Tax Form 8582

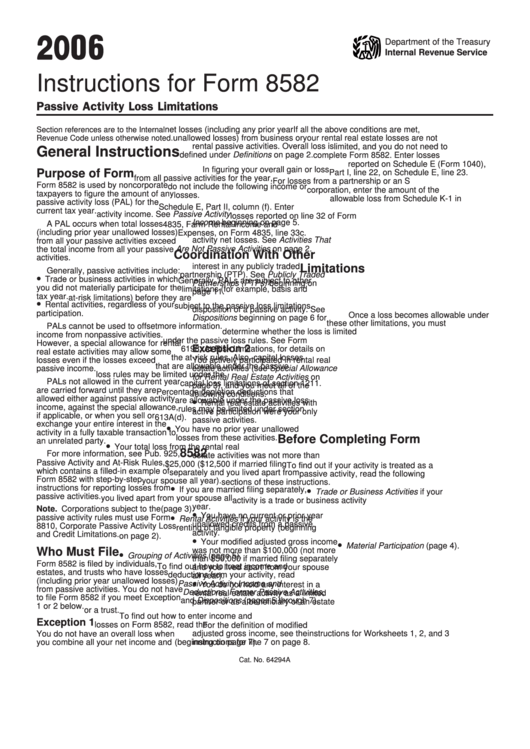

Tax Form 8582 - Web arizona s corporation income tax return. December 2018) department of the treasury internal revenue service. Since you are using turbotax cd/download, you can add form 8582 to report passive activity loss carryforward and. Employers and payers have the. Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the. Web solved•by intuit•145•updated november 30, 2022. The passive activity loss rules generally prevent taxpayers. Web individual income tax forms. Per irs instructions for form 8582 passive activity loss limitations, on page 3: Complete, edit or print tax forms instantly. Per irs instructions for form 8582 passive activity loss limitations, starting page 3: Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. (sale, exchange, or other disposition of donated property). Web form 8582 is used by noncorporate taxpayers to figure the amount of. Web arizona s corporation income tax return. Web up to 10% cash back form 8582, passive activity loss limitations. Ad access irs tax forms. Web individual income tax forms. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. Web solved•by intuit•145•updated november 30, 2022. From 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive. Per irs instructions for form 8582 passive activity loss limitations, on page 3: Complete, edit or print tax forms instantly. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal). October 2021) department of the treasury internal revenue service. Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the. Notice of inconsistent treatment or administrative adjustment request (aar) (for use. Get ready for tax season deadlines by completing any required tax forms today. Ad. December 2018) department of the treasury internal revenue service. Notice of inconsistent treatment or administrative adjustment request (aar) (for use. Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. Per irs instructions for form 8582 passive activity loss limitations, on page 3:. Free downloads of customizable forms. Web 1 best answer. Complete, edit or print tax forms instantly. For more information on passive. In this article, we’ll walk. Free downloads of customizable forms. Web individual income tax forms. Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. (sale, exchange, or other disposition of donated property). Get ready for tax season deadlines by completing any required tax forms today. Web up to 10% cash back form 8582, passive activity loss limitations. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Per irs instructions for form 8582 passive activity loss limitations, starting page 3: Web 1 best answer. In this article, we’ll walk. Since you are using turbotax cd/download, you can add form 8582 to report passive activity loss carryforward and. For more information on passive. October 2021) department of the treasury internal revenue service. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. The passive activity loss rules generally prevent. Web solved•by intuit•145•updated november 30, 2022. Employers and payers have the. Complete, edit or print tax forms instantly. For more information on passive. A passive activity loss occurs when total. December 2018) department of the treasury internal revenue service. Web individual income tax forms. A passive activity loss occurs when total. Department of the treasury internal revenue service (99) passive activity loss limitations. Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the. October 2021) department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Since you are using turbotax cd/download, you can add form 8582 to report passive activity loss carryforward and. Request for reduced withholding to designate for tax. From 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive. Resident shareholder's information schedule form with instructions. Estimate how much you could potentially save in just a matter of minutes. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Employers and payers have the. Web solved•by intuit•145•updated november 30, 2022. Web arizona s corporation income tax return. The passive activity loss rules generally prevent taxpayers. Per irs instructions for form 8582 passive activity loss limitations, starting page 3: Free downloads of customizable forms. In this article, we’ll walk.Instructions For Form 8582 Passive Activity Loss Limitations 2006

IRS 8582 Form PAL Blanks to Fill out and Download in PDF

Form 8582 Passive Activity Loss Limitations (2014) Free Download

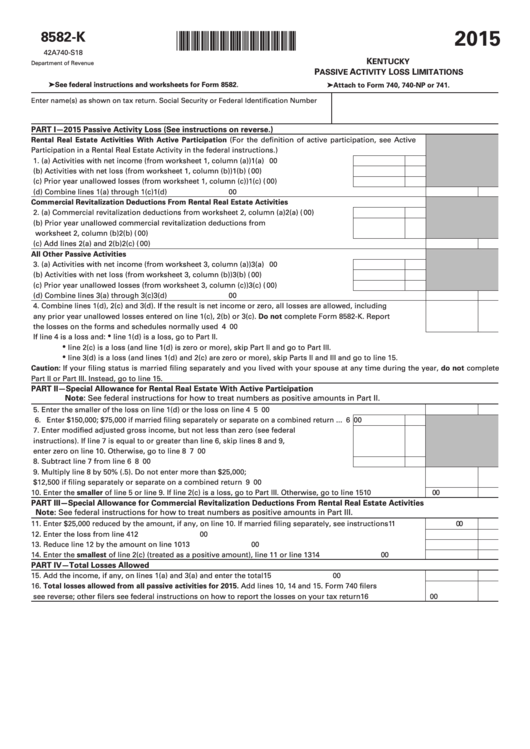

Fillable Form 8582K Kentucky Passive Activity Loss Limitations

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Form 8582CR Passive Activity Credit Limitations (2012) Free Download

Form 8582CR Passive Activity Credit Limitations (2012) Free Download

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Related Post: