Mo 1040 Tax Form

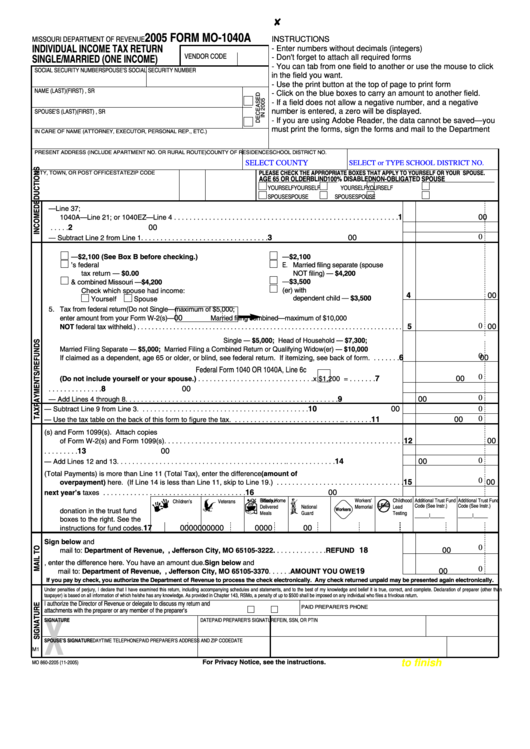

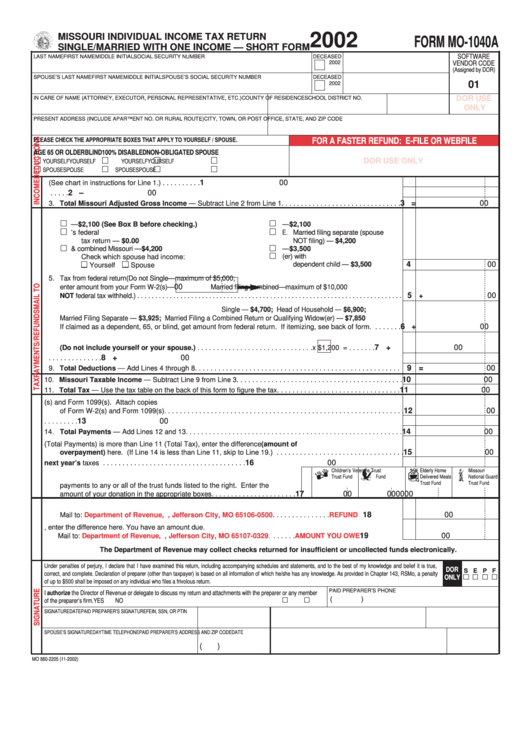

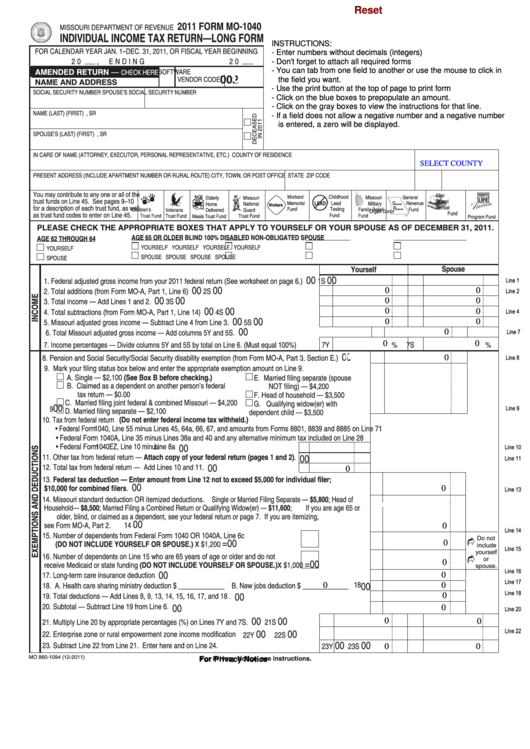

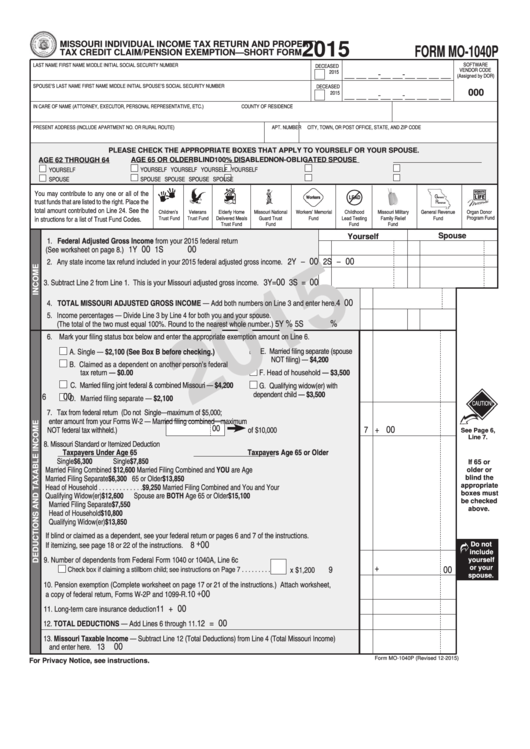

Mo 1040 Tax Form - Print in black ink only and do not staple. This form is for income. Currently, the irs allows taxpayers with adjusted gross incomes up to $73,000 to file their federal tax returns. In each tax year beginning on or after january 1, 1983, each. Funding — income tax refund, designating authorized amount, when — contributions. Tax deadline is april 18. Check the box at the top of the form. Were a missouri resident, nonresident, or part year resident with missouri income only; 4a, the amount from the form 1040nr, line 22 less the. Web enter the taxable income from your tax form and we will calculate your tax for you. Funding — income tax refund, designating authorized amount, when — contributions. You must file your taxes yearly by april 15. We offer a variety of software related to various fields at great prices. Line references from each missouri tax form are provided below. Web enter the taxable income from your tax form and we will calculate your tax for you. Request for transcript of tax return. Web missouri department of revenue,. Missouri has a state income tax that ranges between 1.5% and 5.3% , which is administered by the missouri department of revenue. Estimate your taxes and refunds easily with this free tax calculator from aarp. Tax deadline is april 15. Box 3222, jefferson city, mo. Estimate your taxes and refunds easily with this free tax calculator from aarp. Check the box at the top of the form. We offer a variety of software related to various fields at great prices. Form 1040 is a form that you fill out and send to the irs reporting your income, deductions,. Funding — income tax refund, designating authorized amount, when — contributions. Web individual income tax long form. Web itemize deductions on their missouri return. This form is for income. Electronic filing is fast and easy. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Ad discover helpful information and resources on taxes from aarp. Line references from each missouri tax form are provided below. Were a missouri resident, nonresident, or part year resident with missouri income only; Print in black ink only and do not staple. You must file your taxes yearly by april 15. Tax deadline is april 18. Request for transcript of tax return. Check the box at the top of the form. Printable missouri state tax forms for the. Web individual income tax long form. Ad discover helpful information and resources on taxes from aarp. You will need to provide your first and last name, phone. Box 3222, jefferson city, mo. Were a missouri resident, nonresident, or part year resident with missouri income only; All missouri short forms allow the standard or itemized deduction. Individual income tax long form. Request for transcript of tax return. Calculate over 1,500 tax planning strategies automatically and save tens of thousands In each tax year beginning on or after january 1, 1983, each. Calculate over 1,500 tax planning strategies automatically and save tens of thousands This form is for income. Web file individual income tax return please accept the mytax missouri usage terms to register for a portal account. Web page last reviewed or updated: Web individual income tax long form. Line references from each missouri tax form are provided below. Printable missouri state tax forms for the. Print in black ink only and do not staple. Individual income tax long form. Box 3222, jefferson city, mo. Web enter the taxable income from your tax form and we will calculate your tax for you. Request for transcript of tax return. Tax deadline is april 15. See page 3 for extensions. Printable missouri state tax forms for the. Web no, form 1040 and form 1099 are two different federal tax forms. Currently, the irs allows taxpayers with adjusted gross incomes up to $73,000 to file their federal tax returns. Individual income tax long form. This form is for income. Print in black ink only and do not staple. Web file individual income tax return please accept the mytax missouri usage terms to register for a portal account. Print in black ink only and do not staple. Ad discover helpful information and resources on taxes from aarp. You must file your taxes yearly by april 15. Tax deadline is april 18. If you haven't started your. Were a missouri resident, nonresident, or part year resident with missouri income only; Web why the irs is testing a free direct file program. Form 1040 is a form that you fill out and send to the irs reporting your income, deductions,. Web itemize deductions on their missouri return.Fillable Form Mo1040a Missouri Individual Tax Return Single

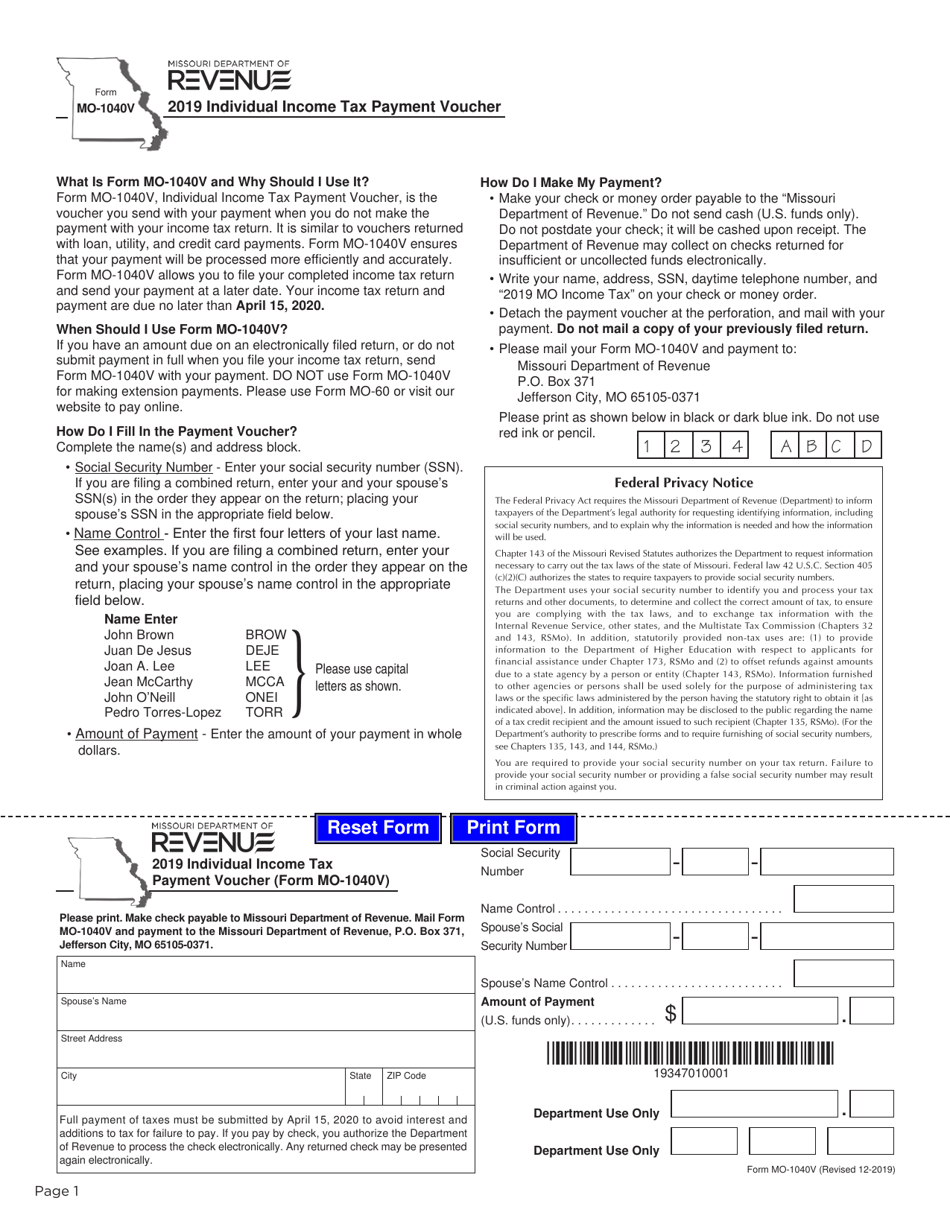

Form MO1040V Download Fillable PDF or Fill Online Individual

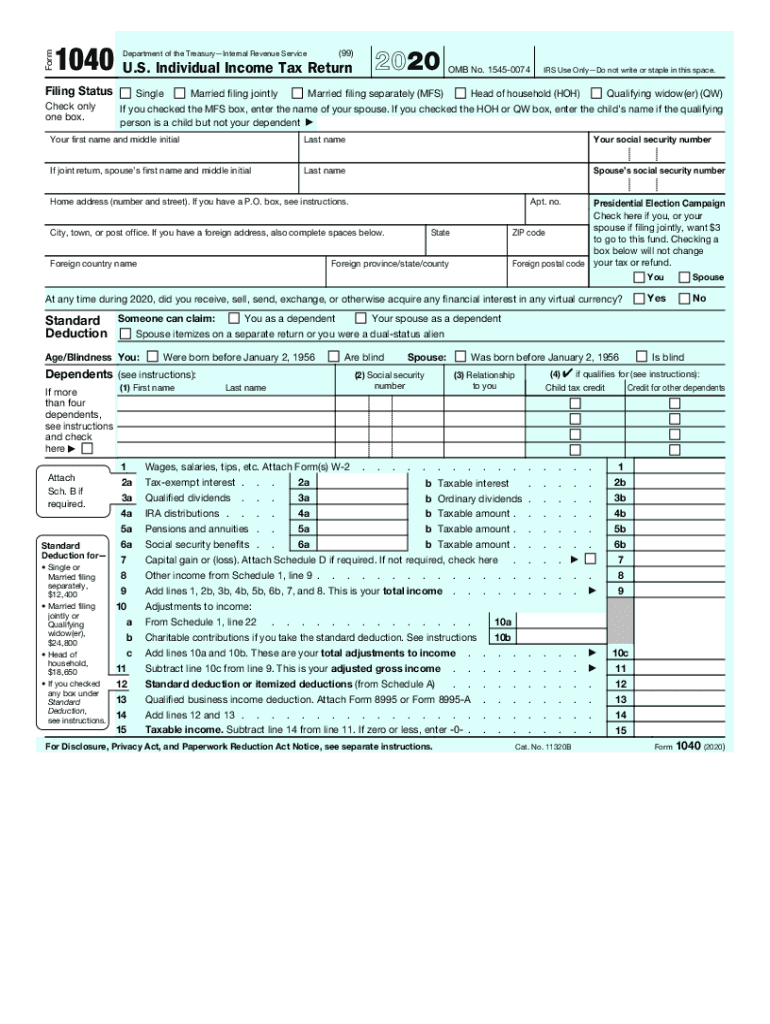

Printable Mo 1040 Form Printable Forms Free Online

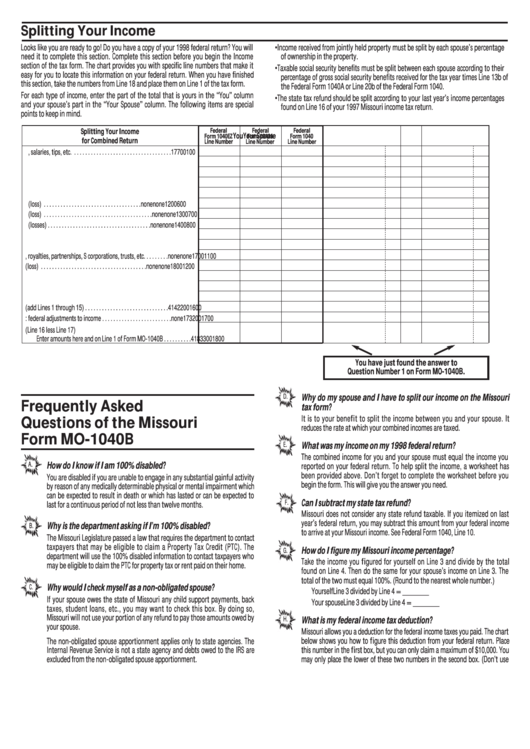

Form Mo1040b Missouri Itemized Deductions printable pdf download

Form Mo1040a Missouri Individual Tax Return Single/married

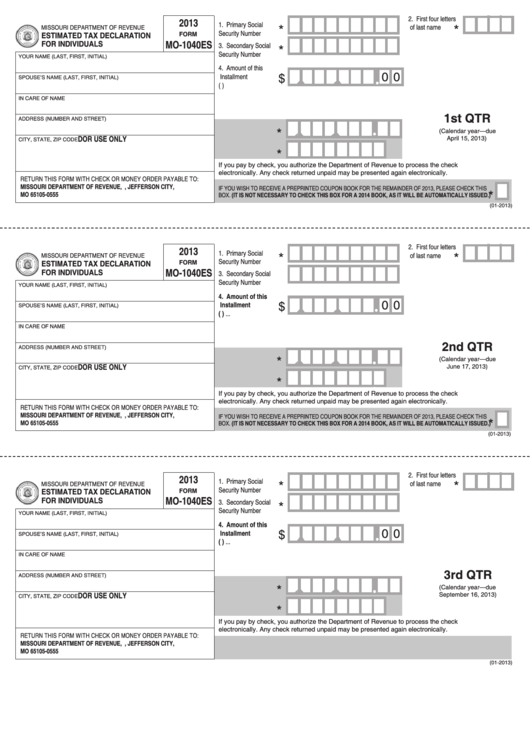

Fillable Form Mo1040es Estimated Tax Declaration For Individuals

MO1040A Fillable Calculating 2015 PDF Tax Refund Social Security

Fillable Form Mo 1040 Individual Tax Return 2021 Tax Forms

Form Mo1040p Missouri Individual Tax Return And Property Tax

1040ez State Tax Form Missouri Form Resume Examples

Related Post: