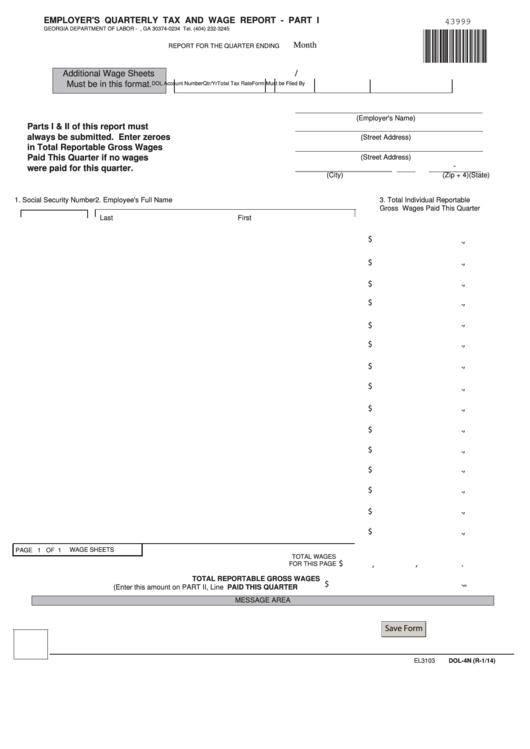

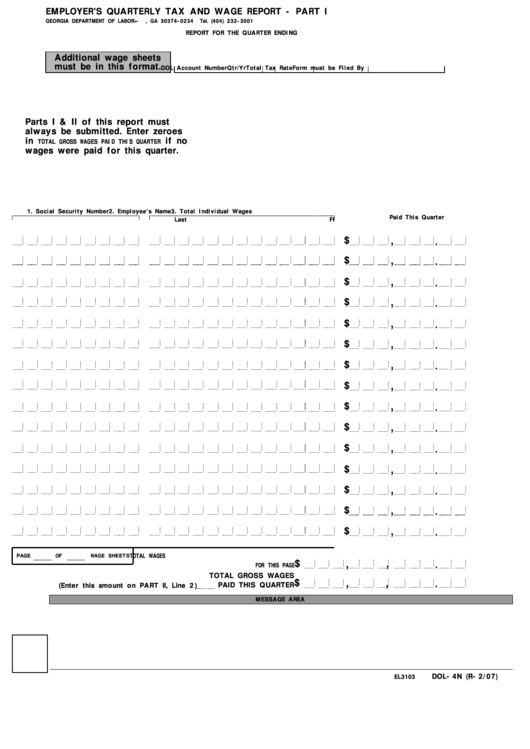

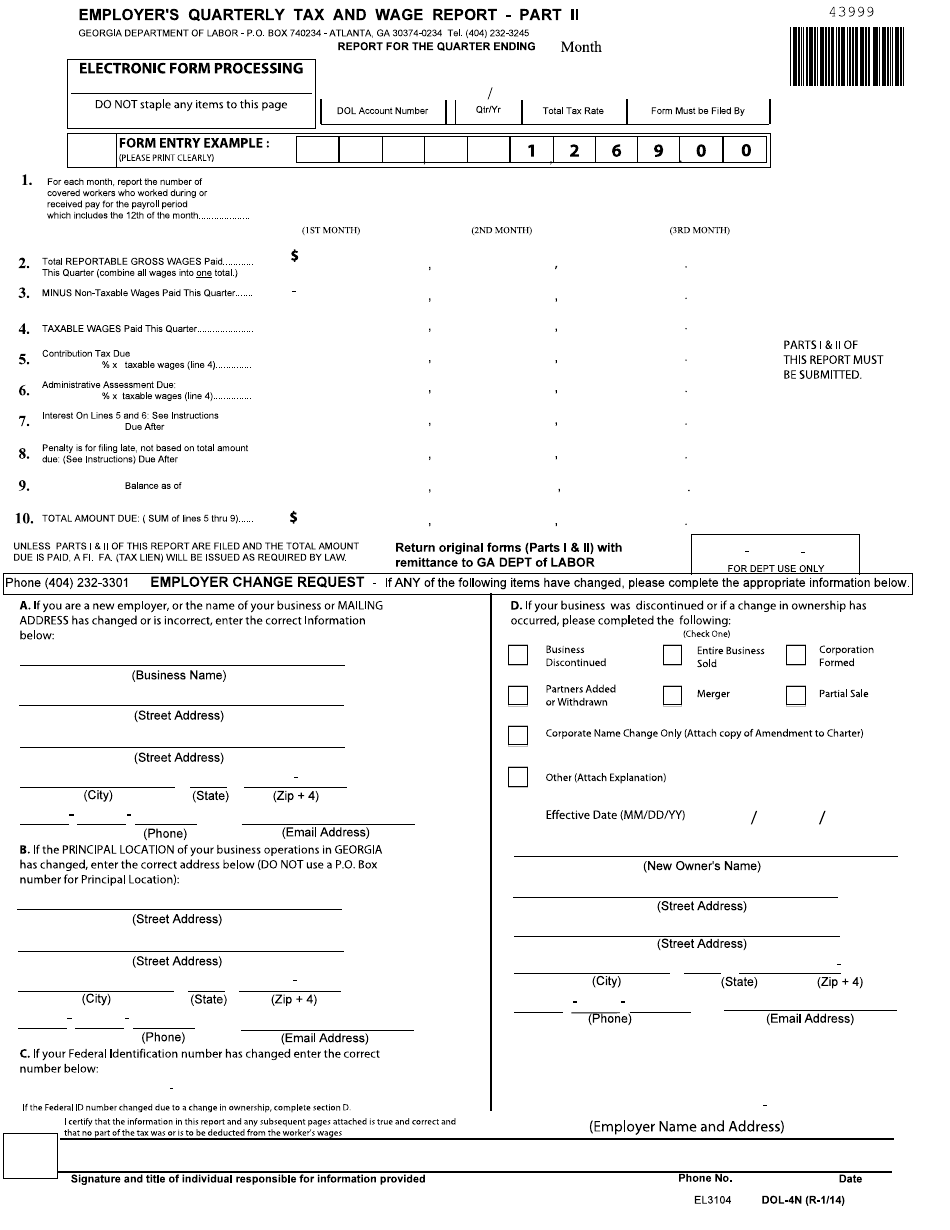

Form Dol 4N

Form Dol 4N - Put the relevant date and. Web requirements for electronic filing of quarterly tax and wage reports. Ad uslegalforms.com has been visited by 100k+ users in the past month Click the link to see the form instructions. These are the most frequently requested u.s. Fill out the military pay order online and print it out for free. These include administration of georgia's unemployment insuran Use the add new button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its url. Click on the get form button. Select the appropriate filing quarter. Click on the fillable fields and put the requested data. Web go to employees or on the fly > state tax & wage forms. Edit & sign dol4n form. Web up to $40 cash back 2. Web the form is designed to: Pick the document template you require from our library of legal form samples. Ad uslegalforms.com has been visited by 100k+ users in the past month Edit & sign dol4n form. Employers are required to file their quarterly wage and tax reports electronically when reporting more. Read the guidelines to determine which info you need to include. Edit & sign dol4n form. Web go to employees or on the fly > state tax & wage forms. Use the add new button. Select the appropriate filing quarter. Click the link to see the form instructions. Web up to $40 cash back 2. Put the relevant date and. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its url. However, failure to provide all requested information may result in an inability to process the form. Web the georgia department of labor provides a wide range of services to job seekers and employers. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its url. Dd form 114 is often used in. Click on the get form button. Put the relevant date and. Employers are required to file their quarterly wage and tax reports electronically when reporting more. Web up to $40 cash back 2. Use the add new button. Updated 10 months ago by greg hatfield. Web reporting taxes and wages. Updated 10 months ago by greg hatfield. Ad uslegalforms.com has been visited by 100k+ users in the past month Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its url. Web the form is designed to: Web go to employees or on the fly > state tax & wage. (1) correct previously reported wages and/or (2) report wages of individuals who were omitted from the original employer’s quarterly tax and wage. These include administration of georgia's unemployment insuran Web reporting taxes and wages. Dd form 114 is often used in. These are the most frequently requested u.s. Edit & sign dol4n form. Select the appropriate filing quarter. Put the relevant date and. These include administration of georgia's unemployment insuran Employers are required to file their quarterly wage and tax reports electronically when reporting more. Web requirements for electronic filing of quarterly tax and wage reports. These are the most frequently requested u.s. (1) correct previously reported wages and/or (2) report wages of individuals who were omitted from the original employer’s quarterly tax and wage. Edit & sign dol4n form. Read the guidelines to determine which info you need to include. Pick the document template you require from our library of legal form samples. Read the guidelines to determine which info you need to include. Web up to $40 cash back 2. The annual report and any payment due must be filed on or before. Updated 10 months ago by greg hatfield. Web the form is designed to: Employers are required to file their quarterly wage and tax reports electronically when reporting more. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its url. Click on the get form button. Web open the form in the online editor. You can complete some forms online, while you can download and print all others. Click on the fillable fields and put the requested data. Upload the ga dol 4n instructions. Web reporting taxes and wages. Web use a printable form dol 4n template to make your document workflow more streamlined. These are the most frequently requested u.s. Edit & sign dol4n form. Put the relevant date and. (1) correct previously reported wages and/or (2) report wages of individuals who were omitted from the original employer’s quarterly tax and wage. Web requirements for electronic filing of quarterly tax and wage reports.Form Dol4n Employer'S Quarterly Tax And Wage Report

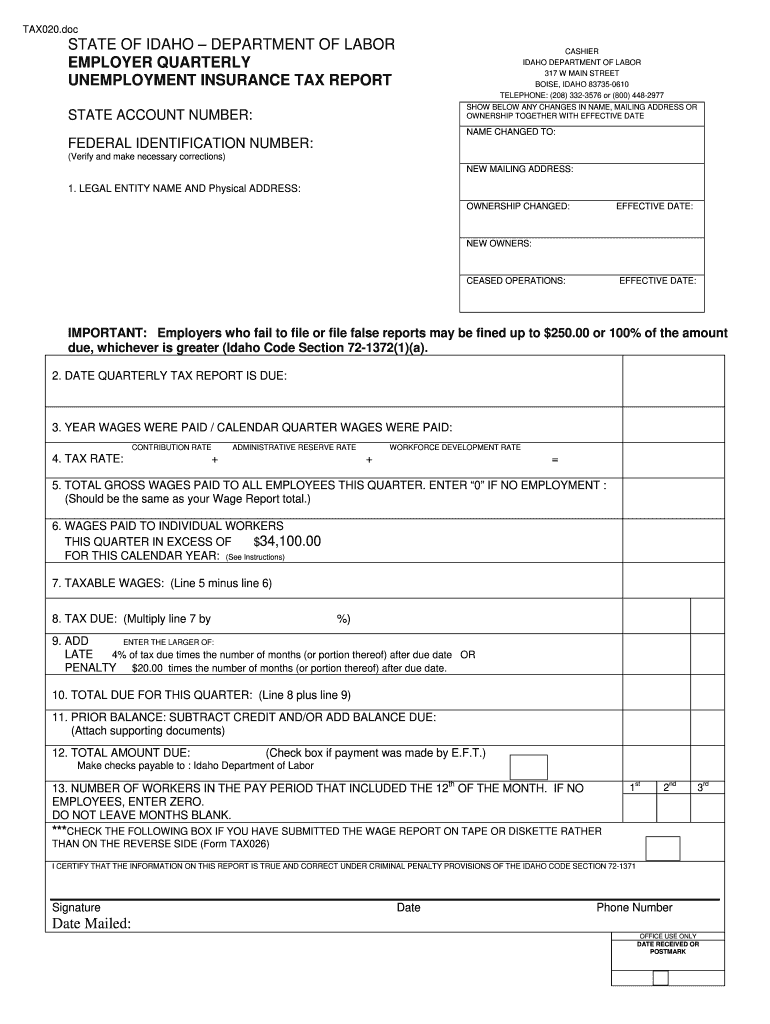

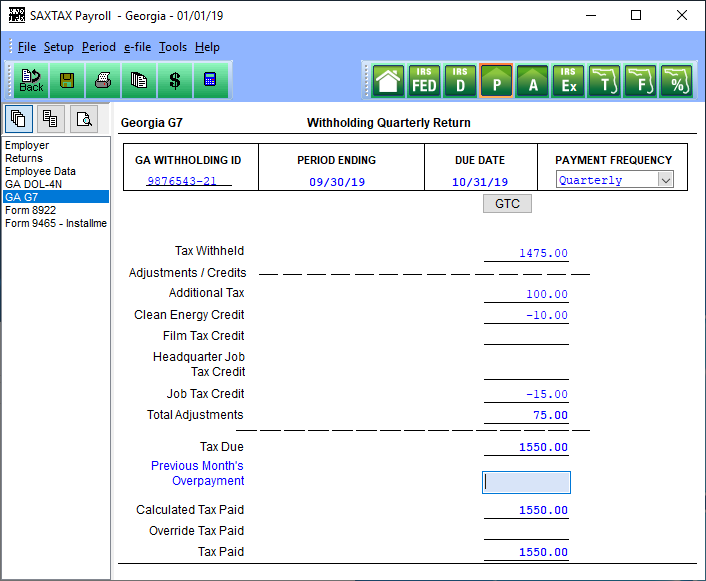

Tax020 form Fill out & sign online DocHub

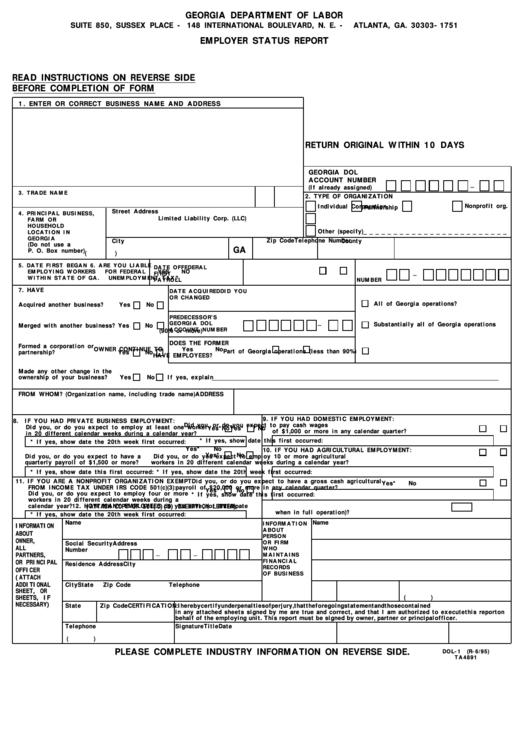

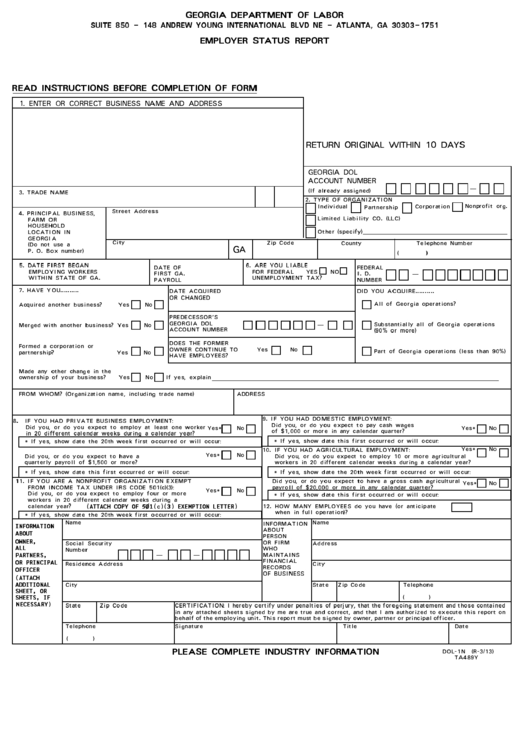

Form Dol1 Employer Status Report printable pdf download

Form Dol4n Employer'S Quarterly Tax And Wage Report

Printable Form Dol4N

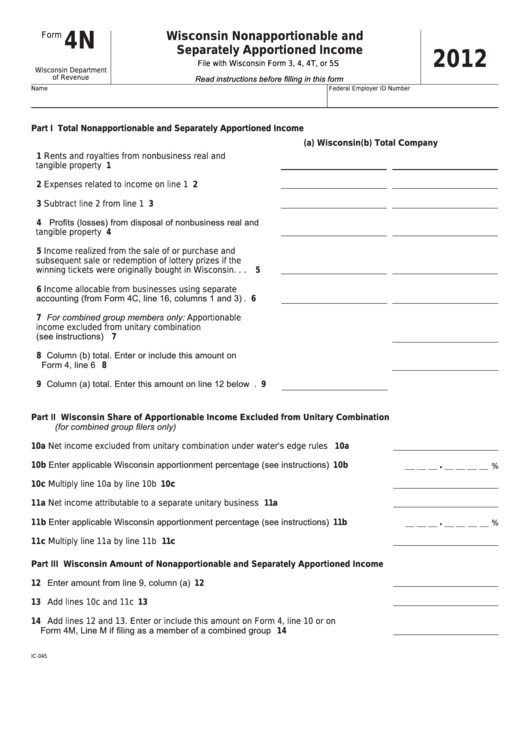

Fillable Form 4n Wisconsin Nonapportionable And Separately

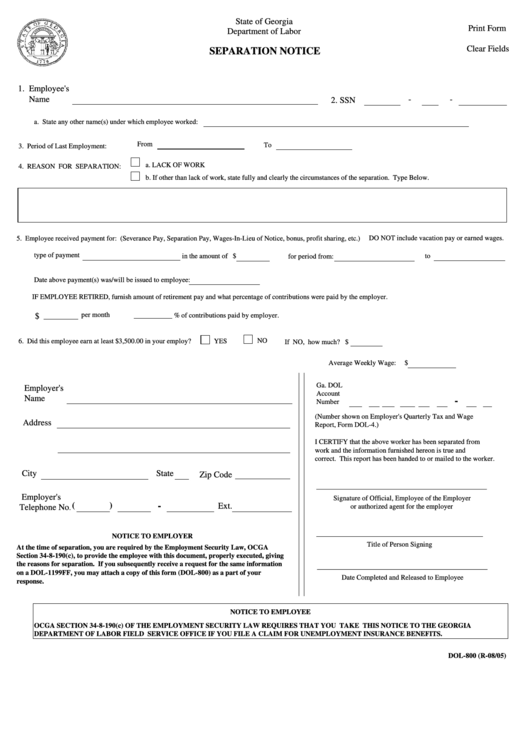

20 Department Of Labor Forms And Templates free to download in PDF

Printable Form Dol4N

Form DOL4N Download Fillable PDF or Fill Online Employer's Quarterly

Dol 4a Fill out & sign online DocHub

Related Post: