Illinois Tax Form Rut 50

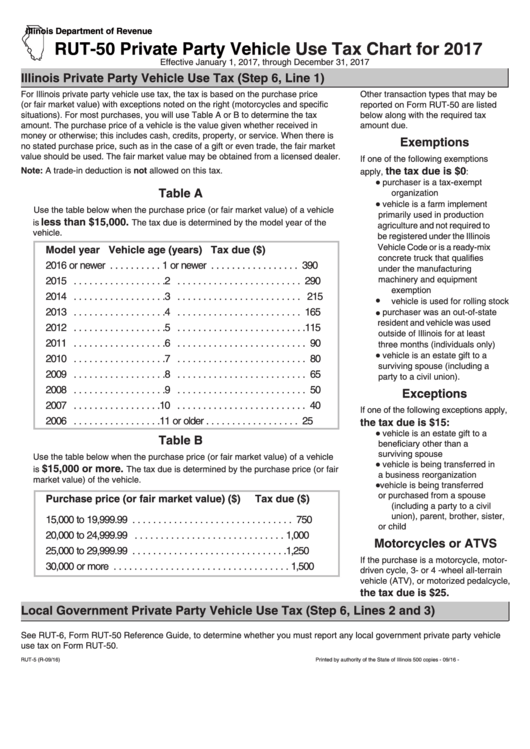

Illinois Tax Form Rut 50 - Visit our web site at. It is known as the private party vehicle use tax, which means that it taxes you for a vehicle. In other words, you should file this form if you. If you need to obtain the forms prior to. Questions and comments are moderated. Choose avalara sales tax rate tables by state or look up individual rates by address. The laws on which the form is based. Web the illinois department of revenue dec. Documents are in adobe acrobat portable. Get everything done in minutes. Web follow the simple instructions below: Choose avalara sales tax rate tables by state or look up individual rates by address. Web illinois tax form rut 50. Get your online template and fill it in using progressive. All questions and comments are. If you need to obtain the forms prior to. Request certain forms from idor. Web follow the simple instructions below: Choose avalara sales tax rate tables by state or look up individual rates by address. Web illinois tax form rut 50. In other words, you should file this form if you. Get your online template and fill it in using progressive. All questions and comments are. If you need to obtain the forms prior to. Web the illinois department of revenue dec. Get your online template and fill it in using progressive. Visit our web site at. All questions and comments are. Questions and comments are moderated. Request certain forms from idor. If you need to obtain the forms prior to. Web illinois tax form rut 50. Ad download avalara sales tax rate tables by state or search tax rates by individual address. The laws on which the form is based. Get your online template and fill it in using progressive. Web rut 50 form rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 46 votes how to fill out and sign tax form rut 50 online? If you need to obtain the forms prior to. Documents are in adobe acrobat portable. Questions and comments are moderated. Visit our web site at. Web follow the simple instructions below: If you need to obtain the forms prior to. Ad download avalara sales tax rate tables by state or search tax rates by individual address. The laws on which the form is based. Exemptions if one of the following exemptions applies, the tax due is $0: Web follow the simple instructions below: Questions and comments are moderated. Choose avalara sales tax rate tables by state or look up individual rates by address. All questions and comments are. In other words, you should file this form if you. Exemptions if one of the following exemptions applies, the tax due is $0: If you need to obtain the forms prior to. Get your online template and fill it in using progressive. Web illinois tax form rut 50. Get everything done in minutes. All questions and comments are. Web rut 50 form rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 46 votes how to fill out and sign tax form rut 50 online? Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Get. Documents are in adobe acrobat portable. Web illinois tax form rut 50. In other words, you should file this form if you. Web the illinois department of revenue dec. Get everything done in minutes. If you need to obtain the forms prior to. All questions and comments are. The laws on which the form is based. Web rut 50 form rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 46 votes how to fill out and sign tax form rut 50 online? Request certain forms from idor. Ad download avalara sales tax rate tables by state or search tax rates by individual address. Get your online template and fill it in using progressive. It is known as the private party vehicle use tax, which means that it taxes you for a vehicle. One of these forms must be. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Choose avalara sales tax rate tables by state or look up individual rates by address. Exemptions if one of the following exemptions applies, the tax due is $0: Visit our web site at. Web follow the simple instructions below: Questions and comments are moderated.Rut 50 Fill Out and Sign Printable PDF Template signNow

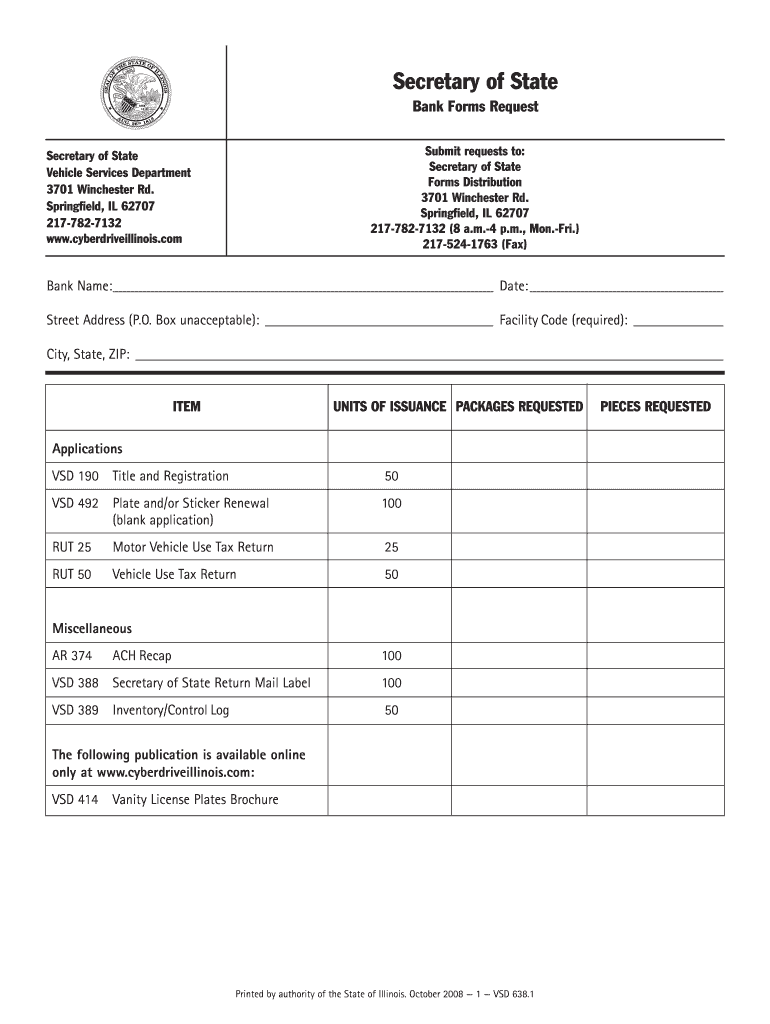

Tax Form Rut50 Printable

Rut 7 form illinois Fill out & sign online DocHub

Tax Form Rut50 Printable

Rut50 Private Party Vehicle Use Tax Chart For 2017 Illinois

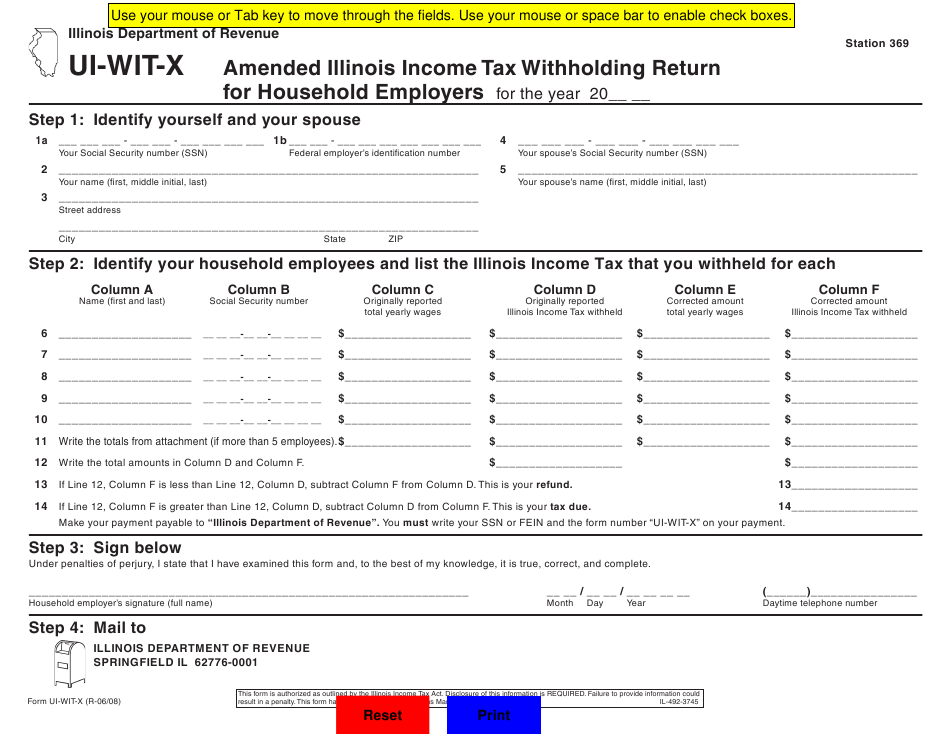

Illinois Withholding Allowance Worksheet Example

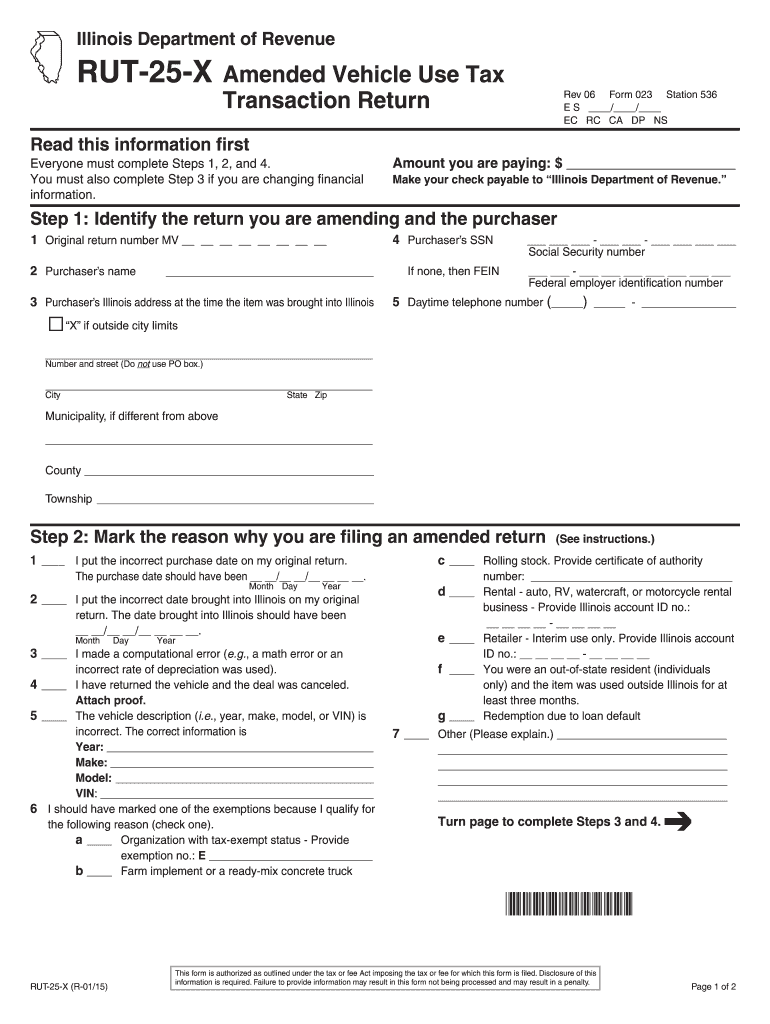

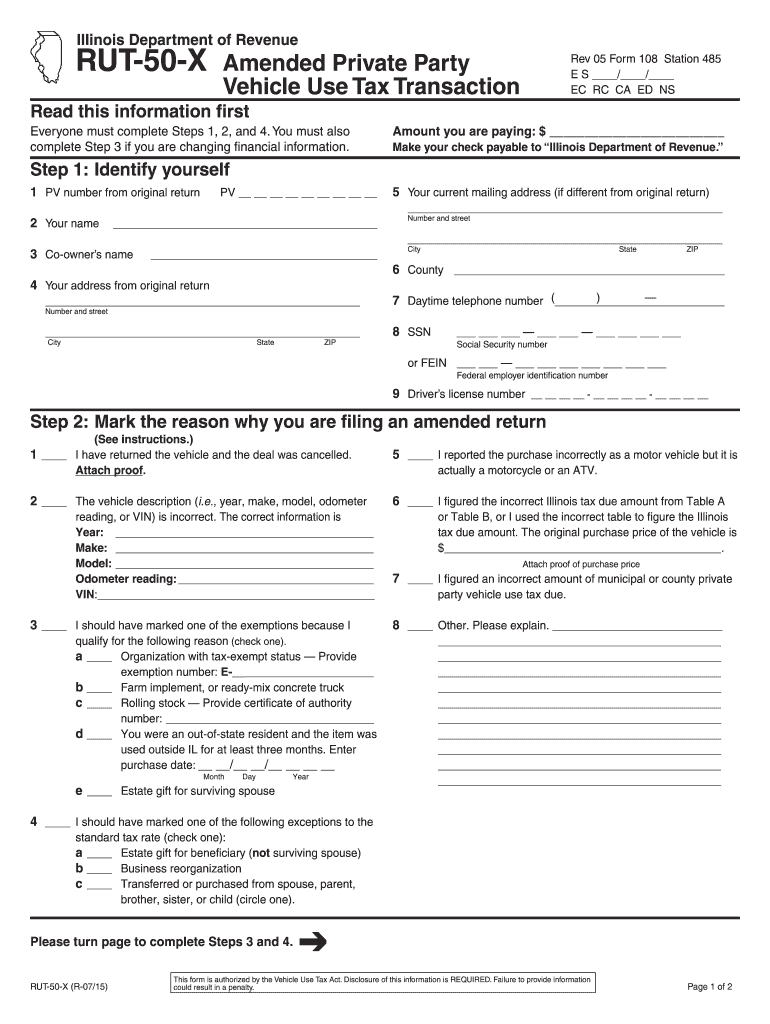

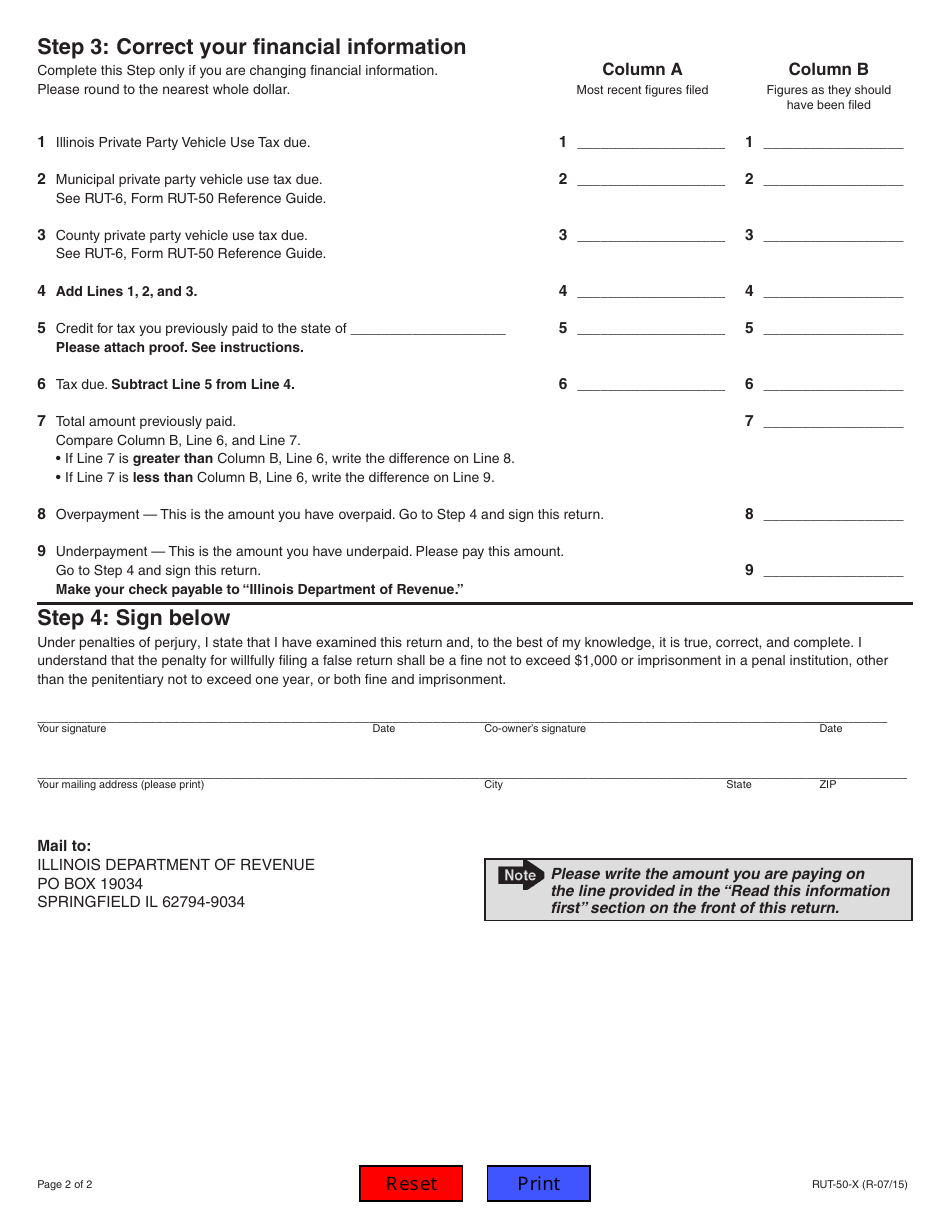

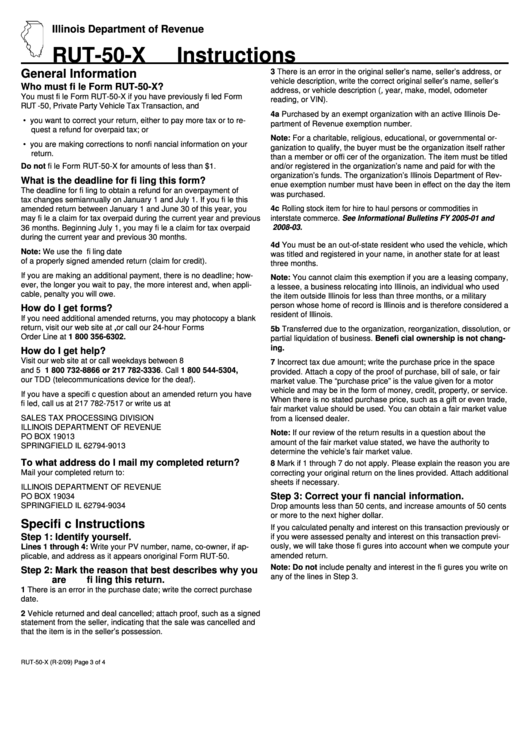

20152023 Form IL RUT50XFill Online, Printable, Fillable, Blank

Form RUT50X Download Fillable PDF or Fill Online Amended Private

IL RUT50X 2010 Fill out Tax Template Online US Legal Forms

Top Illinois Form Rut50 Templates free to download in PDF format

Related Post: