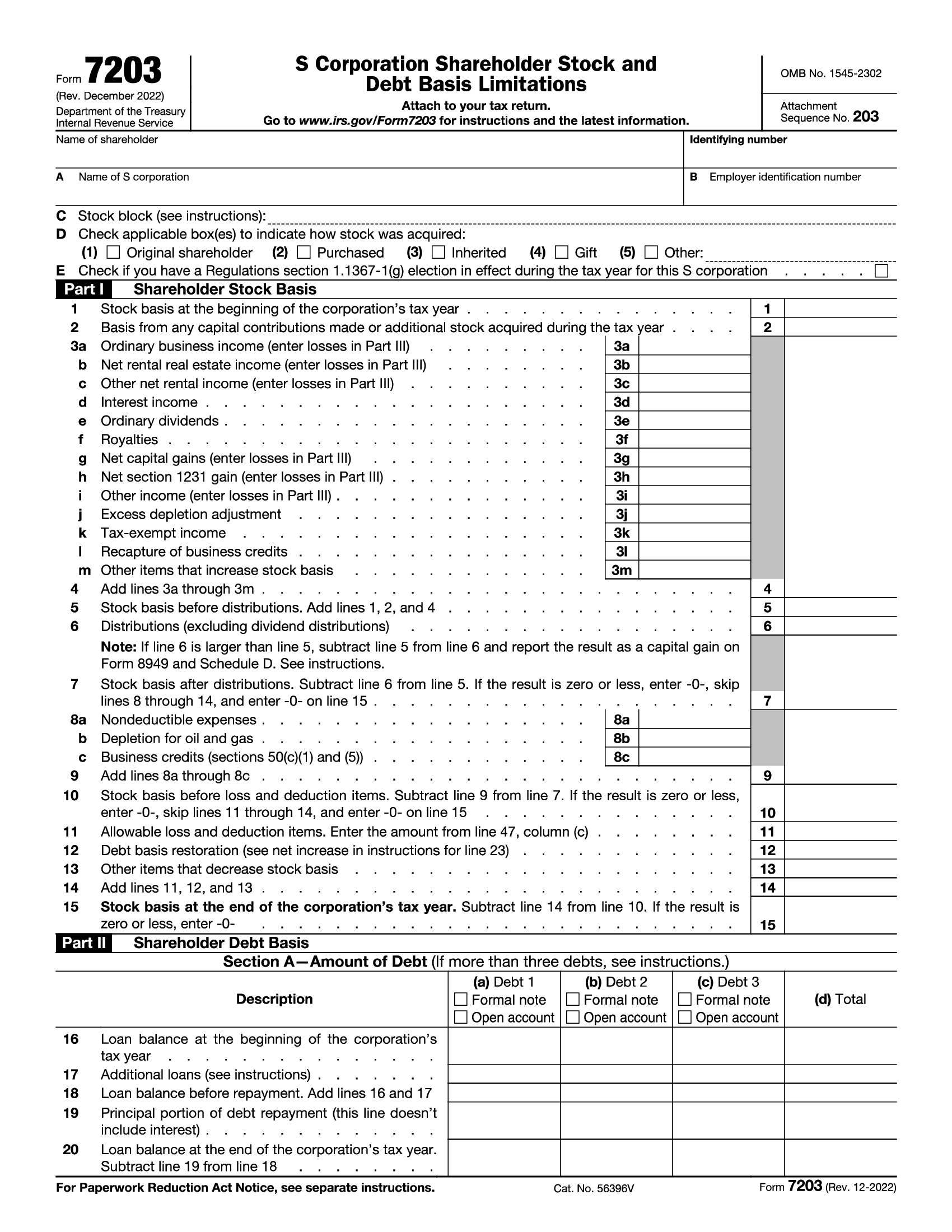

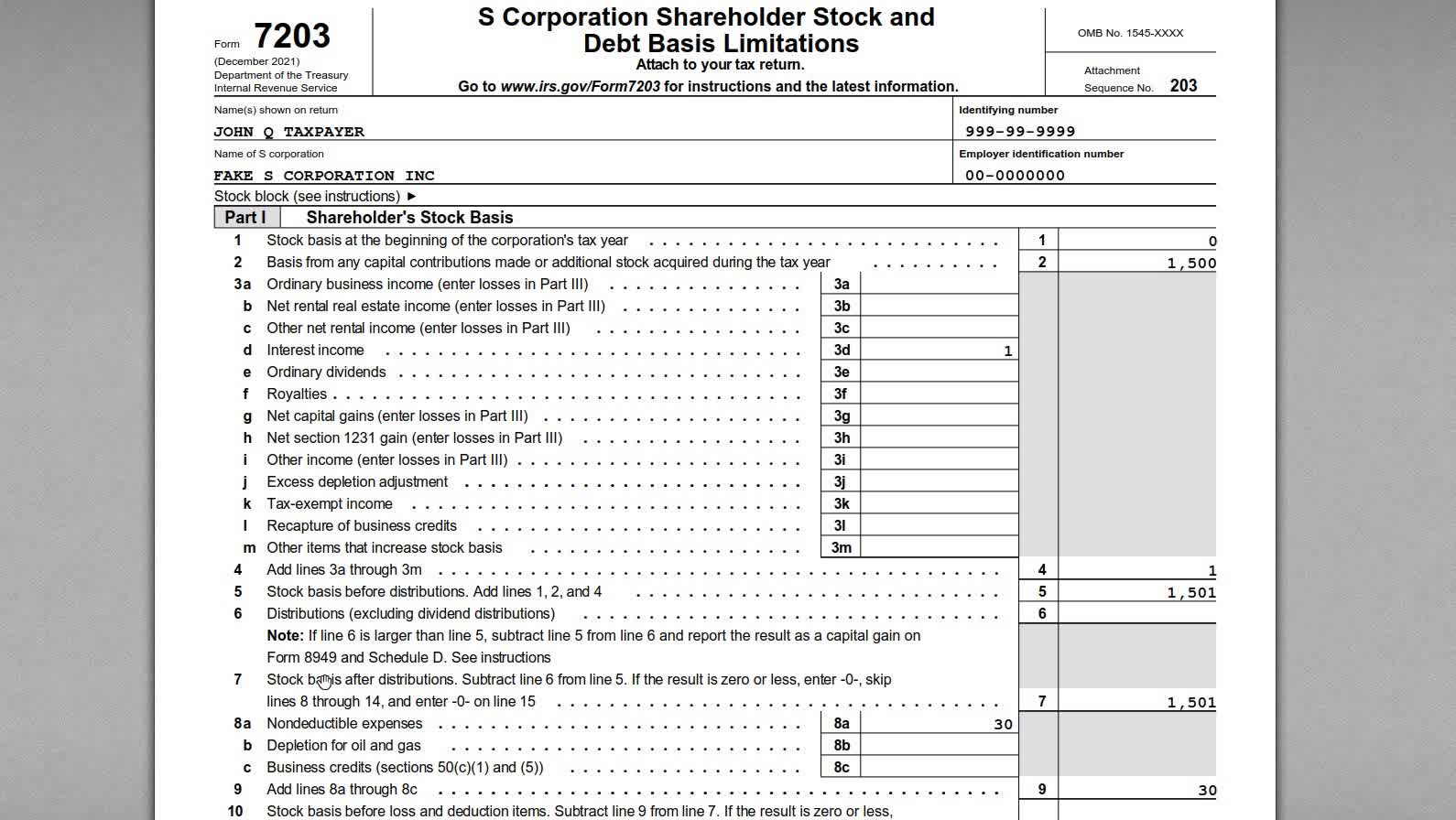

Irs Form 7203 Instructions

Irs Form 7203 Instructions - Go to www.irs.gov/form7203 for instructions and the latest information. For example, the form 1040 page is at. Shareholder allowable loss and deduction items. Web irs issues guidance for s corporation shareholders. • form 940 • form 940 schedule r. The irs recently issued a new draft form 7203, s corporation shareholder stock and debt. Web s corporation shareholders must include form 7203 (instructions can be found here) with their 2021 tax filing when the shareholder: Web 4 rows form 7203 (december 2021) department of the treasury internal revenue service. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Web the blog discussed a new form, form 7203, s corporation shareholder stock and debt basis limitations. Web the blog discussed a new form, form 7203, s corporation shareholder stock and debt basis limitations. Web 4 rows form 7203 (december 2021) department of the treasury internal revenue service. Web taxes that are scheduled to expire. Shareholder allowable loss and deduction items. Web tax year 2023 940 mef ats scenario 3 crocus company. For updates, see the 2023 4th quarter form 720 and. Other items you may find useful all form 7203 revisions about form. Web s corporation shareholders must include form 7203 (instructions can be found here) with their 2021 tax filing when the shareholder: Web effective for 2021, the internal revenue service (“irs”) requires s corporation shareholders to prepare and attach. Web instructions for form 7203 (print version) pdf recent developments none at this time. Shareholder allowable loss and deduction items. Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a new form 7203, s corporation shareholder stock and debt basis. General instructions purpose of form use form 7203 to figure potential. Web taxes that are scheduled to expire. Web instructions, and pubs is at irs.gov/forms. For example, the form 1040 page is at. Web the blog discussed a new form, form 7203, s corporation shareholder stock and debt basis limitations. The irs recently issued a new draft form 7203, s corporation shareholder stock and debt. Web effective for 2021, the internal revenue service (“irs”) requires s corporation shareholders to prepare and attach form 7203, s corporation shareholder. The draft form 7203 was posted by the irs on oct. Shareholder allowable loss and deduction items. Web s corporation shareholders must include form 7203 (instructions can be found here) with their 2021 tax filing when the shareholder:. Web 4 rows form 7203 (december 2021) department of the treasury internal revenue service. Web the blog discussed a new form, form 7203, s corporation shareholder stock and debt basis limitations. • form 940 • form 940 schedule r. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: For updates, see the 2023. • form 940 • form 940 schedule r. Web form 7203 is used to figure potential limitations of a shareholder's share of the s corporation's deductions, credits, and other items that can be deducted on their. Web tax year 2023 940 mef ats scenario 3 crocus company. Web effective for 2021, the internal revenue service (“irs”) requires s corporation shareholders. Unless extended by congress, the following taxes will expire after september 30, 2023. For example, the form 1040 page is at. The draft form 7203 was posted by the irs on oct. General instructions purpose of form use form 7203 to figure potential limitations of your. Web 4 rows form 7203 (december 2021) department of the treasury internal revenue service. Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a new form 7203, s corporation shareholder stock and debt basis. The draft form 7203 was posted by the irs on oct. Shareholder allowable loss and deduction items. Web s corporation shareholders must include form 7203 (instructions can be found here) with. Web instructions, and pubs is at irs.gov/forms. • form 940 • form 940 schedule r. Web effective for 2021, the internal revenue service (“irs”) requires s corporation shareholders to prepare and attach form 7203, s corporation shareholder. Web 4 rows form 7203 (december 2021) department of the treasury internal revenue service. Web you must complete and file form 7203 if. Web form 7203 is used to figure potential limitations of a shareholder's share of the s corporation's deductions, credits, and other items that can be deducted on their. Go to www.irs.gov/form7203 for instructions and the latest information. Web irs issues guidance for s corporation shareholders. Other items you may find useful all form 7203 revisions about form. Web tax year 2023 940 mef ats scenario 3 crocus company. Unless extended by congress, the following taxes will expire after september 30, 2023. Web taxes that are scheduled to expire. Web instructions for form 7203 (print version) pdf recent developments none at this time. Web the blog discussed a new form, form 7203, s corporation shareholder stock and debt basis limitations. The draft form 7203 was posted by the irs on oct. Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a new form 7203, s corporation shareholder stock and debt basis. • form 940 • form 940 schedule r. The irs recently issued a new draft form 7203, s corporation shareholder stock and debt. General instructions purpose of form use form 7203 to figure potential limitations of your. Web internal revenue service attach to your tax return. Shareholder allowable loss and deduction items. For updates, see the 2023 4th quarter form 720 and. Almost every form and publication has a page on irs.gov with a friendly shortcut. As of publication, form 7203 and its instructions. General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions,.IRS Form 7203. S Corporation Shareholder Stock and Debt Basis

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

National Association of Tax Professionals Blog

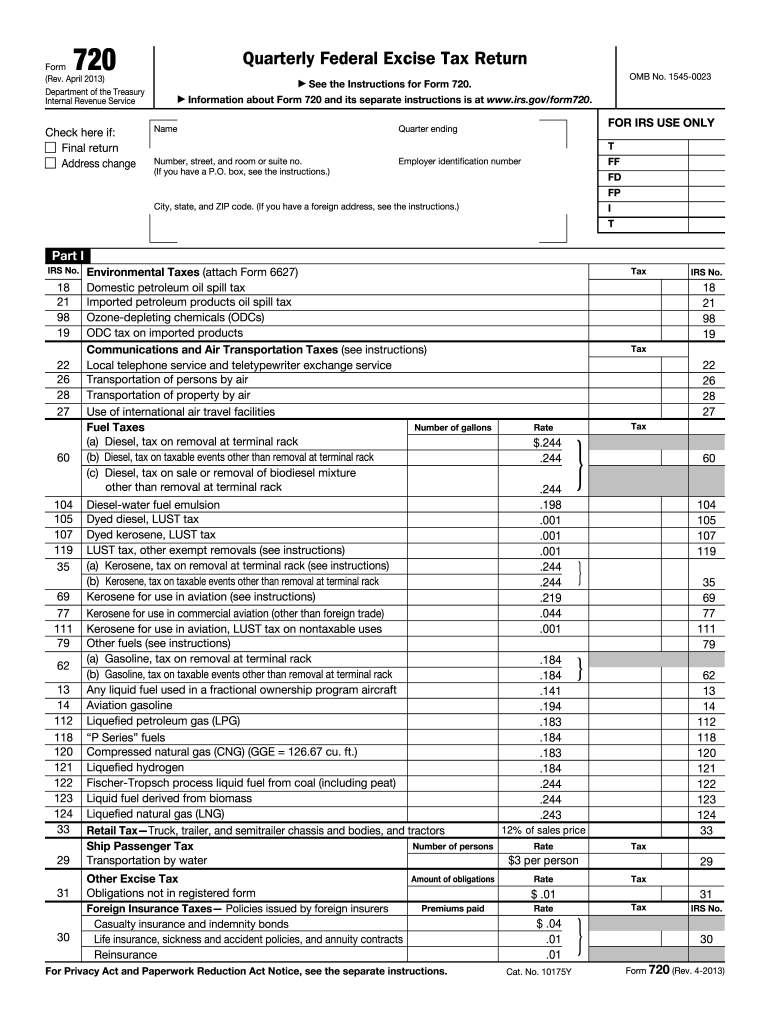

IRS Form 720 Instructions for the PatientCentered Research

How to complete IRS Form 720 for the PatientCentered Research

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

More Basis Disclosures This Year for S corporation Shareholders Need

IRS 720 2013 Fill out Tax Template Online US Legal Forms

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

How to Complete IRS Form 7203 S Corporation Shareholder Basis

Related Post: