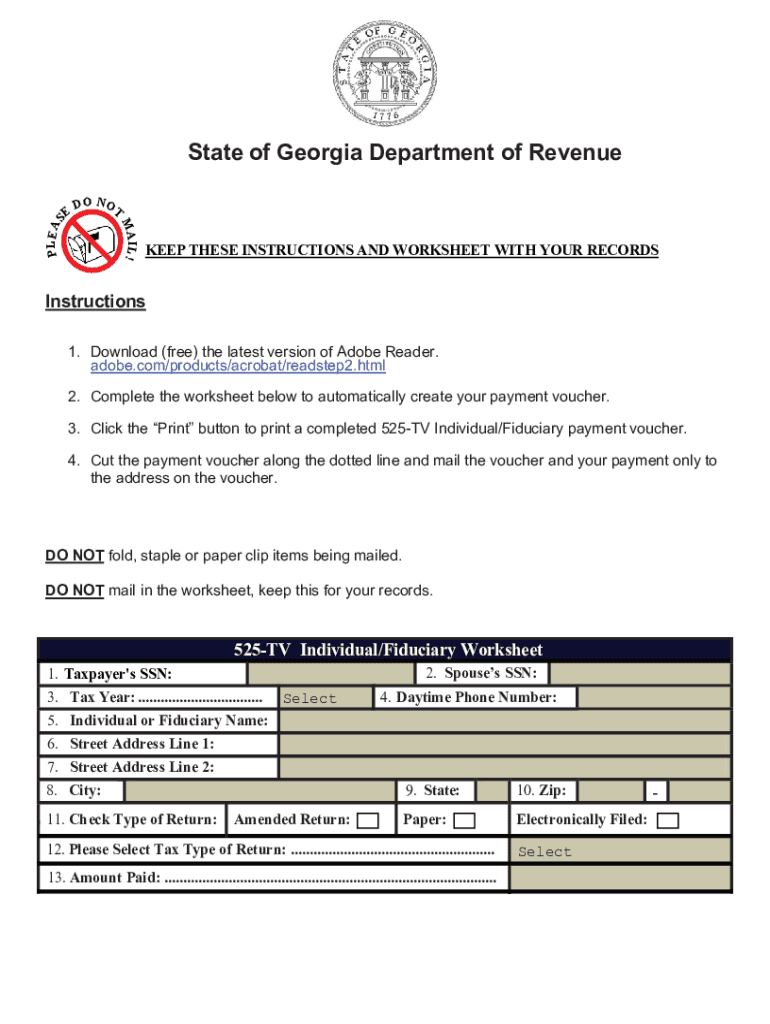

Ga Form 525-Tv

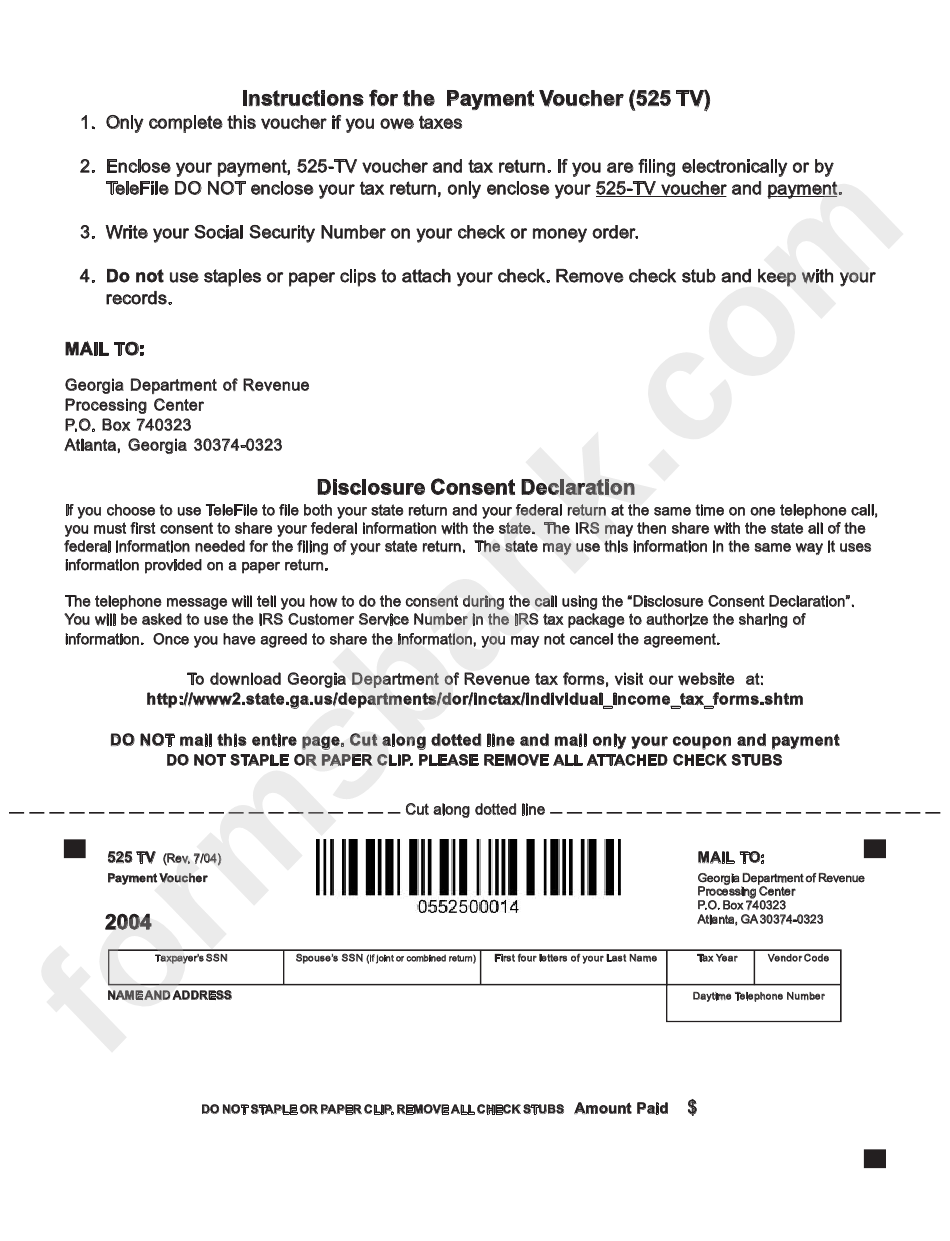

Ga Form 525-Tv - Web the georgia form 525 tv template is a form with fillable fields where one can place information, i.e., fill it out on the web. Save or instantly send your ready documents. Web you are not required to submit 1099 forms with your georgia return unless georgia income tax was withheld. Easily fill out pdf blank, edit, and sign them. To successfully complete the form, you must download and use. Only complete this voucher if you owe taxes. Taxpayer’s ssn or fiduciary fein spouse’s ssn (if joint or. Short individual income tax return georgia department of revenue. Web on this page, find options available for paying your individual income tax, corporate income tax, and georgia department of revenue assessed liabilities using the georgia tax. This form is for income earned in tax year 2022, with tax returns due in april. Make check for this amount. Taxpayer’s ssn or fiduciary fein spouse’s ssn (if joint or. This form is for income earned in tax year 2022, with tax returns due in april. Web on this page, find options available for paying your individual income tax, corporate income tax, and georgia department of revenue assessed liabilities using the georgia tax. Online tax. Easily fill out pdf blank, edit, and sign them. Web on this page, find options available for paying your individual income tax, corporate income tax, and georgia department of revenue assessed liabilities using the georgia tax. To successfully complete the form, you must download and use. Web the georgia form 525 tv template is a form with fillable fields where. Only complete this voucher if you owe taxes. Easily fill out pdf blank, edit, and sign them. Use a payment voucher with a valid scanline. Web the georgia form 525 tv template is a form with fillable fields where one can place information, i.e., fill it out on the web. Web on this page, find options available for paying your. Web 525 tv (rev.1/10) payment voucher paper return electronically filed taxpayer’s ssn or fiduciary fein spouse’s ssn (if joint or combined return) first four letters of your last. Make check for this amount. Online tax forms have been made to help. Taxpayer’s ssn or fiduciary fein spouse’s ssn (if joint or. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Web the georgia form 525 tv template is a form with fillable fields where one can place information, i.e., fill it out on the web. Web you are not required to submit 1099 forms with your georgia return unless georgia income tax was withheld. Save or instantly send your ready documents.. 04/01/21) individual and fiduciary payment voucher individual or fiduciary name and address: This form is for income earned in tax year 2022, with tax returns due in april. Make check for this amount. Online tax forms have been made to help. Use a payment voucher with a valid scanline. This form is for income earned in tax year 2022, with tax returns due in april. Online tax forms have been made to help. Make check for this amount. Web on this page, find options available for paying your individual income tax, corporate income tax, and georgia department of revenue assessed liabilities using the georgia tax. Web you are not. Web on this page, find options available for paying your individual income tax, corporate income tax, and georgia department of revenue assessed liabilities using the georgia tax. Web you are not required to submit 1099 forms with your georgia return unless georgia income tax was withheld. Save or instantly send your ready documents. Web 525 tv (rev.1/10) payment voucher paper. To successfully complete the form, you must download and use. Use a payment voucher with a valid scanline. Online tax forms have been made to help. Web the georgia form 525 tv template is a form with fillable fields where one can place information, i.e., fill it out on the web. This form is for income earned in tax year. Web the georgia form 525 tv template is a form with fillable fields where one can place information, i.e., fill it out on the web. Web on this page, find options available for paying your individual income tax, corporate income tax, and georgia department of revenue assessed liabilities using the georgia tax. Web you are not required to submit 1099. Web you are not required to submit 1099 forms with your georgia return unless georgia income tax was withheld. Web 525 tv (rev.1/10) payment voucher paper return electronically filed taxpayer’s ssn or fiduciary fein spouse’s ssn (if joint or combined return) first four letters of your last. Short individual income tax return georgia department of revenue. Web on this page, find options available for paying your individual income tax, corporate income tax, and georgia department of revenue assessed liabilities using the georgia tax. Only complete this voucher if you owe taxes. Taxpayer’s ssn or fiduciary fein spouse’s ssn (if joint or. To successfully complete the form, you must download and use. Make check for this amount. Use a payment voucher with a valid scanline. Save or instantly send your ready documents. Web the georgia form 525 tv template is a form with fillable fields where one can place information, i.e., fill it out on the web. Easily fill out pdf blank, edit, and sign them. Online tax forms have been made to help. 04/01/21) individual and fiduciary payment voucher individual or fiduciary name and address: This form is for income earned in tax year 2022, with tax returns due in april.2020 Form GA DoR 525TV Fill Online, Printable, Fillable, Blank pdfFiller

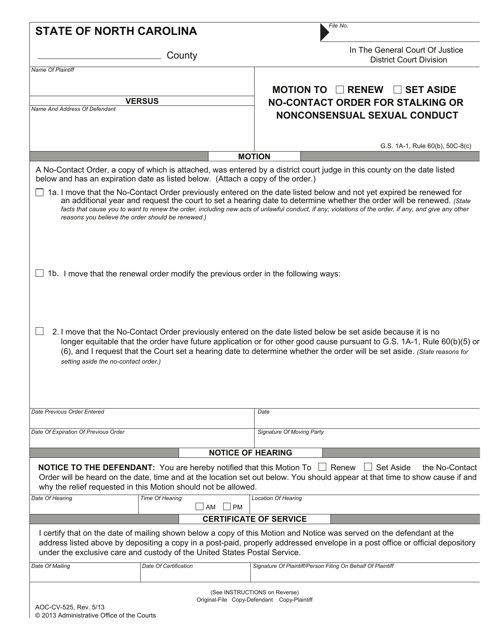

Form AOCCV525 Fill Out, Sign Online and Download Fillable PDF

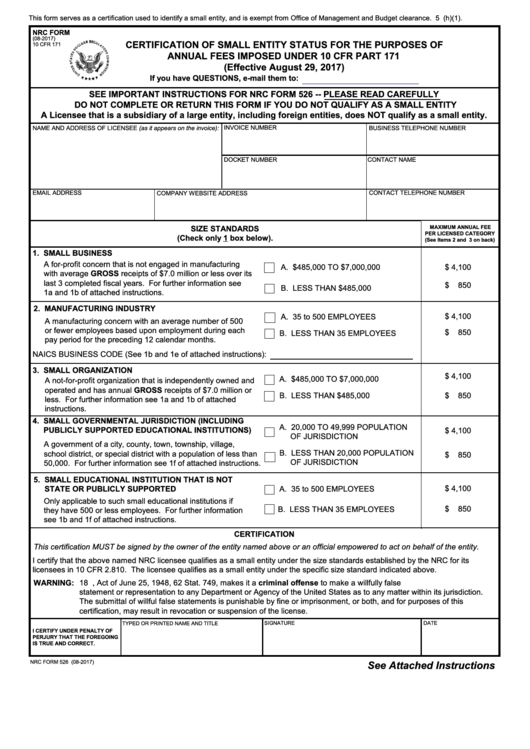

Fillable Nrc Form 525 Nrc Form 525 printable pdf download

Form 525 Tv Payment Voucher Department Of Revenue printable

CR125/JV525 Order to Attend Court or Provide Documents Subpoena Free

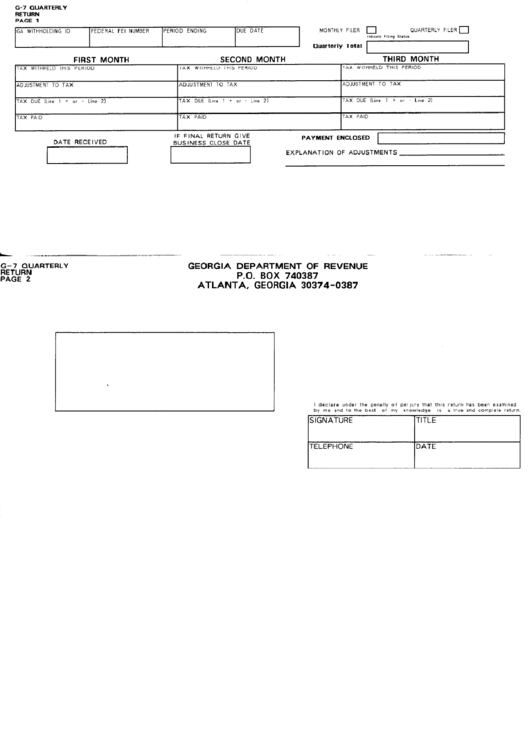

Fillable Form G7 Quarterly Return Department Of Revenue

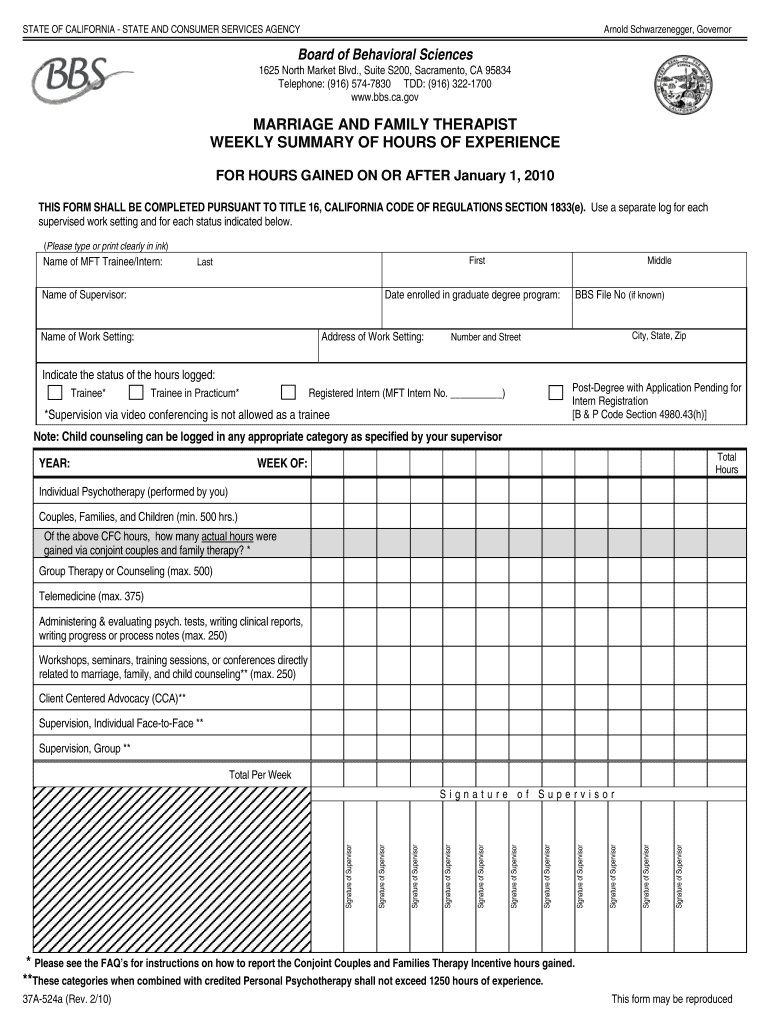

BBS Form 37a 524a CFC Hours Fill Out and Sign Printable PDF Template

repair addendum form Fill out & sign online DocHub

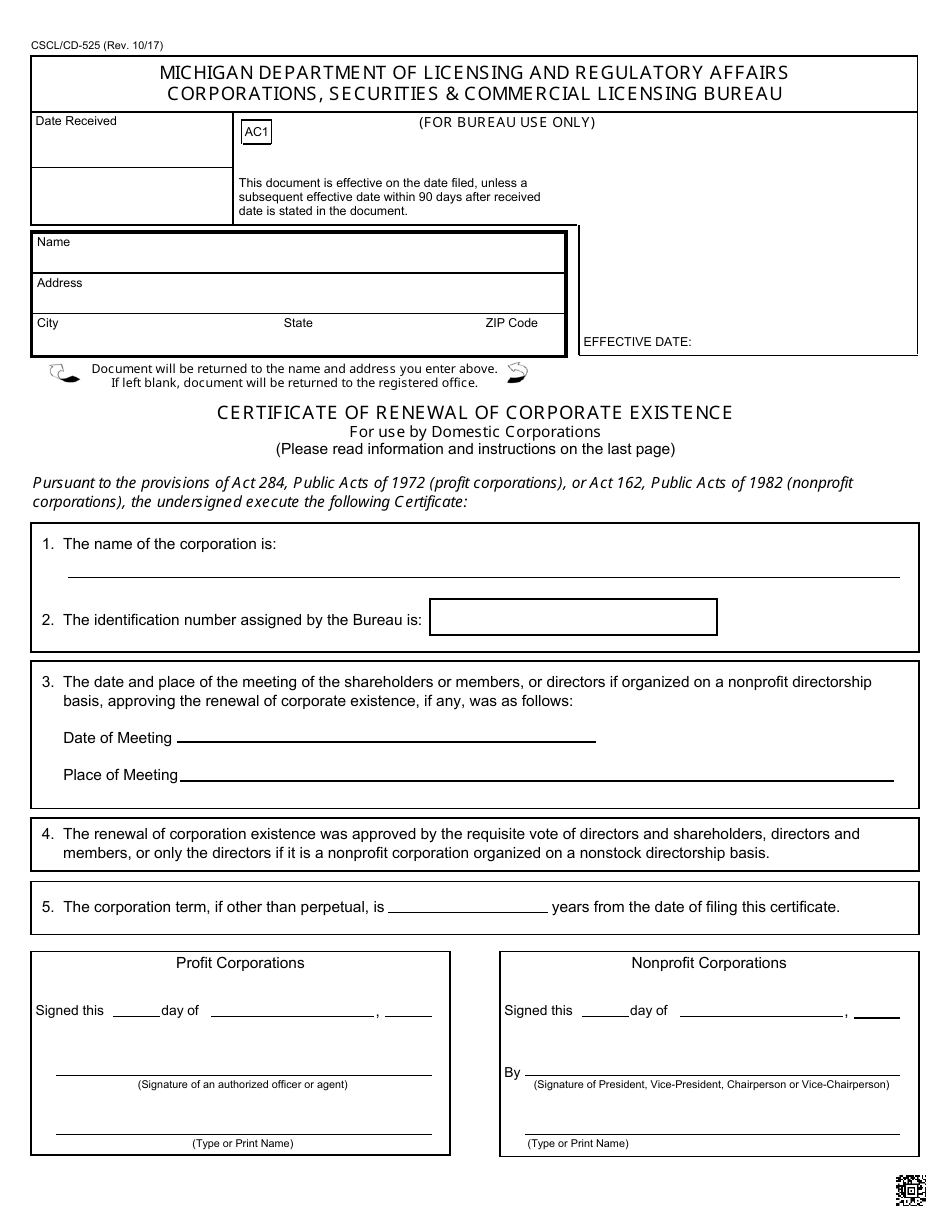

Form CSCL/CD525 Download Fillable PDF or Fill Online Certificate of

Form CD 525 Download Printable PDF, Notice of Intent to Dissolve

Related Post: