Form It-204 Instructions

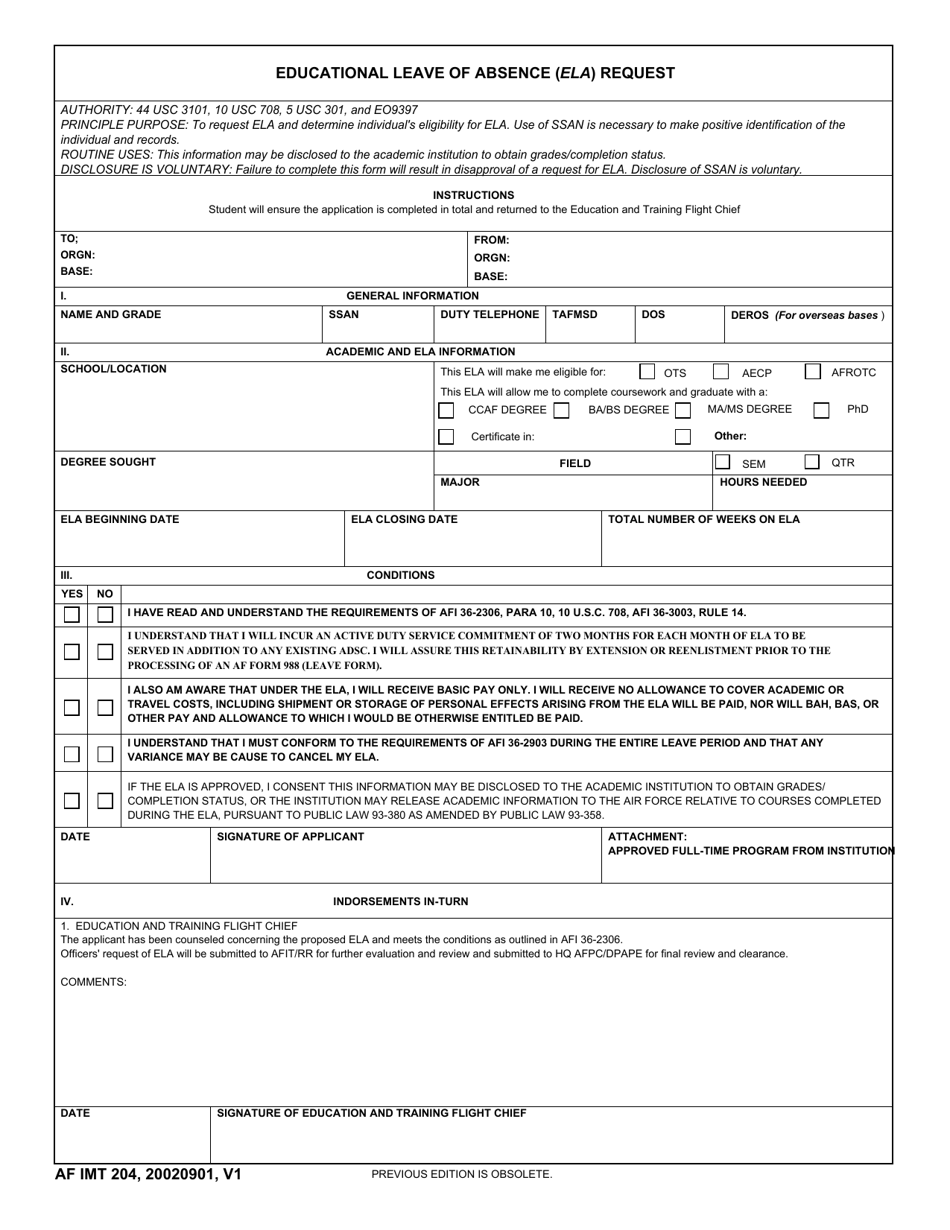

Form It-204 Instructions - Ordinary income (loss) from federal form 1065, line 22 (see instructions). Web application for filing extension form. Web 19 rows partnership return; But every partnership having either (1) at least one partner who is an individual, estate, or trust that. U you allocate total business. For details on the proper reporting of income. For partnerships, including limited liability companies 2022. For tax years beginning on or after. We last updated the partnership tax return in january 2023, so. For partnerships, including limited liability companies 2021. Web application for filing extension form. Select the document you want to sign and click upload. U you allocate total business. But every partnership having either (1) at least one partner who is an individual, estate, or trust that. We last updated the partnership tax return in january 2023, so. U you allocate total business. Follow the instructions on form it‑2104 to determine. But every partnership having either (1) at least one partner who is an individual, estate, or trust that. We last updated the partnership tax return in january 2023, so. For partnerships, including limited liability companies 2021. Web 19 rows partnership return; Ordinary income (loss) from federal form 1065, line 22 (see instructions). Web application for filing extension form. Net income (loss) from all. Select the document you want to sign and click upload. Partnerships are not subject to personal income tax. We last updated the partnership tax return in january 2023, so. Select the document you want to sign and click upload. But every partnership having either (1) at least one partner who is an individual, estate, or trust that. Follow the instructions on form it‑2104 to determine. For tax years beginning on or after. But every partnership having either (1) at least one partner who is an individual, estate, or trust that. Web 19 rows partnership return; Web application for filing extension form. Ordinary income (loss) from federal form 1065, line 22 (see instructions). U you allocate total business. We last updated the partnership tax return in january 2023, so. For details on the proper reporting of income. For partnerships, including limited liability companies 2022. Follow the instructions on form it‑2104 to determine. For partnerships, including limited liability companies 2021. For details on the proper reporting of income. But every partnership having either (1) at least one partner who is an individual, estate, or trust that. Select the document you want to sign and click upload. Net income (loss) from all. For details on the proper reporting of income. Ordinary income (loss) from federal form 1065, line 22 (see instructions). For partnerships, including limited liability companies 2022. Follow the instructions on form it‑2104 to determine. Partnerships are not subject to personal income tax. Web 19 rows partnership return; Partnerships are not subject to personal income tax. But every partnership having either (1) at least one partner who is an individual, estate, or trust that. We last updated the partnership tax return in january 2023, so. For tax years beginning on or after. Select the document you want to sign and click upload. For partnerships, including limited liability companies 2021. Web 19 rows partnership return; But every partnership having either (1) at least one partner who is an individual, estate, or trust that. For details on the proper reporting of income. But every partnership having either (1) at least one partner who is an individual, estate, or trust that. For partnerships, including limited liability companies 2022. Net income (loss) from all. Select the document you want to sign and click upload. For partnerships, including limited liability companies 2021. Partnerships are not subject to personal income tax. For details on the proper reporting of income. Web application for filing extension form. Follow the instructions on form it‑2104 to determine. Ordinary income (loss) from federal form 1065, line 22 (see instructions). We last updated the partnership tax return in january 2023, so. U you allocate total business. For tax years beginning on or after. Web 19 rows partnership return;AF IMT Form 204 Download Fillable PDF or Fill Online Educational Leave

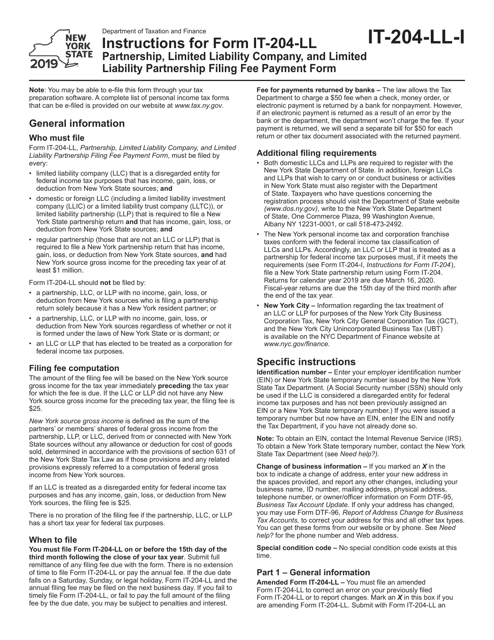

Download Instructions for Form IT204LL Partnership, Limited Liability

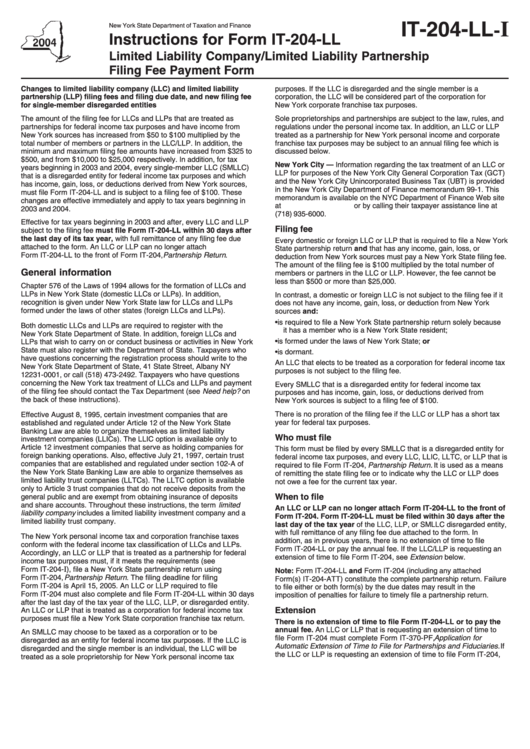

Instructions For Form It204Ll Limited Liability Company/limited

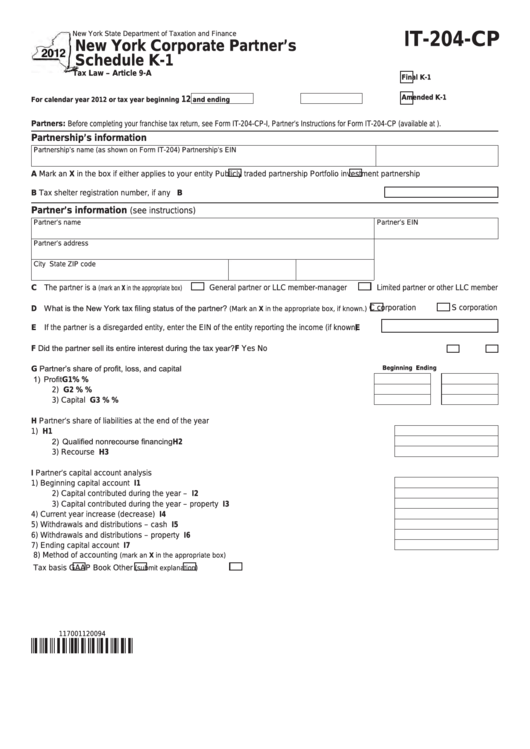

Fillable Form It204Cp New York Corporate Partner'S Schedule K1

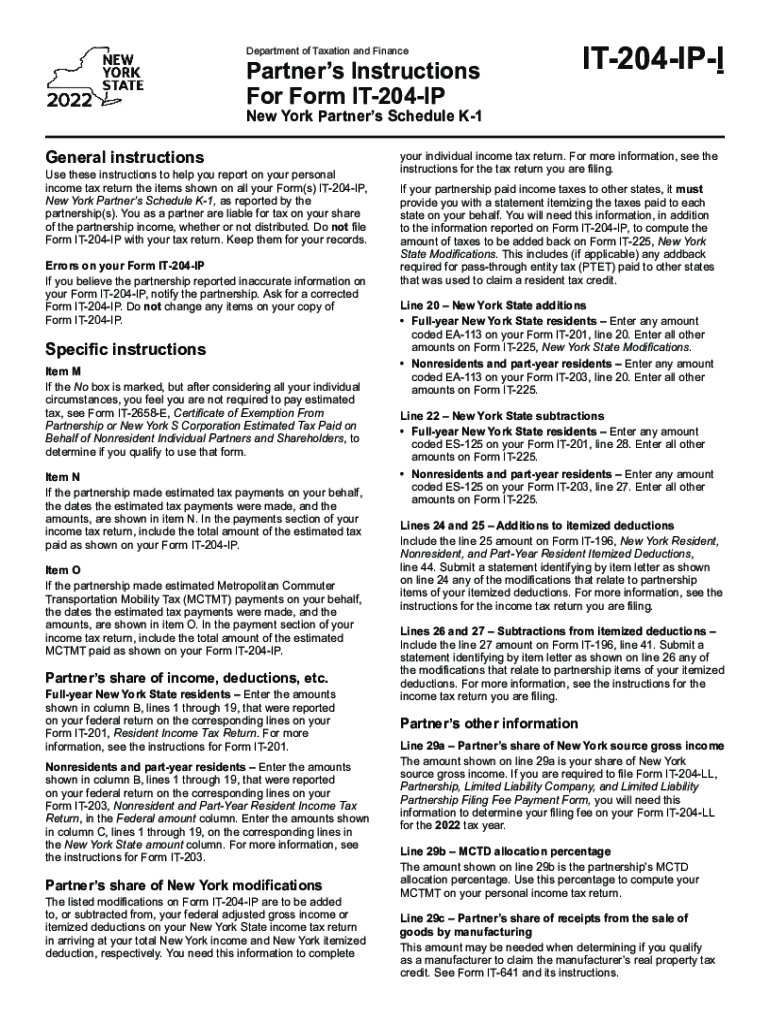

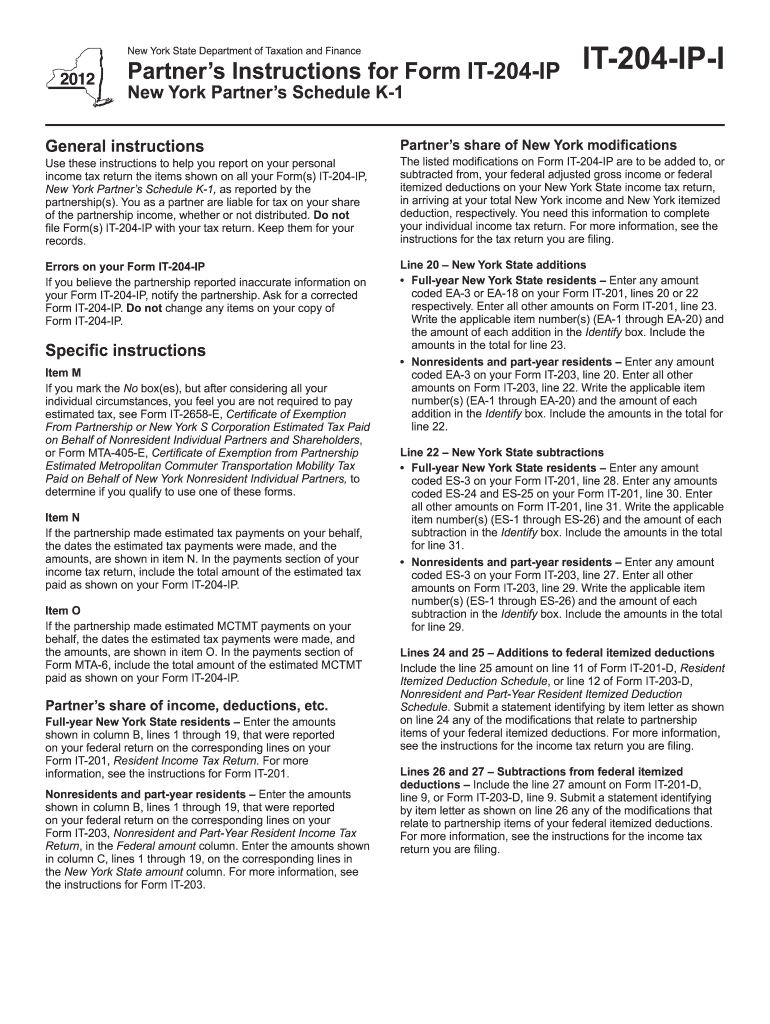

It 204 Ip Instructions Fill Out and Sign Printable PDF Template signNow

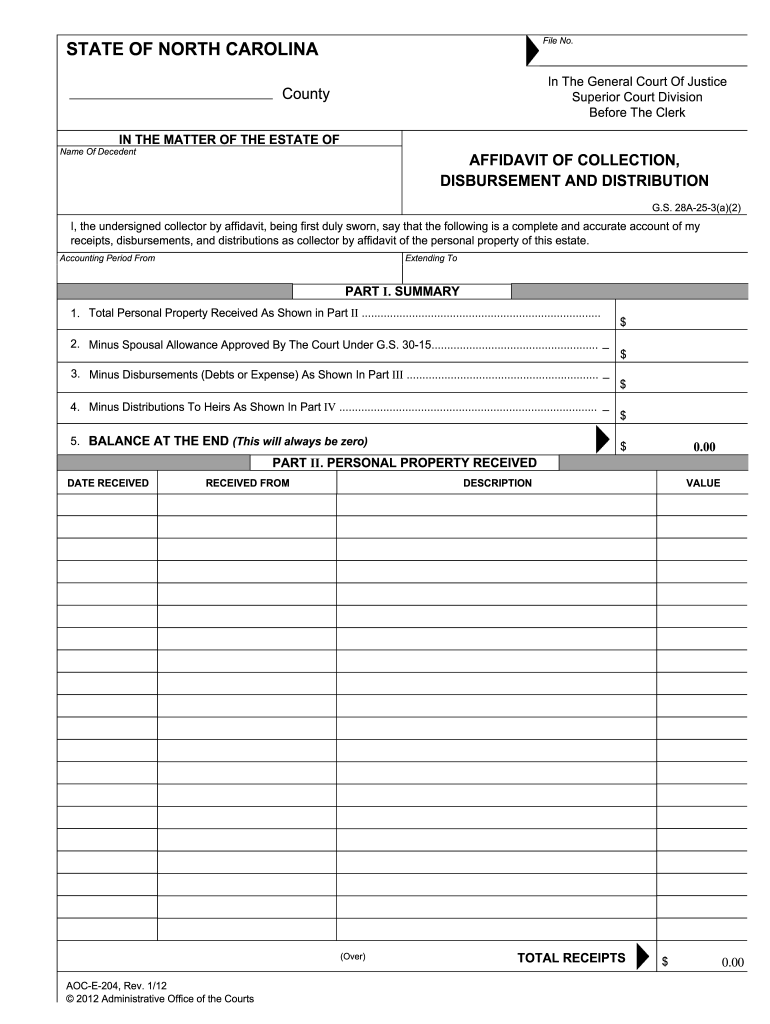

Aoc E 204 Form Fill Out and Sign Printable PDF Template signNow

It 204 IP Instructions Form Fill Out and Sign Printable PDF Template

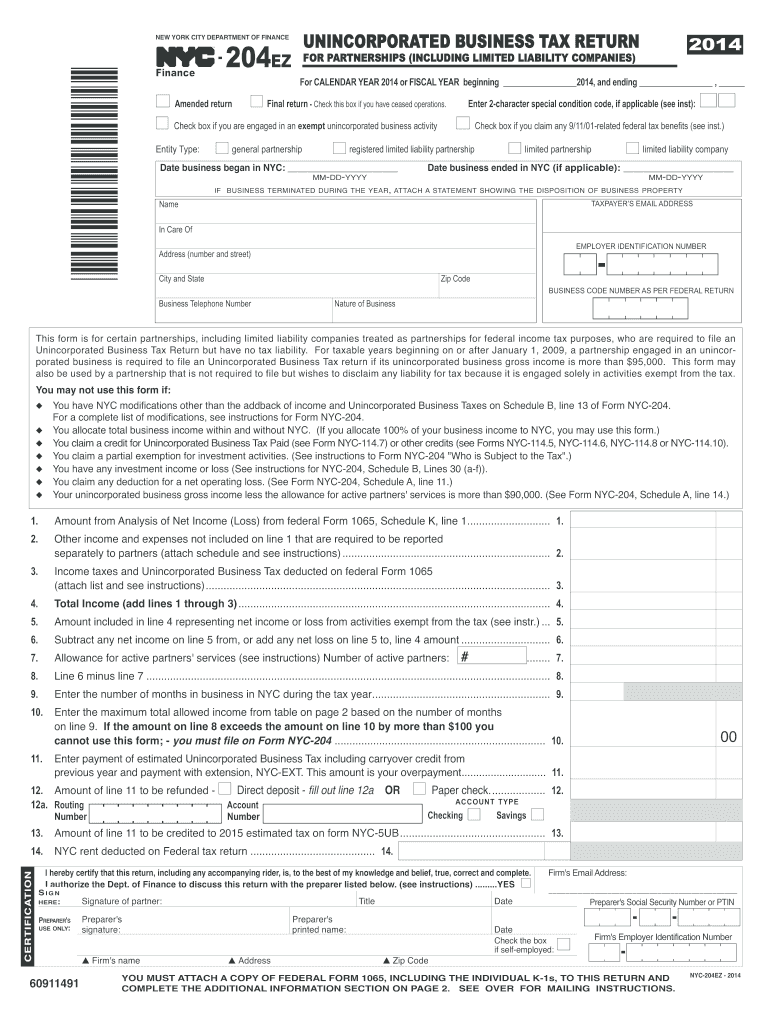

NYC 204 EZ Instructions Form Fill Out and Sign Printable PDF Template

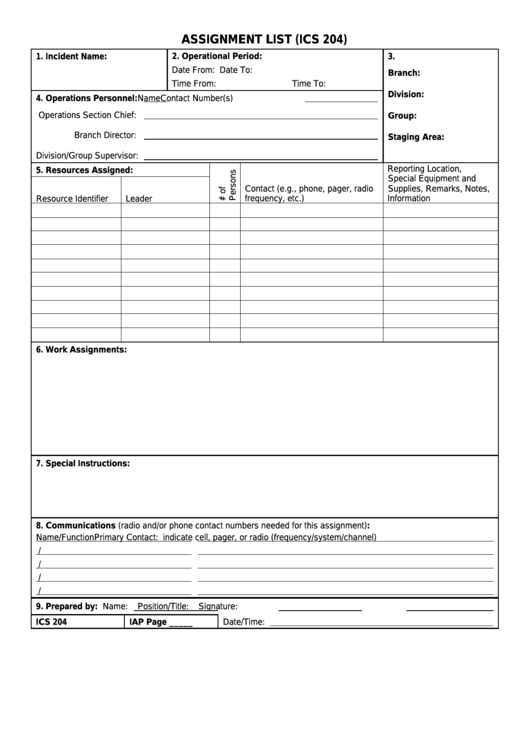

Ics 204 Fillable Form Printable Forms Free Online

PPT Unit 5 PowerPoint Presentation, free download ID2015992

Related Post: