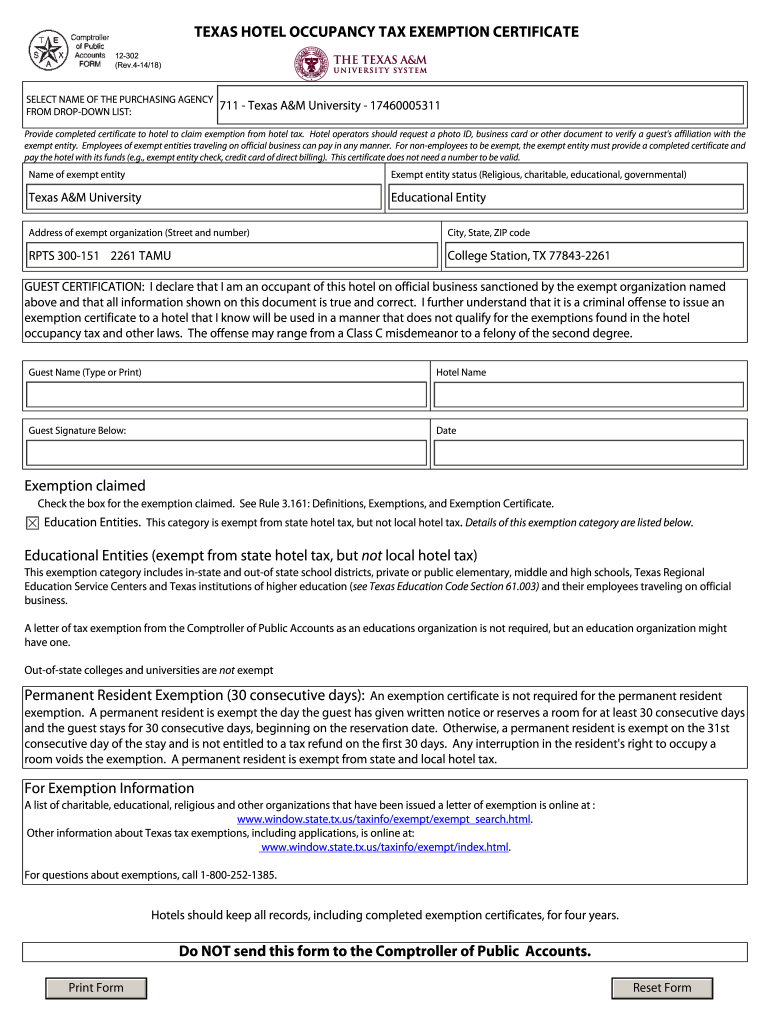

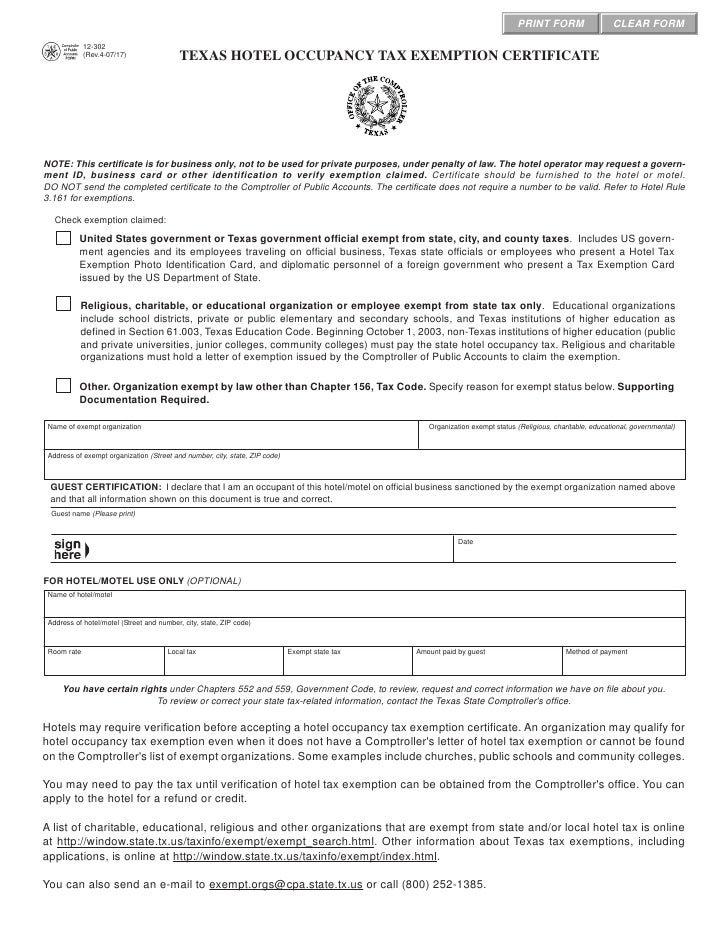

Hotel Tax Exemption Form Texas - Web a permanent resident is exempt from state and local hotel tax. Web sales tax is not exempted under the current sales tax law, since the payment of hotel/motel bills by an employee is not considered to be payment made directly by a state agency. When traveling within the state of texas, using local funds or state funds, we are considered exempt from the texas hotel occupancy tax. Web (2) the rental of a room or space in a hotel is exempt from tax if the person required to collect the tax receives, in good faith from a guest, a properly completed exemption. Web (a) the right to use or possess a room or space in a hotel is exempt from taxation under this chapter if the person required to collect the tax receives, in good faith from a guest,. This certificate is for business only, not to be used for private purposes, under penalty of law. Hotel operators should request a photo id, business card or other document to verify a guest’s afiliation. Streamline the entire lifecycle of exemption certificate management. (an individual must present a hotel tax exemption photo id. Web this category is exempt from state and local hotel tax. When traveling within the state of texas, using local funds or state funds, we are considered exempt from the texas hotel occupancy tax. Web texas hotel occupancy tax exemption certificate description: This certificate is for business only, not to be used for private purposes, under penalty of law. Web hotel occupancy tax exemption. Ad collect and report on exemption certificates. Web sales tax is not exempted under the current sales tax law, since the payment of hotel/motel bills by an employee is not considered to be payment made directly by a state agency. Web provide completed certificate to hotel to claim exemption from hotel tax. Web (2) the rental of a room or space in a hotel is exempt from. (an individual must present a hotel tax exemption photo id. Leave top portion of form filled in as is leave “educational entities” checked complete guest. Web provide completed certificate to hotel to claim exemption from hotel tax. When traveling within the state of texas, using local funds or state funds, we are considered exempt from the texas hotel occupancy tax.. Ad collect and report on exemption certificates quickly to save your company time and money. Ad collect and report on exemption certificates quickly to save your company time and money. Web (2) the rental of a room or space in a hotel is exempt from tax if the person required to collect the tax receives, in good faith from a. Texas comptroller of public accounts form used by utsa employees to claim exemption from. Are local government agencies and their employees exempt from hotel taxes? Web sales tax is not exempted under the current sales tax law, since the payment of hotel/motel bills by an employee is not considered to be payment made directly by a state agency. Leave top. Texas tax code chapter 351 and tax code chapter 352 give. Web texas hotel occupancy tax exemption certificate. Ad collect and report on exemption certificates quickly to save your company time and money. Are local government agencies and their employees exempt from hotel taxes? This certificate is for business only, not to be used for private purposes, under penalty of. Web texas hotel occupancy tax exemption certificate description: Web the purpose of the local hotel occupancy tax is to promote tourism and the convention and hotel industry. Web to provide tax exemption certificate to hotel to claim exemption from hotel tax. Web this category is exempt from state and local hotel tax. (an individual must present a hotel tax exemption. This certificate is for business only, not to be used for private purposes, under penalty of law. Web (2) the rental of a room or space in a hotel is exempt from tax if the person required to collect the tax receives, in good faith from a guest, a properly completed exemption. Texas comptroller of public accounts form used by. Ad collect and report on exemption certificates quickly to save your company time and money. Travelers are exempt from state. Web hotel occupancy tax use this form when traveling within the state of texas. Web a permanent resident is exempt from state and local hotel tax. Web (2) the rental of a room or space in a hotel is exempt. This certificate is for business only, not to be used for private purposes, under penalty of law. Streamline the entire lifecycle of exemption certificate management. Web this category is exempt from state and local hotel tax. (an individual must present a hotel tax exemption photo id. Web a permanent resident is exempt from state and local hotel tax. Web are texas state agencies and their employees exempt from hotel taxes? Web sales tax is not exempted under the current sales tax law, since the payment of hotel/motel bills by an employee is not considered to be payment made directly by a state agency. Web to provide tax exemption certificate to hotel to claim exemption from hotel tax. Streamline the entire lifecycle of exemption certificate management. This certificate is for business only, not to be used for private purposes, under penalty of law. Web hotel occupancy tax exemption. Texas state government officials and employees. Ad collect and report on exemption certificates quickly to save your company time and money. Streamline the entire lifecycle of exemption certificate management. For exemption information list of charitable, educational, religious and other organizations that have been issued a. Web traveling on official business, state of texas officials who present a hotel tax exemption photo identification card, and diplomatic personnel of a foreign. Web hotel occupancy tax use this form when traveling within the state of texas. (an individual must present a hotel tax exemption photo id. Web (2) the rental of a room or space in a hotel is exempt from tax if the person required to collect the tax receives, in good faith from a guest, a properly completed exemption. Hotel operators should request a photo id, business card or other document to verify a guest’s afiliation. Web (a) the right to use or possess a room or space in a hotel is exempt from taxation under this chapter if the person required to collect the tax receives, in good faith from a guest,. Texas tax code chapter 351 and tax code chapter 352 give. Web texas hotel occupancy tax exemption certificate. Web the purpose of the local hotel occupancy tax is to promote tourism and the convention and hotel industry. Travelers are exempt from state.Fillable Request To Attend / Expense Sheet For Employee Travel, Form 12

Fillable Texas Hotel Occupancy Tax Exemption Certificate printable pdf

FREE 10+ Sample Tax Exemption Forms in PDF

Texas Hotel Tax Exempt Form Fillable Printable Forms Free Online

Hotel Tax Exempt Form

Texas hotel tax exempt form 2014 Fill out & sign online DocHub

Texas Hotel Occupancy Tax Forms12302 Texas Hotel Occupancy Tax Exem…

Hotel Tax Exempt Form

Hotel Tax Exempt Form

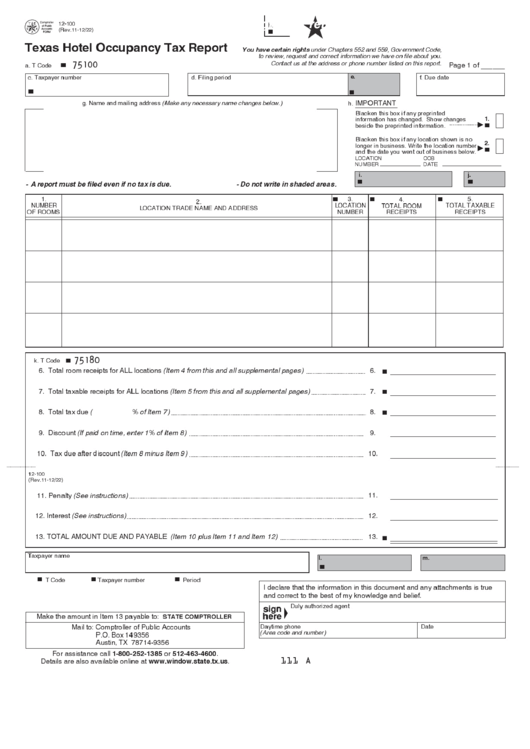

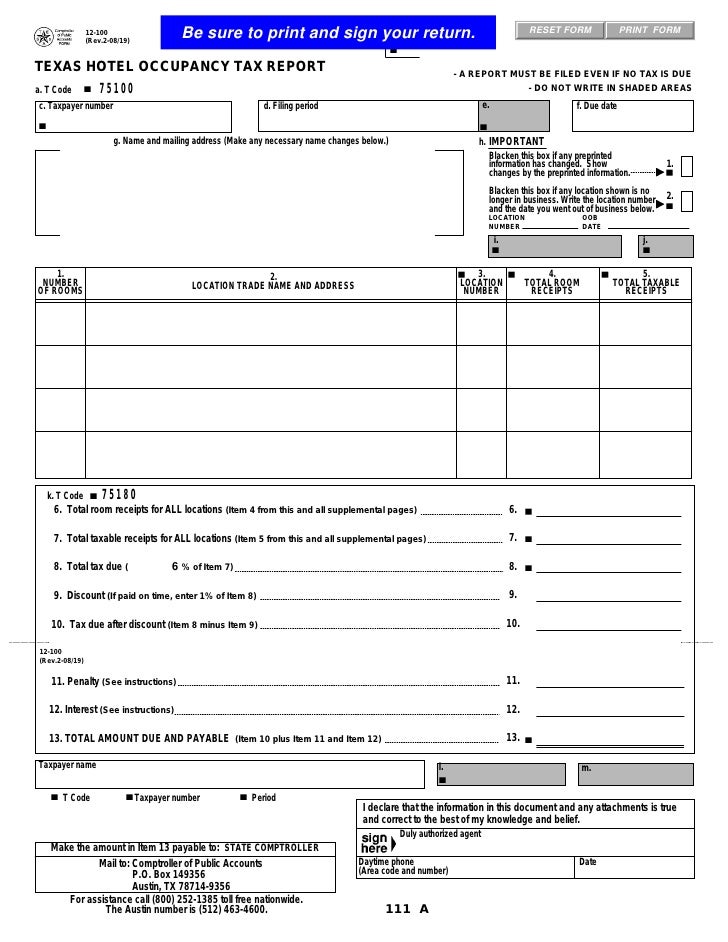

Texas Hotel Occupancy Tax Forms12100 Hotel Occupancy Tax Report

Related Post: