Form Il 2210

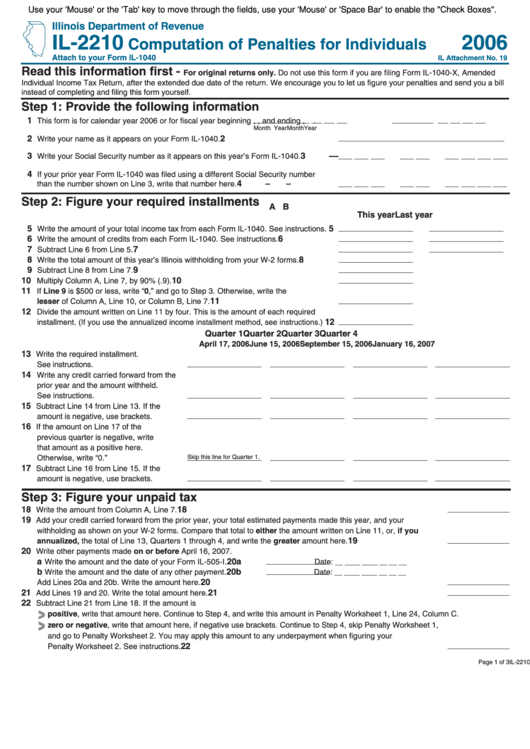

Form Il 2210 - Rate the il 2210 instructions. Web follow the simple instructions below: Web designed by the illinois department of revenue, this form is utilized to calculate penalties for underpayment of estimated tax by individuals. Edit & sign illinois form 2210 from anywhere. Due to the federal and state extension to file 2019 returns, quarterly 2020 estimated payments can be made in. This form is used by illinois residents who file an individual income tax return. Upload, modify or create forms. Web instructions for form 2210 (2022) | internal revenue service. Send filled & signed form or. Easily sign the form with your finger. This form allows you to figure penalties you may owe if you did not make timely estimated payments, pay the tax you. Due to the federal and state extension to file 2019 returns, quarterly 2020 estimated payments can be made in. Tt estimates that form 2210 will be available to the pc program on 3/17/22. Save or instantly send your. Automatic extension payment for individuals. Tt estimates that form 2210 will be available to the pc program on 3/17/22. Ad uslegalforms.com has been visited by 100k+ users in the past month Web follow the simple instructions below: Due to the federal and state extension to file 2019 returns, quarterly 2020 estimated payments can be made in. Web instructions for form 2210. Rate the il 2210 instructions. Web designed by the illinois department of revenue, this form is utilized to calculate penalties for underpayment of estimated tax by individuals. Use this form only if you are a fi scal fi ler. Department of the treasury internal revenue service. Underpayment of estimated tax by individuals, estates, and trusts. Web designed by the illinois department of revenue, this form is utilized to calculate penalties for underpayment of estimated tax by individuals. Due to the federal and state extension to file 2019 returns, quarterly 2020 estimated payments can be made in. Here is a comprehensive list of illinois. By checking the. Try it for free now! Easily fill out pdf blank, edit, and sign them. This form allows you to figure penalties you may owe if you did not make timely estimated payments, pay the tax you. Open form follow the instructions. Web follow the simple instructions below: Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. This form is for income earned in tax year 2022, with tax returns due in. Upload, modify or create forms. Web follow the simple instructions below: This form allows you to figure penalties you may owe. This form is used by illinois residents who file an individual income tax return. This form is for income earned in tax year 2022, with tax returns due in. Save your changes and share il 2210 form. What is the purpose of this form? Tt estimates that form 2210 will be available to the pc program on 3/17/22. Web instructions for form 2210. Easily sign the form with your finger. Automatic extension payment for individuals. Send filled & signed form or. This form allows you to figure penalties you may owe if you did not make timely estimated payments, pay the tax you. Who should file the il form 2210?. What is the purpose of this form? Automatic extension payment for individuals. Rate the il 2210 instructions. Department of the treasury internal revenue service. Upload, modify or create forms. This form allows you to figure penalties you may owe if you did not make timely estimated payments, pay the tax you. Easily fill out pdf blank, edit, and sign them. What is the purpose of this form? Due to the federal and state extension to file 2019 returns, quarterly 2020 estimated payments can be. This form is for income earned in tax year 2022, with tax returns due in. Upload, modify or create forms. Here is a comprehensive list of illinois. Rate the il 2210 instructions. Edit & sign illinois form 2210 from anywhere. For tax years ending on or after december 31, 2022. Tt estimates that form 2210 will be available to the pc program on 3/17/22. By checking the box, irs to figure penalty, the program will. Easily fill out pdf blank, edit, and sign them. Department of the treasury internal revenue service. What is the purpose of this form? Web follow the simple instructions below: Instructions for form 2210 (2022) underpayment of estimated tax by individuals, estates, and trusts. Easily sign the form with your finger. Save your changes and share il 2210 form. Web instructions for form 2210. Automatic extension payment for individuals. Ad uslegalforms.com has been visited by 100k+ users in the past month This form allows you to figure penalties you may owe if you did not make timely estimated payments, pay the tax you. Underpayment of estimated tax by individuals, estates, and trusts.Fillable Form Il2210 Computation Of Penalties For Individuals 2006

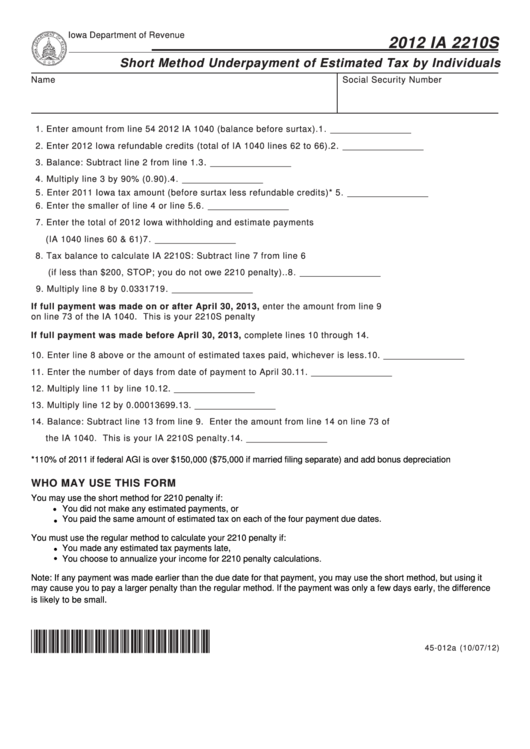

Fillable Form Ia 2210s Short Method Underpayment Of Estimated Tax By

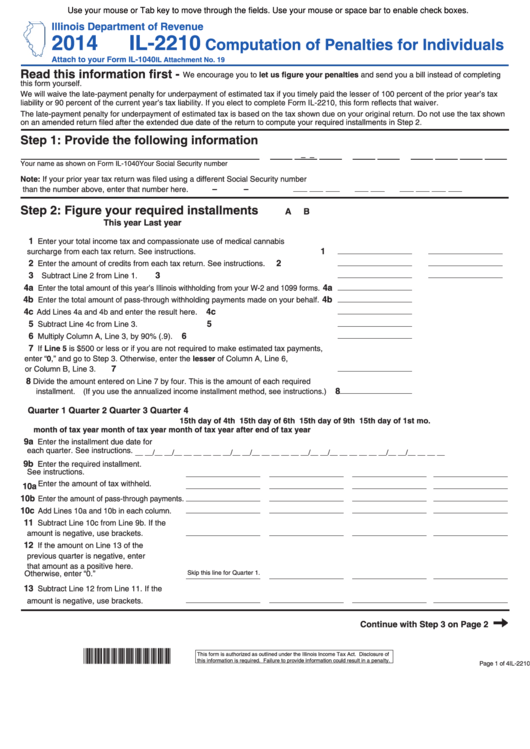

Fillable Form Il2210 Computation Of Penalties For Individuals 2014

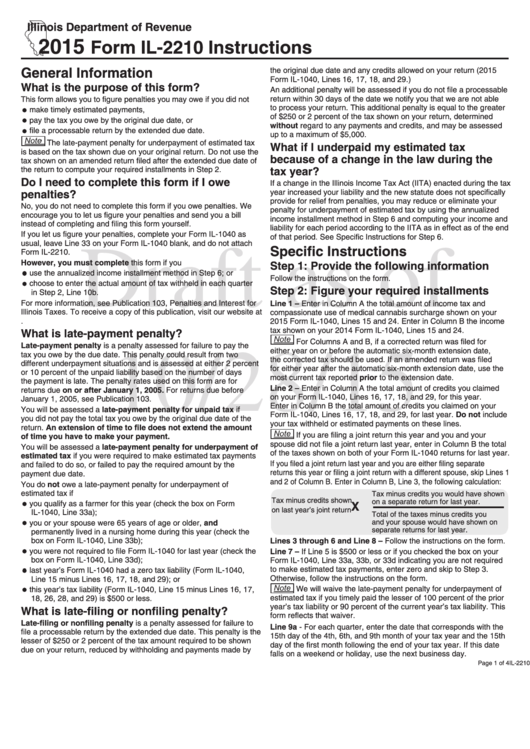

Form Il2210 Instructions Draft 2015 printable pdf download

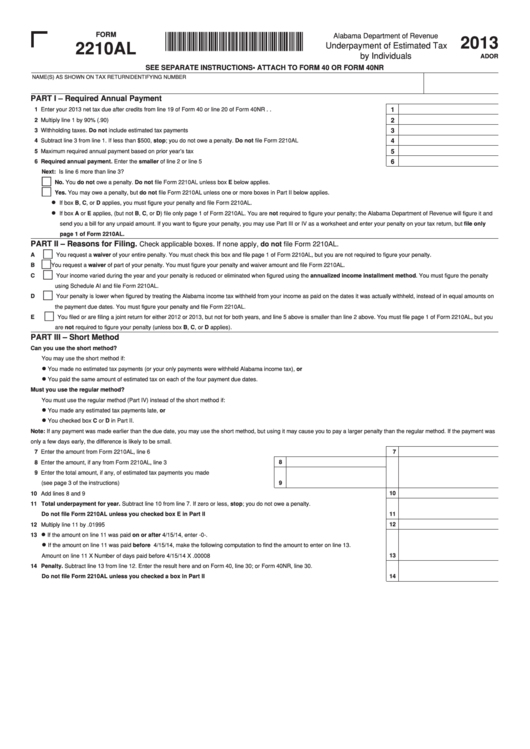

Fillable Form 2210al Underpayment Of Estimated Tax By Individuals

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Form il Fill out & sign online DocHub

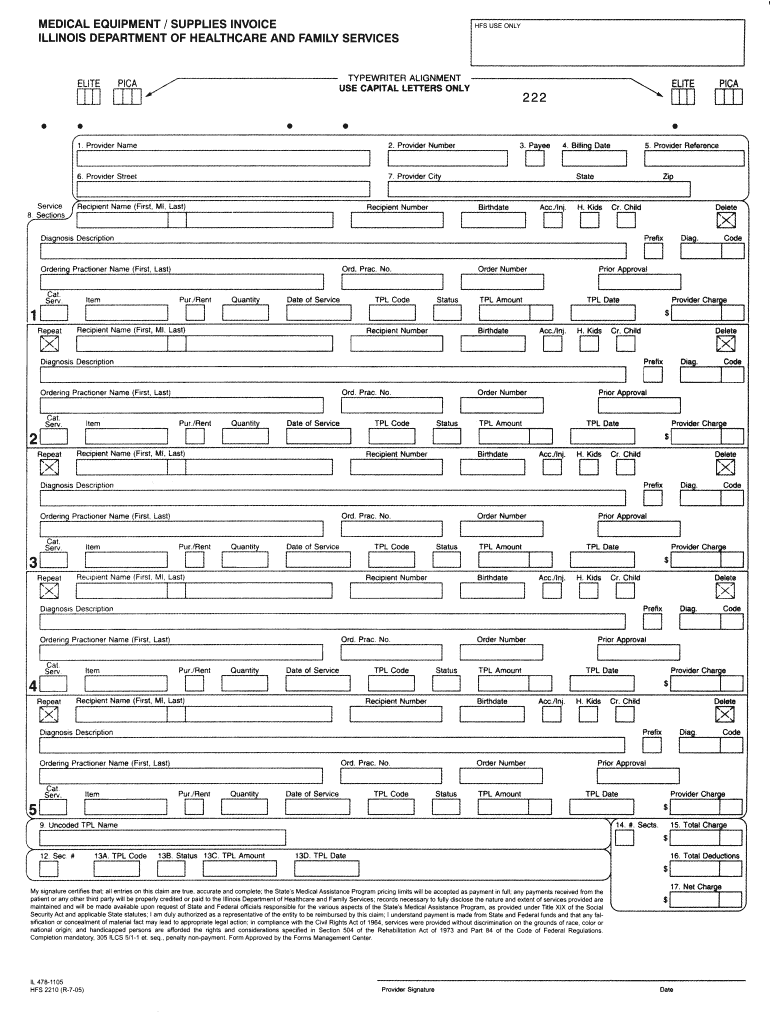

IL HFS 2210 20052022 Fill and Sign Printable Template Online US

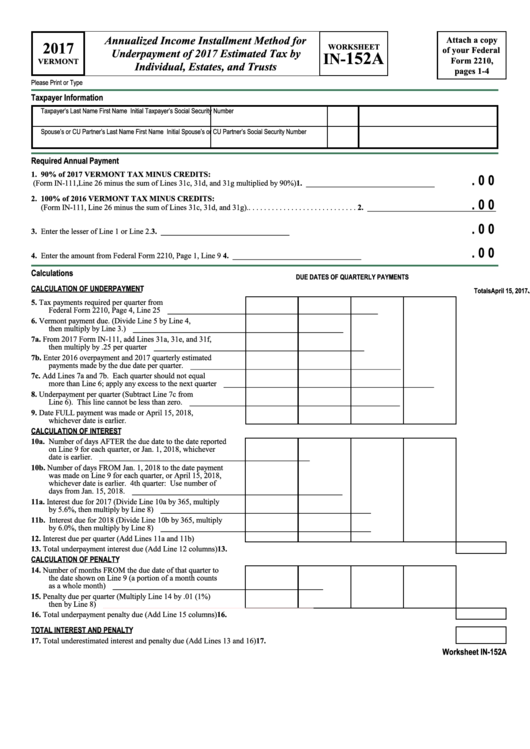

Form 2210 Worksheet In152a Annualized Installment Method

Fillable Online 2005 IL2210 Form IL2210 Instructions FormSend Fax

Related Post: