Illinois Form 1065 Instructions

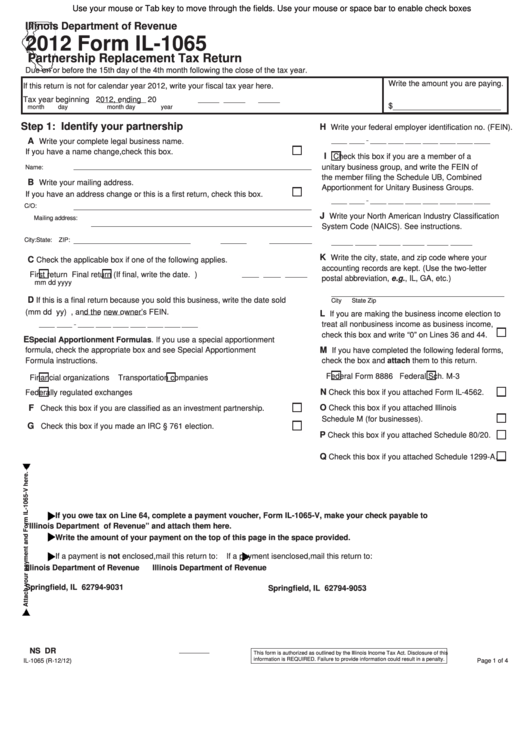

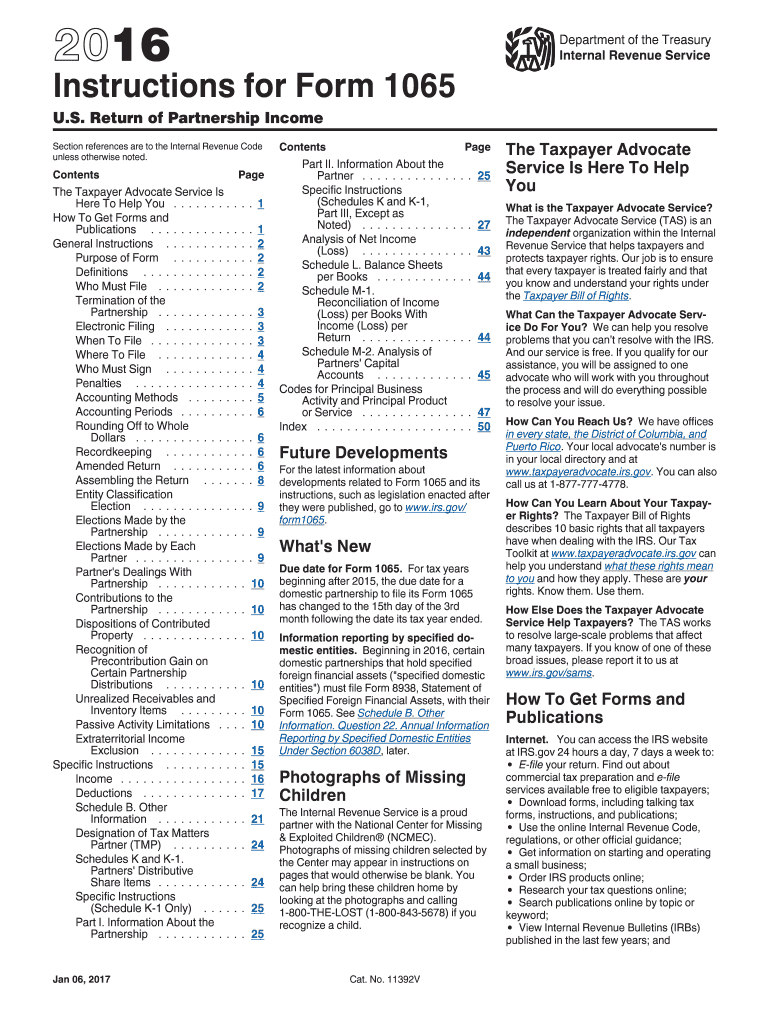

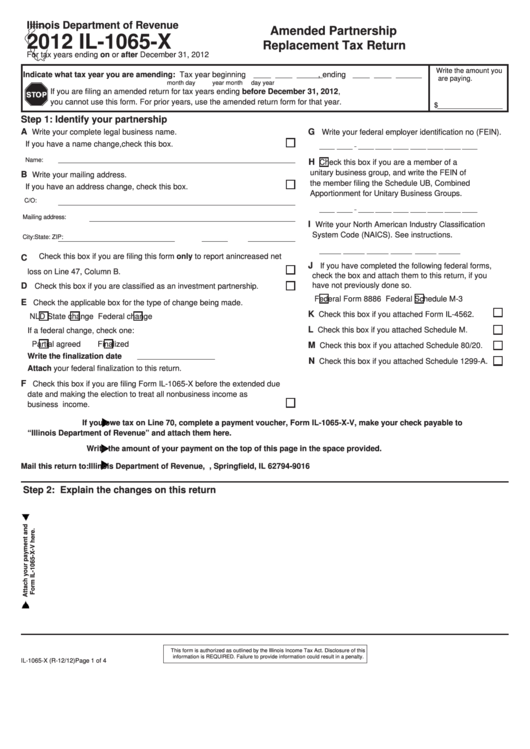

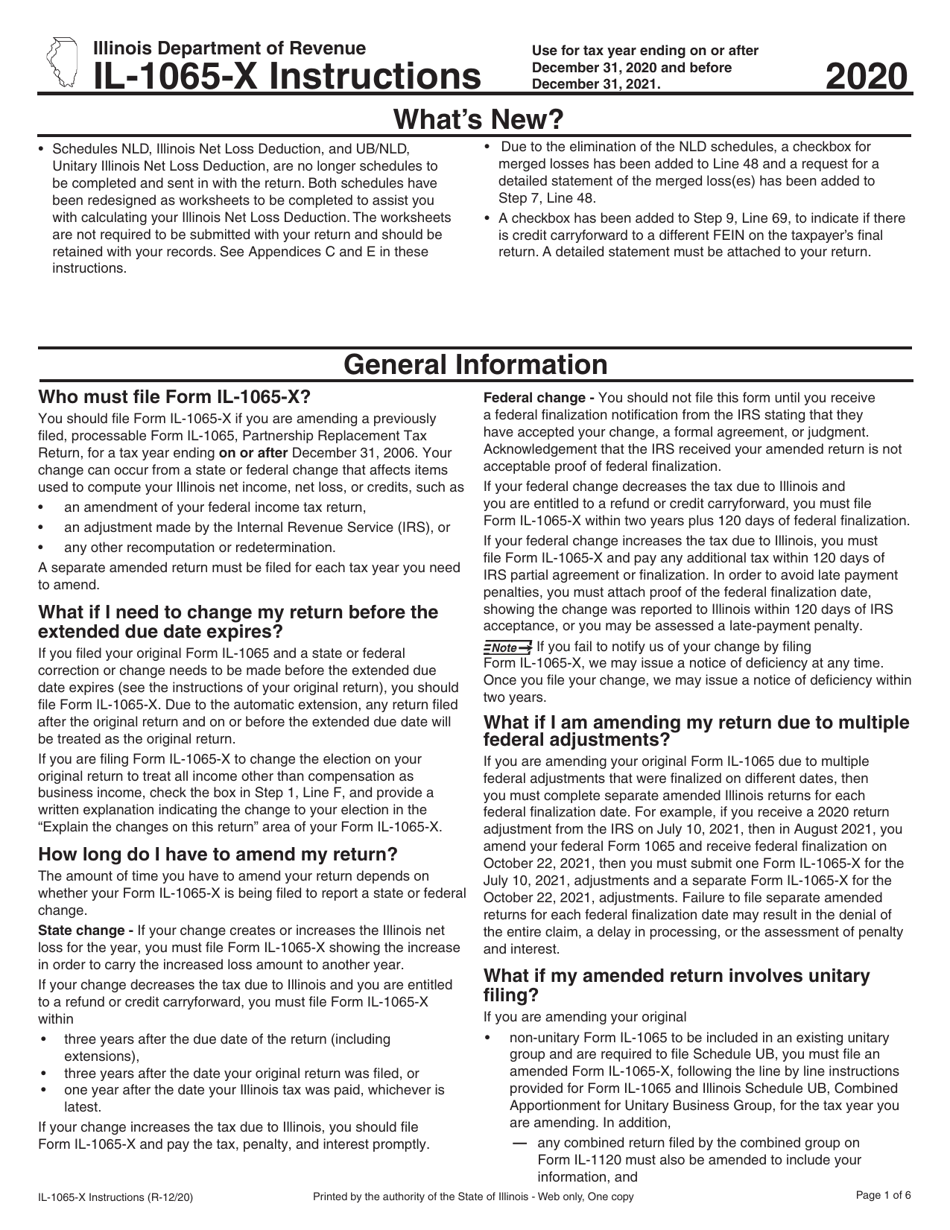

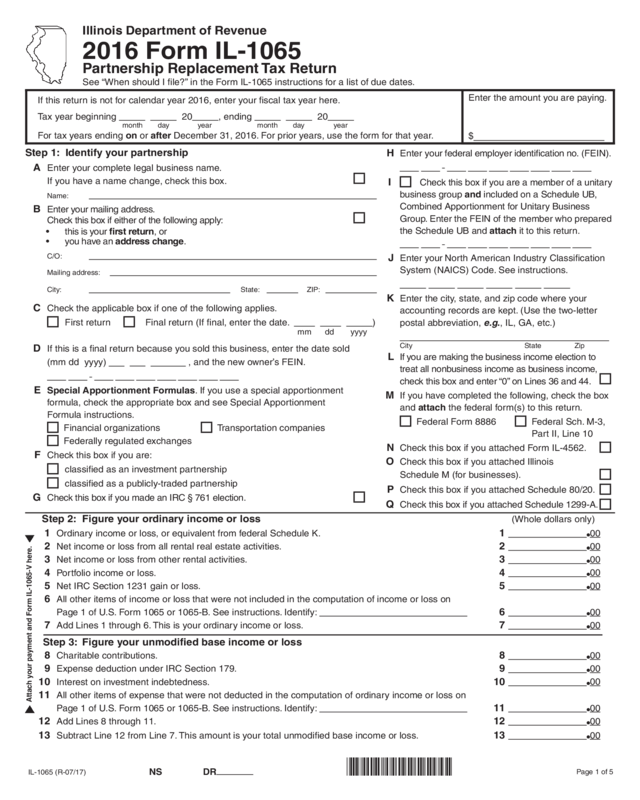

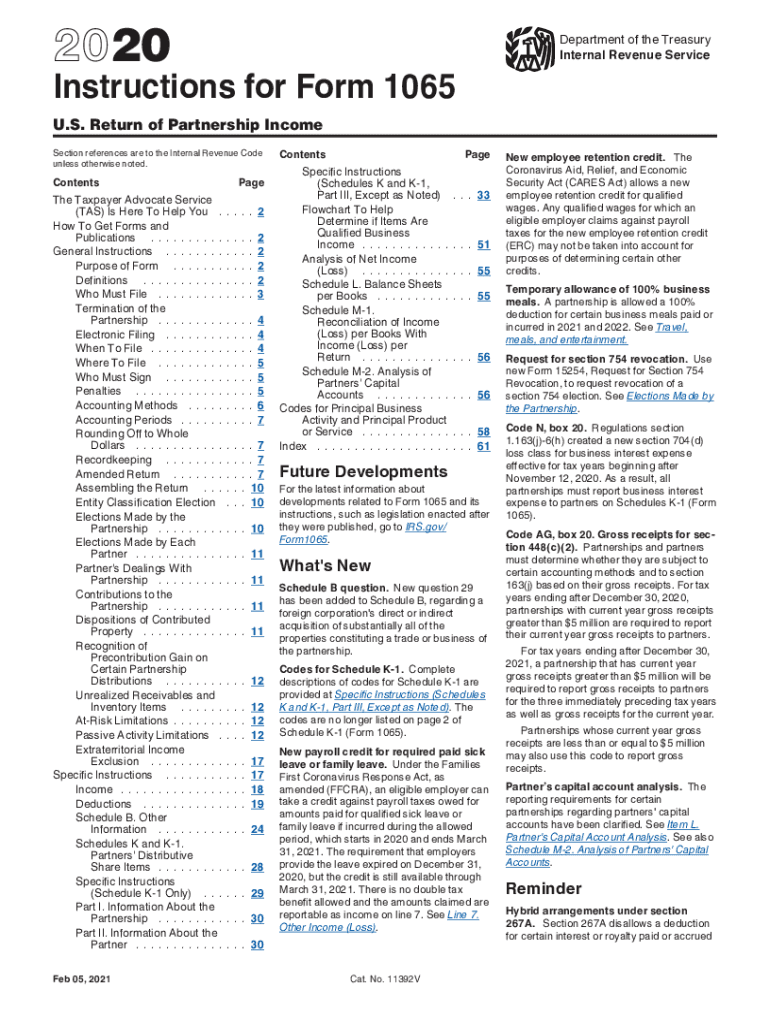

Illinois Form 1065 Instructions - Return of partnership income partnerships file an information return to report their income, gains, losses, deductions, credits, etc. For a fiscal year or a short tax year, fill in the tax. Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Web this form is for tax years ending on or after december 31, 2020, and before december 31, 2021. For all other situations, see instructions to determine the correct form to use. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. You may not use this form. Figure your unmodified base income or. This is your ordinary income or loss. Add lines 1 through 6. • schedules nld, illinois net loss deduction, and ub/nld, unitary illinois net loss deduction, are no longer schedules to be completed. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. Complete, edit or print tax forms instantly. For a fiscal year or a short tax year, fill in. If you are filing an amended return for tax years ending. • schedules nld, illinois net loss deduction, and ub/nld, unitary illinois net loss deduction, are no longer schedules to be completed. If the partnership's principal business, office, or agency is located in: For all other situations, see instructions to determine the correct form to use. Ad download or email. This is your ordinary income or loss. Web tax year beginning , ending. You may not use this form. • schedules nld, illinois net loss deduction, and ub/nld, unitary illinois net loss deduction, are no longer schedules to be completed. Ad get ready for tax season deadlines by completing any required tax forms today. And the total assets at the end of the tax year. Figure your unmodified base income or. Month day year month day year. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web this form is for tax years ending on or after december 31,. Ad download or email irs 1065 & more fillable forms, try for free now! Web the apportionment factor is typically calculated using a formula specified by the state's tax laws. Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023. For all other situations, see instructions to determine the correct form. For a fiscal year or a short tax year, fill in the tax. Month day year month day year. For all other situations, see instructions to determine the correct form to use. Ad download or email irs 1065 & more fillable forms, try for free now! Web this form is for tax years ending on or after december 31, 2022,. For all other situations, see instructions to determine the correct form to use. If the partnership's principal business, office, or agency is located in: Web 23 rows description. Add lines 1 through 6. Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Web page 1 of u.s. Web forms and instructions about form 1065, u.s. Add lines 1 through 6. Web age 1 of u.s. For all other situations, see instructions to determine the correct form to use. If the partnership's principal business, office, or agency is located in: Web age 1 of u.s. Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023. For all other situations, see instructions to determine the correct form to use. Complete, edit or print tax forms instantly. You may not use this form. Web page 1 of u.s. Add lines 1 through 6. Web the apportionment factor is typically calculated using a formula specified by the state's tax laws. Web where to file your taxes for form 1065. Web tax year beginning , ending. Web 23 rows description. And the total assets at the end of the tax year. Figure your unmodified base income. This is your ordinary income or loss. Month day year month day year. Web page 1 of u.s. Complete, edit or print tax forms instantly. Web where to file your taxes for form 1065. If the partnership's principal business, office, or agency is located in: For a fiscal year or a short tax year, fill in the tax. Web forms and instructions about form 1065, u.s. You may not use this form. If you are filing an amended return for tax years ending. Add lines 1 through 6. Web the apportionment factor is typically calculated using a formula specified by the state's tax laws. Figure your unmodified base income or. • schedules nld, illinois net loss deduction, and ub/nld, unitary illinois net loss deduction, are no longer schedules to be completed. Web this form is for tax years ending on or after december 31, 2020, and before december 31, 2021. Web age 1 of u.s.Fillable Form Il1065, Partnership Replacement Tax Return 2012

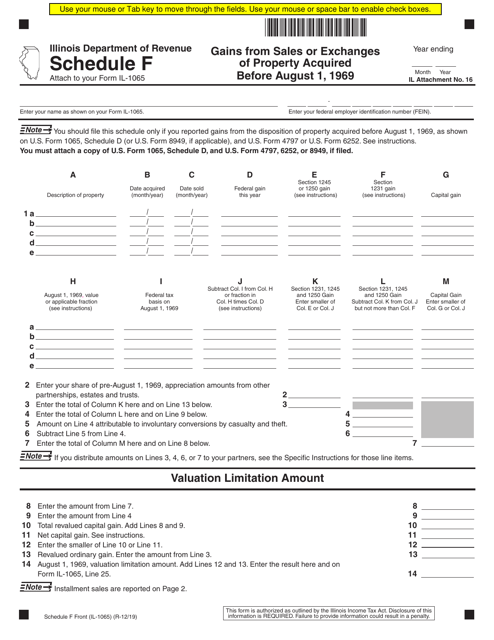

Form IL1065 Schedule F 2019 Fill Out, Sign Online and Download

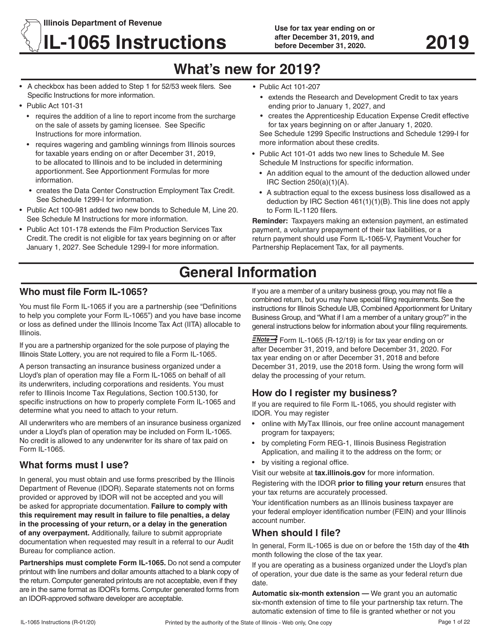

Download Instructions for Form IL1065 Partnership Replacement Tax

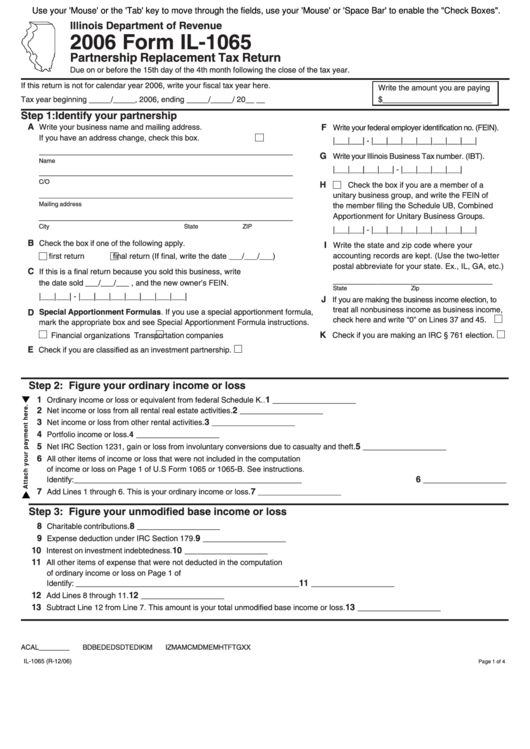

Fillable Form Il1065 Partnership Replacement Tax Return 2006

Form 1065 Instructions Fill Out and Sign Printable PDF Template signNow

Form Il1065X Amended Partnership Replacement Tax Return 2012

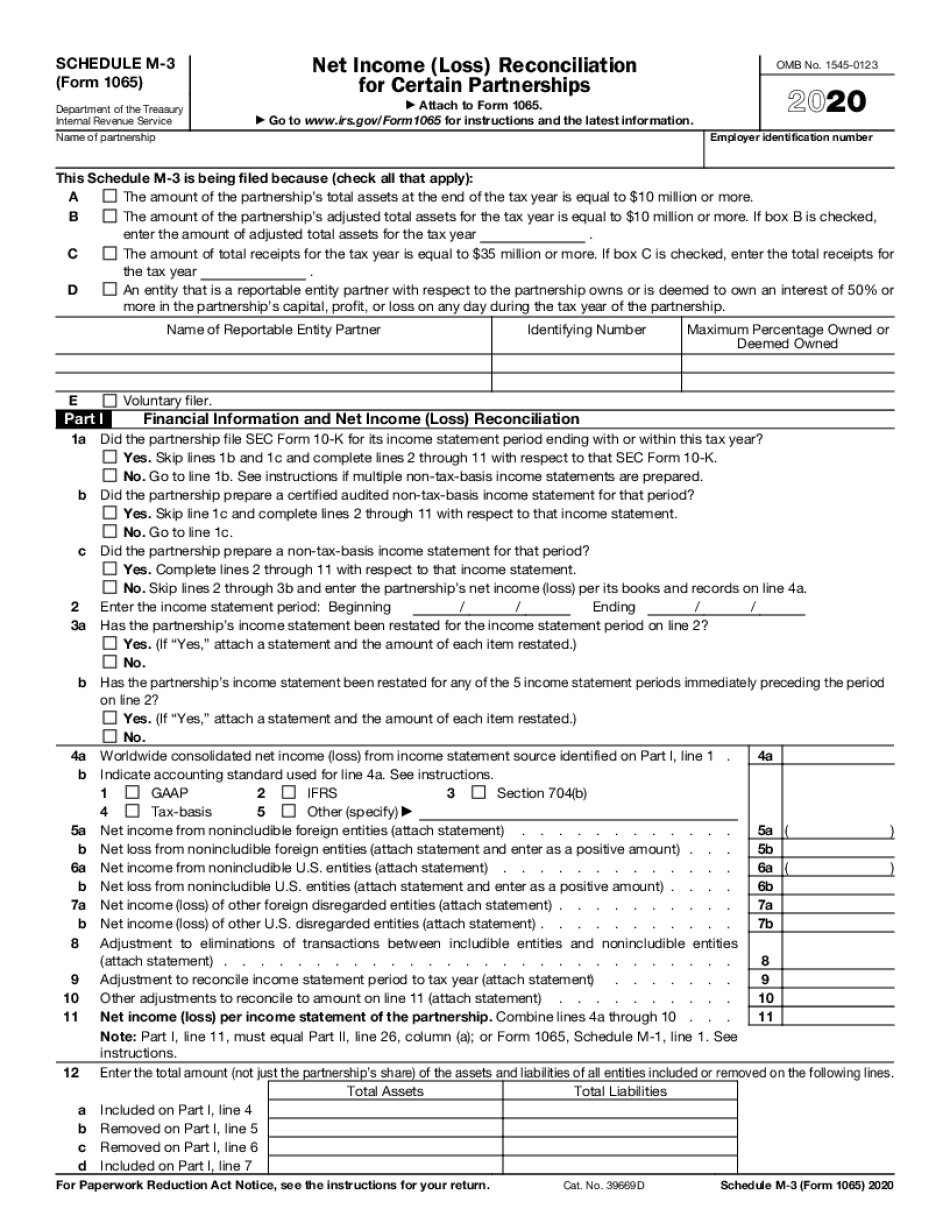

1065 Schedule M 3 Instructions Fill out and Edit Online PDF Template

Download Instructions for Form IL1065X Amended Partnership

2016 Form Il1065, Partnership Replacement Tax Return Edit, Fill

2020 Form IRS Instructions 1065 Fill Online, Printable, Fillable, Blank

Related Post: