Form Mi-1040

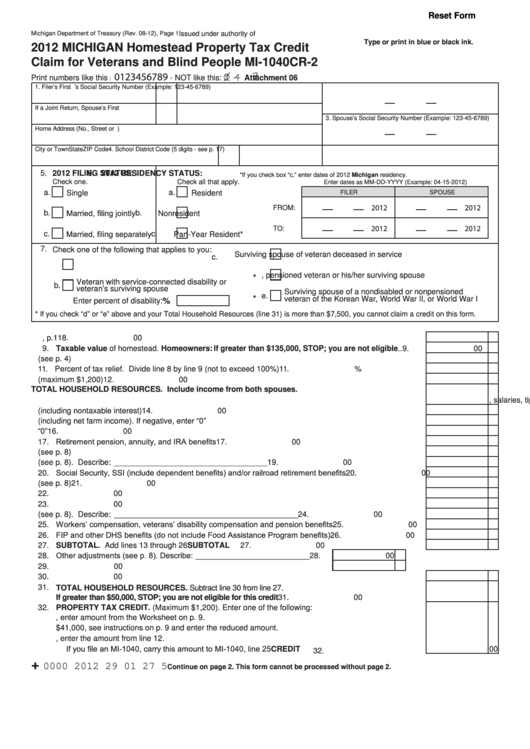

Form Mi-1040 - If you (and your spouse) opt to have no michigan tax withheld from your retirement benefi ts by checking the box on line 1, it may result in a balance due on. 15 tax calculators 15 tax. Type or print in blue or black ink. Homestead property tax credit claim. Ad discover helpful information and resources on taxes from aarp. Taxpayers who reach the age of 67 during 2013 may deduct $20,000 for single or. Individual tax return form 1040 instructions; This form is for income earned in tax year 2022, with tax returns due in. Type or print in blue or black ink. Who must file estimated tax payments you must make estimated. Request for taxpayer identification number (tin) and. Web 2020 individual income tax 2019 individual income tax 2018 individual income tax 2017 individual income tax 2016 individual income tax previous years fiduciary tax forms. Ad premium federal tax software. Type or print in blue or black ink. Search by form number, name or organization. 15 tax calculators 15 tax. You may file online with efile or by mail. You may file online with efile or by mail. Michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury. Type or print in blue or black ink. Use this option to browse a list of forms by tax area. Web city of detroit business & fiduciary taxes search tips search by tax area: You may file online with efile or by mail. Web michigan homestead property tax credits and principal residence exemption refunds received in 2020 may be taxable on your 2020 u.s. Search by form number,. Search by form number, name or organization. This form is for income earned in tax year 2022, with tax returns due in. Enter your status, income, deductions and credits and estimate your total taxes. Web 22 the michigan compiled laws, or his or her designee.the child 23 advocate act, 1994 pa 204, mcl 722.923. Type or print in blue or. Web search irs and state income tax forms to efile or complete, download online and back taxes. You may file online with efile or by mail. Search by form number, name or organization. Pay the lowest amount of taxes possible with strategic planning and preparation Who must file estimated tax payments you must make estimated. The michigan department of treasury is holding millions of. Individual tax return form 1040 instructions; Ad premium federal tax software. Web 2020 individual income tax 2019 individual income tax 2018 individual income tax 2017 individual income tax 2016 individual income tax previous years fiduciary tax forms. Use this option to browse a list of forms by tax area. You may file online with efile or by mail. Web city of detroit business & fiduciary taxes search tips search by tax area: Homestead property tax credit claim. If you (and your spouse) opt to have no michigan tax withheld from your retirement benefi ts by checking the box on line 1, it may result in a balance due on.. Search by form number, name or organization. Type or print in blue or black ink. Michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury. Taxpayers who reach the age of 67 during 2013 may deduct $20,000 for single or. Web 2020 individual income tax 2019 individual income tax 2018 individual. Ad discover helpful information and resources on taxes from aarp. (1) within 63 days after a request for nonidentifying. Easily fill out pdf blank, edit, and sign them. For example, if you are interested in individual. Homestead property tax credit claim. Search by form number, name or organization. If you (and your spouse) opt to have no michigan tax withheld from your retirement benefi ts by checking the box on line 1, it may result in a balance due on. Ad premium federal tax software. The michigan department of treasury is holding millions of. Taxpayers who reach the age of 67. You may file online with efile or by mail. Individual tax return form 1040 instructions; Homestead property tax credit claim. (1) within 63 days after a request for nonidentifying. For example, if you are interested in individual. Web 69 rows 98 pdfs. The michigan department of treasury is holding millions of. Last name if a joint return, spouse’s. Type or print in blue or black ink. Pay the lowest amount of taxes possible with strategic planning and preparation Taxpayers who reach the age of 67 during 2013 may deduct $20,000 for single or. You may file online with efile or by mail. This form is for income earned in tax year 2022, with tax returns due in. Ad discover helpful information and resources on taxes from aarp. Taxformfinder provides printable pdf copies. Easily fill out pdf blank, edit, and sign them. Type or print in blue or black ink. If you (and your spouse) opt to have no michigan tax withheld from your retirement benefi ts by checking the box on line 1, it may result in a balance due on. Enter your status, income, deductions and credits and estimate your total taxes. Michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury.Fillable Form Mi1040cr2 Michigan Homestead Property Tax Credit

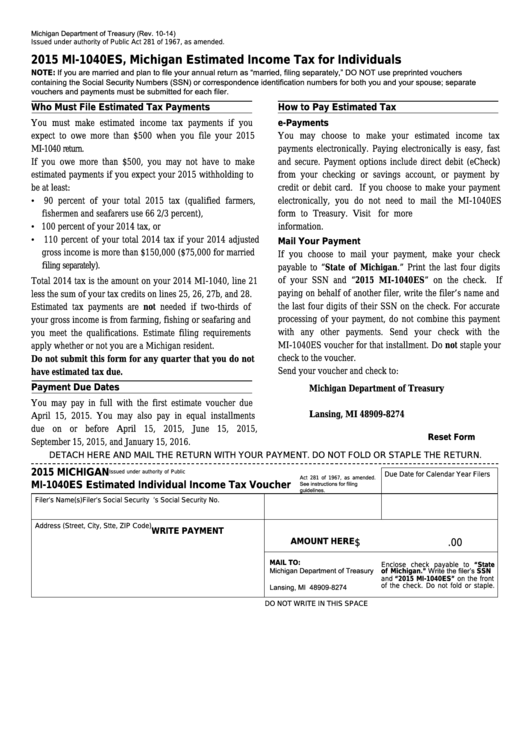

Fillable Form Mi1040es Estimated Individual Tax Voucher

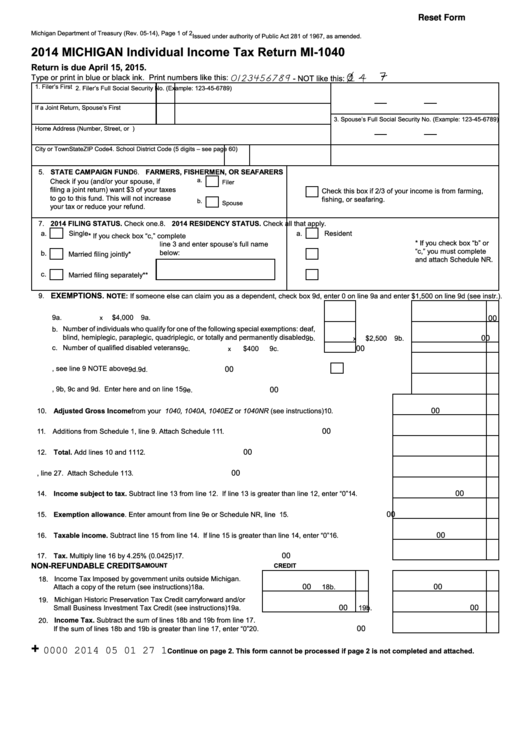

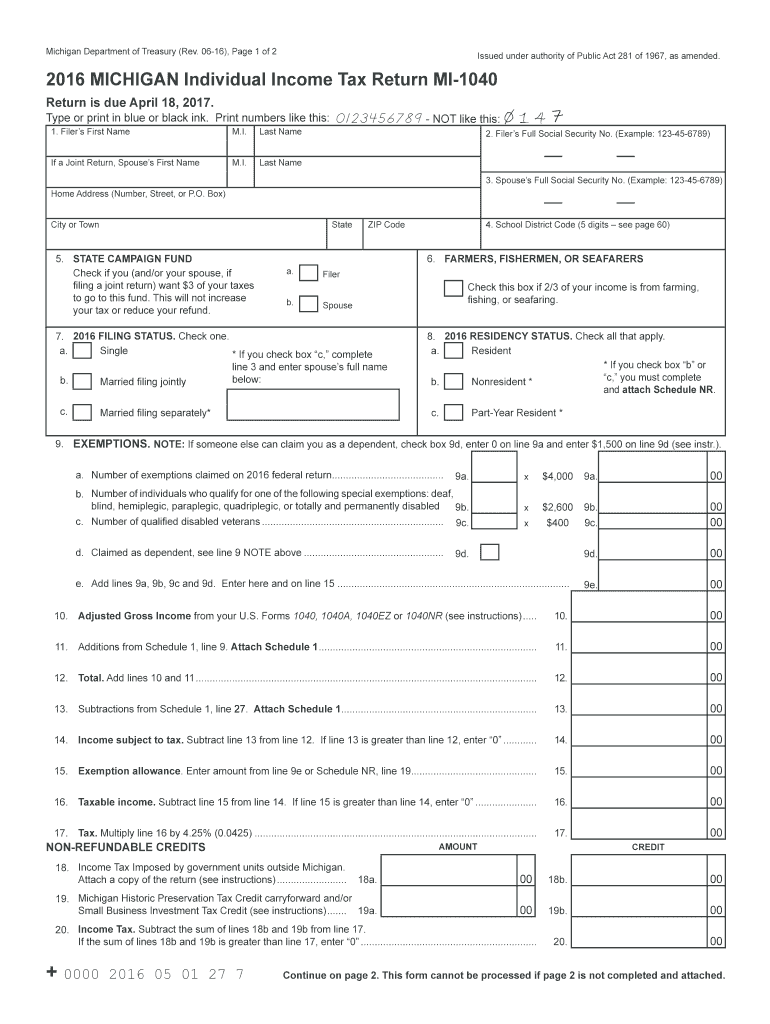

Fillable Form Mi1040 Michigan Individual Tax Return 2014

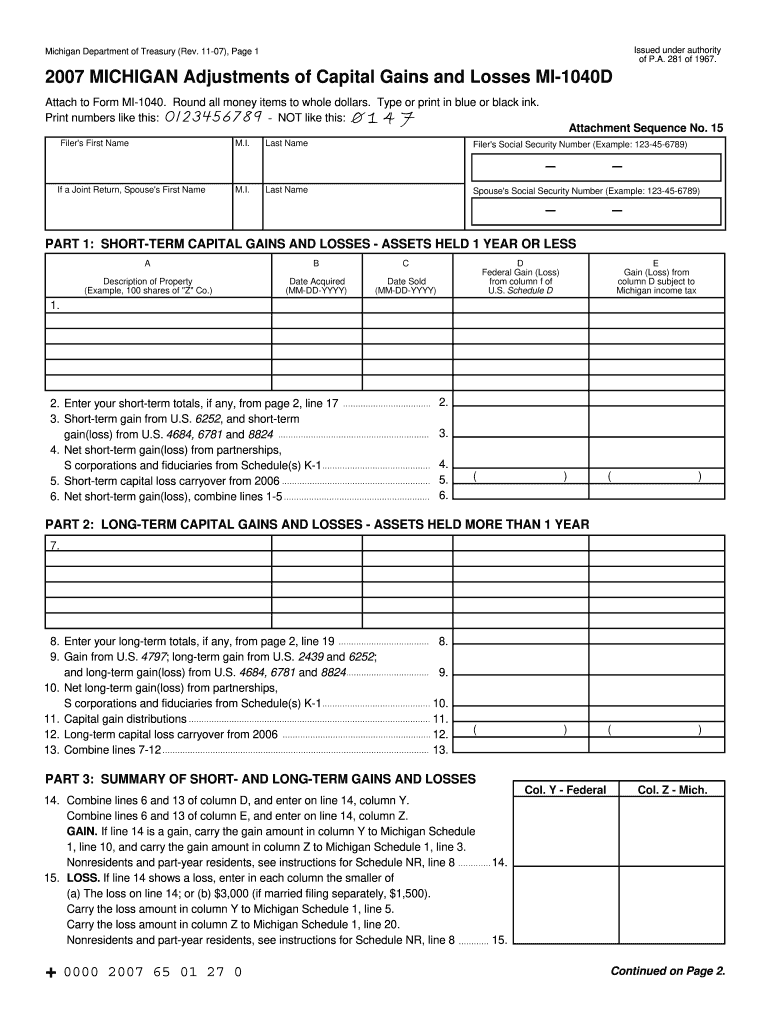

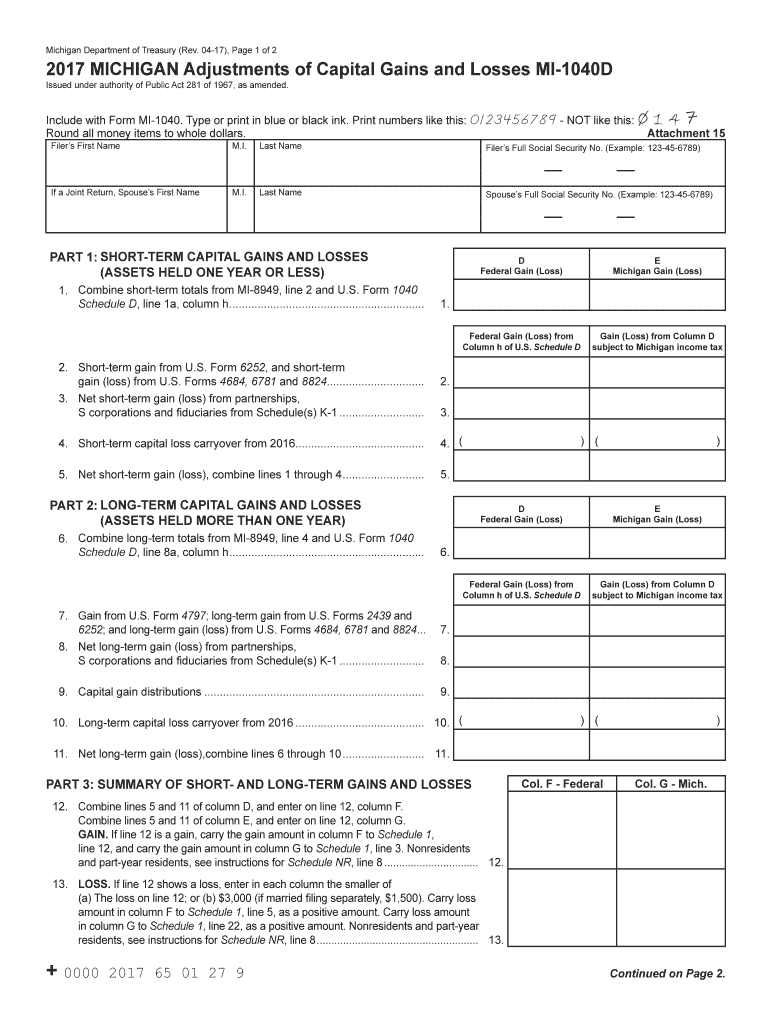

Mi 1040D Fill Out and Sign Printable PDF Template signNow

Mi 1040 Form Fill Out and Sign Printable PDF Template signNow

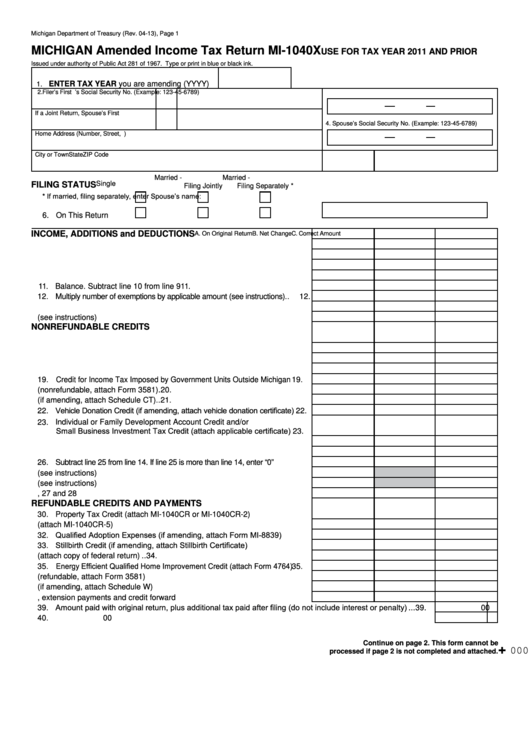

Fillable Form Mi1040x Michigan Amended Tax Return printable

Michigan MI 1040 Individual Tax State of Michigan Fill Out and

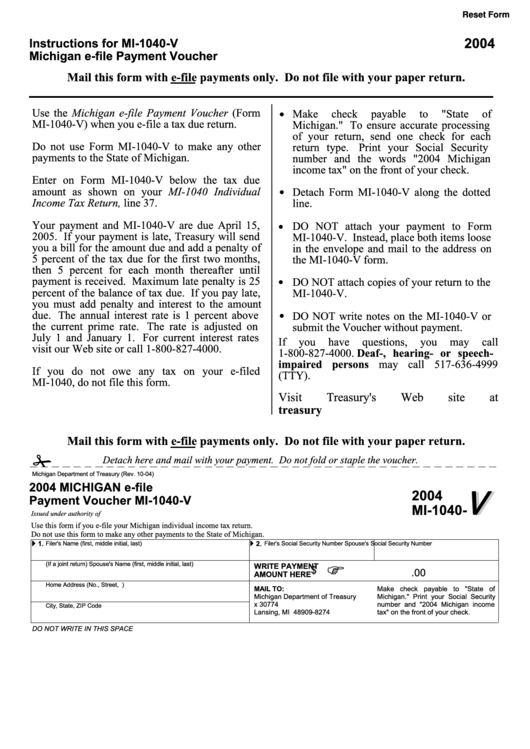

State Of Michigan Form Mi 1040 V 1040 Form Printable

MI1040CR7 MICHIGAN Home Heating Credit State of Michigan

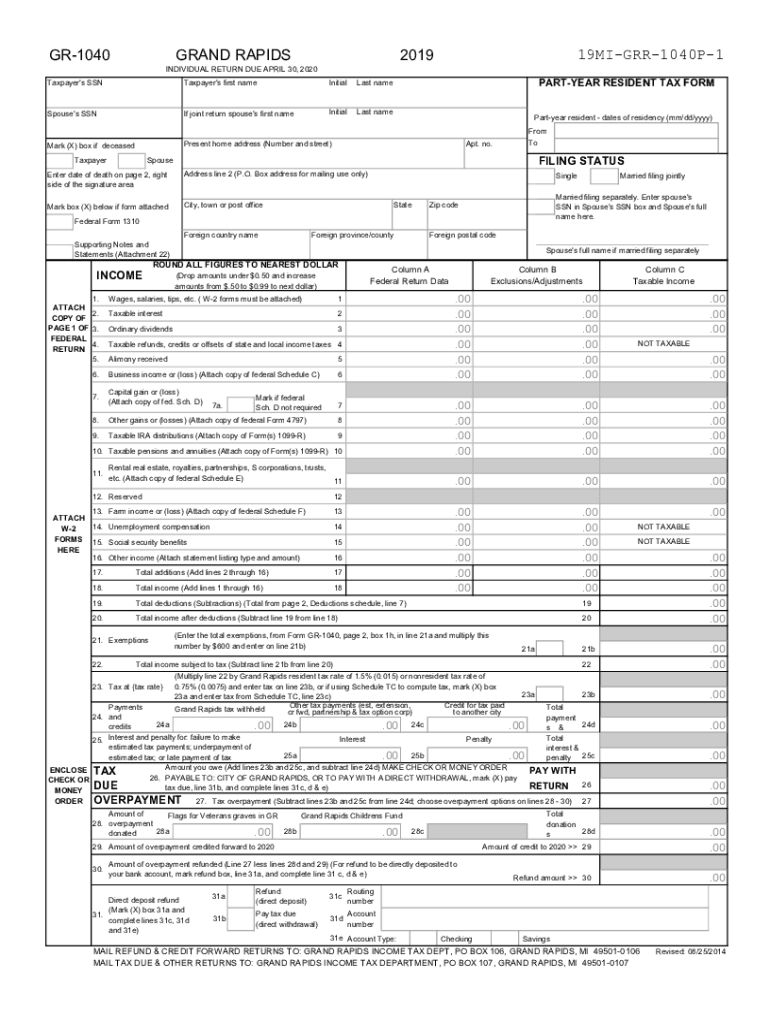

20192023 Form MI GR1040 Fill Online, Printable, Fillable, Blank

Related Post: