Form Ct W4P

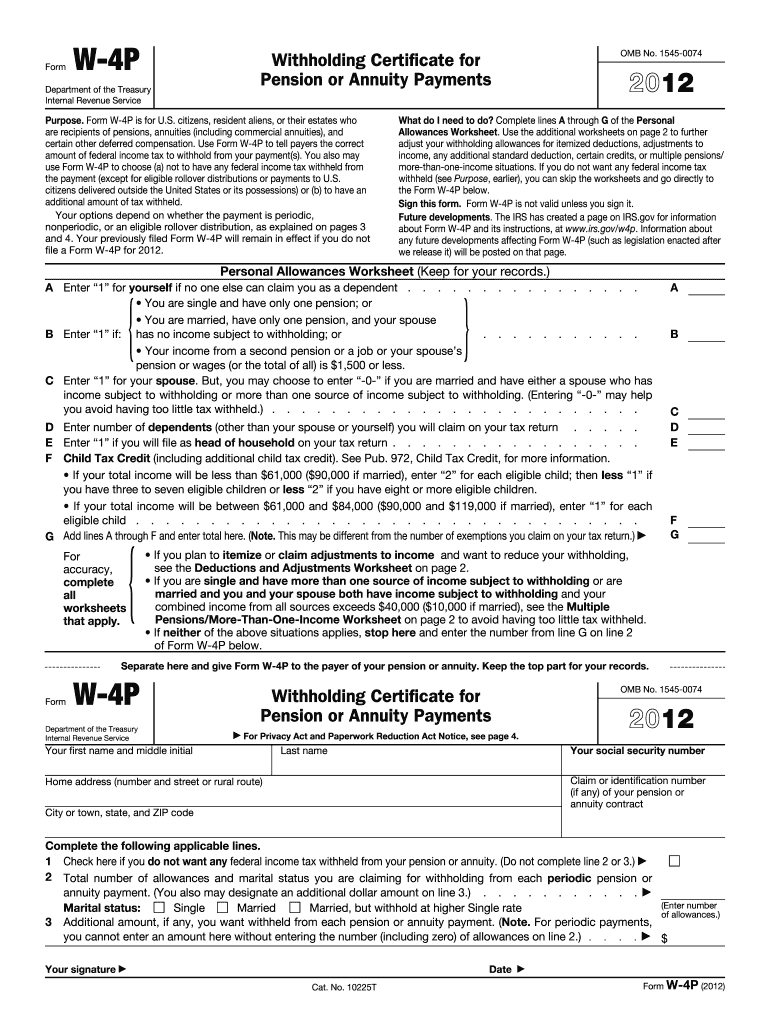

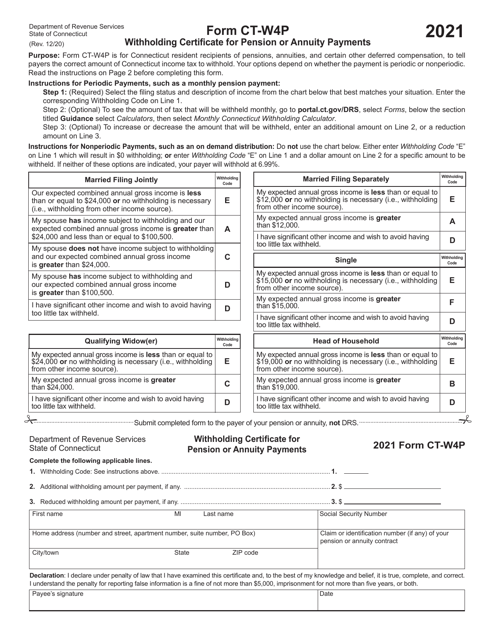

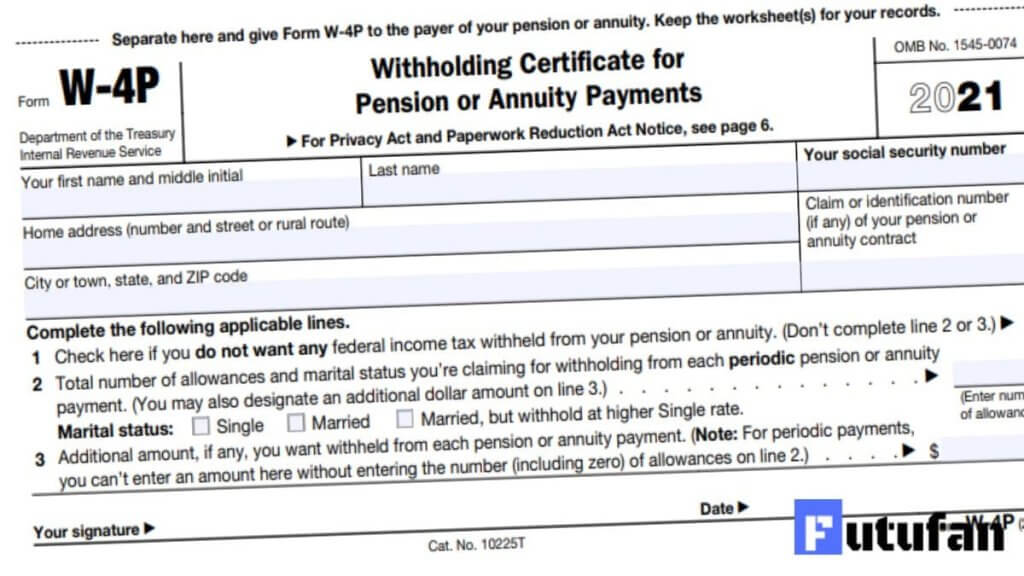

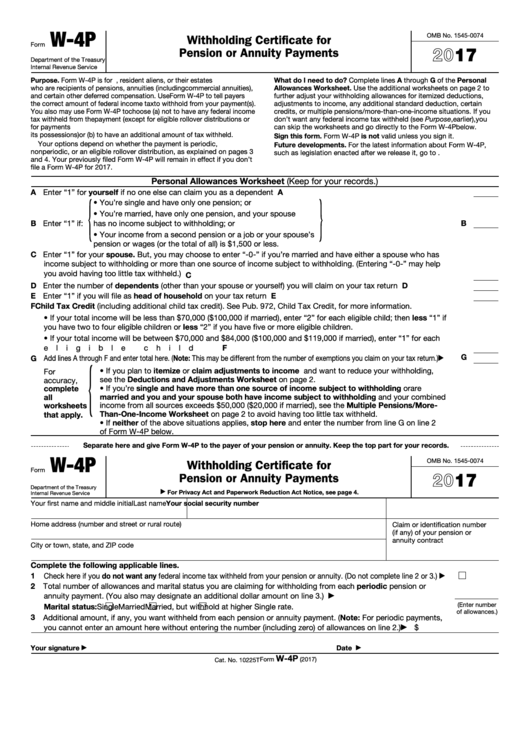

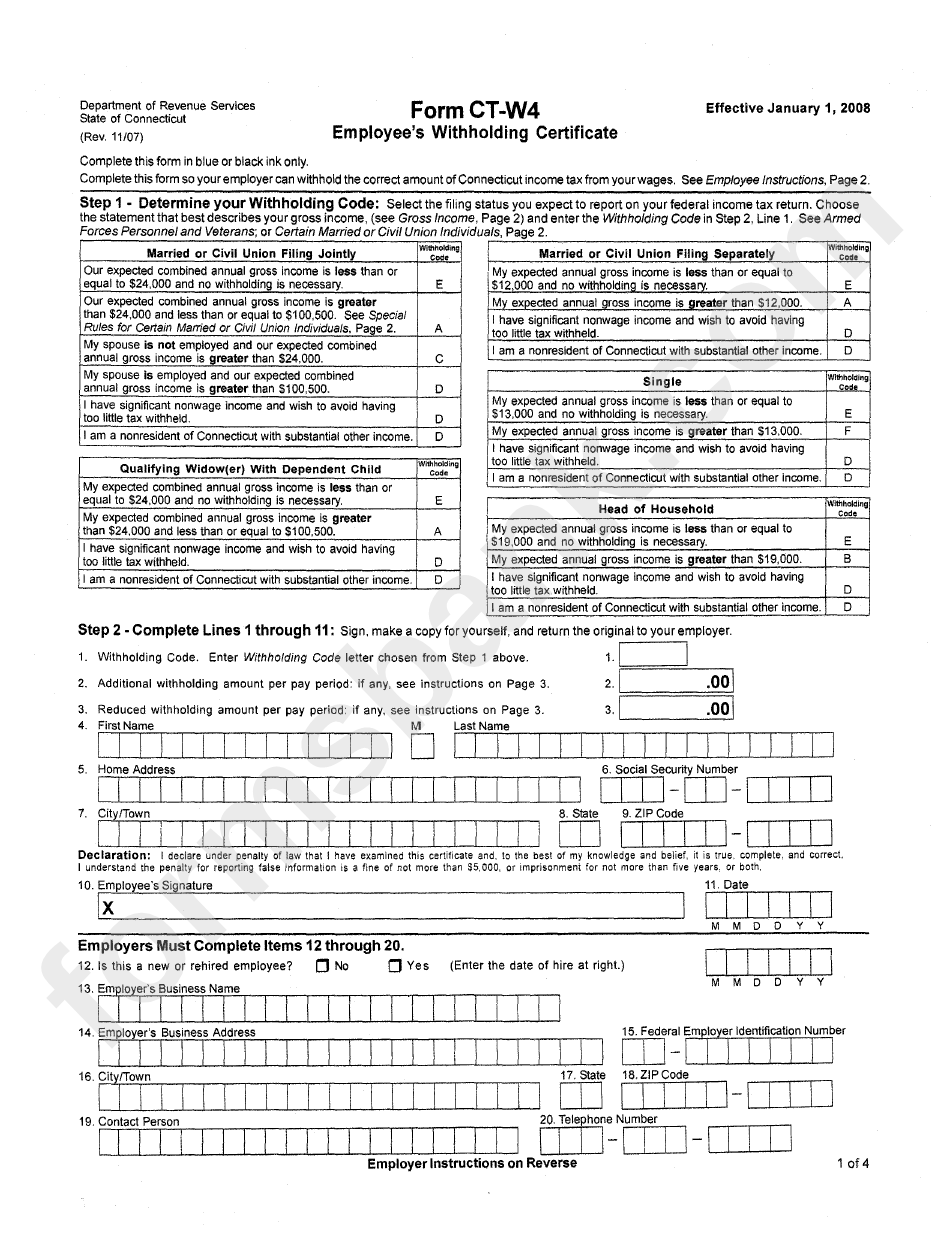

Form Ct W4P - 10/17) withholding certificate for pension or annuity payments r7.'\l. Withholding certifi cate for pension or annuity payments. 2023 connecticut quarterly reconciliation of. Web although this form is made available to you by ct drs, the form must be submitted directly to your pension payer, not to drs. Send filled & signed form or save. Complete, edit or print tax forms instantly. Web form ct‐w4p provides your payer with the necessary information to withhold the correct amount of connecticut income tax from your pension or annuity payment to ensure that. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Web pension or annuity withholding calculator. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. 10/17) withholding certifi cate for pension or annuity payments. 10/17) withholding certificate for pension or annuity payments r7.'\l. Easily sign the form with your finger. 2023 connecticut quarterly reconciliation of. Open form follow the instructions. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Send filled & signed form or. Withholding certifi cate for pension or annuity payments. ★ ★ ★ ★ ★. It is the payer who is responsible to withhold the. ★ ★ ★ ★ ★. 2023 connecticut quarterly reconciliation of. Easily sign the form with your finger. Web form ct‐w4p provides your payer with the necessary information to withhold the correct amount of connecticut income tax from your pension or annuity payment to ensure that. Easily sign the form with your finger. 2023 connecticut quarterly reconciliation of. Web pension or annuity withholding calculator. Web form w‐4p is for u.s. Send filled & signed form or save. Get ready for tax season deadlines by completing any required tax forms today. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. 10/17) withholding certifi cate for pension or annuity payments. 2023 connecticut quarterly reconciliation of. Open form follow the instructions. Web although this form is made available to you by ct drs, the form must be submitted directly to your pension payer, not to drs. Send filled & signed form or save. This calculator is intended to be used as a tool to calculate your monthly connecticut income tax. Easily sign the form with your finger. Form ct‑w4p is for. Open form follow the instructions. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Send filled & signed form or save. Easily sign the form with your finger. Open form follow the instructions. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Ad access irs tax forms. Easily sign the form with your finger. It is the payer who is responsible to withhold the. Web form ct‐w4p provides your payer with the necessary information to withhold the correct amount. Web form ct‐w4p provides your payer with the necessary information to withhold the correct amount of connecticut income tax from your pension or annuity payment to ensure that. Withholding certifi cate for pension or annuity payments. Use this form if you have an ira or retirement account and live in connecticut. Easily sign the form with your finger. Form ct‑w4p. Web form w‐4p is for u.s. Send filled & signed form or. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. It is the payer who is responsible to withhold the. Get ready for tax season deadlines by completing any required tax forms today. 10/17) withholding certificate for pension or annuity payments r7.'\l. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Web although this form is made available to you by ct drs, the form must be submitted directly to your pension payer, not to drs. Web form w‐4p is for u.s. Use this form if you have an ira or retirement account and live in connecticut. This calculator is intended to be used as a tool to calculate your monthly connecticut income tax. 2023 connecticut quarterly reconciliation of. Get ready for tax season deadlines by completing any required tax forms today. Web form ct‐w4p provides your payer with the necessary information to withhold the correct amount of connecticut income tax from your pension or annuity payment to ensure that. Send filled & signed form or save. Web pension or annuity withholding calculator. Open form follow the instructions. Complete, edit or print tax forms instantly. Ad access irs tax forms. Withholding certifi cate for pension or annuity payments. Send filled & signed form or. It is the payer who is responsible to withhold the. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. ★ ★ ★ ★ ★. Easily sign the form with your finger.IRS W4P 2012 Fill out Tax Template Online US Legal Forms

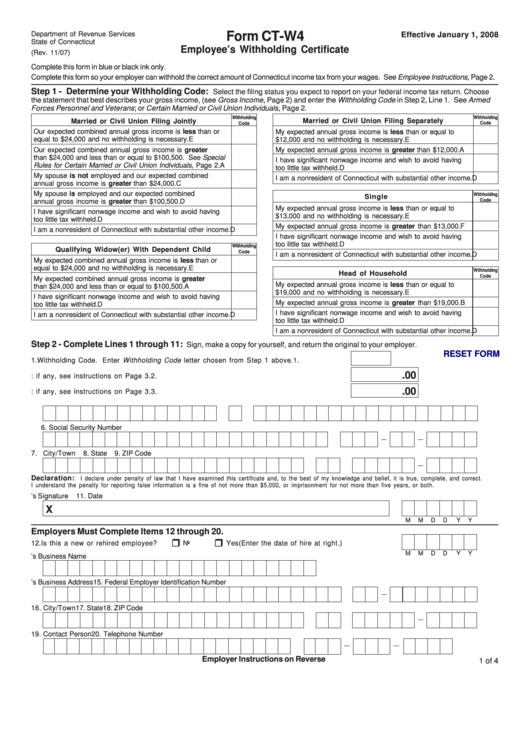

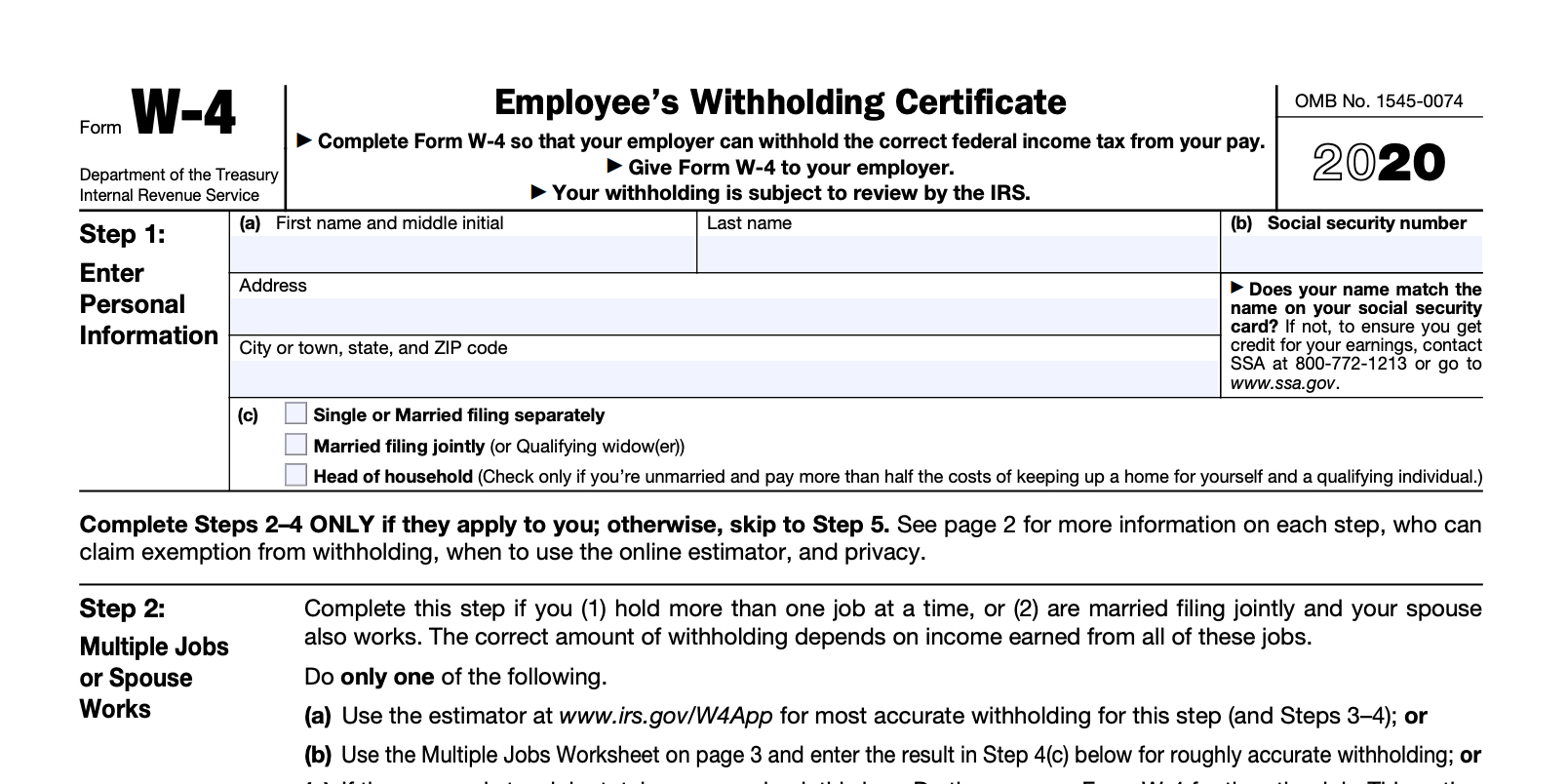

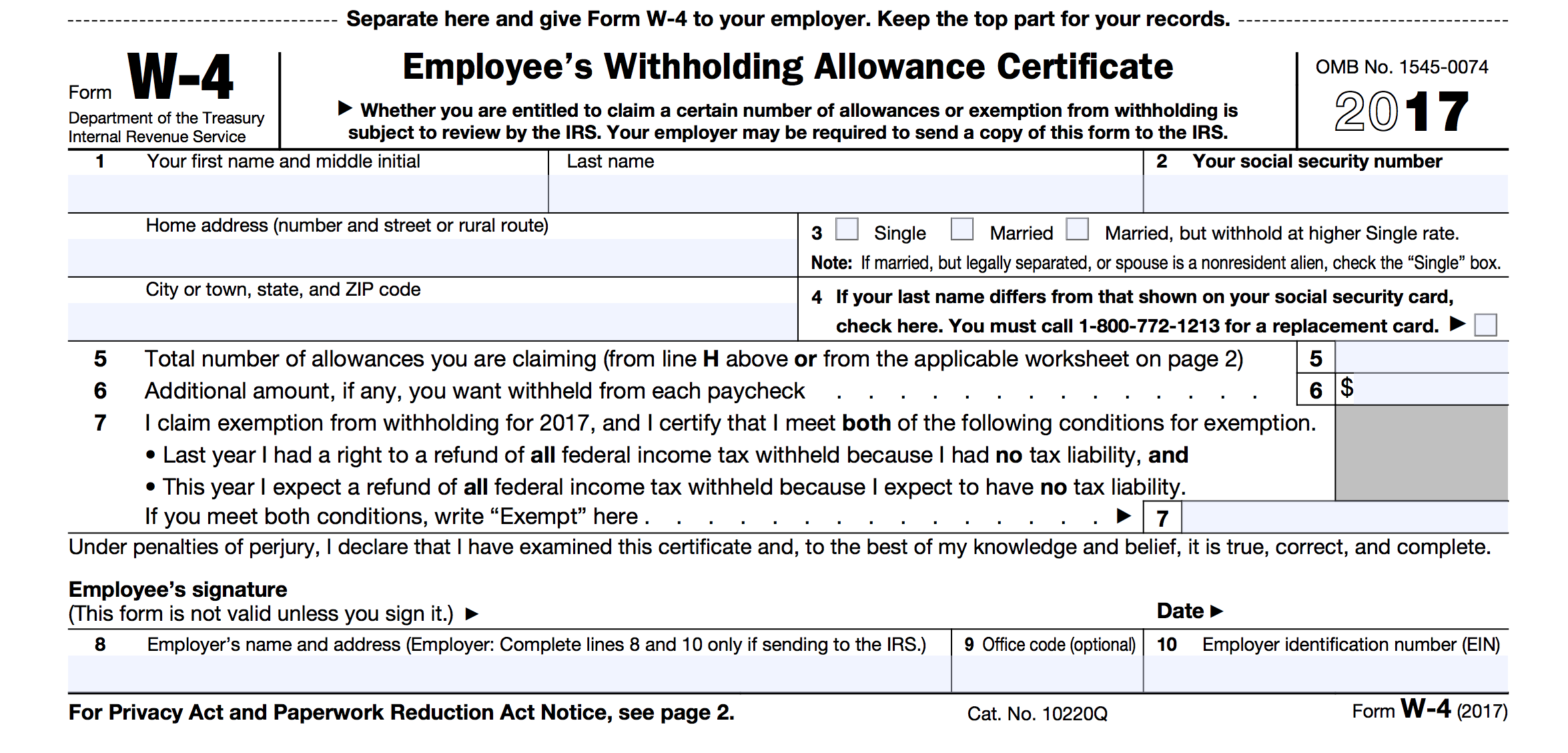

Fillable Form CtW4 Employee'S Withholding Certificate printable pdf

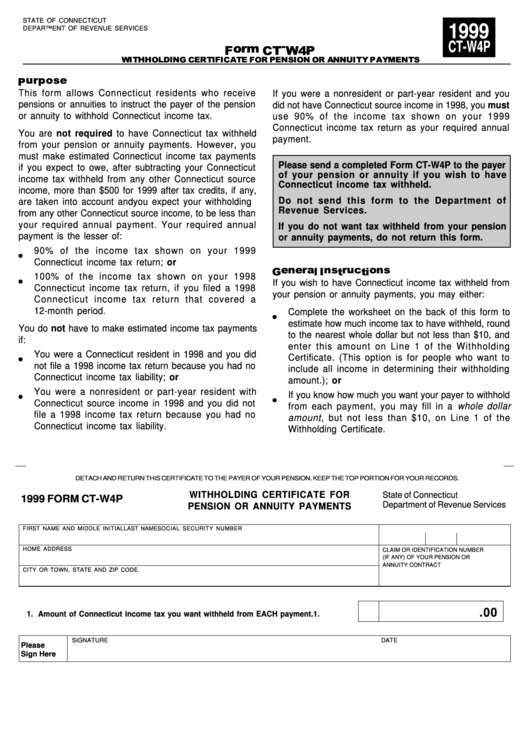

Fillable Form CtW4p Withholding Certificate For Pension Or Annuity

Sample W4 Form Filled Out W4 Form 2023

Form CTW4P 2021 Fill Out, Sign Online and Download Printable PDF

W4 Form 2020 W4 Forms

Fillable Form W4p Withholding Certificate For Pension Or Annuity

W 4 Completed Sample 2022 W4 Form

Form Ct W4 2008 printable pdf download

Irs Form W4V Printable / W 4 V W I T H H O L D I N G F O R M Zonealarm

Related Post: