Form Ct 1120

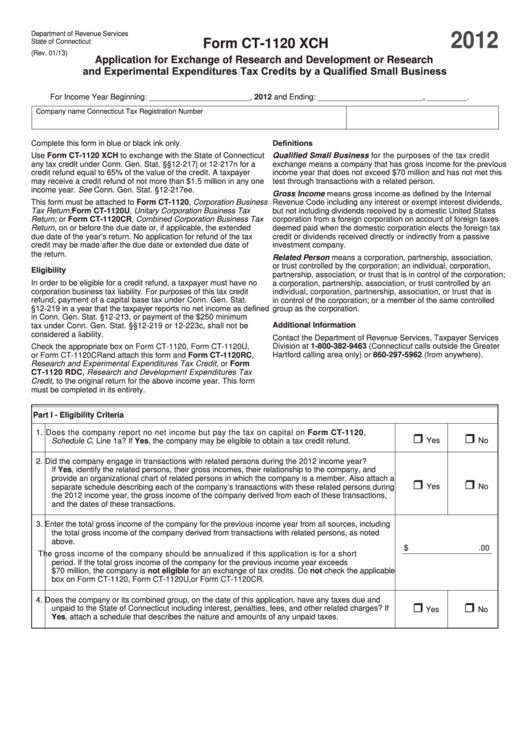

Form Ct 1120 - Drs myconnect allows taxpayers to electronically file, pay. Web form ct‑1120, corporation business tax return, is used to compute tax both on a net income basis and on a capital stock basis. Web connecticut tax registration number. To prevent any delay in processing,. Tax is paid on the basis that yields the higher. 12/22) 1120 1222w 01 9999 2022 attach a complete copy of form. Web be submitted to the department of revenue services (drs). Complete this form in blue or black ink only. 12/21) 1120 1221w 01 9999 2021 attach a complete copy of form. 2022 corporation business tax return. Capital loss carryover (if not deducted in computing federal capital gain). Web connecticut tax registration number. Web corporations that receive income from rendering services to or on behalf of regulated investment companies use form. To prevent any delay in processing,. Complete this form in blue or black ink only. Capital loss carryover (if not deducted in computing federal capital gain). Web connecticut tax registration number. 12/22) 1120 1222w 01 9999 2022 attach a complete copy of form. Ad easy guidance & tools for c corporation tax returns. Web corporations that receive income from rendering services to or on behalf of regulated investment companies use form. Web corporations that receive income from rendering services to or on behalf of regulated investment companies use form. Ad easy guidance & tools for c corporation tax returns. Please verify your input on the basic data worksheet, general. Web be submitted to the department of revenue services (drs). 12/22) 1120 1222w 01 9999 2022 attach a complete copy of form. • file it on or before the fifteenth day of the month following the due date of the company’s corresponding federal. Tax is paid on the basis that yields the higher. Use form ct‑1120cu, combined unitary corporation business tax return, to calculate and report your corporation business tax. Capital loss carryover (if not deducted in computing federal capital gain). Please. 12/22) 1120 1222w 01 9999 2022 attach a complete copy of form. Please verify your input on the basic data worksheet, general. Web connecticut tax registration number. • file it on or before the fifteenth day of the month following the due date of the company’s corresponding federal. Tax is paid on the basis that yields the higher. Web connecticut tax registration number. Please note that each form is year specific. 2022 corporation business tax return. 12/22) 1120 1222w 01 9999 2022 attach a complete copy of form. • file it on or before the fifteenth day of the month following the due date of the company’s corresponding federal. Complete this form in blue or black ink only. Please verify your input on the basic data worksheet, general. The correct year’s form must. Corporation business tax return apportionment computation (with instructions). You can download or print. 12/21) 1120 1221w 01 9999 2021 attach a complete copy of form. 2022 corporation business tax return. Complete this form in blue or black ink only. You can download or print. Web form ct‑1120, corporation business tax return, is used to compute tax both on a net income basis and on a capital stock basis. Please note that each form is year specific. Web form ct‑1120, corporation business tax return, is used to compute tax both on a net income basis and on a capital stock basis. Drs myconnect allows taxpayers to electronically file, pay. 2022 corporation business tax return. Use form ct‑1120cu, combined unitary corporation business tax return, to calculate and report your corporation. 12/20) 1120 1220w 01 9999 2020 attach a complete copy of form. Capital loss carryover (if not deducted in computing federal capital gain). Web page 1 of form ct‑1120. • file it on or before the fifteenth day of the month following the due date of the company’s corresponding federal. The correct year’s form must. Corporation business tax return apportionment computation (with instructions). Please note that each form is year specific. 12/22) 1120 1222w 01 9999 2022 attach a complete copy of form. 12/21) 1120 1221w 01 9999 2021 attach a complete copy of form. Web be submitted to the department of revenue services (drs). Use form ct‑1120cu, combined unitary corporation business tax return, to calculate and report your corporation business tax. • file it on or before the fifteenth day of the month following the due date of the company’s corresponding federal. You can download or print. Web form ct‑1120, corporation business tax return, is used to compute tax both on a net income basis and on a capital stock basis. Web connecticut tax registration number. Ad easy guidance & tools for c corporation tax returns. Web form ct‑1120, corporation business tax return, is used to compute tax both on a net income basis and on a capital stock basis. 12/20) 1120 1220w 01 9999 2020 attach a complete copy of form. Drs myconnect allows taxpayers to electronically file, pay. Capital loss carryover (if not deducted in computing federal capital gain). Web corporations that receive income from rendering services to or on behalf of regulated investment companies use form. 2022 corporation business tax return. Please verify your input on the basic data worksheet, general. Tax is paid on the basis that yields the higher. Web application for exchange of research and development or research and experimental expenditures tax credits by a qualified small business, for eligibility.Form Ct1120 Xch Application For Exchange Of Research And Development

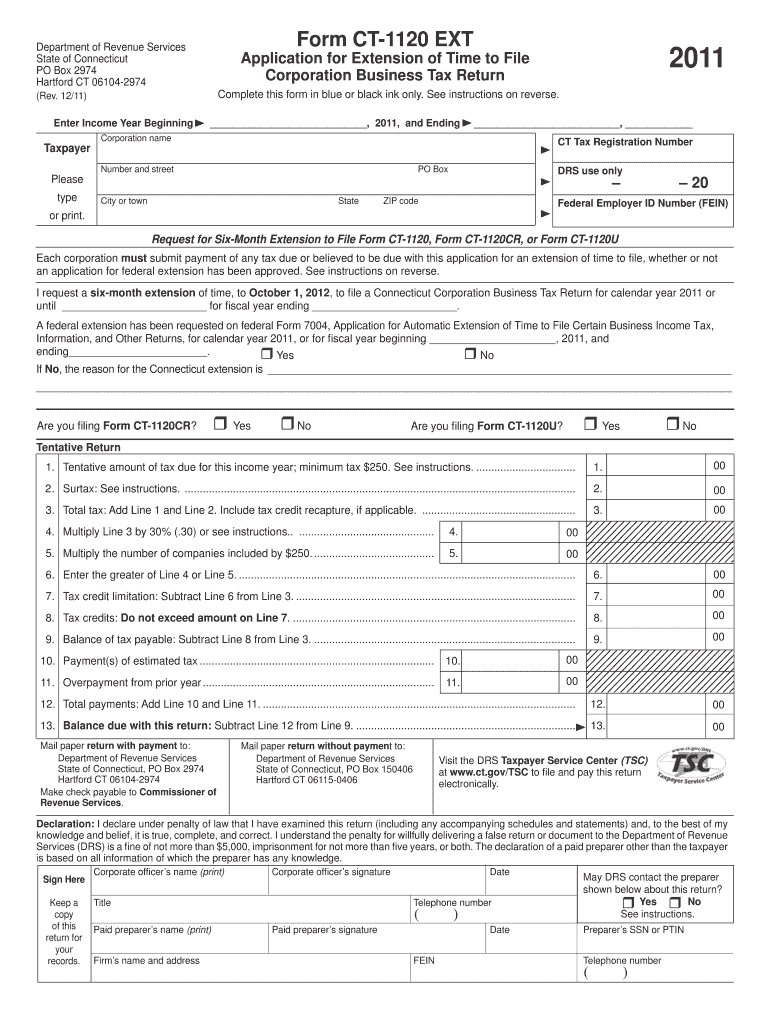

Ct 1120ext Form Fill Out and Sign Printable PDF Template signNow

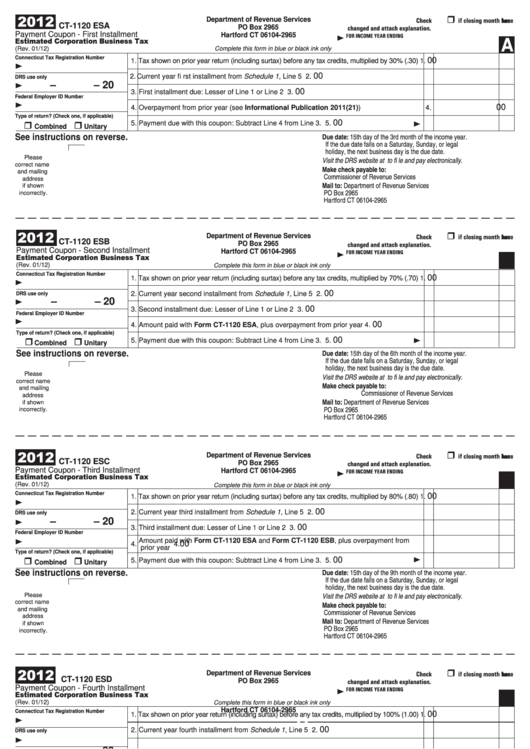

Form Ct1120 Esa Estimated Corporation Business Tax 2012 printable

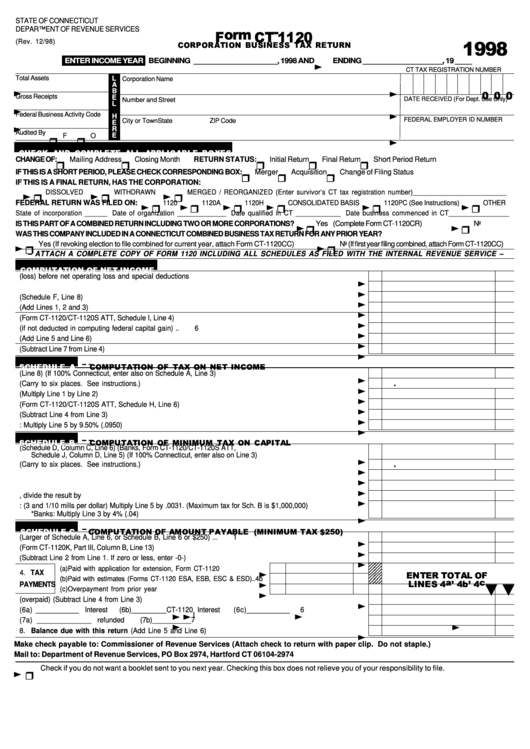

Fillable Form Ct1120 Corporation Business Tax Return 1998

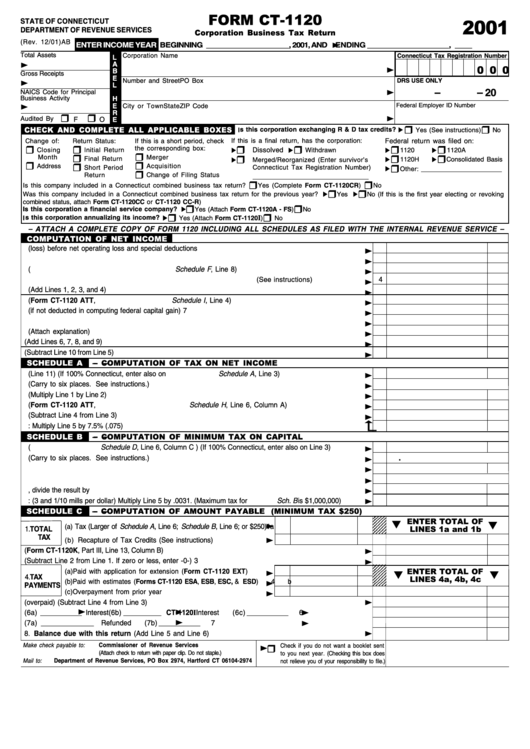

Form Ct1120 Corporation Business Tax Return 2001 printable pdf download

2015 Form CT DRS CT1120 Fill Online, Printable, Fillable, Blank

Form CT1120 PIC Fill Out, Sign Online and Download Printable PDF

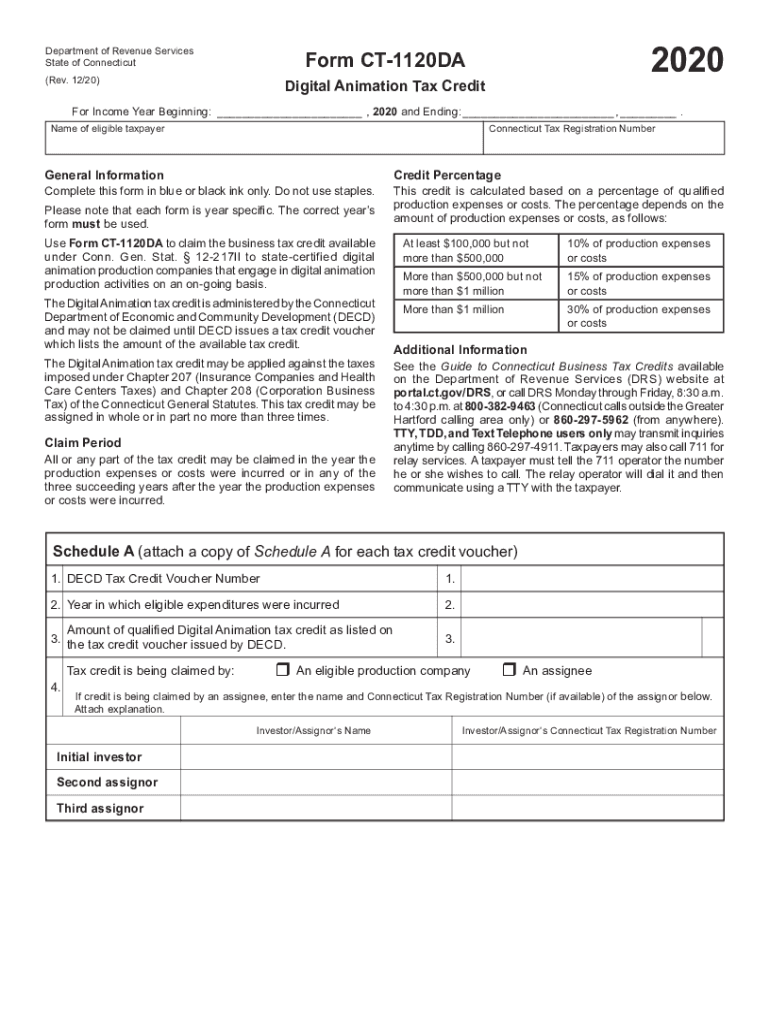

20202022 Form CT DRS CT1120DA Fill Online, Printable, Fillable, Blank

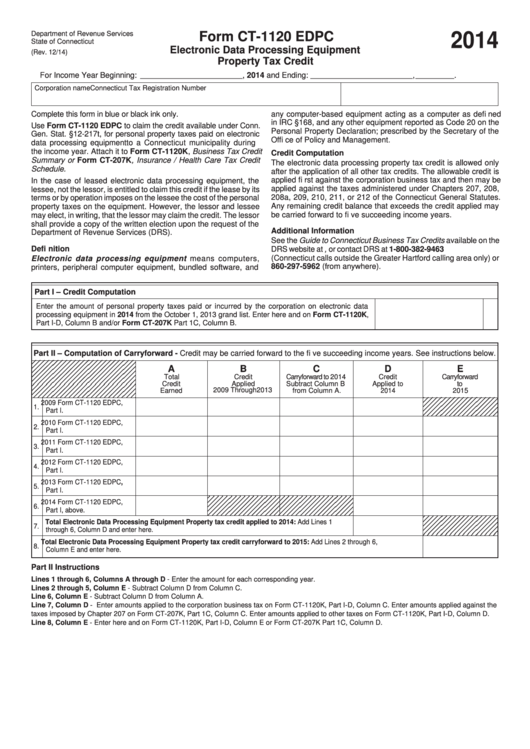

Form Ct1120 Connectictut Edpc Electronic Data Processing Equipment

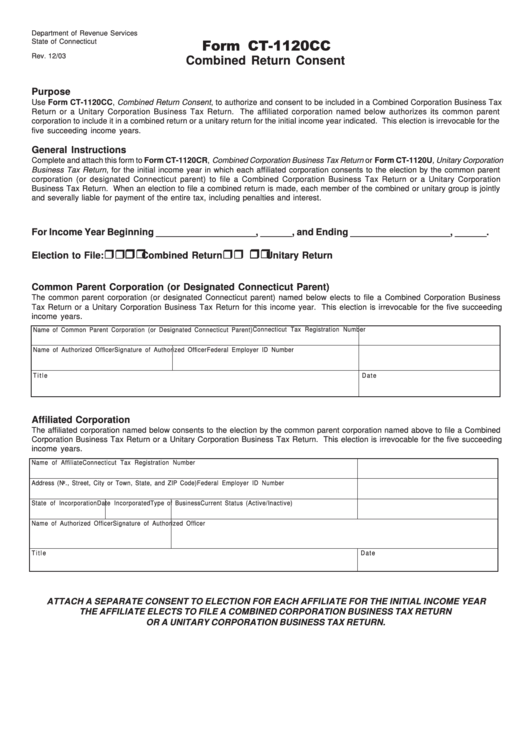

Form Ct1120cc Combined Return Consent Connecticut Department Of

Related Post: