Ftb Form 3537

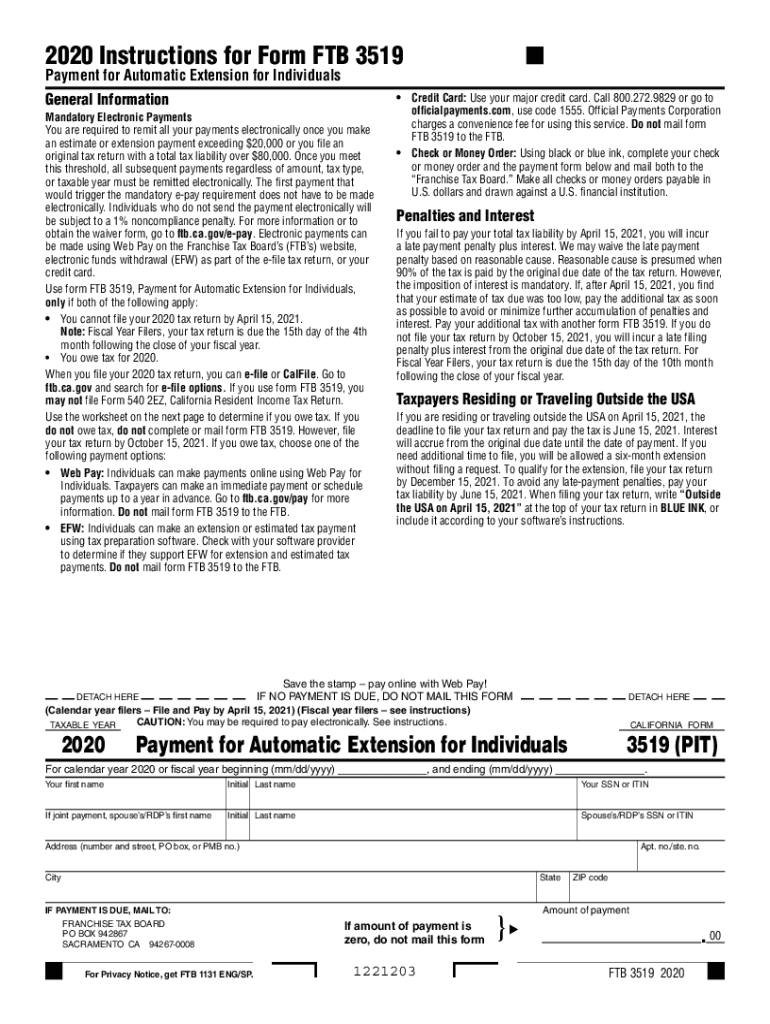

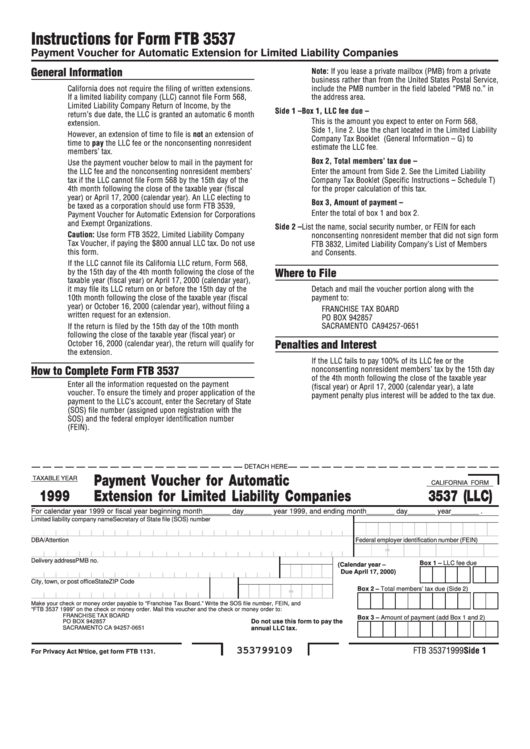

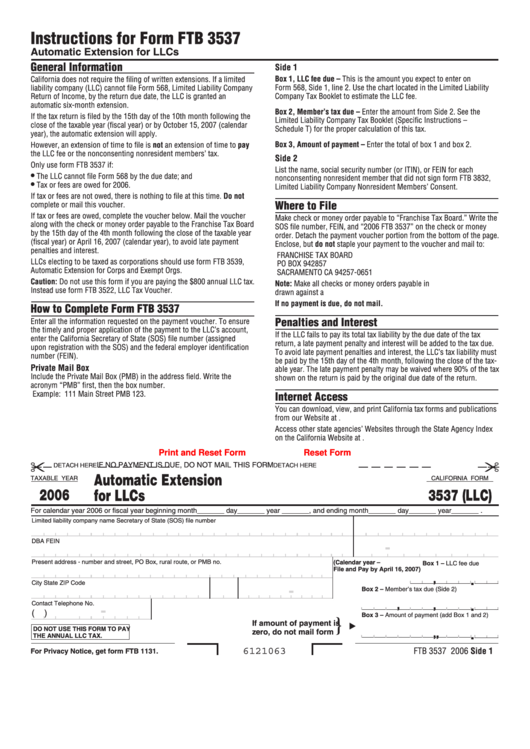

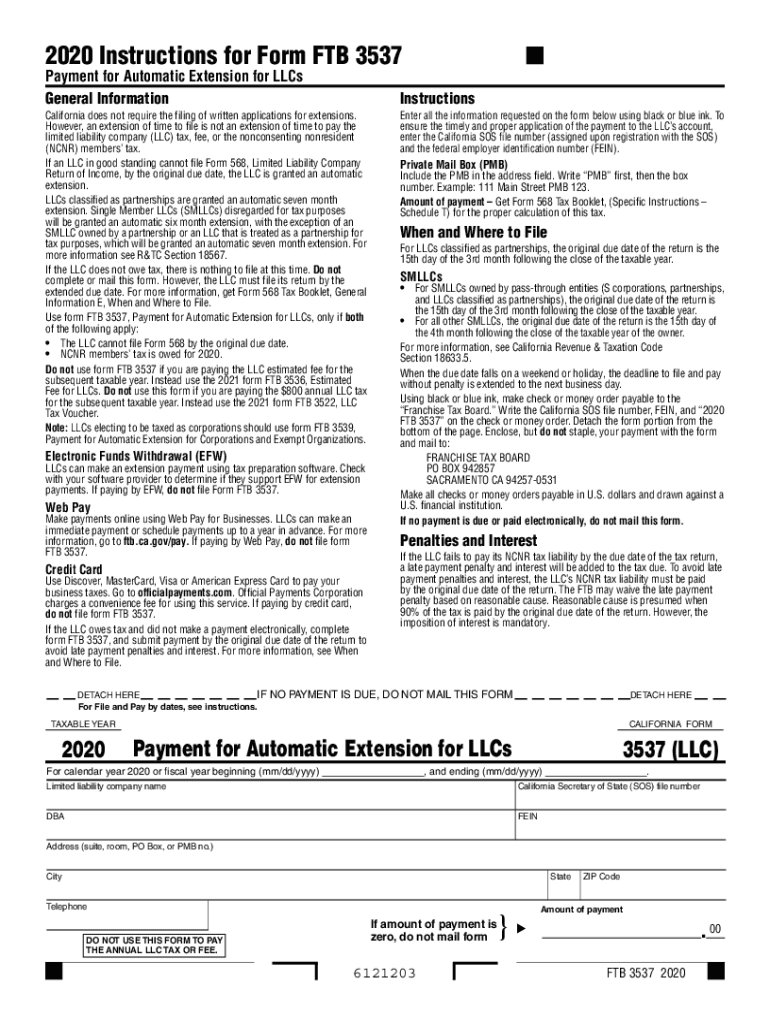

Ftb Form 3537 - Form 3536 only needs to be filed if your income is $250,000. If you're over age 65, this increases to $11,950. Web use form ftb 3537, only if both of the following apply: Web the limited liability company should submit form 3537, payment voucher for automatic extension for limited liability company with their payment. You cannot file your 2022 tax return by. Web if the limited liability company has not paid its llc fee or nonconsenting members tax by the original due date of the return, the partnership should use payment for automatic. Form ftb 3537, and submit payment by the original due date of the return to. Web general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and must make an estimated fee payment by the 15th day of the 6th. Solved•by intuit•97•updated august 22, 2023. Web income tax forms form 3537 (llc) california — payment for automatic extension for llcs download this form print this form it appears you don't have a pdf plugin for. Pay a $34 installment agreement fee, which we will add to your tax liability. Form 3536 only needs to be filed if your income is $250,000. Nonconsenting nonresident members’ tax is owed for 2016. This article will review options. Web purpose of this form. If the llc owes tax and did not make a payment electronically, complete. Web the limited liability company should submit form 3537, payment voucher for automatic extension for limited liability company with their payment. • the llc cannot file form 568 by the original due date. What is the limited liability. The fee amount is subject to change without further. Web purpose of this form. Generating ca form 568 in the partnership module of lacerte. This article will review options. Web income tax forms form 3537 (llc) california — payment for automatic extension for llcs download this form print this form it appears you don't have a pdf plugin for. Web the limited liability company should submit form 3537, payment. Nonconsenting nonresident members’ tax is owed for 2016. Web general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and must make an estimated fee payment by the 15th day of the 6th. Web here is a basic breakdown for filing: Web pay all future income tax liabilities timely. Web use form. What is the limited liability. Form 3536 only needs to be filed if your income is $250,000. Generating ca form 568 in the partnership module of lacerte. If you're over age 65, this increases to $11,950. Web “franchise tax board.” write the california sos fle number, fein, and “2015 ftb 3537” on the check or money order. • the llc cannot file form 568 by the original due date. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Web “franchise tax board.” write the california sos fle number, fein, and “2015 ftb 3537” on the check or money order. Form ftb 3537, and. Web use form ftb 3537 if you are paying the llc estimated fee for the subsequent taxable year. However, with our predesigned online templates, everything gets. Form ftb 3537, and submit payment by the original due date of the return to. Web if the limited liability company has not paid its llc fee or nonconsenting members tax by the original. Free, fast, full version (2023) available! The fee amount is subject to change without further notice. • ncnr members’ tax is. Web open the form 3537 california 2021 and follow the instructions easily sign the 2022 california llc with your finger send filled & signed 2022 llc or save handy tips for filling out. What is the limited liability. The fee amount is subject to change without further notice. Web if the limited liability company has not paid its llc fee or nonconsenting members tax by the original due date of the return, the partnership should use payment for automatic. Form 3536 only needs to be filed if your income is $250,000. Pay a $34 installment agreement fee, which. Web purpose of this form. Generating ca form 568 in the partnership module of lacerte. Web open the form 3537 california 2021 and follow the instructions easily sign the 2022 california llc with your finger send filled & signed 2022 llc or save handy tips for filling out. Web general information the limited liability company (llc) must estimate the fee. Web open the form 3537 california 2021 and follow the instructions easily sign the 2022 california llc with your finger send filled & signed 2022 llc or save handy tips for filling out. What is the limited liability. Use payment for automatic extension for individuals (ftb 3519) to make a payment by mail if both of the following apply: If you're over age 65, this increases to $11,950. If you're single and under age 65, then you must file if your gross income was at least $10,400. However, with our predesigned online templates, everything gets. Web follow the simple instructions below: Web pay all future income tax liabilities timely. Web general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and must make an estimated fee payment by the 15th day of the 6th. You cannot file your 2022 tax return by. Free, fast, full version (2023) available! Web purpose of this form. Web file form ftb 3537. Web use form ftb 3537 if you are paying the llc estimated fee for the subsequent taxable year. Instead use the 2023 form ftb 3536, estimated fee for llcs. You can use this form to initiate an office of tax appeals (ota) review of a proposed tax liability, action on a request for innocent spouse relief,. Detach the form portion from the bottom of the page. • ncnr members’ tax is. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. This article will review options.ftb form 3519 Fill out & sign online DocHub

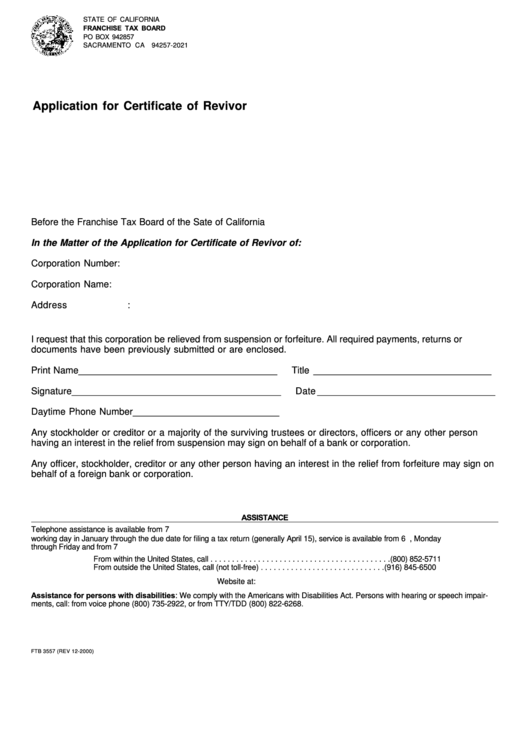

Form Ftb 3557Application For Certificate Of Revivor printable pdf download

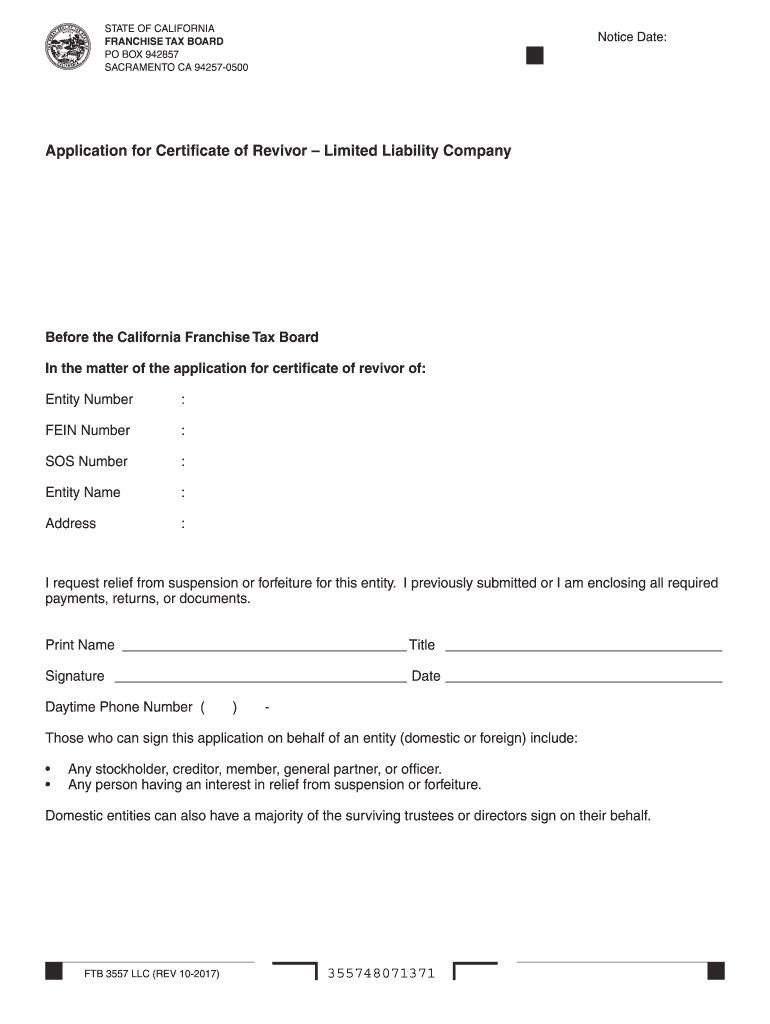

California LLC Application for Certificate of Revivor (Form FTB 3557

Form Ftb 3537 Payment Voucher For Automatic Extension For Limited

Fillable California Form 3537 (Llc) Automatic Extension For Llcs

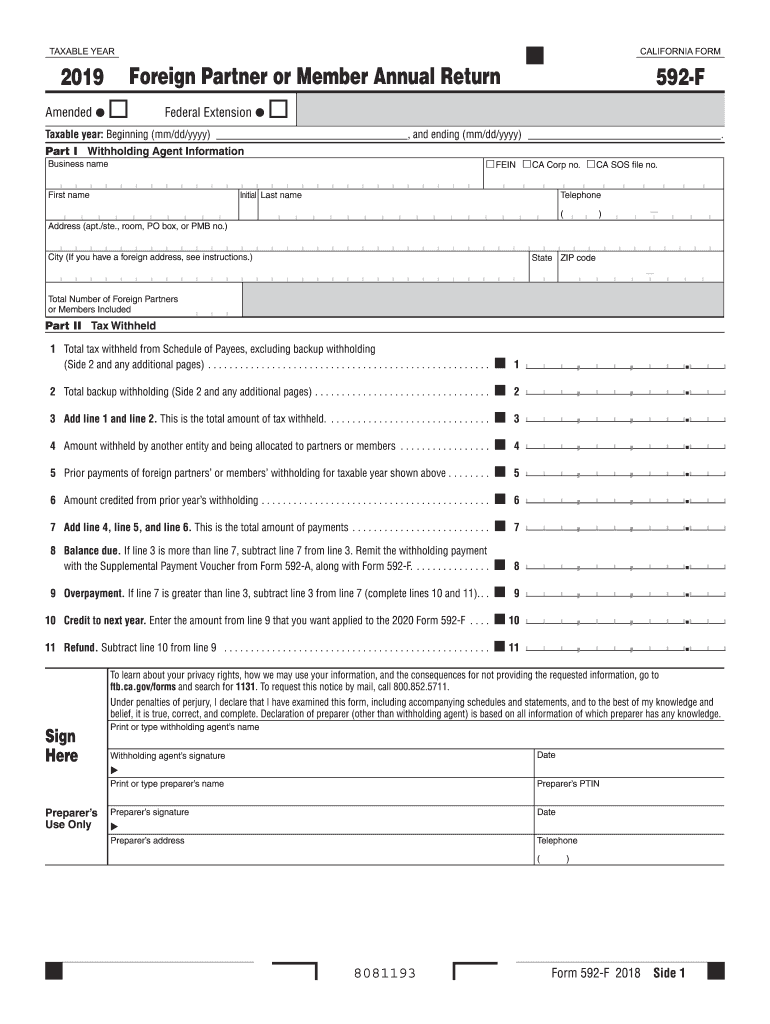

CA FTB 592F 2019 Fill out Tax Template Online US Legal Forms

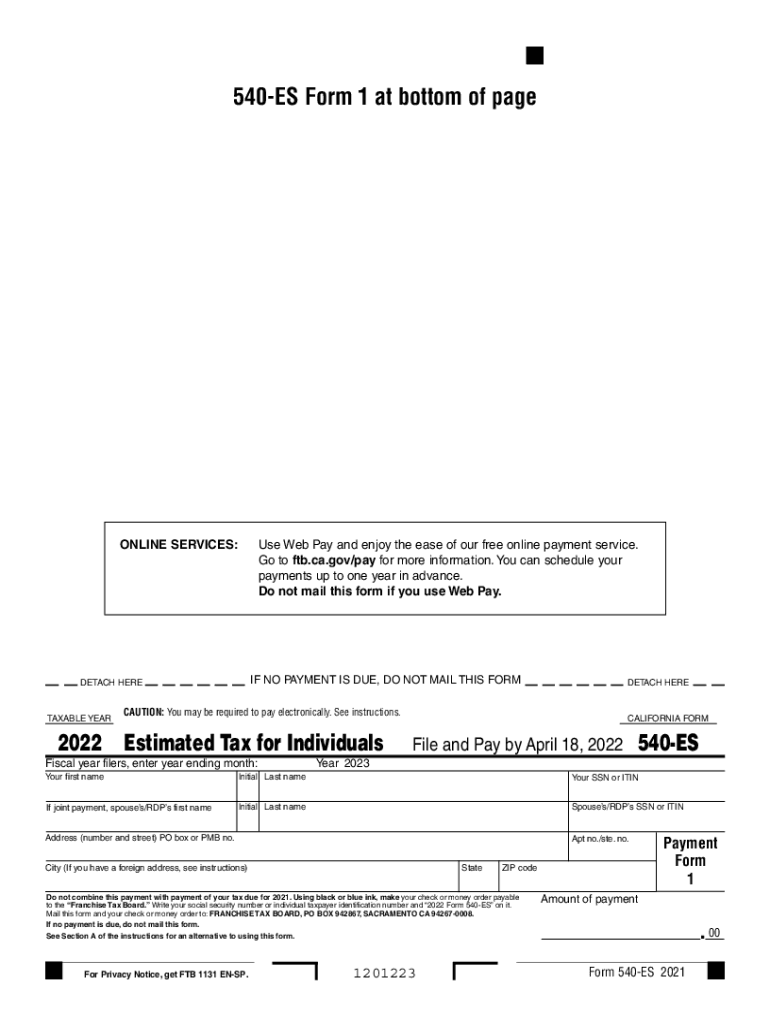

CA FTB 540ES 2022 Fill and Sign Printable Template Online US Legal

Ftb 3537 Fill out & sign online DocHub

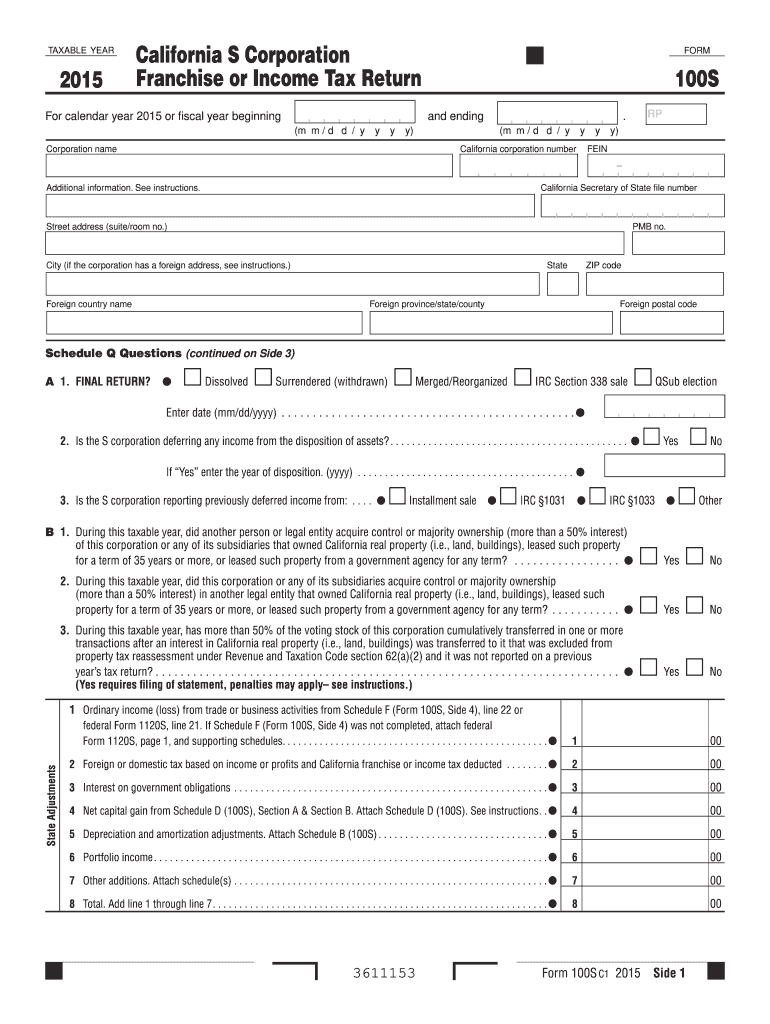

2015 Form CA FTB 100SFill Online, Printable, Fillable, Blank pdfFiller

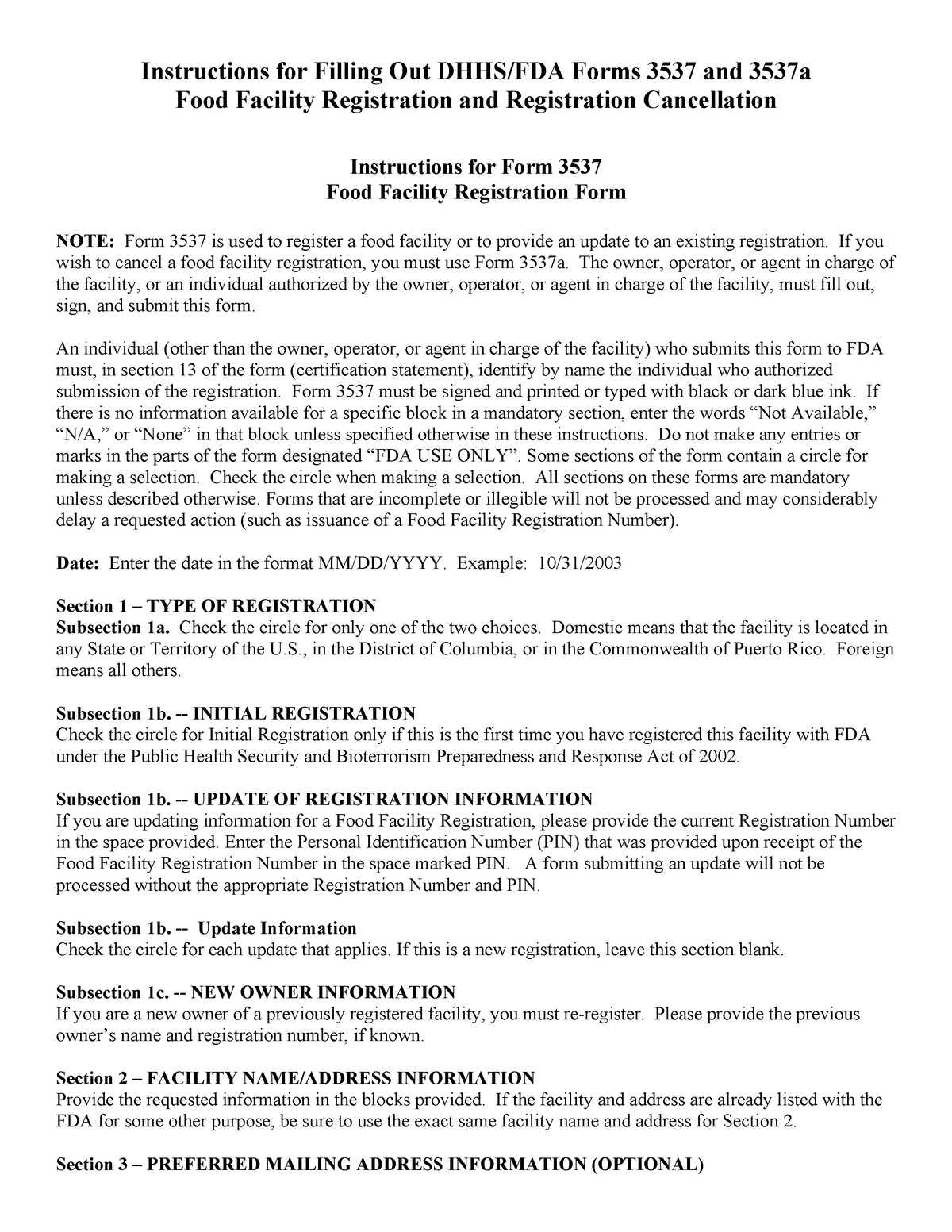

Instrucciones FORM 3537 Instructions for Filling Out DHHS/FDA Forms

Related Post: