Form Il 1120 Instructions

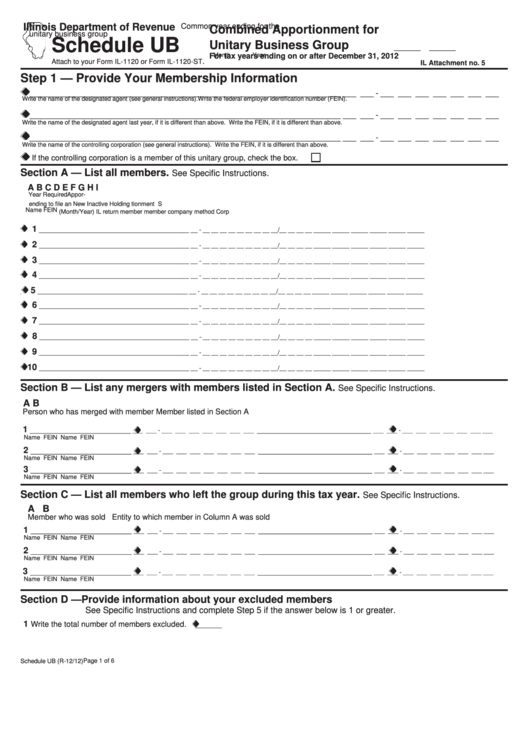

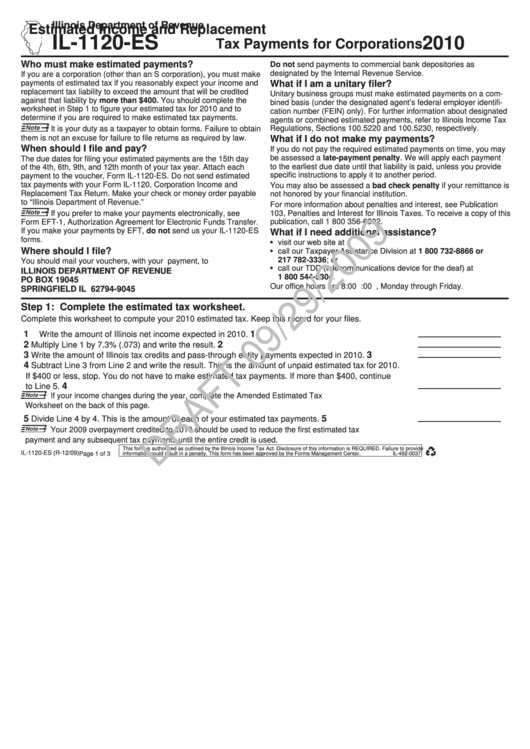

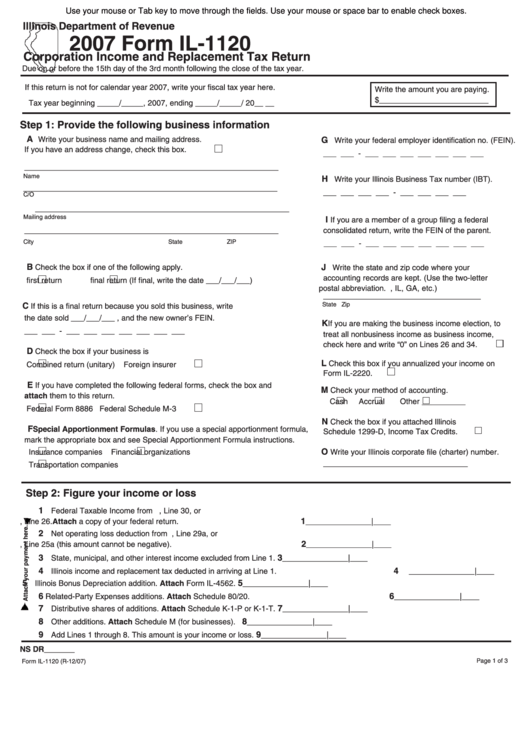

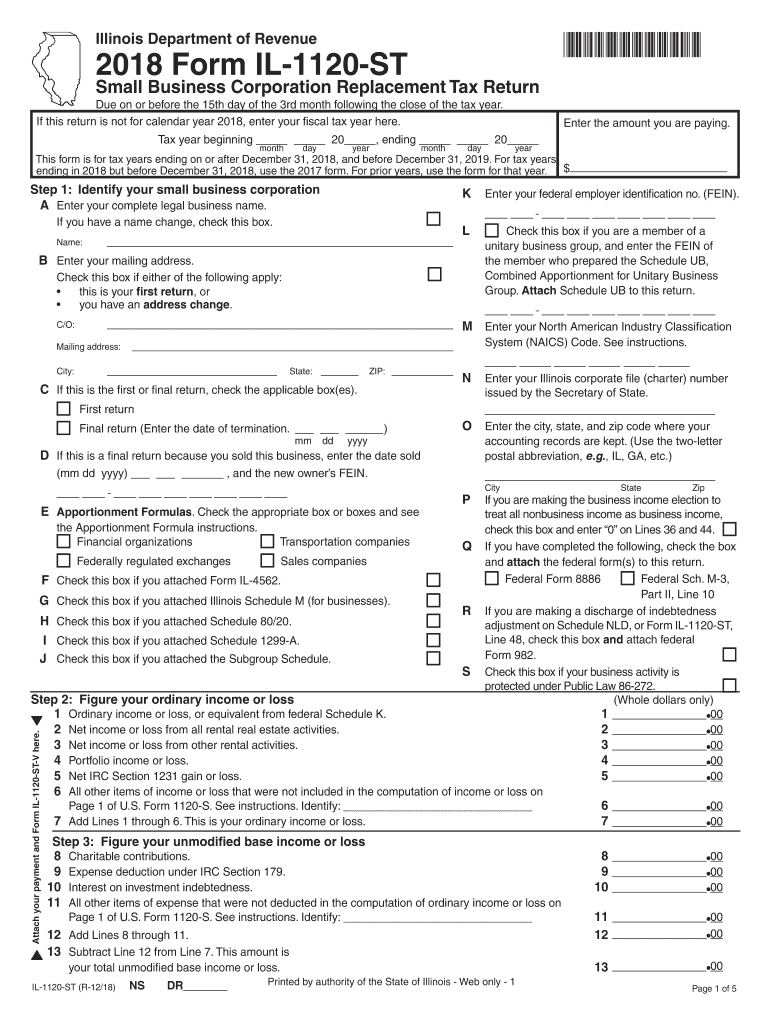

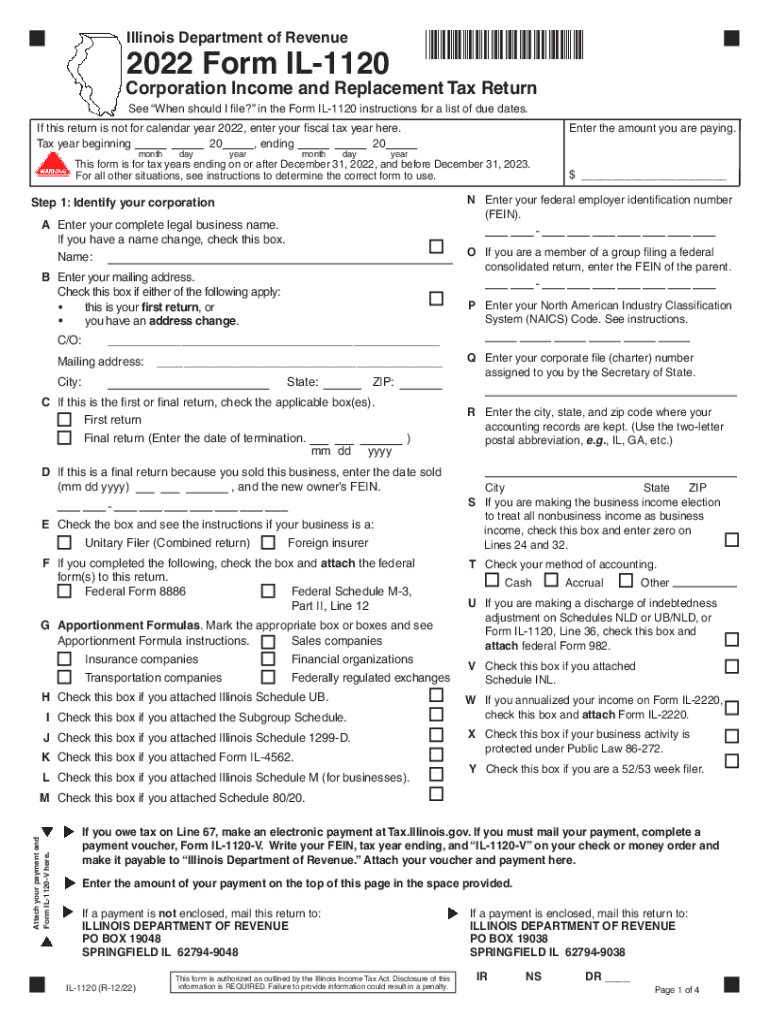

Form Il 1120 Instructions - For tax years ending before december 31, 2020, use the 2019. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. For prior years, see instructions to determine the correct form to use. Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023. 2022 small business corporation replacement tax forms. For tax years ending on or after december 31, 2021 and. For tax years ending before december 31, 2021, use the 2020. You may not use this. Increase in penalty for failure to file. Web corporation income and replacement tax return. For all other situations, see instructions to determine the correct form to use. You may not use this. Corporation income and replacement tax return: Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Payment voucher for 2019 corporation income and replacement tax (use this voucher and appendix a of. Web corporation income and replacement tax return. Enter your illinois corporate file (charter) number. 2022 small business corporation replacement tax forms. Corporation income and replacement tax return: Increase in penalty for failure to file. For tax years ending before december 31, 2021, use the 2020. For prior years, see instructions to determine the correct form to use. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. For tax years ending before december 31, 2020, use the 2019. You may not use this. Increase in penalty for failure to file. Enter your illinois corporate file (charter) number. Web corporation income and replacement tax return. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. For all other situations, see instructions to determine the correct form to use. After december 31, 2020 and before december 31, 2021. Corporation income and replacement tax return: For tax years ending before december 31, 2020, use the 2019. Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023. 2022 small business corporation replacement tax forms. For tax years ending before december 31, 2020, use the 2019. Increase in penalty for failure to file. For prior years, see instructions to determine the correct form to use. Payment voucher for 2019 corporation income and replacement tax (use this voucher and appendix a of. You may not use this. For all other situations, see instructions to determine the correct form to use. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. For tax years ending before december 31, 2021, use the 2020. 2022 small business corporation replacement tax forms. For prior years, see instructions to determine the correct form to use. 2022 small business corporation replacement tax forms. Corporation income and replacement tax return: Increase in penalty for failure to file. For tax years ending before december 31, 2021, use the 2020. Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Enter your illinois corporate file (charter) number. Web corporation income and replacement tax return. Corporation income and replacement tax return: After december 31, 2020 and before december 31, 2021. Payment voucher for 2019 corporation income and replacement tax (use this voucher and appendix a of. For prior years, see instructions to determine the correct form to use. After december 31, 2020 and before december 31, 2021. Web corporation income and replacement tax return. Increase in penalty for failure to file. Enter your illinois corporate file (charter) number. After december 31, 2020 and before december 31, 2021. For all other situations, see instructions to determine the correct form to use. For tax years ending on or after december 31, 2021 and. Corporation income and replacement tax return: You may not use this. Web corporation income and replacement tax return. • has net income or loss as defined under the illinois income tax act. Payment voucher for 2019 corporation income and replacement tax (use this voucher and appendix a of. 2022 small business corporation replacement tax forms. For tax years ending before december 31, 2021, use the 2020. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. For tax years ending before december 31, 2020, use the 2019. Increase in penalty for failure to file. For prior years, see instructions to determine the correct form to use. Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023.Schedule Ub Attach To Your Form Il1120 Or Form Il1120St Combined

1120s instructions 2023 PDF Fill online, Printable, Fillable Blank

What is Form 1120S and How Do I File It? Ask Gusto

Form Il1120Es Draft Estimated And Replacement Tax Payments

Fillable Form Il1120 Corporation And Replacement Tax Return

Il 1120st Form Fill Out and Sign Printable PDF Template signNow

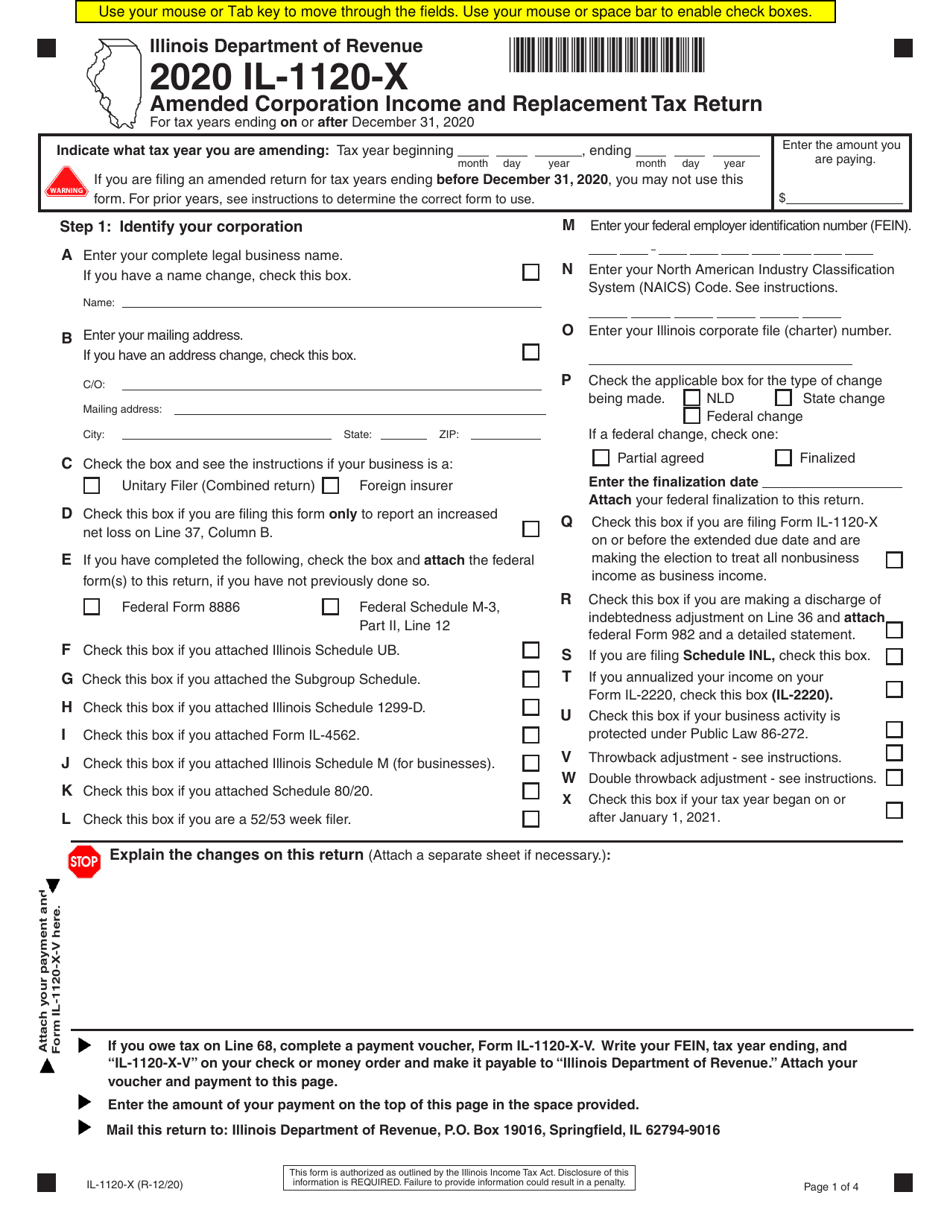

Form IL1120X Download Fillable PDF or Fill Online Amended Corporation

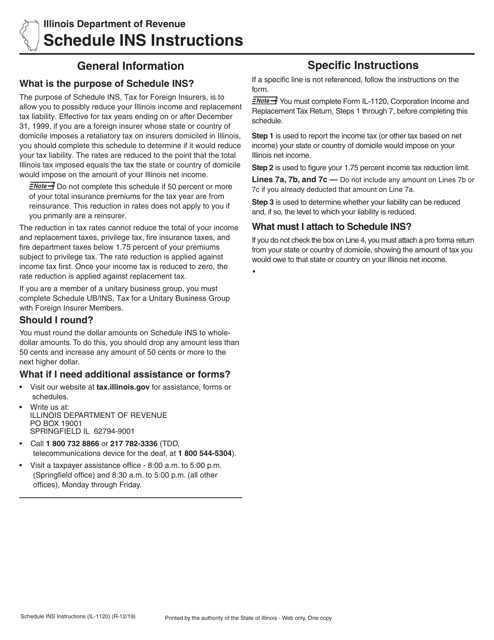

Download Instructions for Form IL1120 Schedule INS Tax for Foreign

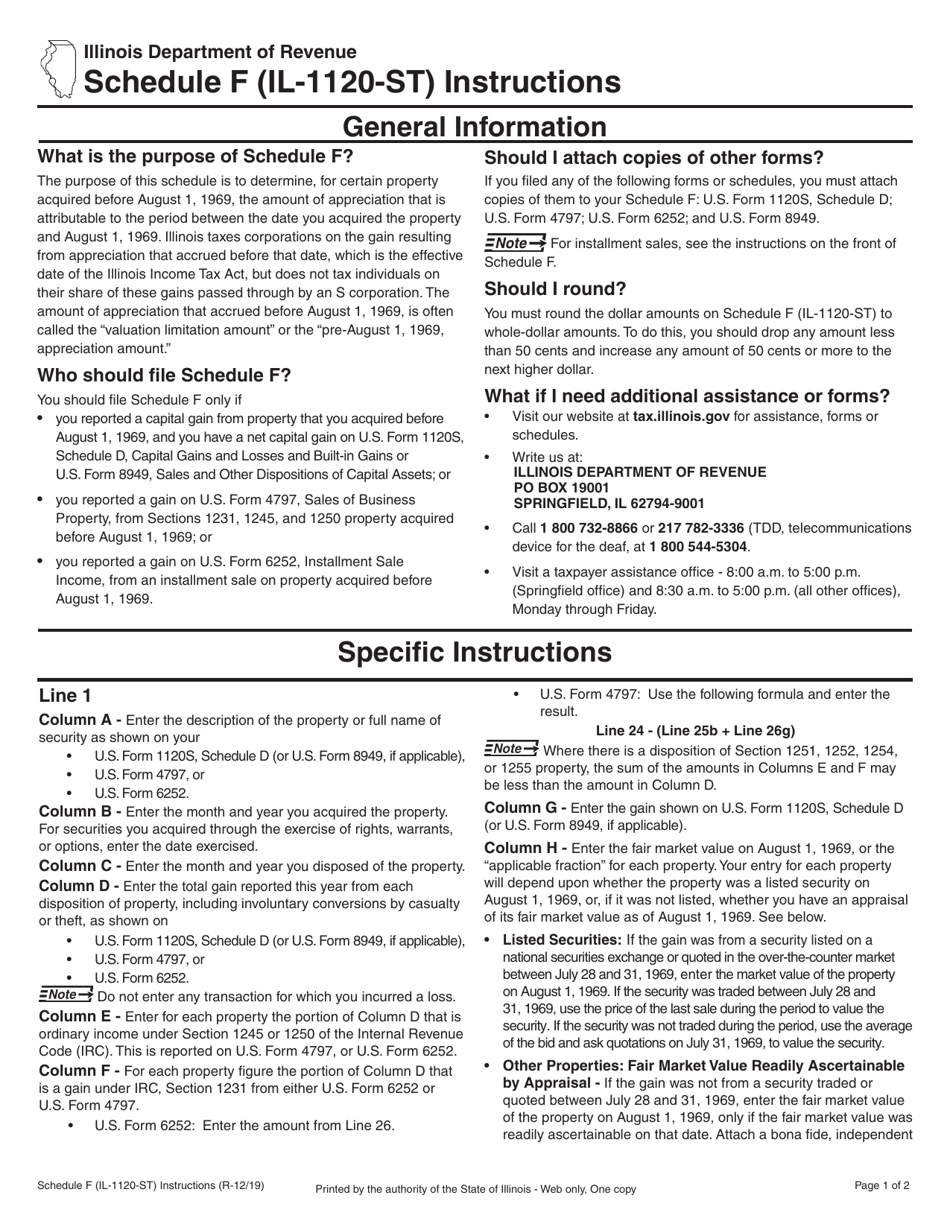

Download Instructions for Form IL1120ST Schedule F Gains From Sales

Il 1120 Fill Out and Sign Printable PDF Template signNow

Related Post: