Instructions Form 4972

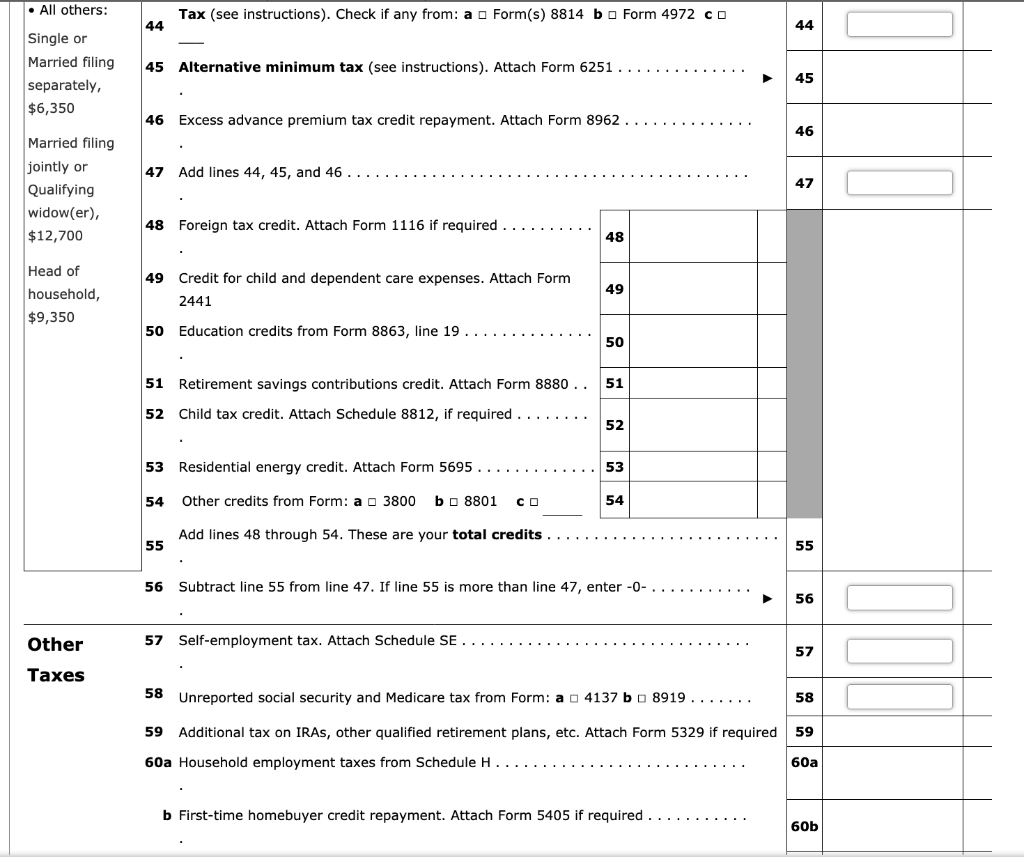

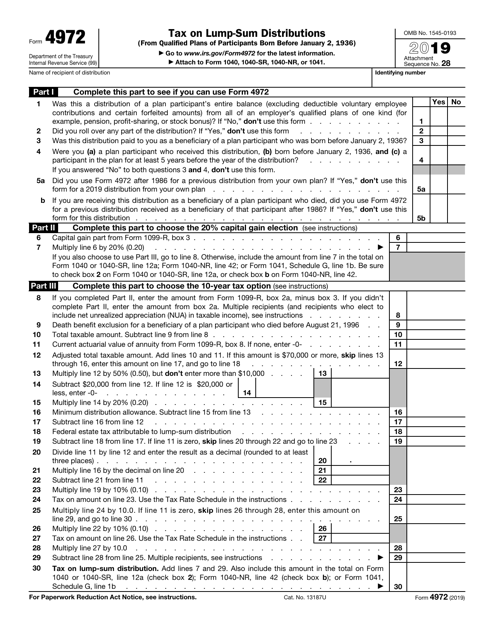

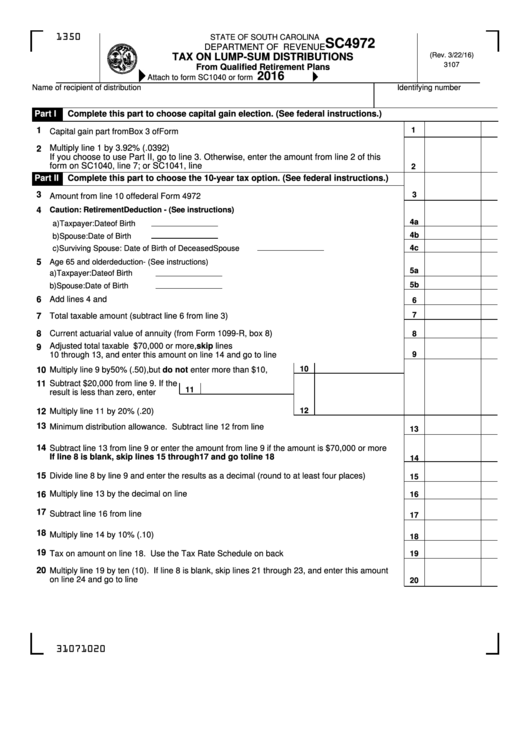

Instructions Form 4972 - Be sure to check box. Web some forms and instructions also available in: Gain from line 6 of federal form 4972. Complete only part 2, line 1, and the income percentage schedule on. Use screen 1099r in the income folder to complete form 4972. Web help deciphering tax forms and instructions provided by the internal revenue service (irs) can be daunting. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Instructions for this form are included with the form, which is available. Or form 1041, schedule g, line 1b. This lets me use form 4972. Who can use the form c. Be sure to check box. Web the purpose of form 4972 and instructions to fill it the purpose. Do not misread the statement, it means that the form is filled. Web what is irs form 4972 used for? Irs form 4972 is considered one of the more complex forms for. Tax form 4972 is used for reducing taxes. Do not misread the statement, it means that the form is filled. Who can use the form c. Get ready for tax season deadlines by completing any required tax forms today. Do not misread the statement, it means that the form is filled. This lets me use form 4972. Web some forms and instructions also available in: Get ready for tax season deadlines by completing any required tax forms today. See the form 4972 instructions. Web (see instructions).on federal form 4972 for the period of new york residence only nonresidents: This lets me use form 4972. See the form 4972 instructions. Get ready for tax season deadlines by completing any required tax forms today. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Instructions for this form are included with the form, which is available. Web (see instructions).on federal form 4972 for the period of new york residence only nonresidents: Or form 1041, schedule g, line 1b. Complete only part 2, line. Or form 1041, schedule g, line 1b. Tax form 4972 is used for reducing taxes. Gain from line 6 of federal form 4972. Instructions for this form are included with the form, which is available. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Free, fast, full version (2023) available! Web some forms and instructions also available in: Irs form 4972 is considered one of the more complex forms for. Instructions for this form are included with the form, which is available. Complete only part 2, line 1, and the income percentage schedule on. The federal tax difference between. Web (see instructions).on federal form 4972 for the period of new york residence only nonresidents: Tax form 4972 is used for reducing taxes. Web regulatory and legislative. Or form 1041, schedule g, line 1b. Get ready for tax season deadlines by completing any required tax forms today. Web the purpose of form 4972 and instructions to fill it the purpose. Tax form 4972 is used for reducing taxes. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Use screen 1099r in the income folder to complete form 4972. Web help deciphering tax forms and instructions provided by the internal revenue service (irs) can be daunting. I answered the questions for lines 1 through 5b. Or form 1041, schedule g, line 1b. Web form 4972 (2008) section references are to the internal revenue code. Ad download or email irs 4972 & more fillable forms, register and subscribe now! The federal tax difference between. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Do not misread the statement, it means that the form is filled. Get ready for tax season deadlines by completing any required tax forms today. Web department of the treasury internal revenue service (99) i n format ibuf 4972d sc vle w.g / attach to form 1040, form 1040nr, or form 1041. Irs form 4972 is considered one of the more complex forms for. See the form 4972 instructions. Be sure to check box. Use distribution code a and answer. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Or form 1041, schedule g, line 1b. Who can use the form c. Web the purpose of form 4972 and instructions to fill it the purpose. Gain from line 6 of federal form 4972. I answered the questions for lines 1 through 5b. Web follow these steps to generate form 4972 in the program: Web what is irs form 4972 used for? Web form 4972 (2008) section references are to the internal revenue code. Web (see instructions).on federal form 4972 for the period of new york residence only nonresidents: Web treat this amount as a capital gain on form 4972 (not on schedule d (form 1040)).Form 4972 Tax on LumpSum Distributions (2015) Free Download

Note This Problem Is For The 2017 Tax Year. Janic...

Form 4972 Tax on LumpSum Distributions (2015) Free Download

IRS Form 4972 Instructions Lump Sum Distributions

Form 4972 Tax on LumpSum Distributions (2015) Free Download

IRS Form 4972 Instructions Lump Sum Distributions

IRS Form 4972 2019 Fill Out, Sign Online and Download Fillable PDF

2019 IRS Form 4972 Fill Out Digital PDF Sample

IRS Form 4972 Instructions Lump Sum Distributions

Sc4972 Tax On Lump Sum Distributions printable pdf download

Related Post: