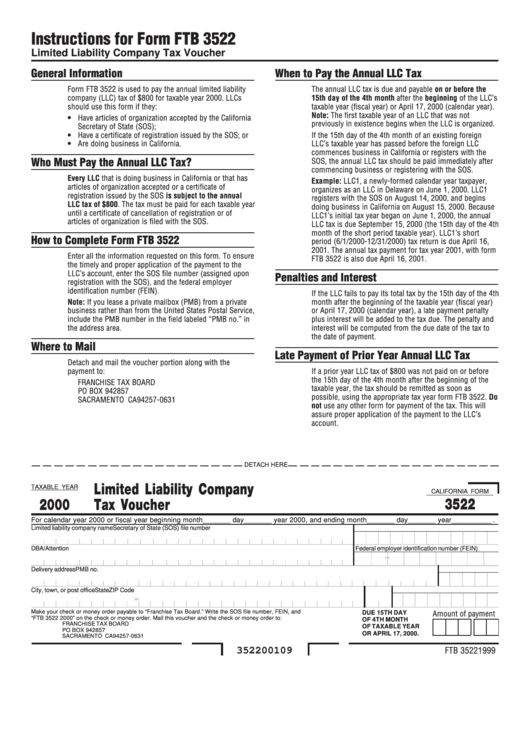

Form Ftb 3522

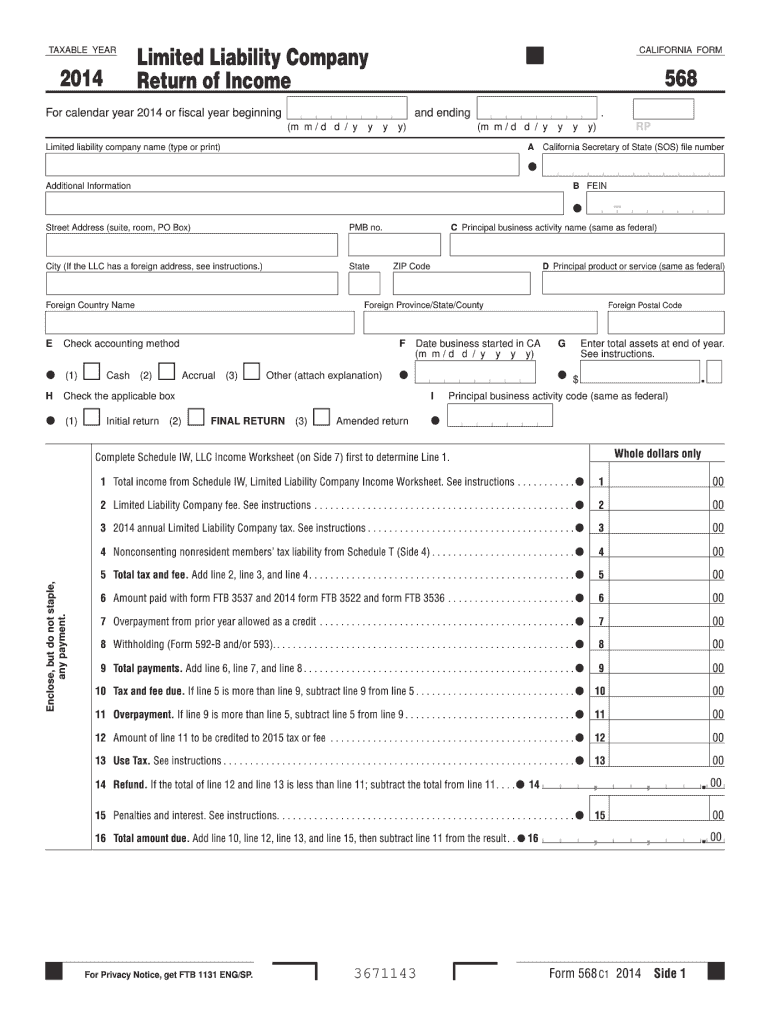

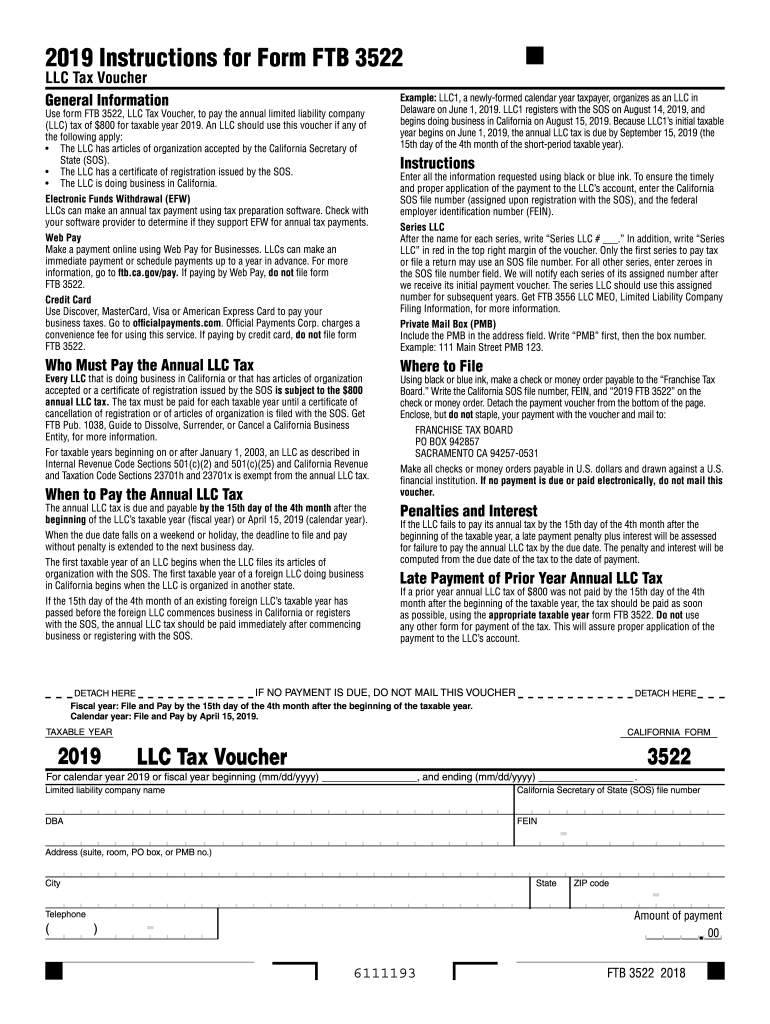

Form Ftb 3522 - Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2019. Web if a prior year llc tax of $800 was not paid by the 15th day of the 4th month after the beginning of the taxable year, the tax should be paid as soon as possible, using the. An llc should use this voucher if any of the following. Web 2021 instructions for form ftb 3522 llc tax voucher general informationuse form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for. Web we last updated california form 3522 in january 2023 from the california franchise tax board. Web llc owners should use the llc tax voucher form (ftb 3522), which can be submitted and paid online with a credit card, through the ftb’s web pay portal, or. Web form ftb 3522. The annual franchise tax form, called the llc tax voucher, is filed and paid using form ftb 3522. Web the california franchise tax board (ftb) june 1 issued the 2023 instructions for ftb 3522, llc tax voucher, for individual income tax purposes. No matter your llc’s revenue, the annual tax is. Web we last updated california form 3522 in january 2023 from the california franchise tax board. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Web llc owners should use the llc tax voucher form (ftb 3522), which can be submitted and paid online with a. Web the california franchise tax board (ftb) june 1 issued the 2023 instructions for ftb 3522, llc tax voucher, for individual income tax purposes. Web this form explains who is required to pay the annual llc tax, when to make the payment, how to file the application, and where to file it. No matter your llc’s revenue, the annual tax. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Web corporations file the franchise tax form or form 100. Form 3536 only needs to be filed if your income is $250,000. This form is used to report income from sources. Llcs will use form ftb 3522. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. Llcs will use form ftb 3522 to file their franchise taxes. Web once you’ve finished signing your instructions for form ft 3522 california franchise tax board, choose what you wish to do after that — save it or share the file. Web up to $40 cash back california form ftb 3522 is a tax form used by certain california taxpayers to report estimated tax payments. Web once you’ve finished signing your instructions for form ft 3522 california franchise tax board, choose what you wish to do after that — save it or share the file with other. Web the 3522 is. Web once you’ve finished signing your instructions for form ft 3522 california franchise tax board, choose what you wish to do after that — save it or share the file with other. Web llc owners should use the llc tax voucher form (ftb 3522), which can be submitted and paid online with a credit card, through the ftb’s web pay. Form 3536 only needs to be filed if your income is $250,000. An llc should use this voucher if any of the following. Web 2021 instructions for form ftb 3522 llc tax voucher general informationuse form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for. Use form ftb 3522, llc tax voucher,. We last updated the limited liability. Web corporations file the franchise tax form or form 100. An llc should use this. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2019. Web the california franchise tax board (ftb) june 1 issued the 2023 instructions for ftb 3522, llc. Llcs will use form ftb 3522 to file their franchise taxes. The annual franchise tax form, called the llc tax voucher, is filed and paid using form ftb 3522. An llc should use this. Web 2021 instructions for form ftb 3522 llc tax voucher general informationuse form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc). Llcs will use form ftb 3522 to file their franchise taxes. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2019. No matter your llc’s revenue, the annual tax is. An llc should use this. An llc should use this. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Web form ftb 3522. No matter your llc’s revenue, the annual tax is. Form 3522 will need to be filed in the 2nd. All llcs in the state are required to pay this annual tax to stay compliant. Web llc owners should use the llc tax voucher form (ftb 3522), which can be submitted and paid online with a credit card, through the ftb’s web pay portal, or. Web the california franchise tax board (ftb) june 1 issued the 2023 instructions for ftb 3522, llc tax voucher, for individual income tax purposes. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. An llc should use this. Web corporations file the franchise tax form or form 100. Web get forms, instructions, and publications. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2019. The annual franchise tax form, called the llc tax voucher, is filed and paid using form ftb 3522. Web up to $40 cash back california form ftb 3522 is a tax form used by certain california taxpayers to report estimated tax payments. An llc should use this voucher if any of the following. An llc and other entity types must also be registered with the. We last updated the limited liability. This form is for income earned in tax year 2022, with tax returns due in april. An llc should use this. This form is used to report income from sources.2014 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

2019 Form CA FTB 3522 Fill Online, Printable, Fillable, Blank pdfFiller

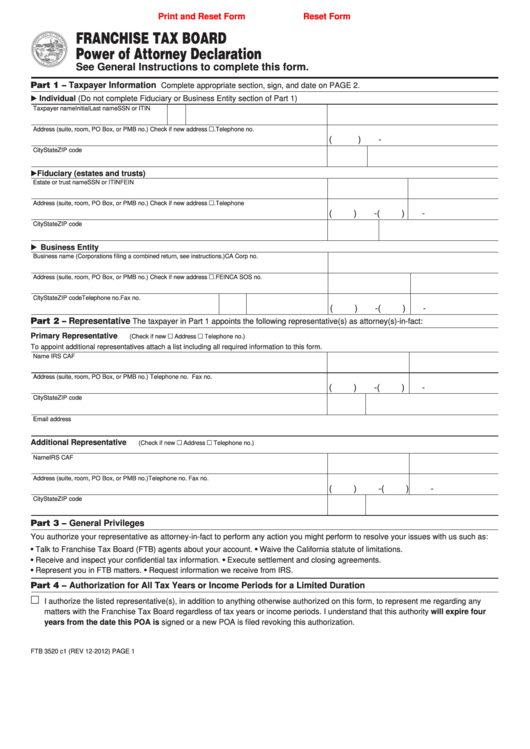

Fillable Form Ftb 3520 C1 Ranchise Tax Board Power Of Attorney

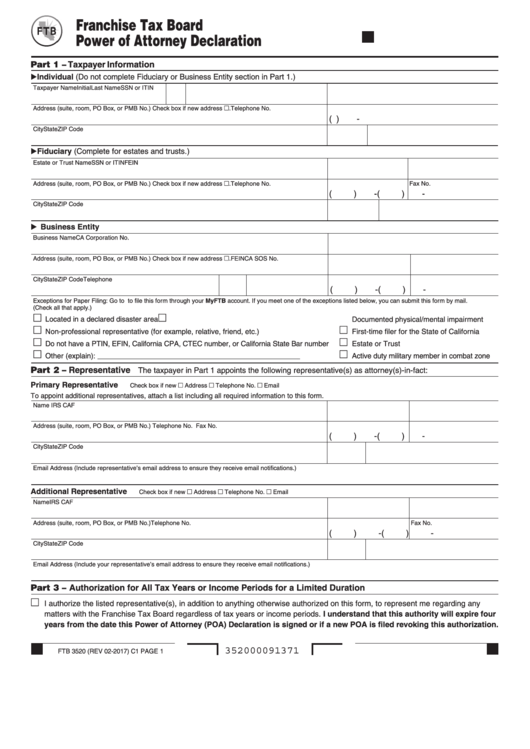

Fillable Form Ftb 3520 Franchise Tax Board Power Of Attorney

2017 Form 3522 Llc Tax Voucher Edit, Fill, Sign Online Handypdf

California Tax Form 3522 (Draft) Instructions For Form Ftb 3522 Llc

Form Ftb 3522 Limited Liability Company Tax Voucher 2000 printable

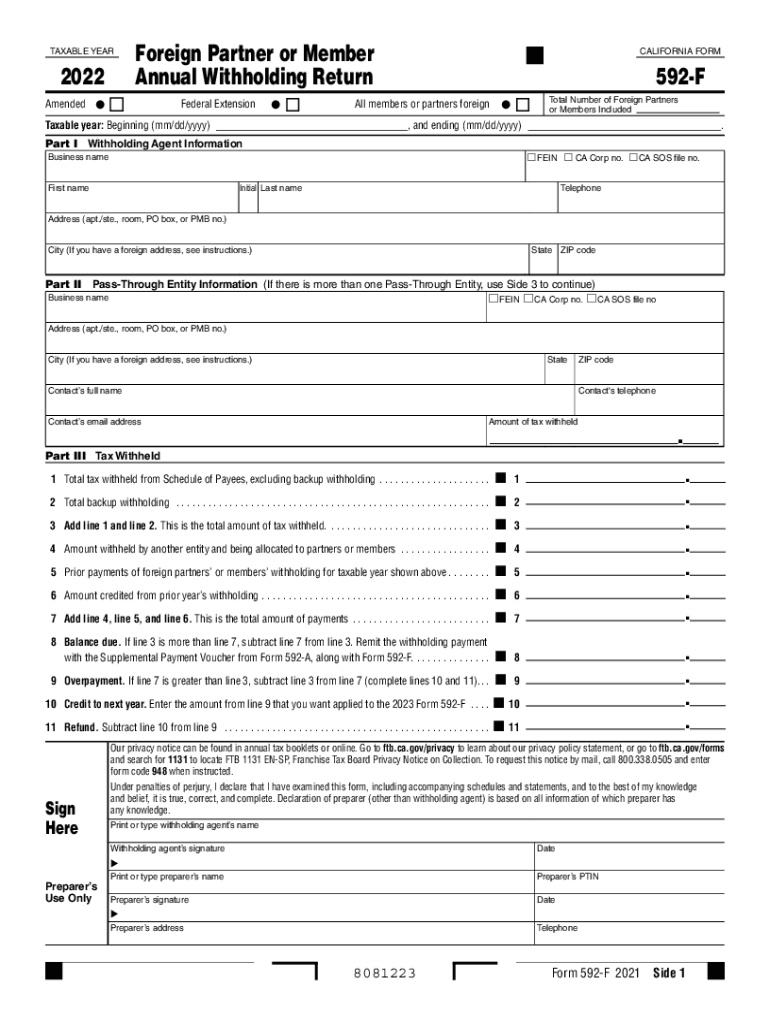

ftb.ca.gov forms 09_592

2015 Form Ftb 3522 Llc Tax Voucher Tax Walls

592 F Fill Out and Sign Printable PDF Template signNow

Related Post: