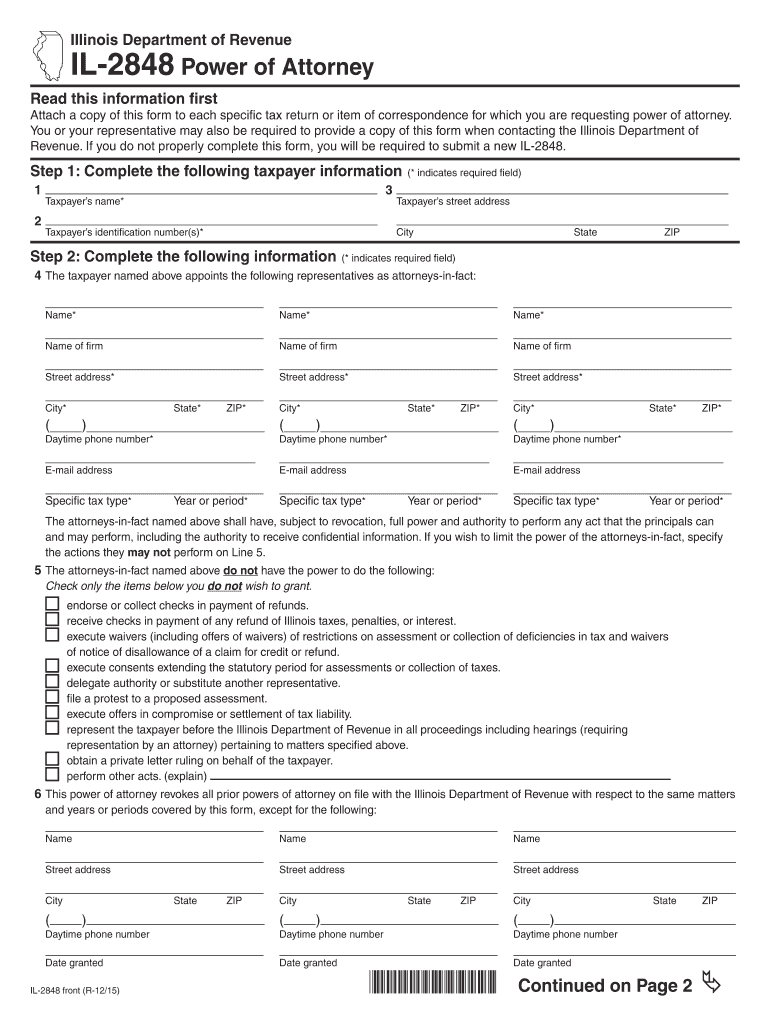

Form Il 2848

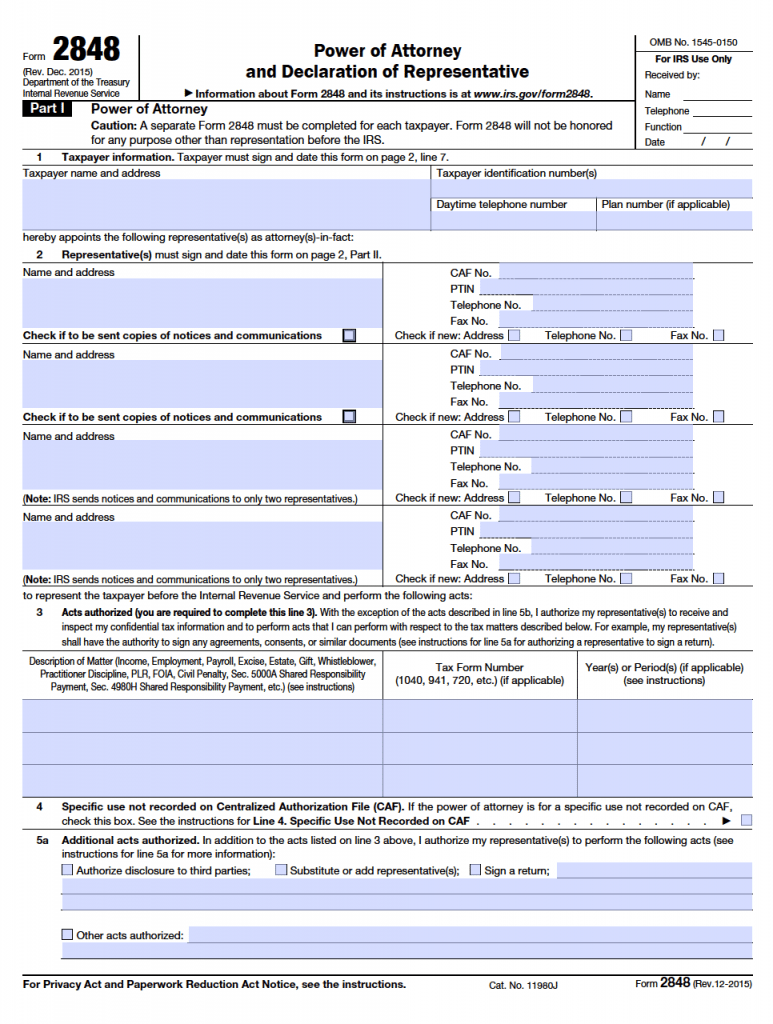

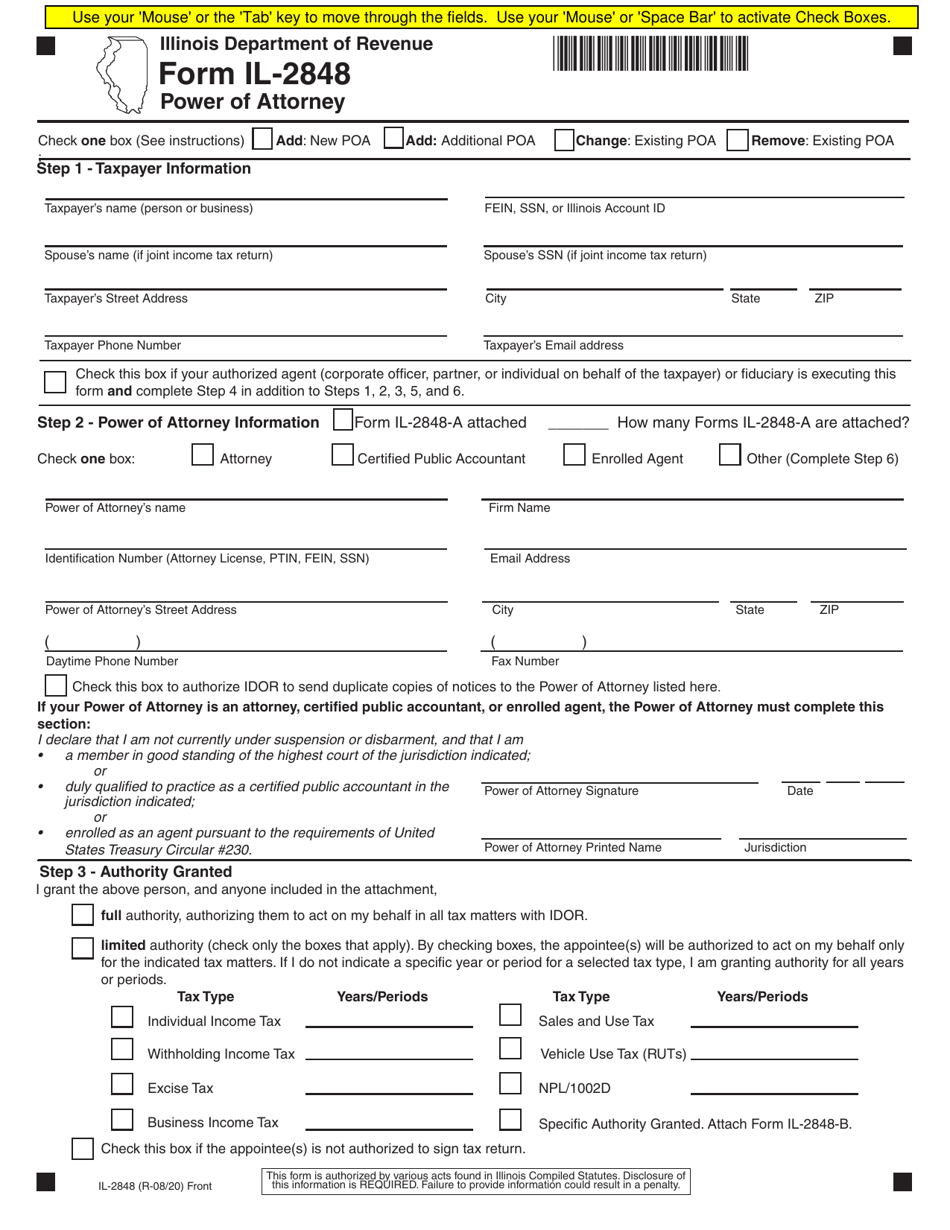

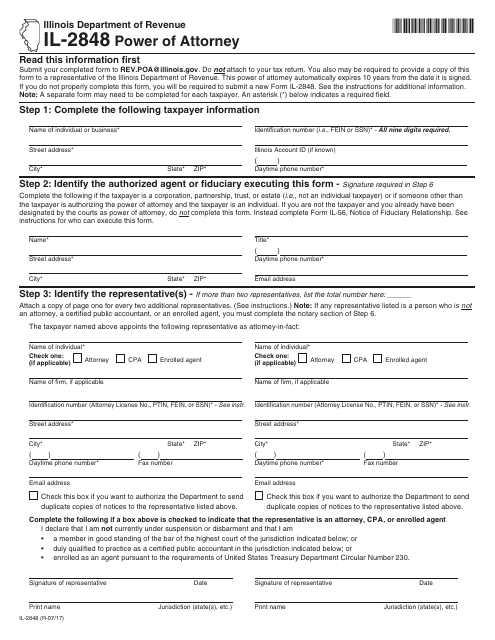

Form Il 2848 - Section references are to the internal revenue code unless otherwise noted. Online tax forms have been made to help. If you do not properly complete. Attach a copy of this form to each specific tax return or item of correspondence for which you are requesting power of. Disclosure of this information is required. Web form to a representative of the illinois department of revenue. Failure to provide information could result in a penalty. To withdraw representation, the power of attorney must write. This form is authorized by various acts found in illinois compiled statutes. We last updated the power of attorney in september. Web this form is authorized by various acts found in illinois compiled statutes. Check this box if your authorized agent (corporate officer,. Web the il 2848 2009 form template is a form with fillable spaces where one can place information, i.e., complete it on the internet. Learn more illinois tax issues &. Online tax forms have been made to help. Online tax forms have been made to help. This power of attorney form is effective for five years from the date of execution. Web instructions for form 2848 (09/2021) power of attorney and declaration of representative. Get ready for tax season deadlines by completing any required tax forms today. To withdraw representation, the power of attorney must write. This form is authorized by various acts found in illinois compiled statutes. Learn more illinois tax issues &. We last updated the power of attorney in september. Web instructions for form 2848 (09/2021) power of attorney and declaration of representative. Check this box if the appointee(s) is not authorized to sign tax return. Online tax forms have been made to help. We last updated the power of attorney additional information in september 2022, so this is the. Illinois — power of attorney additional information. This power of attorney automatically expires 10 years from the date it is signed. Web this form is authorized by various acts found in illinois compiled statutes. Disclosure of this information is required. Through an il 2848, a. Check this box if the appointee(s) is not authorized to sign tax return. Learn more illinois tax issues &. It appears you don't have a pdf plugin for this browser. We last updated the power of attorney additional information in september 2022, so this is the. This power of attorney form is effective for five years from the date of execution. Learn more illinois tax issues &. Web form to a representative of the illinois department of revenue. Section references are to the internal revenue code unless otherwise noted. Attach a copy of this form to each specific tax return or item of correspondence for which you are requesting power of. This power of attorney form is effective for five years from the date of execution. Web the il 2848 2009 form template is a form with fillable spaces where one can place information, i.e., complete it on the. Through an il 2848, a. Get ready for tax season deadlines by completing any required tax forms today. Disclosure of this information is required. • email your completed form to [email protected]. This power of attorney form is effective for five years from the date of execution. Check this box if your authorized agent (corporate officer,. Check this box if the appointee(s) is not authorized to sign tax return. • email your completed form to [email protected]. Section references are to the internal revenue code unless otherwise noted. Illinois — power of attorney additional information. To withdraw representation, the power of attorney must write. This power of attorney form is effective for five years from the date of execution. Disclosure of this information is required. This power of attorney automatically expires 10 years from the date it is signed. Check this box if your authorized agent (corporate officer,. Information about form 2848, power of attorney and declaration of representative, including recent updates,. Web instructions for form 2848 (09/2021) power of attorney and declaration of representative. Disclosure of this information is required. Failure to provide information could result in a penalty. This form is authorized by various acts found in illinois compiled statutes. Illinois — power of attorney additional information. Web form to a representative of the illinois department of revenue. We last updated the power of attorney in september. Web updated june 02, 2022. Web the illinois tax power of attorney (form il 2848) is a form that allows a taxpayer or business to elect a power of attorney to handle their tax matters. This power of attorney form is effective for five years from the date of execution. Disclosure of this information is required. Web page last reviewed or updated: Through an il 2848, a. To withdraw representation, the power of attorney must write. Online tax forms have been made to help. Attach a copy of this form to each specific tax return or item of correspondence for which you are requesting power of. We last updated the power of attorney additional information in september 2022, so this is the. Check this box if the appointee(s) is not authorized to sign tax return. This power of attorney automatically expires 10 years from the date it is signed.Form IL2848, Power of Attorney Illinois.gov Fill out & sign online

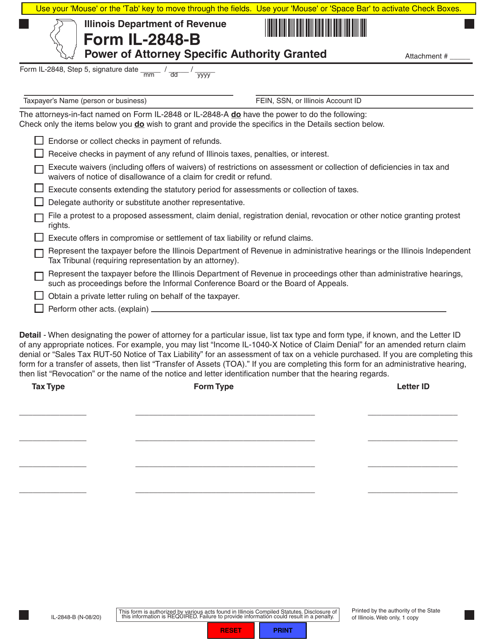

Form IL2848B Download Fillable PDF or Fill Online Power of Attorney

IRS Power of Attorney Form 2848 Year 2016 Power of Attorney

Free Illinois Tax Power of Attorney Form PDF

Form IL2848 Download Fillable PDF or Fill Online Power of Attorney

Free Illinois Tax Power of Attorney Form PDF

IL2848 Power of Attorney Form Illinois Department of Revenue Free

Form 2848 YouTube

Form IL2848 Download Fillable PDF or Fill Online Power of Attorney

Illinois Archives Page 2 of 9 PDFSimpli

Related Post: